Are Social Security Death Benefits For A Child Taxable Social Security survivor benefits received by children don t affect income tax for a surviving parent or guardian but the child may have to pay taxes on the money

If a child is entitled to Social Security benefits such as after the death of a parent the benefit is considered to be the child s regardless of who actually receives the payment Per IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits page 3 Children s benefits If you have children you can often claim them as dependents on your annual tax return However when your children receive Social Security checks because of a disability disabled parent or deceased parent tax returns become a bit more complicated

Are Social Security Death Benefits For A Child Taxable

Are Social Security Death Benefits For A Child Taxable

https://lealfuneralhome.com/wp-content/uploads/2023/08/social-security-death-benefits.webp

How To Apply For Social Security Survivor Benefits For A Child

http://www.wikihow.com/images/a/a5/Apply-for-Social-Security-Survivor-Benefits-for-a-Child-Step-12.jpg

Social Security Survivors Benefits Explained YouTube

https://i.ytimg.com/vi/1ppPtY6s750/maxresdefault.jpg

Social Security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income payments which aren t taxable The portion of benefits that are taxable depends on the taxpayer s income and filing status Generally adults collect Social Security benefits but a child can also collect benefits if a parent is retired disabled or deceased When you file your own income taxes the obvious scenario is that you have to claim your own child s benefits

If you are the spouse ex spouse child or dependent parent of someone who worked and paid Social Security taxes before they died you might be eligible for Social Security Survivor benefits Millions of people receive these benefits from the Social Security Administration SSA every year If you are referring to Social Security survivor benefits You should not enter a dependent s social security benefits reported on a SSA 1099 on your tax return If the dependent earned no other income during the tax year the income is not taxable or reportable and thus a tax return is not required

More picture related to Are Social Security Death Benefits For A Child Taxable

Social Security Death Benefit How To Get 255 After Your Spouse Dies

https://houstoncasemanagers.com/wp-content/uploads/2021/09/Social-Security-Death-Benefit-1-1-644x322.png

Workers Compensation Disability Rating Chart

https://tuckerdisability.com/wp-content/uploads/2020/10/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1-1.png

How To Apply For Social Security Death Benefits For A Child Retire Gen Z

https://retiregenz.com/wp-content/uploads/2023/05/how-to-apply-for-social-security-death-benefits-for-a-child-8HVK.jpg

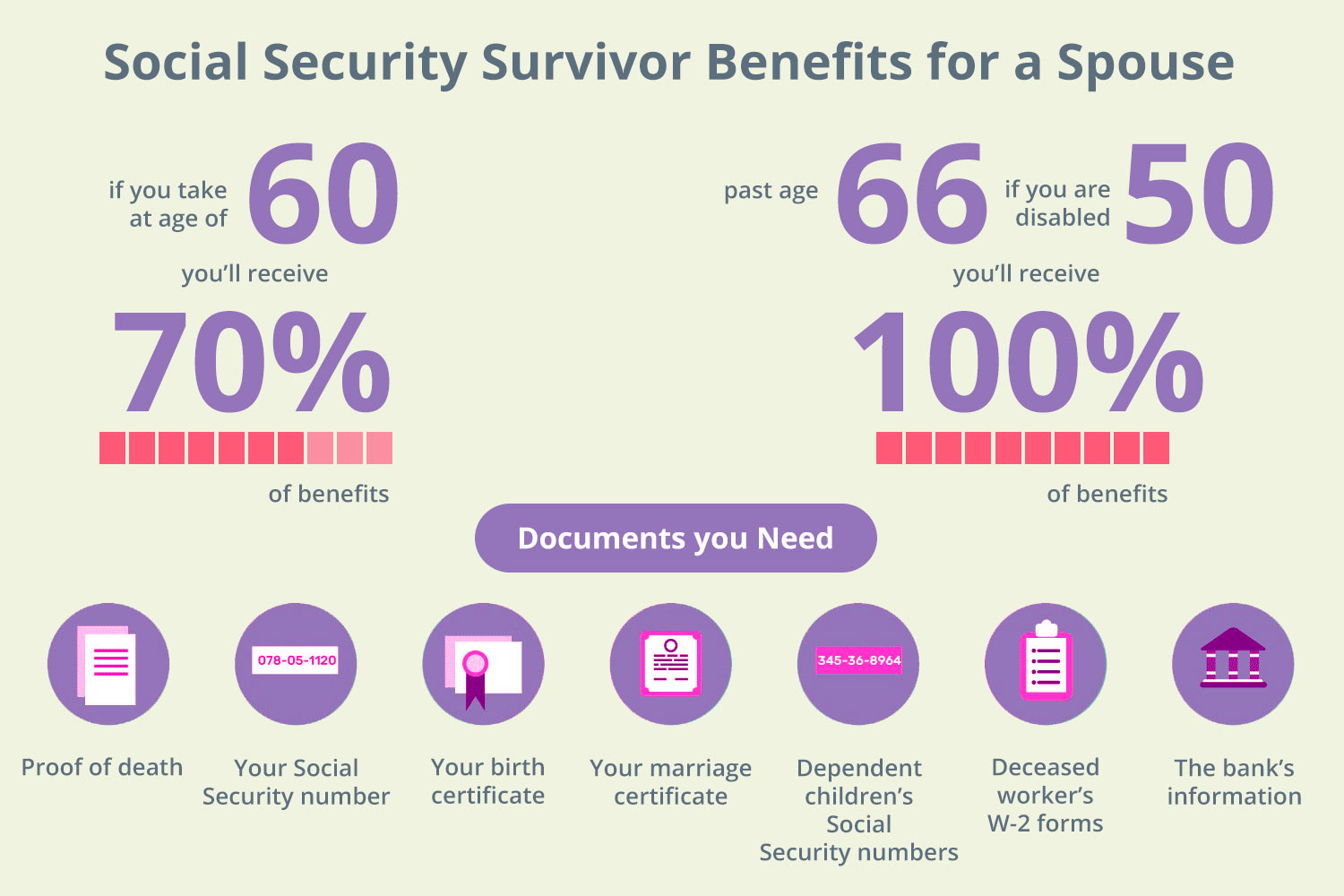

1 Are these benefits taxable The survivor benefit is not taxable if they are the child s only income Parents guardians are not responsible for taxes on this income 2 Is there a time limit to apply The application for benefits must be made within two years of the parent s death A child under 18 19 if he s still in high school or a child who is disabled can qualify for up to 75 percent of their dead parent s retirement benefits The surviving parent can also claim 75 percent if he s caring for a child under 16

Social Security survivor benefits are subject to federal income tax if the recipient s combined income exceeds specific thresholds As of 2024 if combined income calculated as adjusted gross income plus nontaxable interest and half of the Social Security benefits exceeds 25 000 for individuals or 32 000 for married couples filing If your children receive Social Security survivors disability benefits that is income to them not to you You do not enter it on your tax return Look at Box 2 of the SSA 1099 and you should see the child s SSN

When Are Social Security Survivor Benefits Paid

https://wctpension.org/sites/default/files/C11-Ex-How-Child-Benefits-are-Paid.png

Who Is Eligible For Sss Lump Sum Death Benefit Printable Online

https://www.teachmepersonalfinance.com/wp-content/uploads/2022/12/Form_ssa_8_featured_image.png

https://www.investopedia.com › ask › answers › ...

Social Security survivor benefits received by children don t affect income tax for a surviving parent or guardian but the child may have to pay taxes on the money

https://www.taxact.com › support

If a child is entitled to Social Security benefits such as after the death of a parent the benefit is considered to be the child s regardless of who actually receives the payment Per IRS Publication 915 Social Security and Equivalent Railroad Retirement Benefits page 3 Children s benefits

Social Security Death Index

When Are Social Security Survivor Benefits Paid

How To Apply For Social Security Spousal Death Benefits

Social Security Death Benefit Benefits How To Collect Them

Social Security Benefits Chart MoneyMatters101

Petition Raise The Social Security Death Benefit From 255 To Cover A

Petition Raise The Social Security Death Benefit From 255 To Cover A

Who Is Entitled To Death Benefits In Social Security Disability

Calculating Social Security Taxable Income TaxableSocialSecurity

How Do You Get The 250 Death Benefit From Social Security Fill Out

Are Social Security Death Benefits For A Child Taxable - Generally adults collect Social Security benefits but a child can also collect benefits if a parent is retired disabled or deceased When you file your own income taxes the obvious scenario is that you have to claim your own child s benefits