At What Income Level Does Social Security Become Taxable Up to 50 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is between

Social Security benefits are 100 tax free when your income is low As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your For individuals combined income exceeding 25 000 may result in up to 50 of Social Security benefits being taxable For married couples filing jointly this threshold

At What Income Level Does Social Security Become Taxable

At What Income Level Does Social Security Become Taxable

https://data.formsbank.com/pdf_docs_html/298/2984/298474/page_1_thumb_big.png

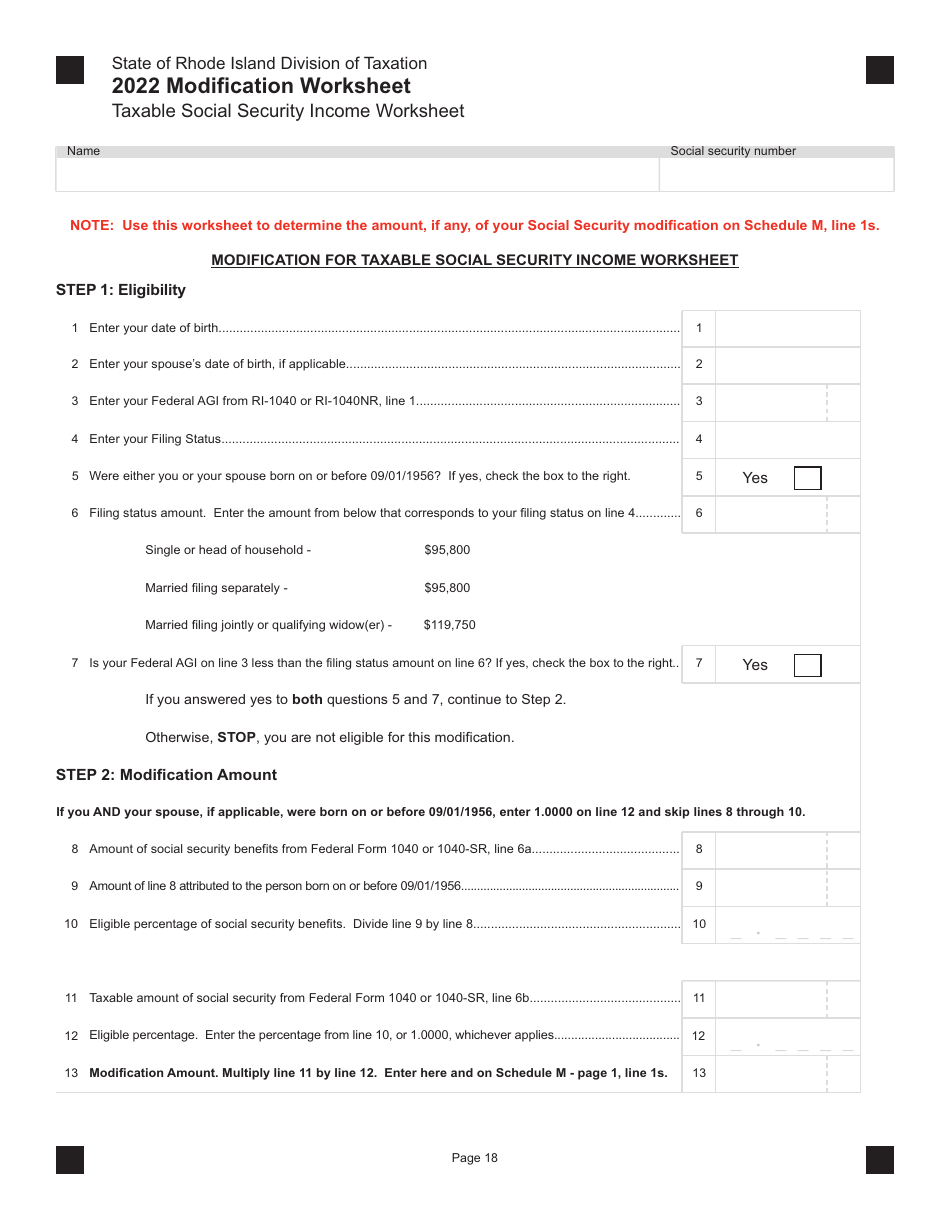

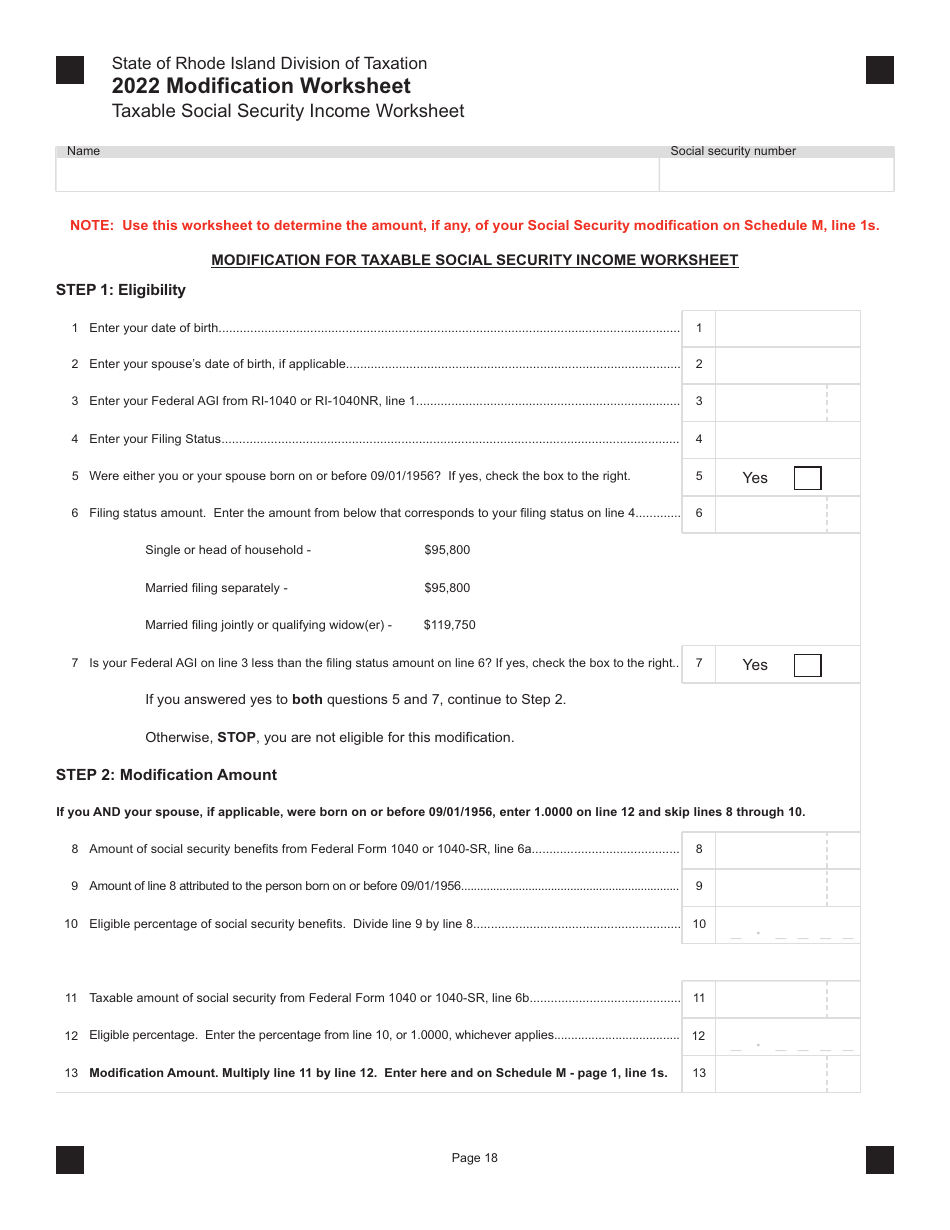

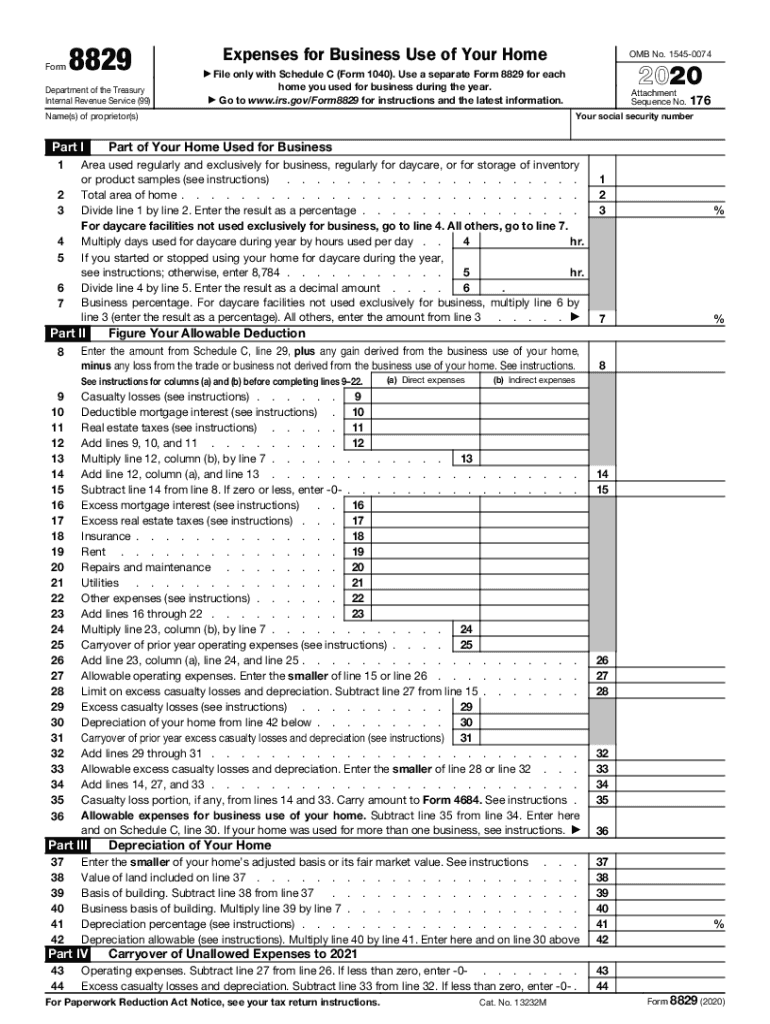

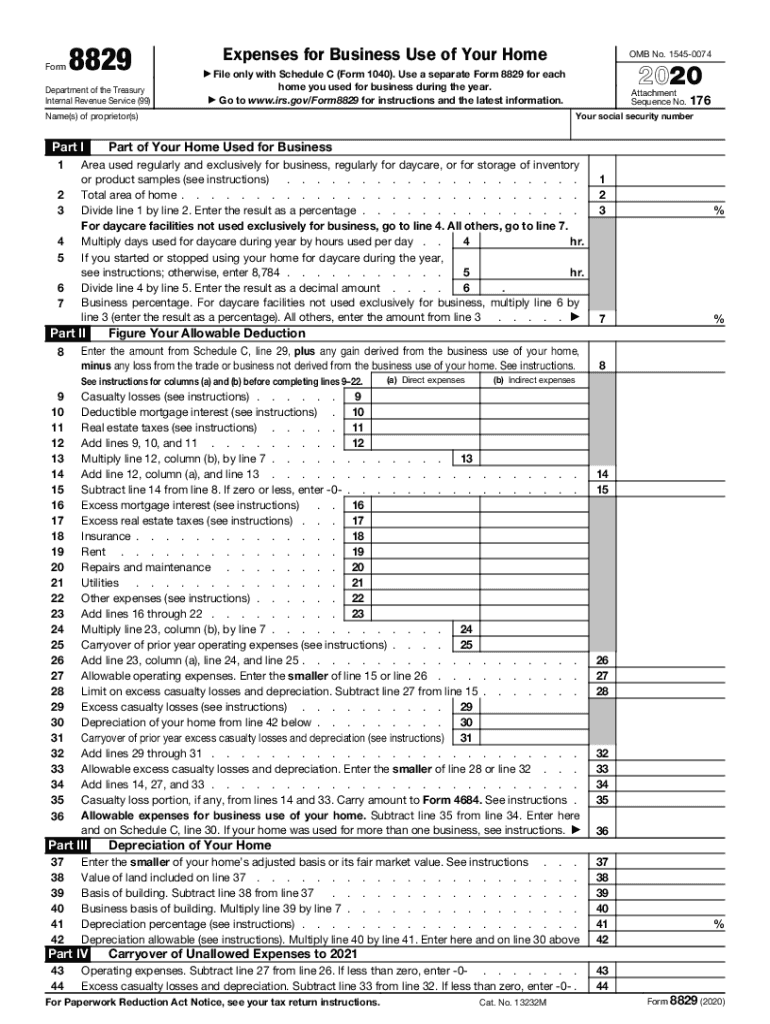

2022 Rhode Island Taxable Social Security Income Worksheet Download

https://data.templateroller.com/pdf_docs_html/2578/25787/2578765/taxable-social-security-income-worksheet-rhode-island_print_big.png

Max Taxable Social Security Wages 2025 Olympics Amara Paige

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png

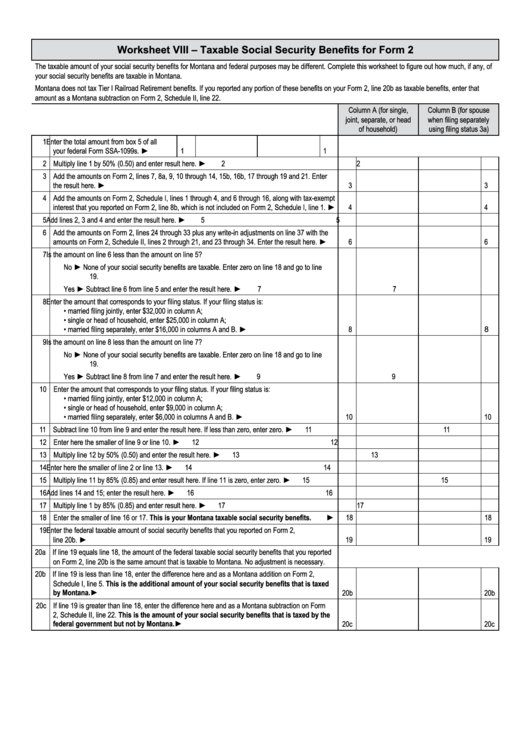

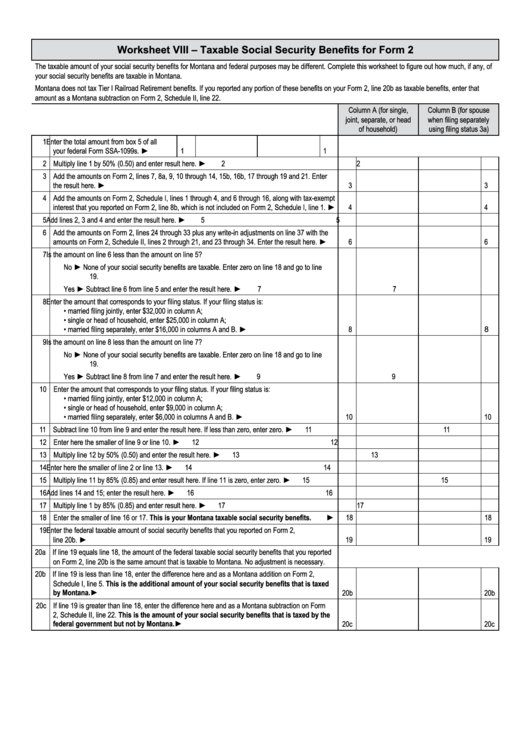

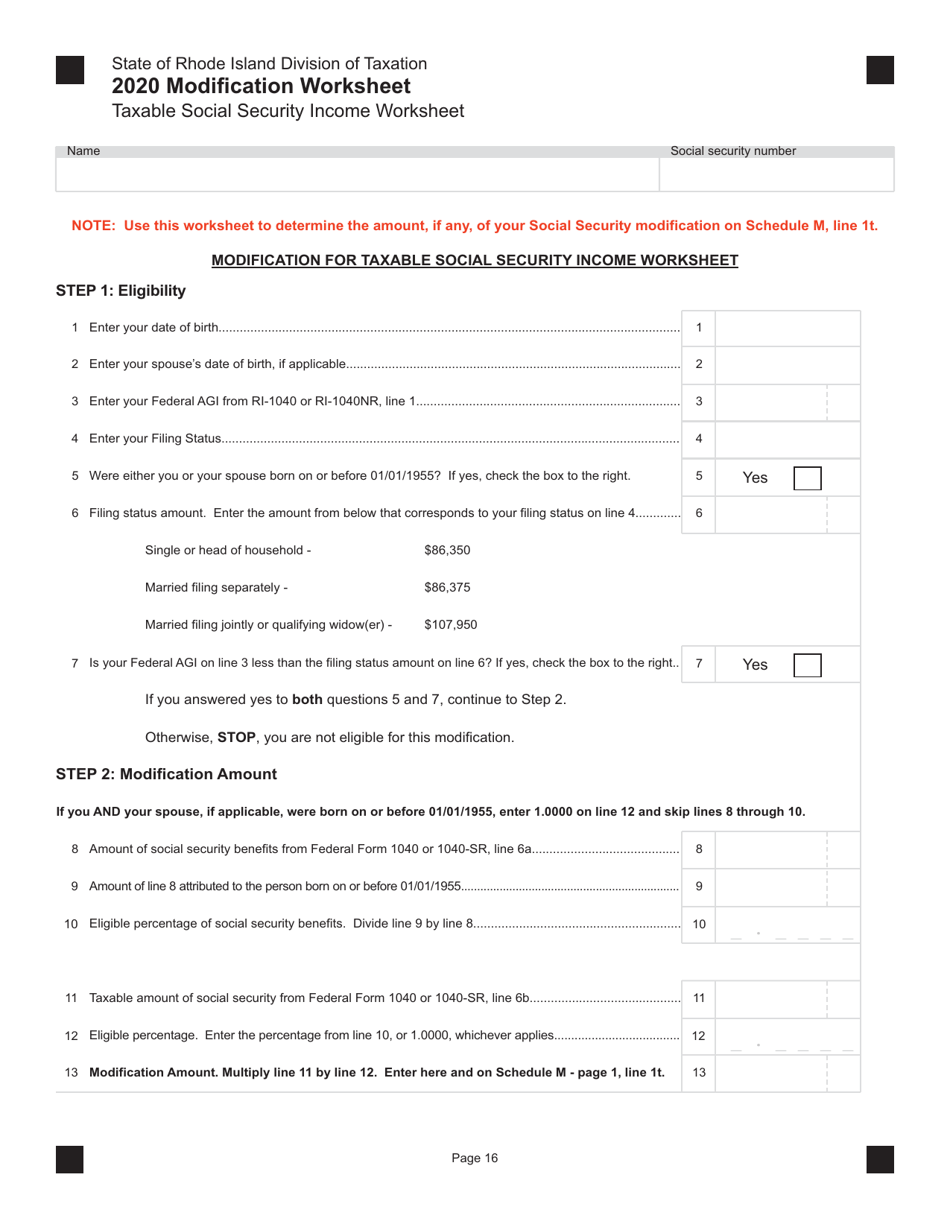

Different income levels are taxed at varying rates impacting the portion of Social Security benefits that become taxable These rates ensure a balanced tax burden across Social Security income benefits can be taxed up to 85 depending on the beneficiary s total annual income Social Security income is taxed in some form or another by 12 states

Depending on your income up to 85 of your Social Security benefits can be subject to tax That includes retirement and benefits from Social Security trust funds like survivor and disability For single filers up to 50 of Social Security benefits become taxable if provisional income is between 25 000 and 34 000 Exceeding 34 000 leads to a taxation of

More picture related to At What Income Level Does Social Security Become Taxable

![]()

What Are Medicare Income Limits For 2025 Hossein Summer

https://cdn.shortpixel.ai/client/to_webp,q_lossless,ret_img,w_840,h_597/https://www.medicareplanfinder.com/wp-content/uploads/2019/06/michigan-medicaid-eligibility-medicare-plan-finder.jpg

Taxable Social Security Worksheet 2024 Printable Taxable Soc

http://www.jdunman.com/ww/business/sbrg/graphics/26584r03.gif

Income Tax

https://thecollegeinvestor.com/wp-content/uploads/2023/11/TCI_-_2024_Federal_Tax_Brackets_1600x974.png

Unfortunately the federal income thresholds used to determine the taxability of your Social Security benefits aren t adjusted for inflation meaning many people will find their As much as 85 of your Social Security income can be taxed Learn what is taxable how taxes are calculated and how to minimize taxes owed

The amount of your taxable Social Security income depends on your total income Up to 85 of your Social Security income might be taxable The final 15 of this income is never taxed For an individual with a combined For the tax year 2023 the following income thresholds determine whether your Social Security benefits are taxable If your combined income is between 25 000 and 34 000 up to 50 of

Taxable Social Security Worksheet 2023

https://data.formsbank.com/pdf_docs_html/324/3240/324001/page_1_thumb_big.png

Social Security Limit 2025 Earnings Per Naomi Pink

http://www.socialsecurityintelligence.com/wp-content/uploads/2016/11/annual-update-charts-1024x576.jpg

https://www.usatoday.com › story › mone…

Up to 50 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is between

https://thefinancebuff.com › social-security-taxable-calculator.html

Social Security benefits are 100 tax free when your income is low As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Free Payroll Tax Calculator 2023 RomanyDarroch

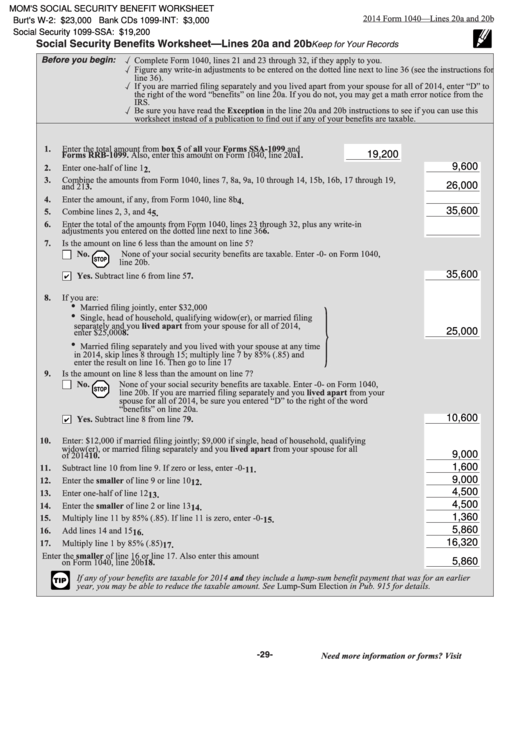

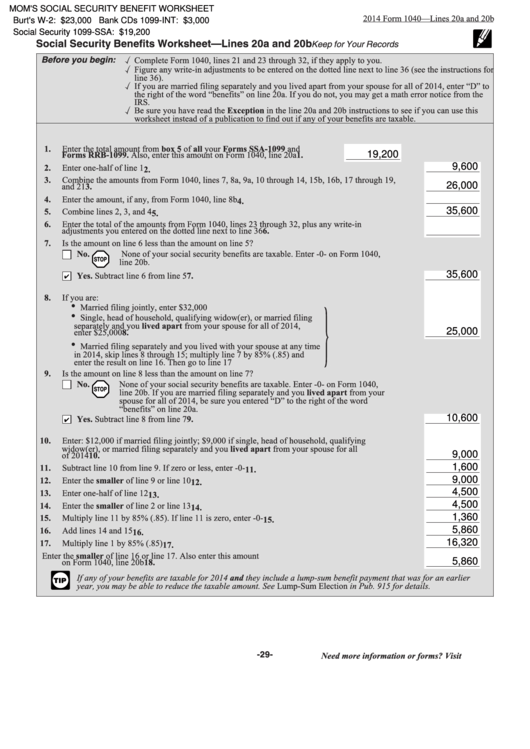

Taxable Social Security Worksheet 2023

Social Security Taxable Worksheets

Worksheet Taxable Social Security Benefits Taxable Social Se

Are Social Security Benefits Taxable Social Security Intelligence

Taxable Social Security Worksheet 2024

Taxable Social Security Worksheet 2024

Ss Worksheet 2023 Taxable Social Security Worksheets

Social Security Taxable Worksheets

Taxable Social Security Benefits Worksheet Social Security T

At What Income Level Does Social Security Become Taxable - Social Security income benefits can be taxed up to 85 depending on the beneficiary s total annual income Social Security income is taxed in some form or another by 12 states