Do I Pay Into Social Security If I Am Self Employed Paying Social Security and Medicare taxes If you work for an employer you and your employer each pay a 6 2 Social Security tax on up to 176 100 of your earnings Each must also pay a

If you re self employed you still have to pay Social Security taxes Find out how much you ll need to pay how to file and how to claim benefits too Even if you don t owe any income tax you must complete Form 1040 and Schedule SE to pay self employment Social Security tax This is true even if you already get Social Security

Do I Pay Into Social Security If I Am Self Employed

Do I Pay Into Social Security If I Am Self Employed

https://templatelab.com/wp-content/uploads/2016/02/Proof-of-employment-letter-38.jpg

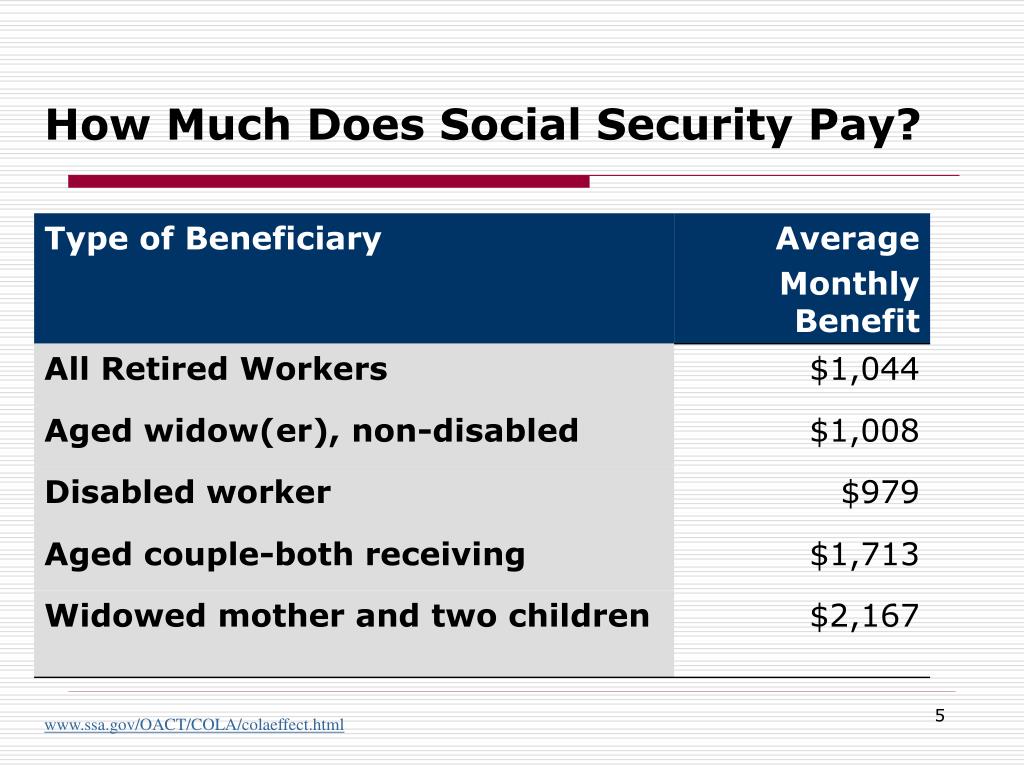

Social Security Taxability Worksheet

https://3.bp.blogspot.com/-CdXz1lKcPuQ/Tx3wgcF-ewI/AAAAAAAAAXk/cqo4tkyoGoQ/s1600/SS%2BTax.jpg

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Max Fica Tax 2025 Meade Brigida

https://www.thebalancemoney.com/thmb/apcFotrcGmN0DxX56zUvIVjKusQ=/1500x1000/filters:fill(auto,1)/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png

Yes You pay in the form of Self Employment Contributions Act SECA taxes reported on your federal tax return You file a Schedule C Self employed people must do all these actions and pay their taxes directly to the IRS You re self employed if you operate a trade business or profession either by yourself or as a partner You report your earnings for

Do self employed people pay into Social Security Self employed people are required to pay into Social Security but their obligations differ from those of traditional employees If you were a traditional employee you d Self employed people must report their earnings and pay their taxes directly to the Internal Revenue Service More Information Before self employed people can earn Social

More picture related to Do I Pay Into Social Security If I Am Self Employed

Social Security Max 2024 Wages 2024 Bella Regine

https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png

Got A Job At Age 70 Do I Pay Into Social Security Again

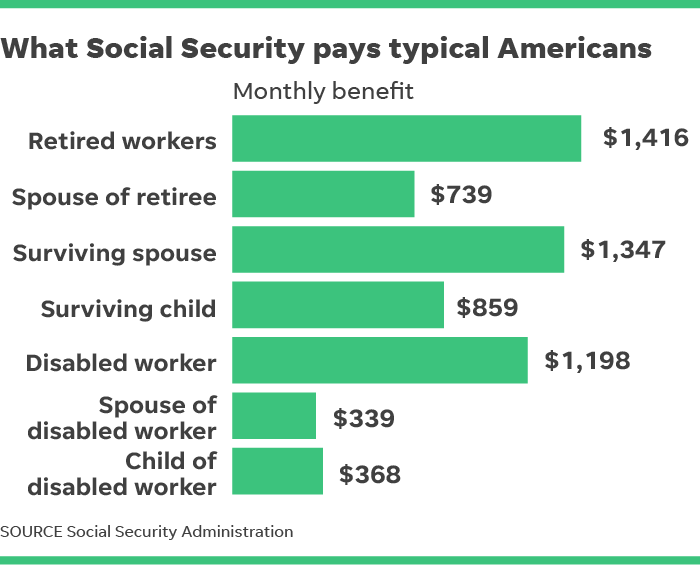

https://i2.cdn.turner.com/money/dam/assets/131219135502-social-security-pay-1024x576.png

Social Security Pay Days 2025 Kippy Marlee

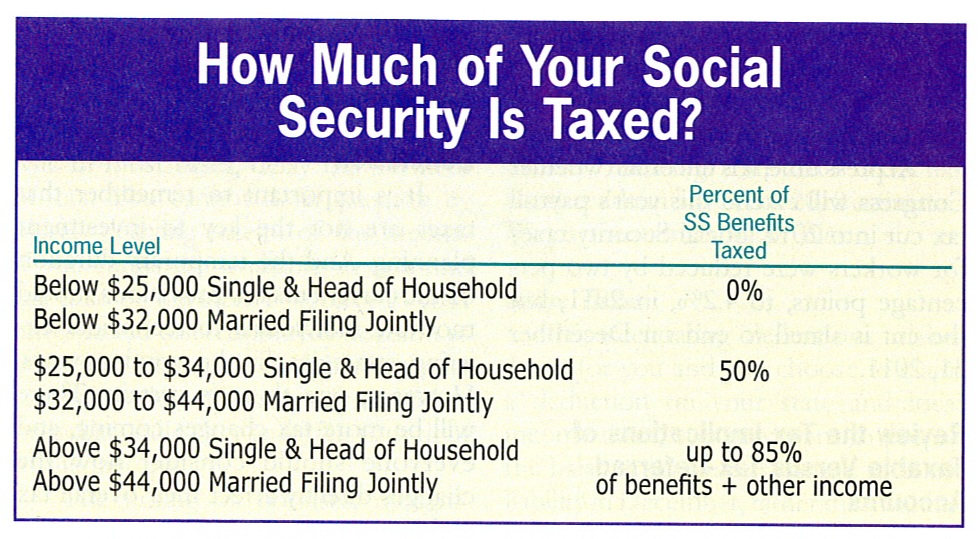

https://image.slideserve.com/333915/how-much-does-social-security-pay-l.jpg

All self employed workers must pay Social Security taxes just like individuals who work for an employer Those who work for an employer split their Social Security tax burden down the The truth is that Social Security benefits really don t vary whether you re self employed or are an employee in a business the major difference is that self employed workers must pay both the employee and employer portions of

Social Security is an issue for the self employed though Many shortchange themselves without knowing it According to the Squared Away Blog self employed folks may be As a self employed individual you re required to pay Social Security taxes on your earnings These taxes are essential as they fund your future Social Security benefits It s

Social Security Max Income Allowed 2024 Abbe Lindsy

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2023/02/social-security-max-income.png?fit=1456

How Do I Pay Into Social Security If I Am Self Employed

https://www.collinsprice.com/wp-content/uploads/2021/06/Untitled-design-1-e1627685306647.png

https://www.ssa.gov › pubs

Paying Social Security and Medicare taxes If you work for an employer you and your employer each pay a 6 2 Social Security tax on up to 176 100 of your earnings Each must also pay a

https://www.thebalancemoney.com

If you re self employed you still have to pay Social Security taxes Find out how much you ll need to pay how to file and how to claim benefits too

How Much Is Social Security Going Up In 2024 Corny Laetitia

Social Security Max Income Allowed 2024 Abbe Lindsy

Dr Barbara Provost EdD MS Ed MBM On LinkedIn financiallyfearless

How To Pay Social Security Tax As A Self Employed Individual

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paiement Des Cotisations De S curit Sociale Sur Les Revenus Apr s L

How Do I Pay Into Social Security If I Am Self employed

How Do I Pay Into Social Security If I Am Self employed

How Do I Pay Into Social Security If I Am Self employed

How Do I Pay Into Social Security If I Am Self employed

How Do I Pay Into Social Security If I Am Self employed

Do I Pay Into Social Security If I Am Self Employed - Yes You pay in the form of Self Employment Contributions Act SECA taxes reported on your federal tax return You file a Schedule C