Do You Pay State Taxes On Social Security Out of all 50 states in the U S 41 states and the District of Columbia do not levy any tax on Social Security benefits Nine of those states don t collect state income tax at all

Social Security benefits can be taxed at the federal level but whether they are subject to state taxes depends on where you live Some states tax these benefits fully or All of the above concerns federal income taxes For the 2024 tax year nine states will also tax Social Security to varying degrees Colorado Connecticut Minnesota Montana

Do You Pay State Taxes On Social Security

Do You Pay State Taxes On Social Security

https://www.taxestalk.net/wp-content/uploads/who-is-responsible-for-state-unemployment-taxes-netpeo.jpeg

Do You Have To Pay Tax On Your Social Security Benefits YouTube

https://i.ytimg.com/vi/yVRdBCJXqAU/maxresdefault.jpg

Taxes On Social Security Benefits Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2022/11/2022-optima-taxes-social-security.jpg

Retirees who have reached full retirement age and meet income requirements aren t subject to state tax on Social Security benefits There s good news for retirees in most states 39 states plus the District of Columbia don t tax Social Security benefits at all

In some places you might also owe state income taxes on your Social Security benefits Knowing which states levy these taxes can help you prepare for retirement Here are For the 2024 tax year nine states tax Social Security benefits Colorado Connecticut Minnesota Montana New Mexico Rhode Island Utah Vermont and West

More picture related to Do You Pay State Taxes On Social Security

Will I Have To Pay Taxes On My Social Security Income

https://media.zenfs.com/en/smartasset_475/23673842494ef0e9d25ad87fac73fa93

How To Withhold Taxes On Social Security Benefits YouTube

https://i.ytimg.com/vi/NzKp7qvvagY/maxresdefault.jpg

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Single Social Security recipients with an AGI of less than 75 000 and married couples with an AGI under 100 000 are exempt from paying state taxes on their benefits For This comprehensive guide will delve into the tax treatment of Social Security benefits across different states highlight states that don t tax these benefits and provide insights into the

[desc-10] [desc-11]

Taxes Committee Joins The Social Security Subtraction Conversation

https://www.house.mn.gov/SessionDaily/VSDImagesFull/030923-PHOTO-Social Security Tax Bills-AV.jpg

Do You Have To Pay Tax On Your Social Security Benefits Greenbush

https://images.squarespace-cdn.com/content/v1/601c437c854ffc4d9f0aead9/1632925508407-0WE2VDQJQ26TKQIOD9UO/Do+you+pay+tax+on+social+security.JPG

https://www.investopedia.com

Out of all 50 states in the U S 41 states and the District of Columbia do not levy any tax on Social Security benefits Nine of those states don t collect state income tax at all

https://accountinginsights.org › do-you-have-to-pay...

Social Security benefits can be taxed at the federal level but whether they are subject to state taxes depends on where you live Some states tax these benefits fully or

PA Tax Credit Programs Kentucky Avenue School

Taxes Committee Joins The Social Security Subtraction Conversation

Property Taxes By State County Median Property Tax Bills

IRS Announces Taxes Retirees Will Have To File In 2024

STATE INCOME TAXES ON SOCIAL SECURITY AND PDF FileSTATE INCOME TAXES

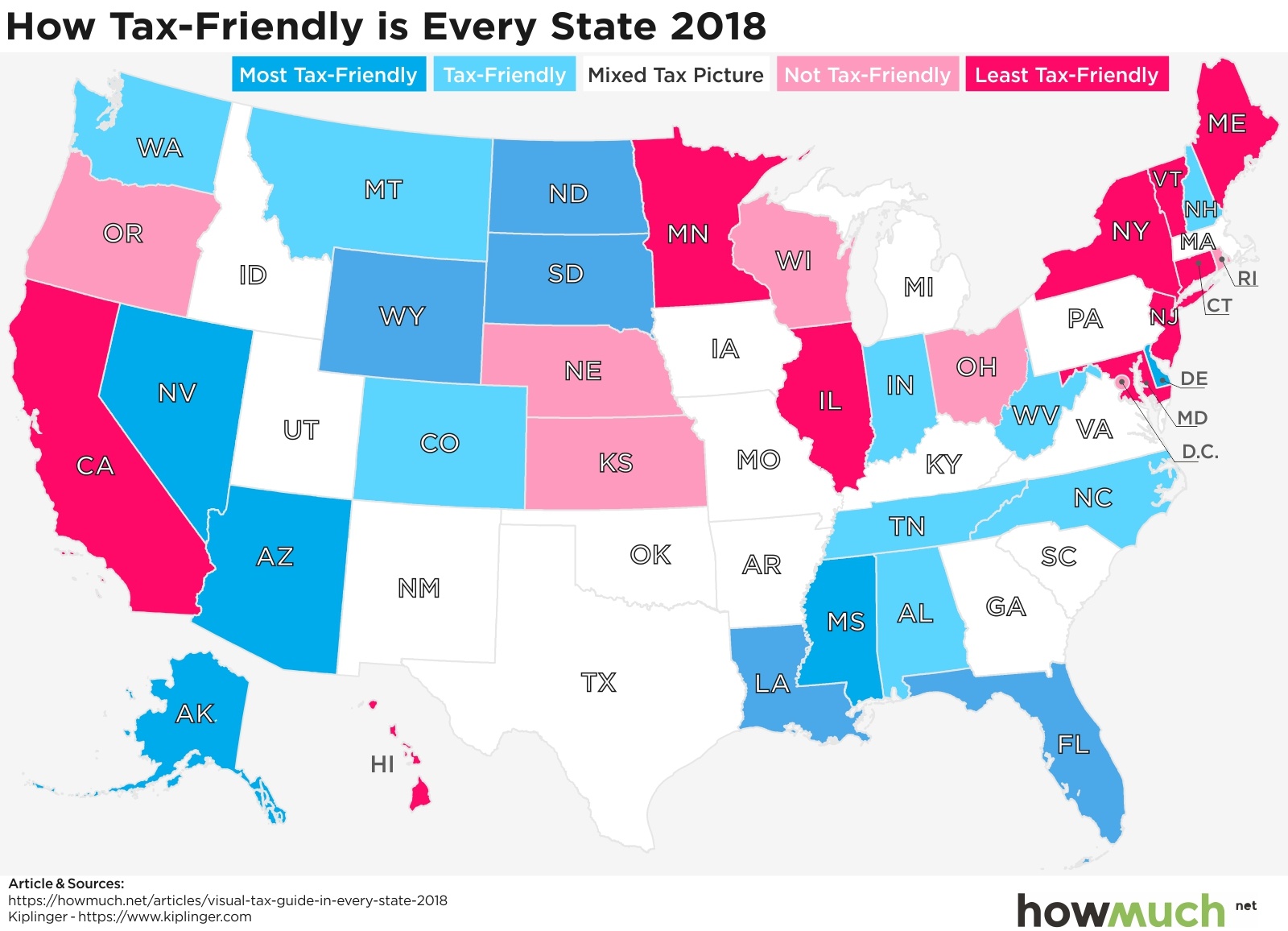

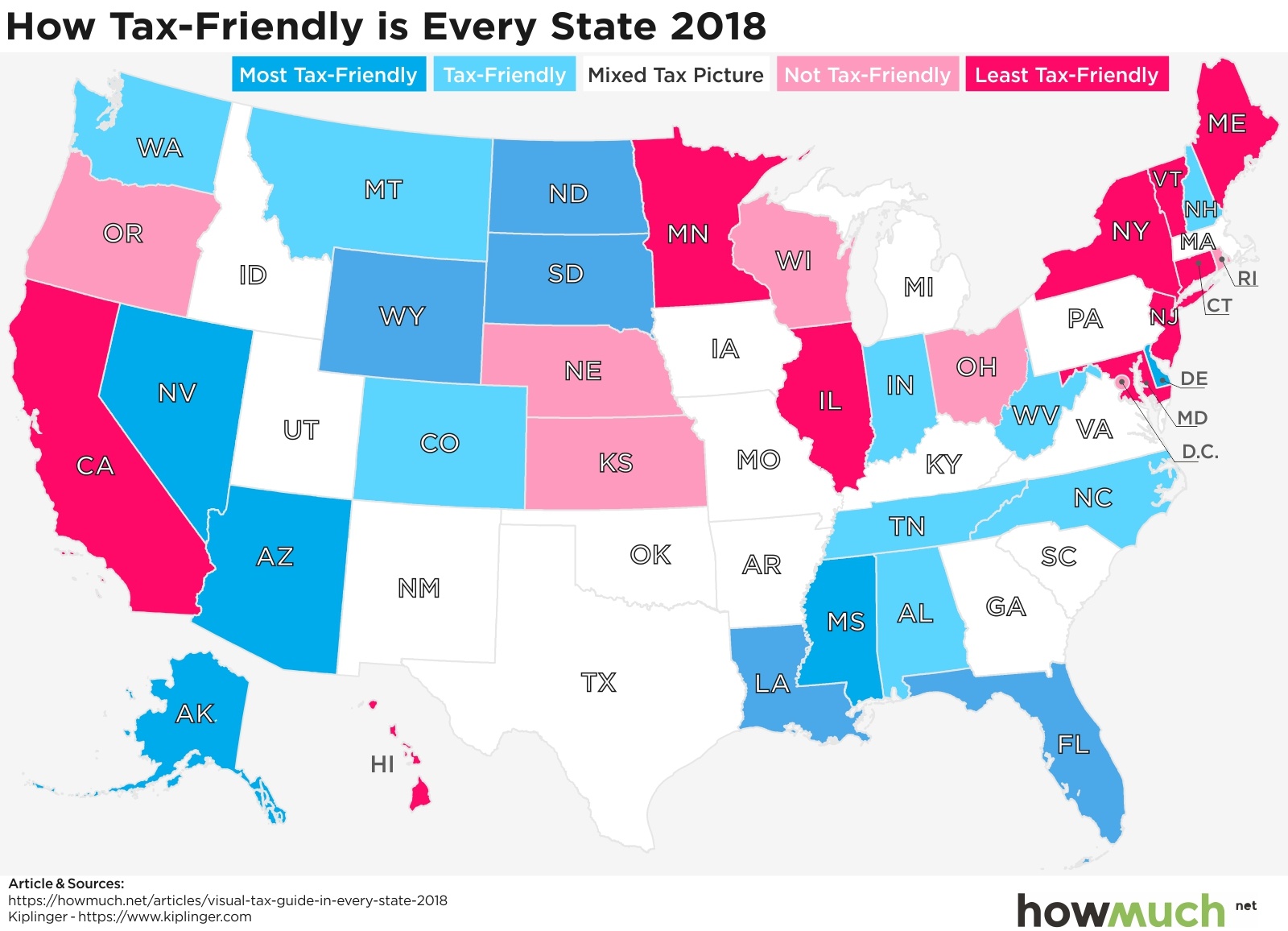

Visualizing Taxes By State

Visualizing Taxes By State

Can You Avoid Taxes On Social Security

Do You Pay Taxes On Social Security Income

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

Do You Pay State Taxes On Social Security - [desc-14]