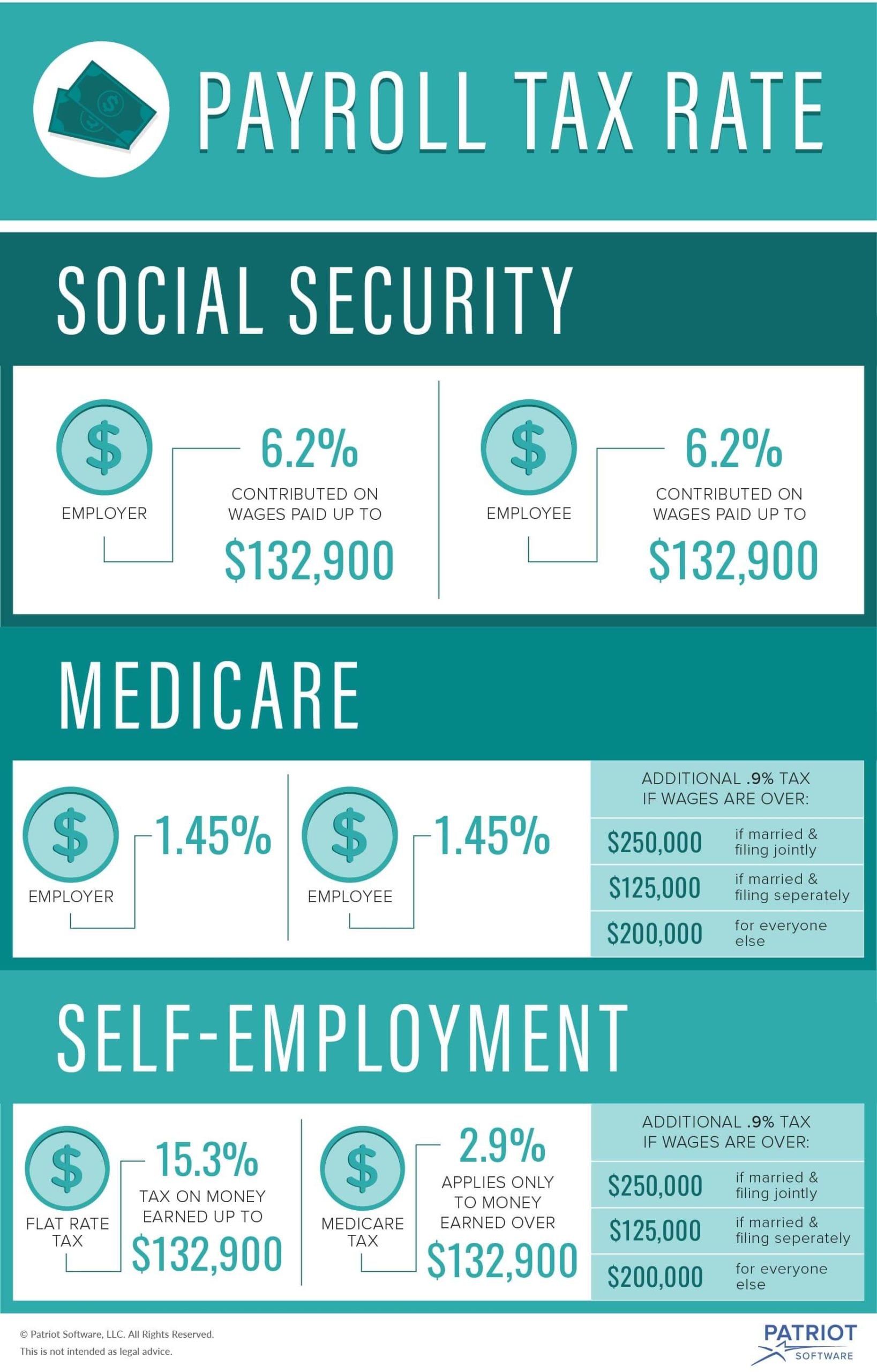

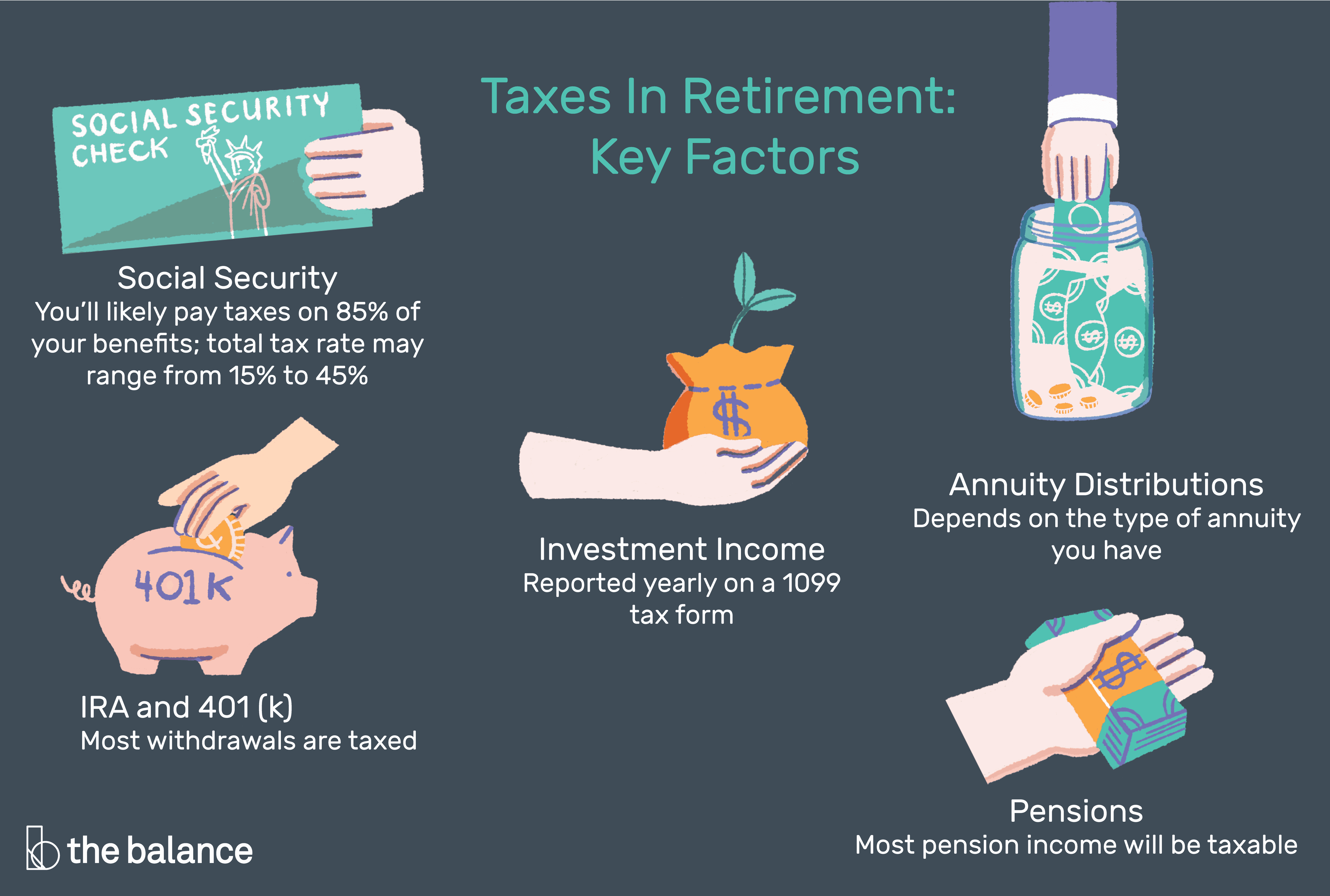

Do You Pay Taxes On Social Security Retirement Income Once retired and living on unearned income you will no longer be paying Social Security and Medicare payroll taxes You will still be subject to

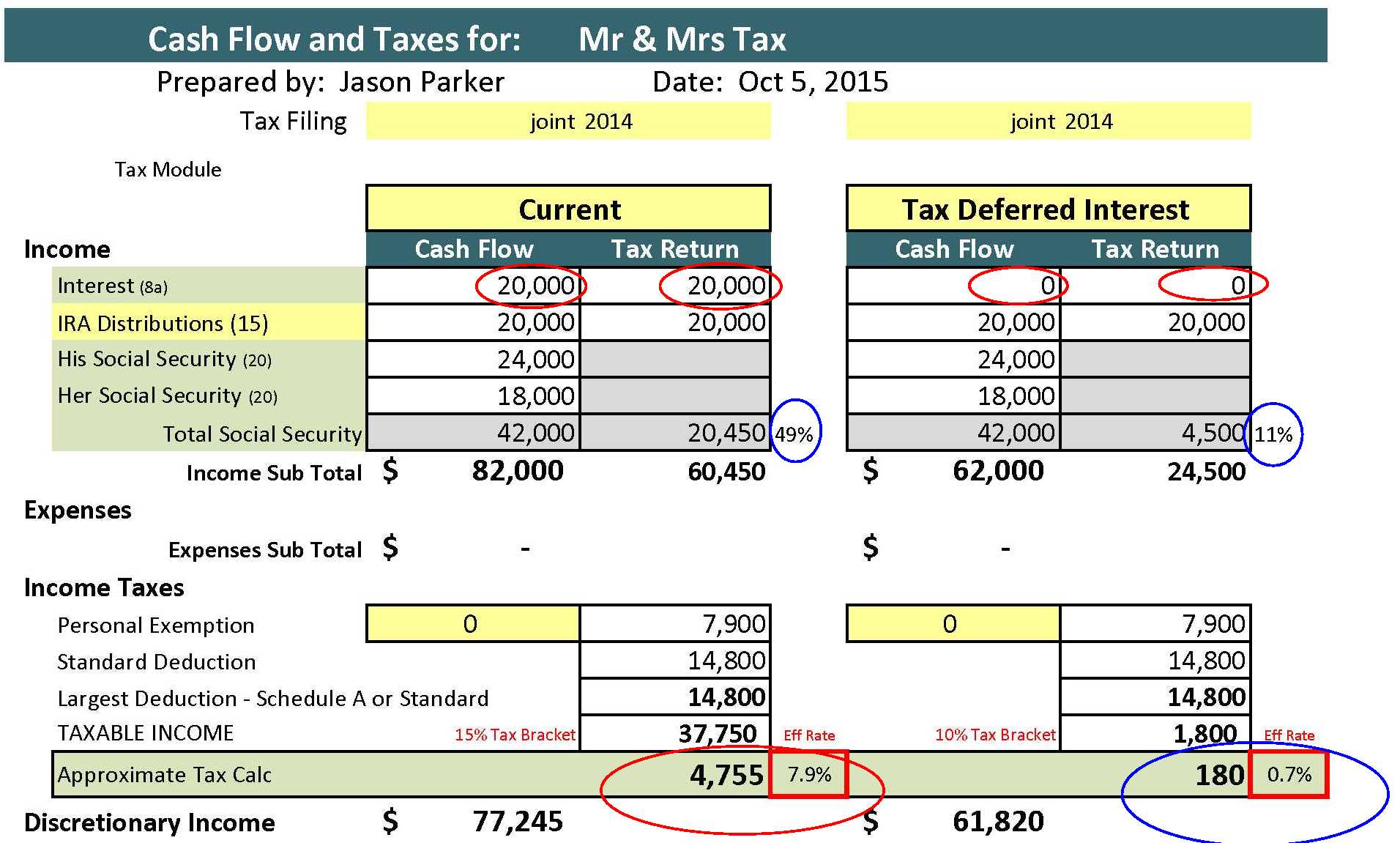

If you have income from multiple sources in retirement such as pensions withdrawals from retirement accounts or side jobs you may have to This guide will address the specific question of whether you need to pay taxes on your Social Security benefits if you also receive a pension Taxation of Social Security

Do You Pay Taxes On Social Security Retirement Income

/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8.png?resize=618,416&ssl=1)

Do You Pay Taxes On Social Security Retirement Income

https://i2.wp.com/www.thebalance.com/thmb/i0CWu29cMfAQTnIorSnssKixxcw=/6250x4211/filters:no_upscale()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8.png?resize=618,416&ssl=1

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png)

Rule Of 85 Pension

https://www.thebalancemoney.com/thmb/-LW2MdV2t4ff5yh_RqjiixyZkXQ=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png

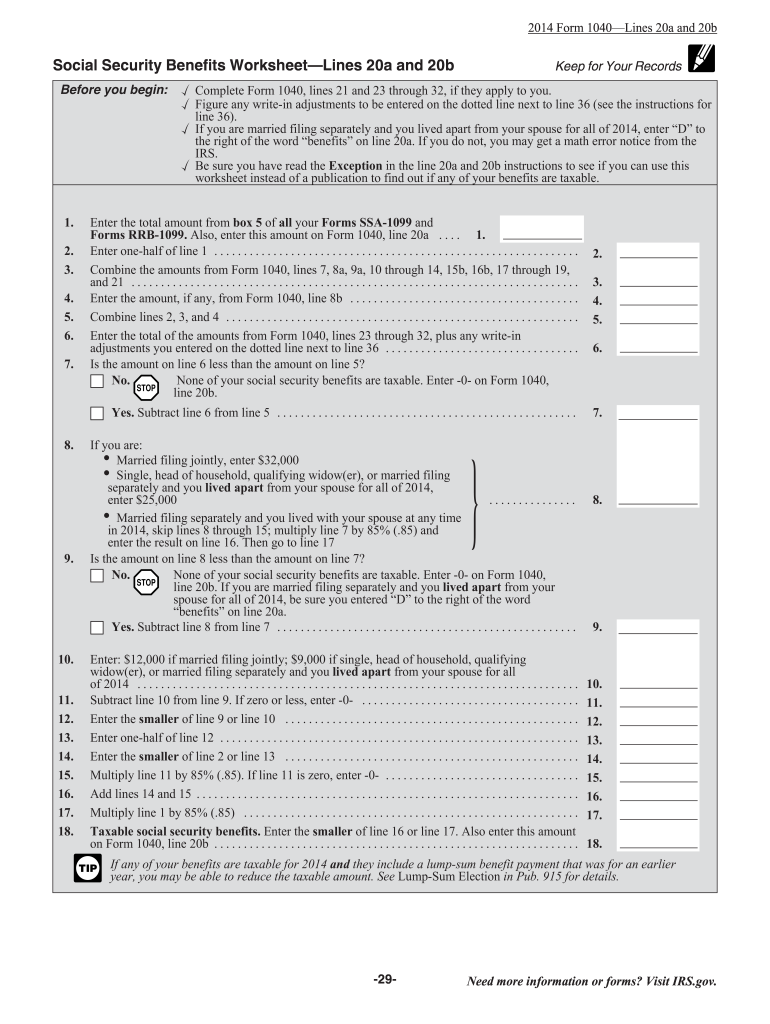

Social Security Taxability Worksheet

https://3.bp.blogspot.com/-CdXz1lKcPuQ/Tx3wgcF-ewI/AAAAAAAAAXk/cqo4tkyoGoQ/s1600/SS%2BTax.jpg

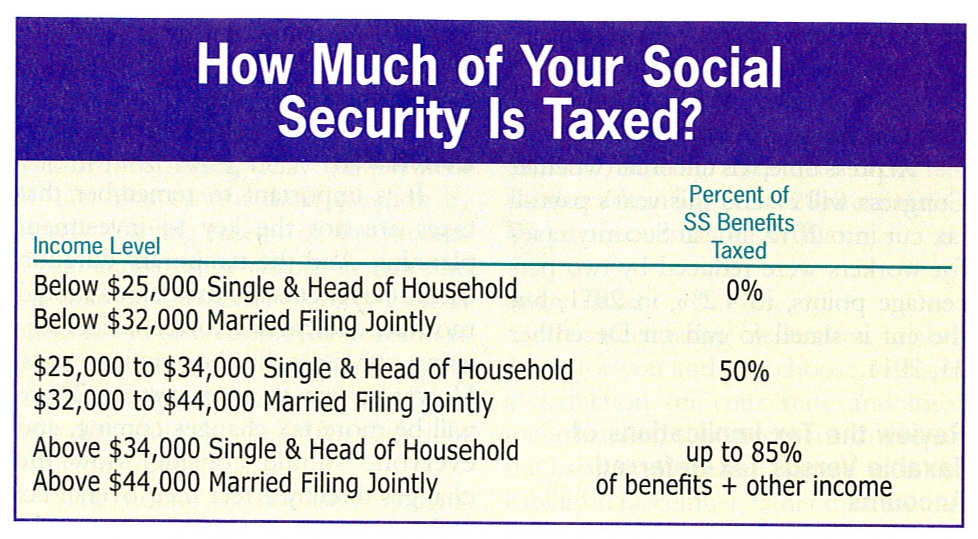

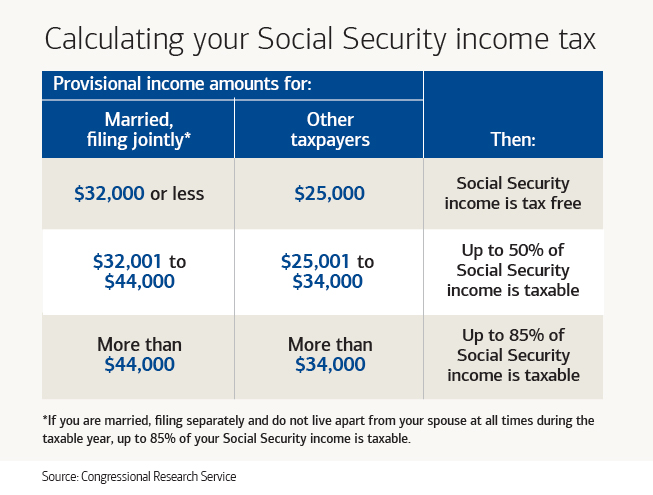

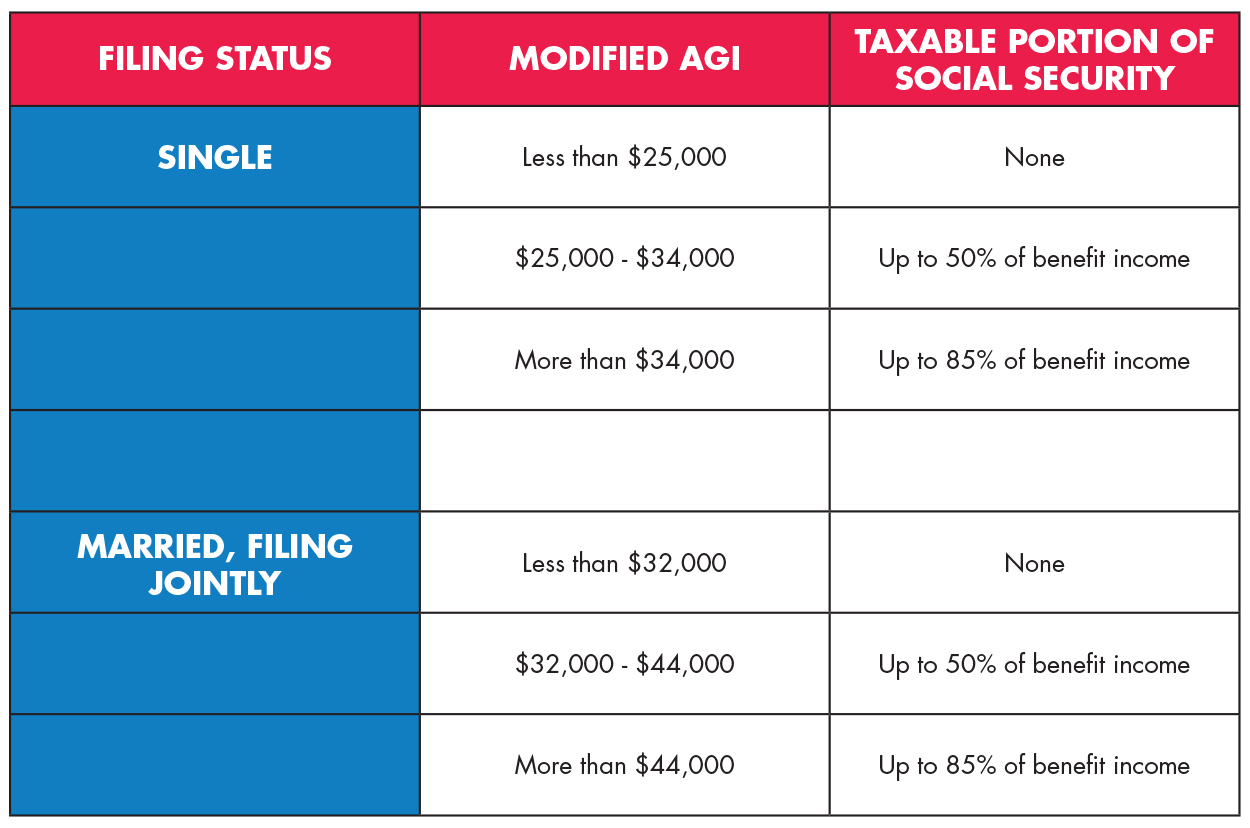

These are Social Security retirement income survivor benefits and Social Security Disability Insurance SSDI payments The good news is that 15 of your social security payments are never taxable But what about the other 85 You probably won t pay any taxes in retirement if Social Security benefits are your only source of income but a portion of your benefits will likely be taxed if you have other additional sources of income

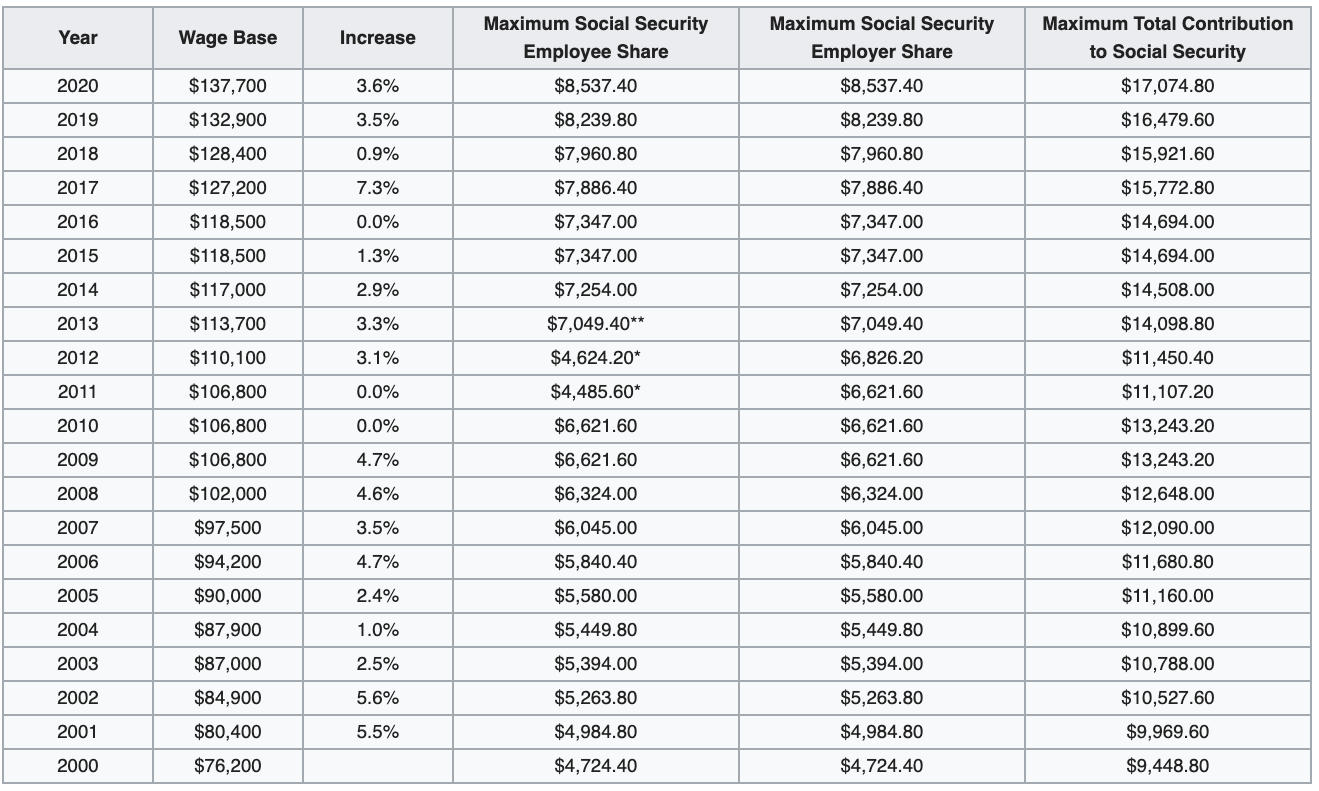

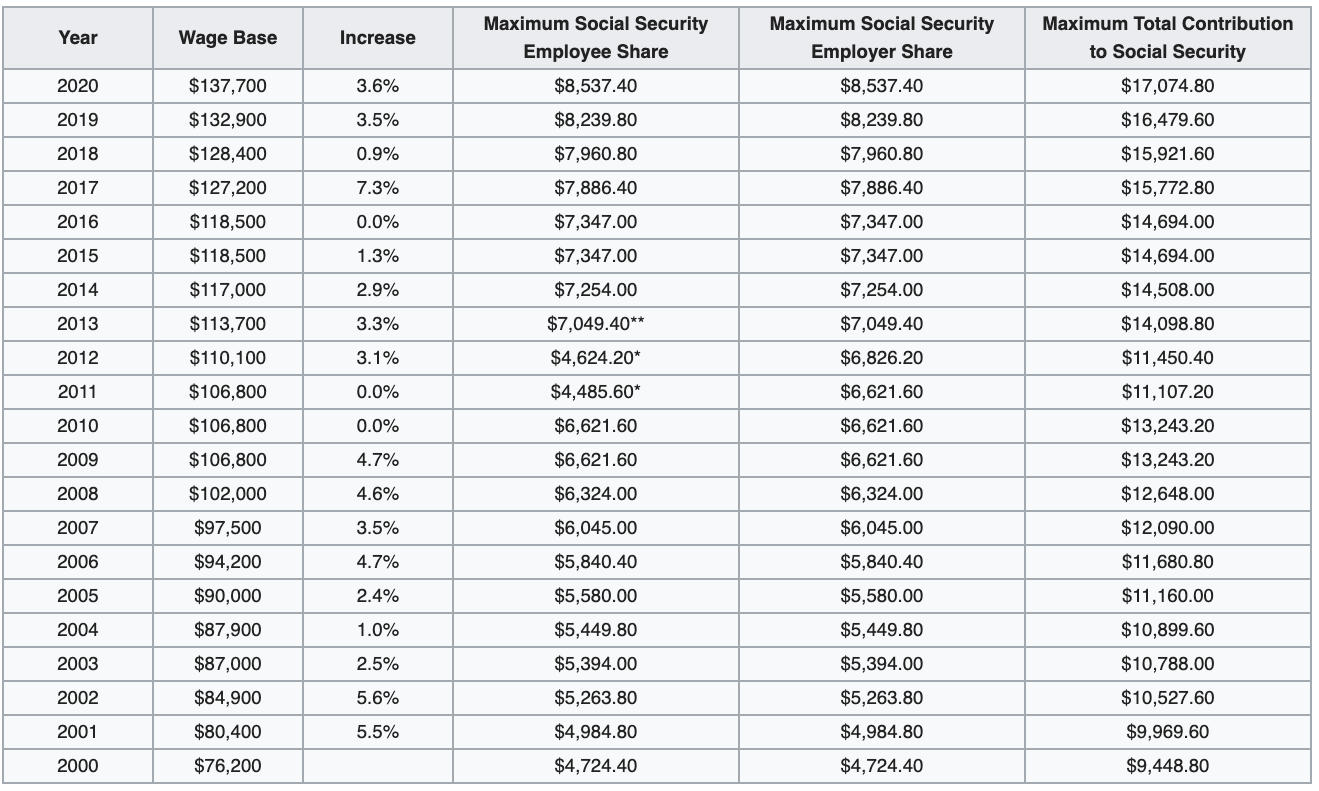

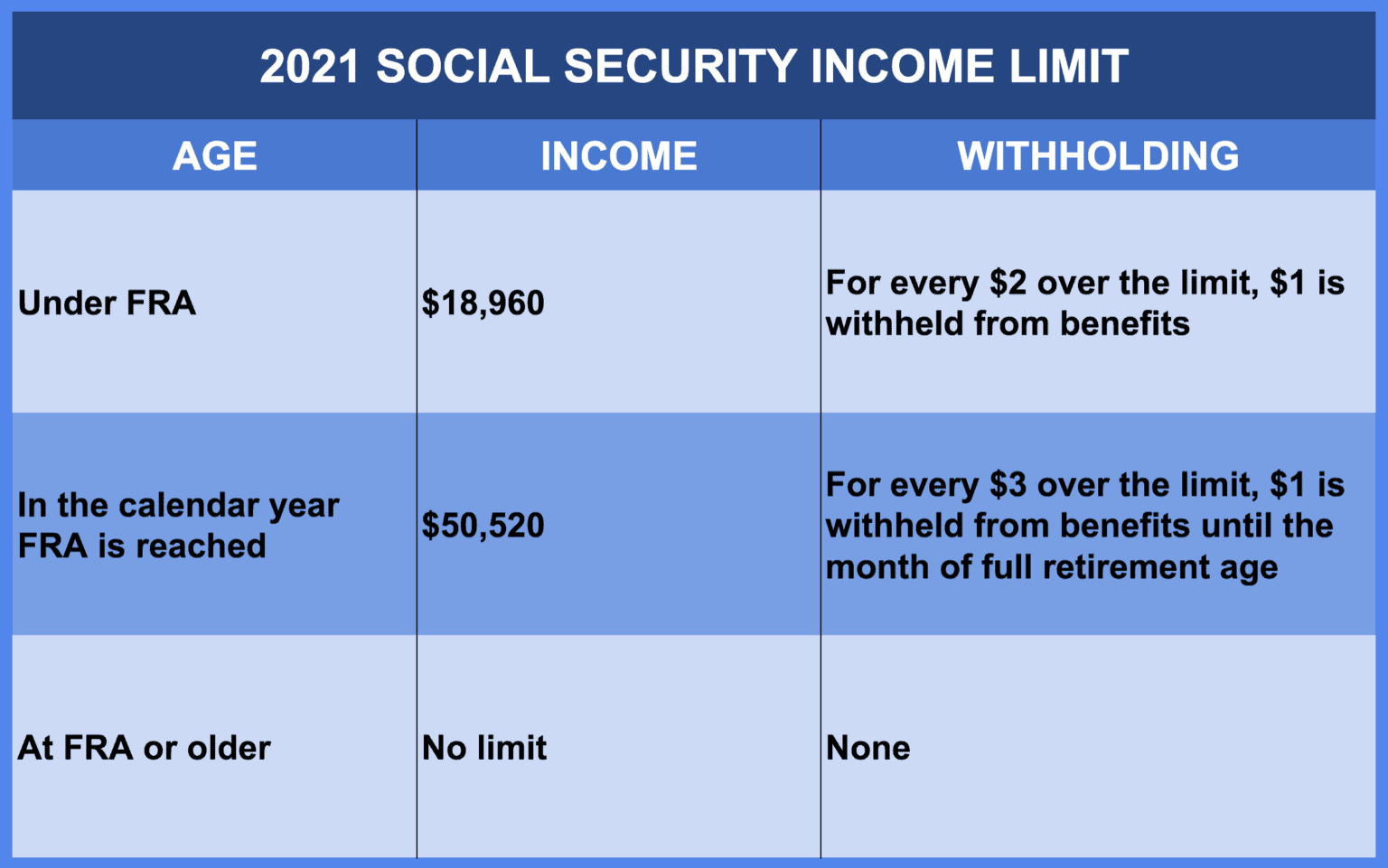

How much you pay in taxes depends on your income and the state you live in Age is not a factor COLA the largest since 1981 increased the average retired worker s Generally you can figure the taxable amount of the benefits in Are my Social Security or railroad retirement tier I benefits taxable on a worksheet in the Instructions for

More picture related to Do You Pay Taxes On Social Security Retirement Income

Medicare Additional Tax 2025 Hunter Mustafa

https://www.patriotsoftware.com/wp-content/uploads/2019/12/payroll-tax-rate-2019-1-scaled.jpg

Irs Support Worksheets

https://www.signnow.com/preview/6/963/6963800/large.png

Gross Up Social Security Income Worksheet

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

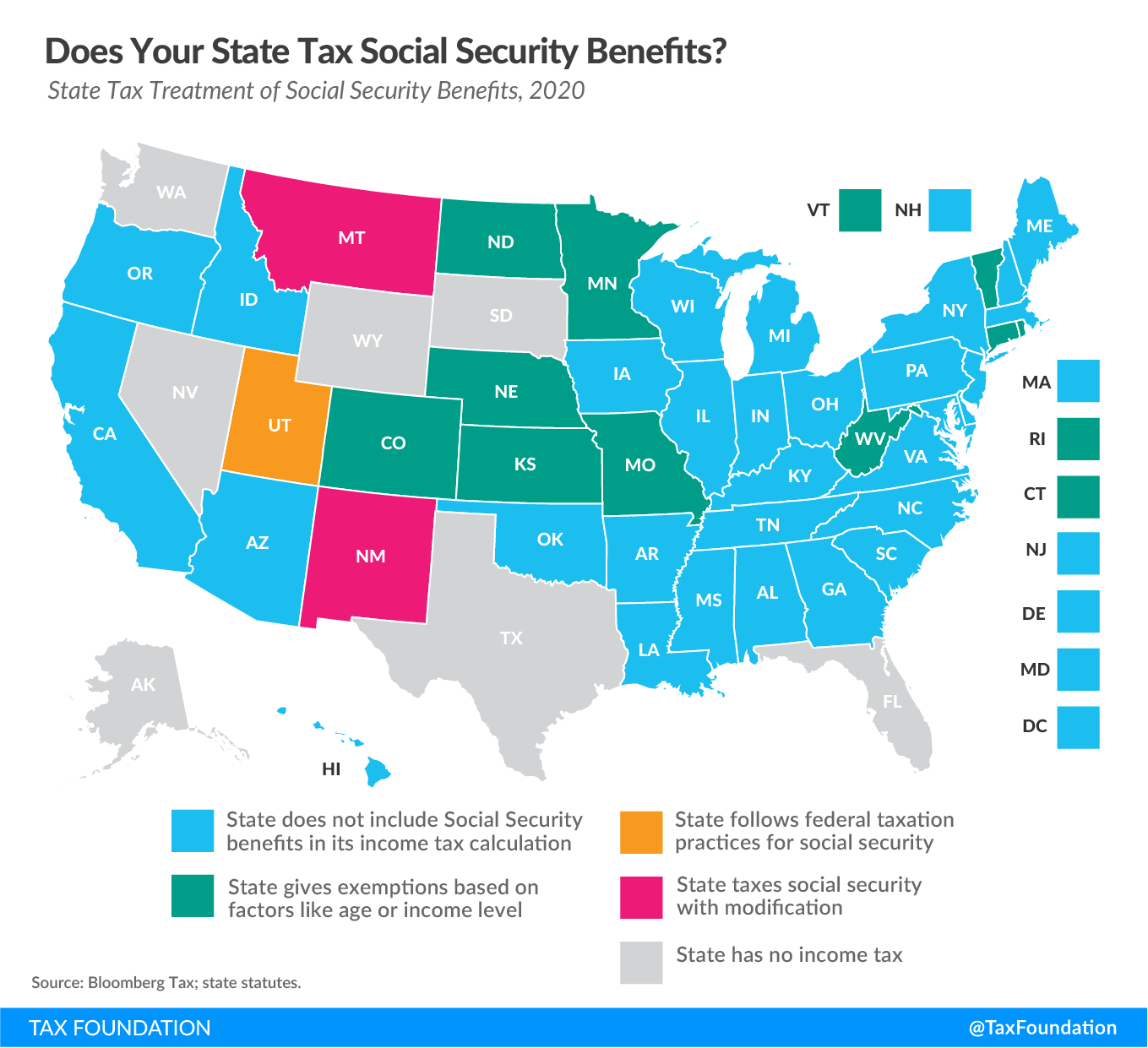

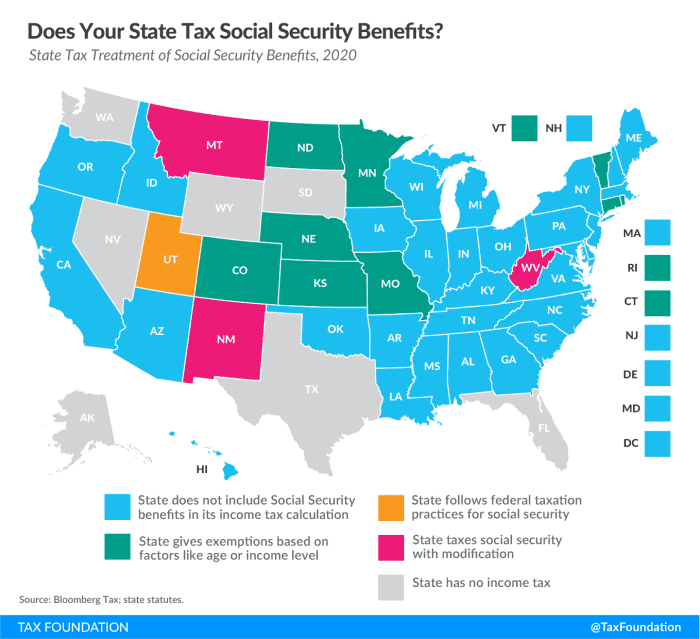

Rhode Island If your income exceeds 104 200 for single filers or 130 250 if you re filing jointly or if you re younger than what Social Security considers full retirement age you In reality Social Security is taxed at any age if your income exceeds a certain level Essentially if your taxable income is greater than the Standard Deduction for your filing status you ll typically have to file a tax return

To see it in action let s assume 1 you re married filing jointly 2 you have a combined income of over 44 000 and 3 you receive 30 000 in annual Social Security benefits You may end up paying taxes on your Social Security benefits depending on your household income One key to reducing your tax burden in retirement is to reduce your taxable income

Social Security Benefit Tax Limit 2025 Angela I Gott

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png

Do I Get Taxed On Social Security Income Tax Walls

https://realdaily.com/wp-content/uploads/2018/07/ml_calc-social.jpg

/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8.png?resize=618,416&ssl=1?w=186)

https://www.forbes.com › sites › davidrae › ...

Once retired and living on unearned income you will no longer be paying Social Security and Medicare payroll taxes You will still be subject to

:max_bytes(150000):strip_icc()/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8-8ed4f6b983744e1ba2e910636aa65873.png?w=186)

https://money.usnews.com › money › retir…

If you have income from multiple sources in retirement such as pensions withdrawals from retirement accounts or side jobs you may have to

Social Security Income Tax Limit 2025 Calendar Joaquin Theo

Social Security Benefit Tax Limit 2025 Angela I Gott

2025 Social Security Tax Limit Beth D Harper

Social Security Worksheets Calculator

2024 Tax On Social Security Benefits Debra Devonna

Max Social Security Benefit 2025 Age 62 James Idris

Max Social Security Benefit 2025 Age 62 James Idris

Social Security Withholding Income Limit 2025 Samuel Faris

One Way To Reduce Taxes On Social Security Income Sound Retirement

How Much Tax Will I Pay On My 401k Encinitas Daily News

Do You Pay Taxes On Social Security Retirement Income - How much you pay in taxes depends on your income and the state you live in Age is not a factor COLA the largest since 1981 increased the average retired worker s