Do You Pay Social Security On Capital Gains Learn how capital gains are taxed when you receive Social Security benefits depending on your income level and other factors See

The good news is that capital gains unlike earned income do not directly impact the calculation of your Social Security benefits This means that regardless of the capital gains Here s the quick answer Capital gains do not count as earned income for Social Security benefits This means profits from selling investments are not considered income when

Do You Pay Social Security On Capital Gains

Do You Pay Social Security On Capital Gains

https://moneytips.com/wp-content/uploads/Homes_HowToAvoidCapitalGainsTaxonInheritedProperty.jpg

Do You Have To Pay Social Security Tax If You re Self employed Farm

https://www.fbfs.com/getmedia/c0cd3a59-ddee-414d-9348-df986fdcb164/lcarticle_doyoupaysocialsecurityselfemployed.jpg

When Do You Pay Capital Gains On A Roth IRA

https://www.teachmepersonalfinance.com/wp-content/uploads/2022/05/capital_gains_tax.jpeg

If you will have no capital gains to report on your tax return then the sale does not affect your Social Security benefits or any Medicare premiums you pay in any way Depending on combined income including capital gains anywhere from 0 to 85 of your Social Security benefits can be taxable What income counts towards capital

For example in 2024 individual filers won t pay any capital gains tax if their total taxable income is 47 025 or below However they ll pay 15 percent on capital gains if their How do capital gains affect Social Security No Income that comes from something other than work such as pensions annuities investment income interest IRA and 401 k distributions and capital gains is not counted toward

More picture related to Do You Pay Social Security On Capital Gains

Do You Have To Pay Tax On Your Social Security Benefits YouTube

https://i.ytimg.com/vi/yVRdBCJXqAU/maxresdefault.jpg

BIR Tax Penalties For Failure To File And Pay Taxes

https://mpm.ph/wp-content/uploads/2023/07/bir-tax-penalties.jpg

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term

https://i.ytimg.com/vi/TLFG1_jFQ_Y/maxresdefault.jpg

Regardless of whether or not you receive Social Security benefits the IRS levies taxes on capital gains If your capital gains are short term meaning that you held the asset While capital gains income will not result in a reduced benefit it may determine whether you must pay taxes on those benefits More than half of Social Security recipients pay some income taxes on their benefits

Capital gains can also affect tax on your Social Security benefits Keep in mind that up to 85 of Social Security benefits can be subject to tax depending on your overall Our tax experts discuss a proposal to impose Social Security payroll taxes on capital gains for the wealthy

13 Things You Need To Know About Social Security Vision Retirement

https://images.squarespace-cdn.com/content/v1/5e987637e1c6961885db98a3/1670294092041-83GET7D9MPEF1GO4KRGS/What+you+need+to+know+about+Social+Security.png

Series 3 Capital Gains Tax Rates PPL CPA

https://www.pplcpa.com/wp-content/uploads/2022/11/Series-3-Capital-Gains-Tax-Rates.png

https://thefinancebuff.com › tax-on-capital-gains...

Learn how capital gains are taxed when you receive Social Security benefits depending on your income level and other factors See

https://themoneyknowhow.com › do-capital-gains...

The good news is that capital gains unlike earned income do not directly impact the calculation of your Social Security benefits This means that regardless of the capital gains

Washington Supreme Court Greenlights Capital Gains Tax On Wealthy To

13 Things You Need To Know About Social Security Vision Retirement

Capital Gains Account Scheme CGAS Taxation And Types

How Much Income Do You Pay Social Security Tax On YouTube

Capital Gains Distribution What It Is How It s Taxed InfoComm

Do You Have To Pay Tax On Your Social Security Benefits Greenbush

Do You Have To Pay Tax On Your Social Security Benefits Greenbush

Do You Pay Social Security Tax On Capital Gains CountyOffice

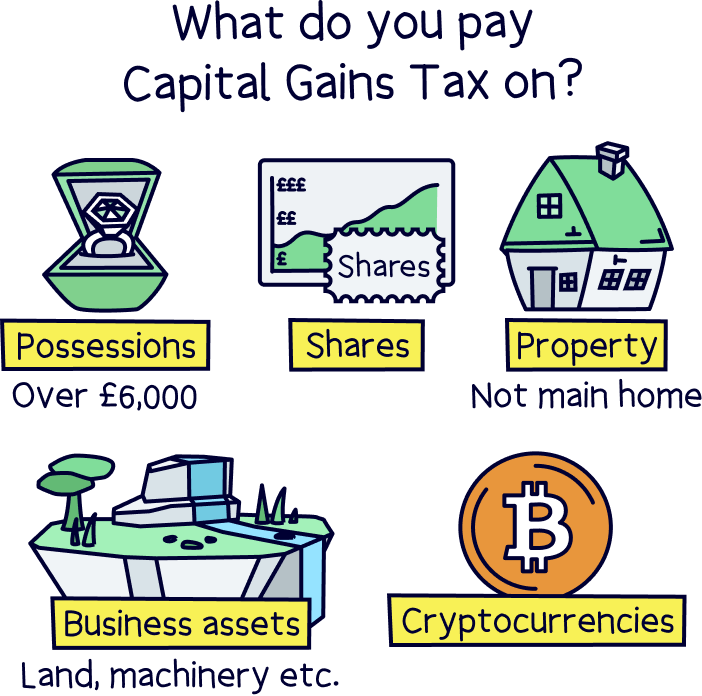

What Is Capital Gains Tax Nuts About Money

Can You Get Social Security Benefits Without Being A US Citizen YouTube

Do You Pay Social Security On Capital Gains - If you will have no capital gains to report on your tax return then the sale does not affect your Social Security benefits or any Medicare premiums you pay in any way