Do I Pay Social Security Tax On 1099 Income For those earning 1099 income the primary factor determining Social Security tax liability is whether the income qualifies as self employment earnings According to the IRS self

When you receive a 1099 MISC for earned income this is reported on Schedule C where you list the income and the expenses related to your business you are in the How do you file and pay Social Security taxes if you are self employed You file Schedule SE through Form 1040 or 1040 SR For sole proprietors or independent contractors the form to use is Schedule C

Do I Pay Social Security Tax On 1099 Income

Do I Pay Social Security Tax On 1099 Income

http://zenmonics.com/wp-content/uploads/2023/07/c057aaf6-5eb7-4c71-ab7d-500c02524a9a.png

Do You Have To Pay Tax On Your Social Security Benefits Greenbush

https://images.squarespace-cdn.com/content/v1/601c437c854ffc4d9f0aead9/1632925508407-0WE2VDQJQ26TKQIOD9UO/Do+you+pay+tax+on+social+security.JPG

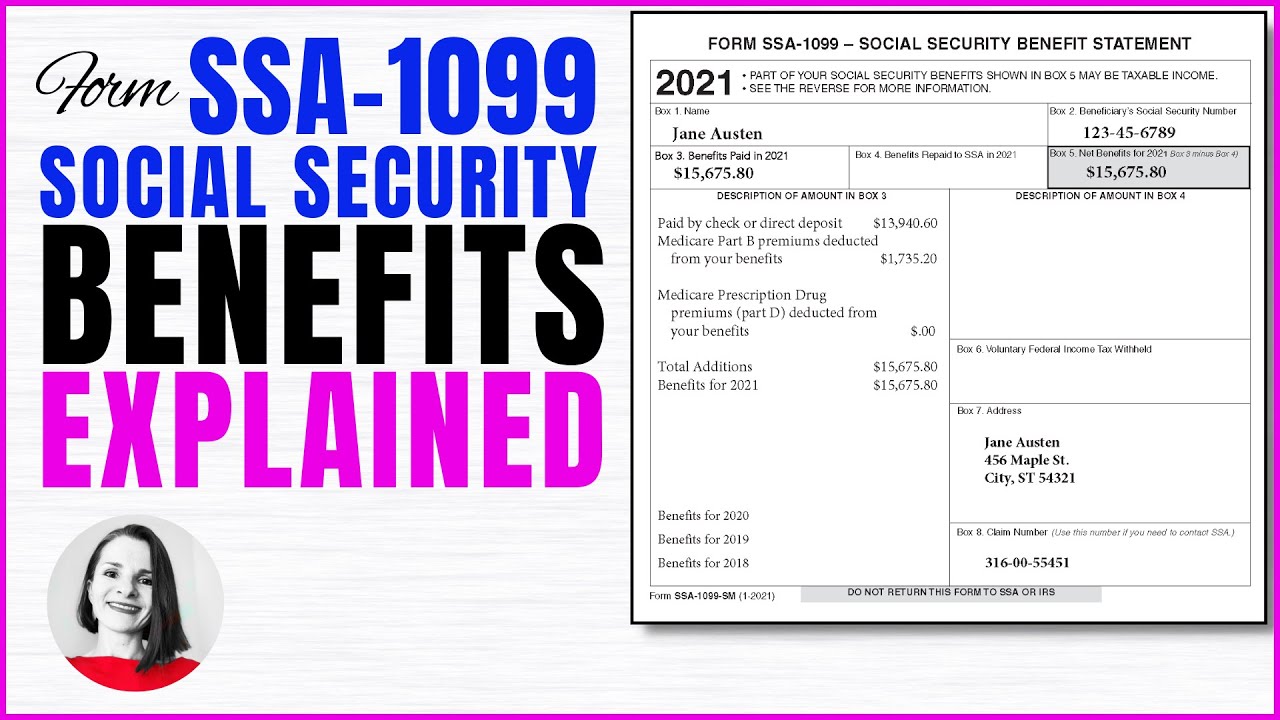

Tax Form SSA 1099 Social Security Benefit Explained Is My Social

https://i.ytimg.com/vi/8_9b9_HQkDY/maxresdefault.jpg

You must include the taxable part of a lump sum payment of benefits received in the current year reported to you on Form SSA 1099 Social Security Benefit Statement in When you work as a standard employee your employer automatically withholds your income and FICA taxes Social Security taxes and Medicare taxes and pays them to the IRS Self employed individuals on the other hand have to

If I work on a 1099 MISC I will pay approximately 15 for social security and medicare Do I also pay for state and federal taxes all the same For example I see NY state Learn when and how to report SSA 1099 on your taxes understand income thresholds and avoid potential penalties

More picture related to Do I Pay Social Security Tax On 1099 Income

Virginia 2023 Tax Form Printable Forms Free Online

https://www.tax.virginia.gov/sites/default/files/inline-images/1099-g-2022.png

Understanding Your Tax Forms 2016 SSA 1099 Social Security Benefits

https://i.pinimg.com/originals/e2/1a/f7/e21af78ef39658d5eac33ebb1b99b1dd.jpg

Irs Gov Form Ssa 1099 Universal Network Printable Form 2021

https://www.printableform.net/wp-content/uploads/2021/07/irs-gov-form-ssa-1099-universal-network.png

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between Up to 85 of your Social Security benefits may be subject to taxes at your ordinary income tax rate but 44 of people won t owe any income taxes on their Social Security

Do self employed individuals get Social Security benefits Yes they do Like every taxpayer who contributes to Social Security 1099 workers also receive benefits at retirement age Your In 202 3 income taxes on benefits added 50 7 billion to the Social Security trust funds accounting for about 3 8 percent of Social Security s revenue the vast majority of

How To Calculate Tax On 1099 Income For 2024 Benzinga

https://cdnwp-s3.benzinga.com/wp-content/uploads/2018/12/20175025/Screen-Shot-2018-12-20-at-12.50.09-PM.png

How To Enter A 1099 SSA Social Security YouTube

https://i.ytimg.com/vi/2wJ0wh90Zo0/maxresdefault.jpg

https://accountinginsights.org

For those earning 1099 income the primary factor determining Social Security tax liability is whether the income qualifies as self employment earnings According to the IRS self

https://ttlc.intuit.com › community › taxes › discussion › ...

When you receive a 1099 MISC for earned income this is reported on Schedule C where you list the income and the expenses related to your business you are in the

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

How To Calculate Tax On 1099 Income For 2024 Benzinga

Taxes On Social Security Social Security Intelligence

Understanding Your Tax Forms 2016 SSA 1099 Social Security Benefits

Did Reagan Impose An Income Tax On Social Security The Meme Policeman

Ssa 1099 Form 2020 2022 Fill And Sign Printable Template Online US

Ssa 1099 Form 2020 2022 Fill And Sign Printable Template Online US

How To Calculate Tax On 1099 Income For 2021 Benzinga

Social Security Limit 2024 Taxable Minne Christabella

Form 1040 Line 6 Social Security Benefits The Law Offices Of O

Do I Pay Social Security Tax On 1099 Income - Learn when and how to report SSA 1099 on your taxes understand income thresholds and avoid potential penalties