Do Seniors Pay Income Tax On Social Security Benefits The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits

But despite these areas of confusion keep in mind this one key rule the taxability of your Social Security benefits depends on your income not your age Whether you re 62 or 82 If you have income from multiple sources in retirement such as pensions withdrawals from retirement accounts or side jobs you may have to pay taxes on part of your Social

Do Seniors Pay Income Tax On Social Security Benefits

Do Seniors Pay Income Tax On Social Security Benefits

https://www.retireguide.com/wp-content/uploads/an-impact-taxes-pdf-preview.png

A Bill To Drop Income Tax On Social Security Is Passed

https://images.radio.com/aiu-media/seniors-pic-a8a24047-e94b-46dc-8485-a4762648f181.jpg

How To Calculate Find Social Security Tax Withholding Social

https://i.ytimg.com/vi/q342U65tAgA/maxresdefault.jpg

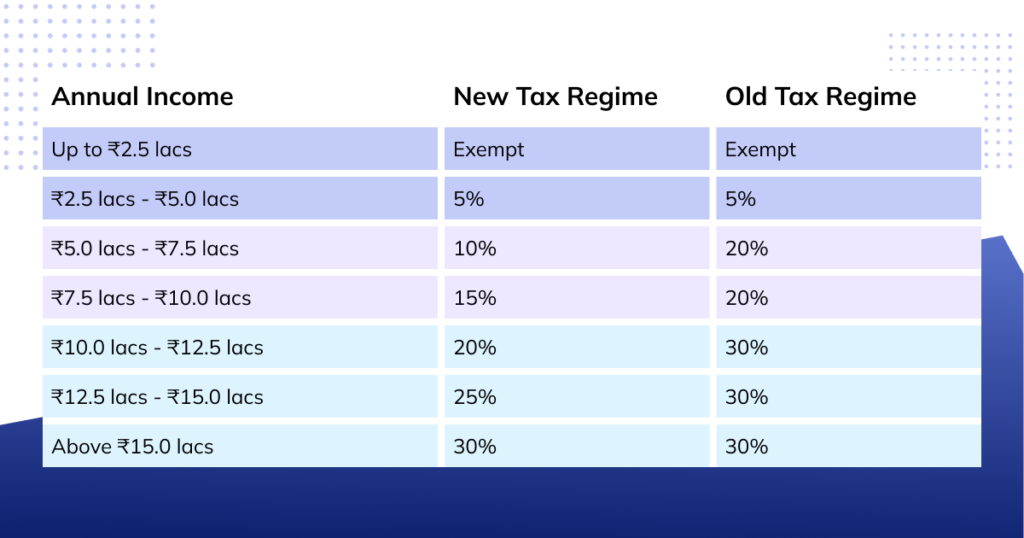

Income matters age doesn t Contrary to another common misperception you don t stop paying taxes on your Social Security when you reach a certain age Income and income alone dictates whether you owe federal taxes on your benefits Depending on these figures your Social Security may be partially taxable However not all seniors will owe taxes on their benefits The IRS sets thresholds to guide this process If your income exceeds certain limits some of your benefits could be taxable Here s a quick breakdown of tax implications

Social Security benefits include monthly retirement survivor and disability benefits They don t include supplemental security income SSI payments which aren t taxable Use the Interactive Tax Assistant to get retirement income information including pensions IRAs and Social Security Tax information for seniors and retirees including typical sources of income in retirement and special tax rules

More picture related to Do Seniors Pay Income Tax On Social Security Benefits

Taxes On Social Security Benefits Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2022/11/2022-optima-taxes-social-security.jpg

What Do You Need To Know About Income Tax Benson Wood Co

https://www.benson-wood.co.uk/wp-content/uploads/2023/05/What-do-you-need-to-know-about-Income-Tax-1.png

Paying Federal Income Tax On Social Security Benefits

https://stwserve.com/wp-content/uploads/2023/03/Fedzone-Images-Income-Tax-on-Social-Security.jpeg

Everyone must pay applicable Social Security taxes on income even those working past full retirement age On the plus side working past full retirement age may also increase Whether your Social Security benefits will be taxed will depend on your total income and where you live during your golden years First let s talk federal taxes If your benefits are pretty much

Do seniors pay taxes on Social Security income between 25 000 and 34 000 you may have to pay income tax on up to 50 percent of your benefits more than 34 000 up to 85 percent of your benefits may be taxable At what age is Social Security no longer taxed Social Security benefits may or may not be taxed after 62 depending on your other income earned If you only receive Social Security benefits and no other income then you likely

Salary Breakup Structure Format Calculation More Razorpay Payroll

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

Social Security Cuts These States Would Be Impacted The Least

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA19S47I.img?w=1920&h=1080&m=4&q=93

https://www.irs.gov › newsroom › irs-reminds-taxpayers...

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits

https://www.kiplinger.com › taxes › taxes-on-social-security-age

But despite these areas of confusion keep in mind this one key rule the taxability of your Social Security benefits depends on your income not your age Whether you re 62 or 82

Social Security And Income Tax When Does Good News Become Bad News

Salary Breakup Structure Format Calculation More Razorpay Payroll

How Can You Save Income Tax On Severance Pay In Germany

Withholding Income Tax On Social Security Benefits Parks Company

Understanding How Taxes Work

Calculating Social Security Taxable Income TaxableSocialSecurity

Calculating Social Security Taxable Income TaxableSocialSecurity

Senior Care Professional Talks Benefits Of Proposed Social Security Tax

How Much Income Tax Do You Pay On Social Security Retire Gen Z

Seniors Receiving Social Security Benefits May Pay More Taxes In 2024

Do Seniors Pay Income Tax On Social Security Benefits - Income matters age doesn t Contrary to another common misperception you don t stop paying taxes on your Social Security when you reach a certain age Income and income alone dictates whether you owe federal taxes on your benefits