Who Is The Richest Man In The World 2024 October Use this online tool to check if you have to pay tax on your pension You ll pay Income Tax on any part of the lump sum that goes above either Find out what your lump sum allowances are

In this guide we break down the key tax changes for pensioners in the UK for 2025 including personal allowance adjustments state pension changes and what it all means for Full list of UK tax allowances and rates for 2025 26 covering income tax National Insurance Capital Gains Tax CGT pensions dividends Stamp Duty Land Tax SDLT

Who Is The Richest Man In The World 2024 October

Who Is The Richest Man In The World 2024 October

https://i.ytimg.com/vi/oMPhco30Suk/maxresdefault.jpg

The Unrivaled Wealth World Richest President 2024

https://d.newsweek.com/en/full/815445/billionaires-intro.jpg

Who Is The Richest Person In The World In 2024 Top 10 Richest People

https://www.forbesindia.com/media/images/2023/Jun/img_209633_top10richestpeopleintheworld.jpg

Here are the updated allowances for pensions for the 2025 26 tax year The Lump Sum Allowance LSA When you take part or all your pension as a lump sum 25 is usually tax As a result HMRC pension tax changes 2025 discussions include potential limits or conditions on salary sacrifice use especially where employer contributions are significantly boosting total

Standard Annual Allowance 60 000 for the 2024 25 tax year Who qualifies All contributions made by you your employer and third parties count toward this limit What if you exceed it For 2025 26 it s frozen at 12 570 a policy extended until 2028 per GOV UK If your income exceeds 100 000 the allowance reduces by 1 for every 2 earned above this vanishing

More picture related to Who Is The Richest Man In The World 2024 October

Who Is The Richest Person In The World The US Sun

https://www.the-sun.com/wp-content/uploads/sites/6/2021/01/ad-elon-musk-bezos-comp.jpg?strip=all&quality=100&w=1200&h=800&crop=1

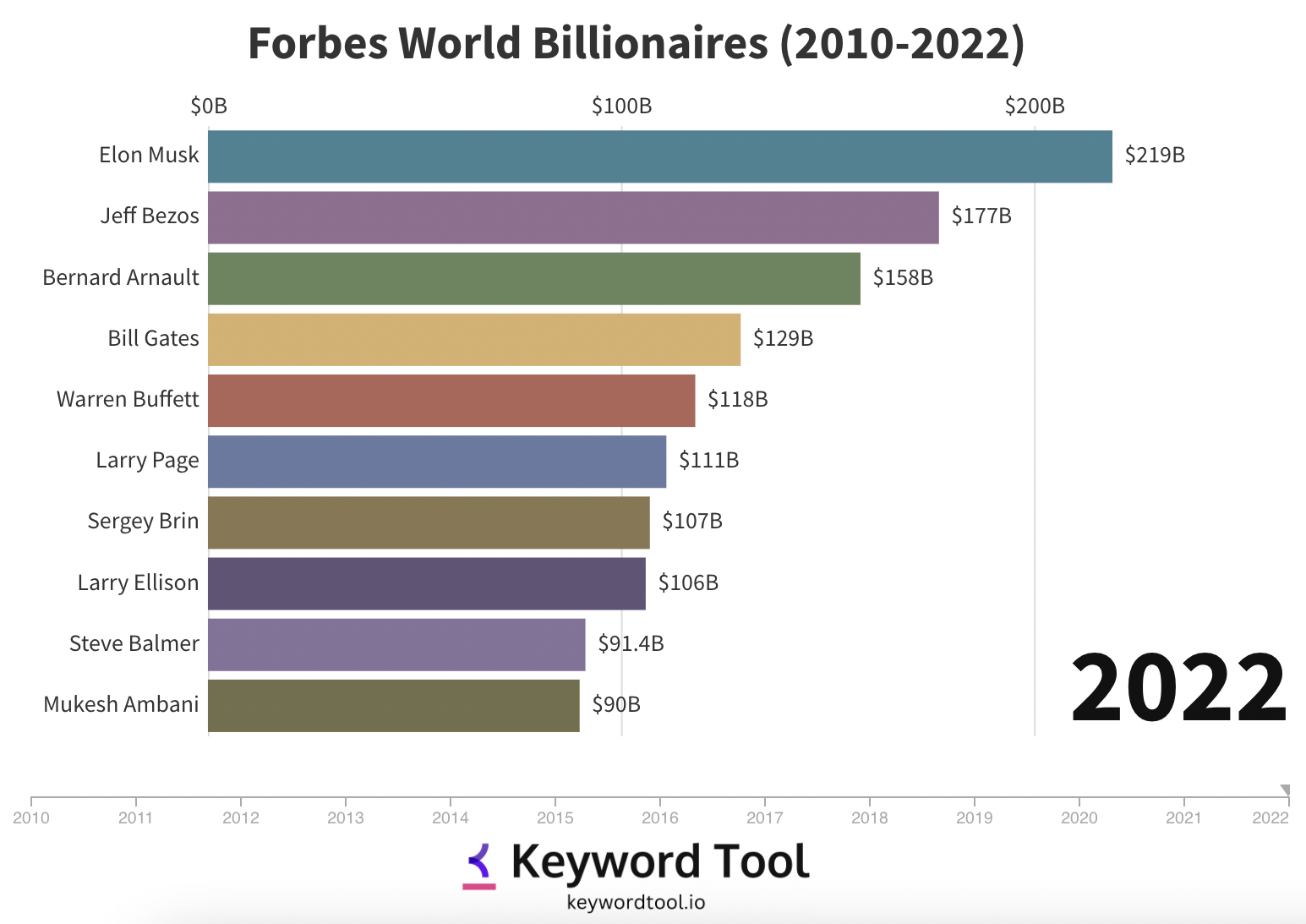

Richest People In The World 2023 Top 10 Forbes Billionaires

https://keywordtoolio-blog.s3.amazonaws.com/wp-content/uploads/2023/01/06172741/richest-people-in-the-world-e1672997529285.png

The Richest People In The World In 2023 2024

https://i0.wp.com/www.visualcapitalist.com/wp-content/uploads/2023/03/Richest-People-in-The-World-2023_SUPP.jpeg

Kick off the 2025 26 tax year with confidence Discover key tax changes pension updates tax friendly savings strategies and expert retirement planning tips from Joslin Rhodes Here s a quick breakdown of the 2025 tax bands Employer NI Increase Higher costs for businesses Capital Gains Tax Rise Increased tax on asset sales Stamp Duty Up

[desc-10] [desc-11]

World Richest Man 2023 List Top 10 Rich Person Forbes

https://www.urbanaffairskerala.org/wp-content/uploads/2023/01/photo_2023-01-08_10-03-57-1024x577.webp

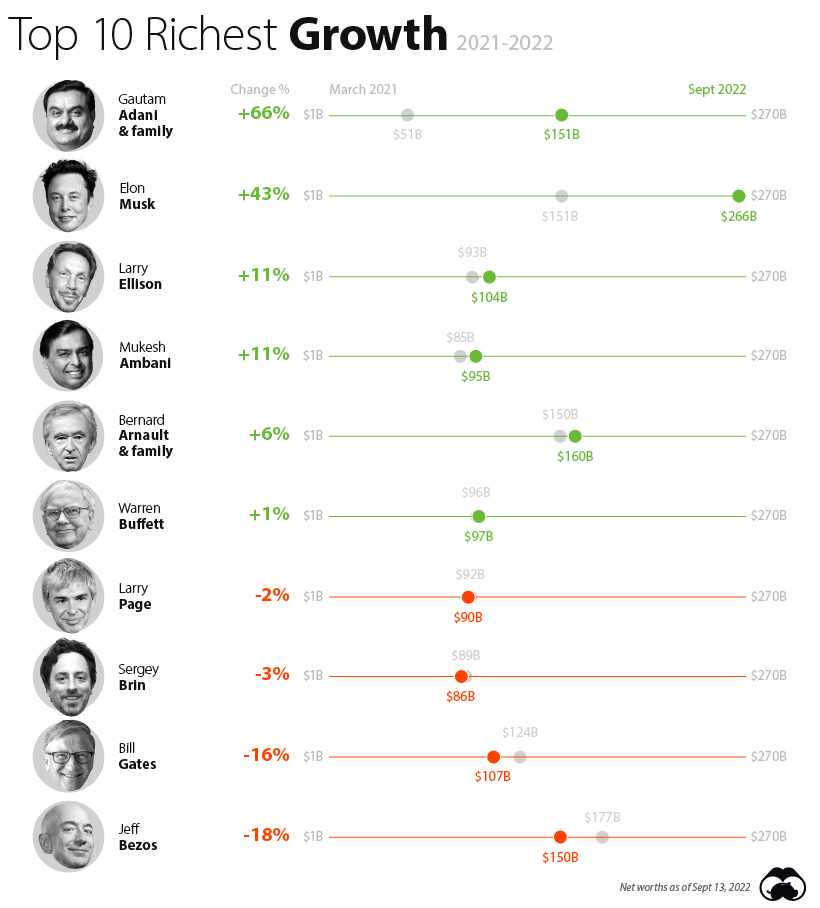

The Richest People In The World In 2022 Sept 2022 Update 2024

https://www.visualcapitalist.com/wp-content/uploads/2022/03/2021-Billionaires_Sept_21-Supplmental.jpg

https://www.gov.uk › tax-on-pension

Use this online tool to check if you have to pay tax on your pension You ll pay Income Tax on any part of the lump sum that goes above either Find out what your lump sum allowances are

https://www.retirementpasta.co.uk

In this guide we break down the key tax changes for pensioners in the UK for 2025 including personal allowance adjustments state pension changes and what it all means for

Who Is The Richest Person In The World Today 7 November 2023

World Richest Man 2023 List Top 10 Rich Person Forbes

Richest People In Dubai Top 10 Richest Man In UAE 2024

Forbes 2023 List See Di Top 10 Richest Pipo For Di World Plus Africans

Top 10 Richest People In The World 2021

Richest Man In The World 2023 List Of Top 10 Richest Person In 2023

Richest Man In The World 2023 List Of Top 10 Richest Person In 2023

Top 10 Richest People In The World 2024

World Richest Man List 2023 Top 10 Forbes Billionaires

Who Is The Richest Man In The World

Who Is The Richest Man In The World 2024 October - As a result HMRC pension tax changes 2025 discussions include potential limits or conditions on salary sacrifice use especially where employer contributions are significantly boosting total