Does California Tax Social Security Income However Social Security isn t taxed and taxpayers age 65 and older won t pay tax on income from federal local or state retirement plans including military retirement benefits

Social Security retirement benefits are not taxed at the state level in California Keep in mind however that if you have income from sources besides Social Security you may need to pay federal taxes on your Social Security income The short answer is yes Social Security benefits are taxable in California However the rules surrounding Social Security taxation in California somewhat differ from those in other states Here s what you need to know California taxes Social Security benefits based on your income level

Does California Tax Social Security Income

Does California Tax Social Security Income

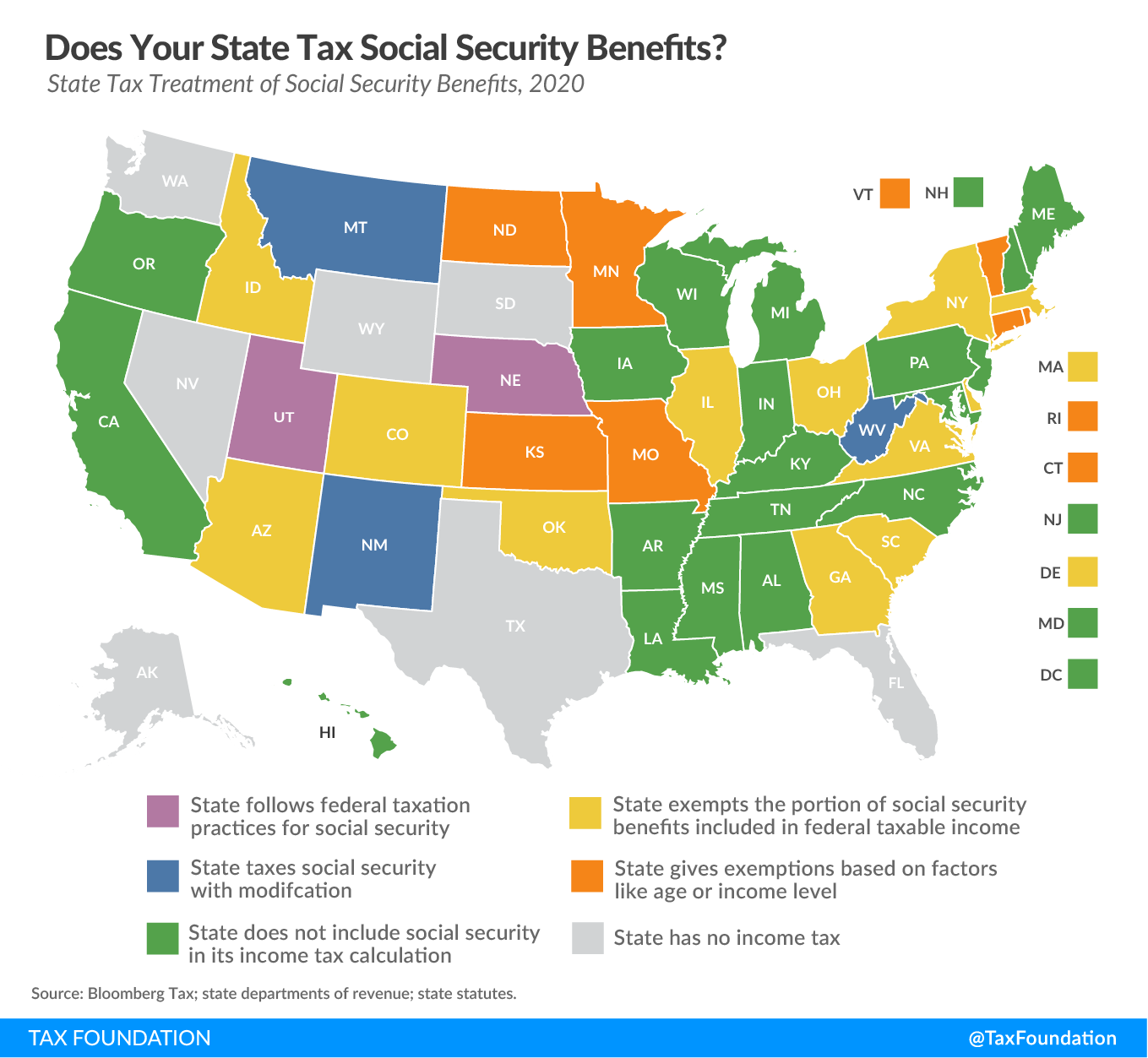

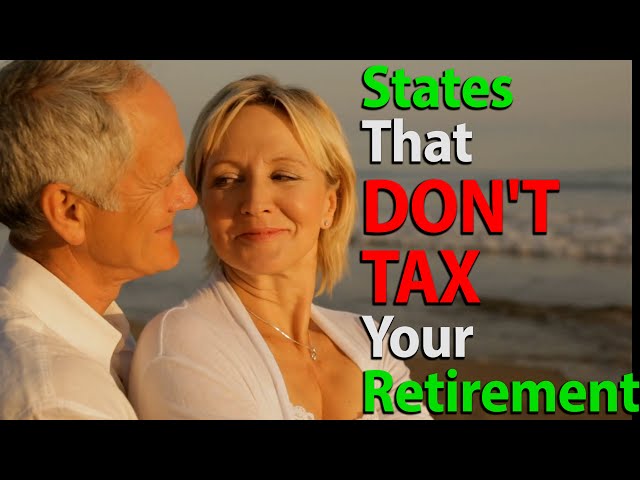

https://youngandtheinvested.com/wp-content/uploads/states-that-tax-social-security-benefits.jpg

Does California Tax Social Security YouTube

https://i.ytimg.com/vi/aA0bqtStZp0/maxresdefault.jpg

Does Social Security Count Toward Your AGI Leia Aqui Is Social

https://cdn.mos.cms.futurecdn.net/uiZ7oNVwGfuaD9UhiJodCF.jpg

Like the retirement income benefits once you hit that taxability threshold up to 85 of your SSDI benefits may be taxed again depending on your filing status and how much total income you earned Social Security Disability Insurance is exempt from state taxes in California Some of your Social Security income may be taxable Visit About Publication 915 Social Security and Equivalent Railroad Retirement Benefits for more information California return Make an adjustment to exclude any of this income if it was included in your federal AGI

Does California tax Social Security benefits No Social Security income is not taxed by the state of California But you may pay federal taxes on a portion of your Social Security benefits depending on your income Social Security benefits including retirement survivor and disability benefits are not subject to California state income tax However these benefits may be taxed at the federal level based on your total income

More picture related to Does California Tax Social Security Income

Does California Tax Social Security Benefits Homey Gears

https://homeygears.com/wp-content/uploads/2023/02/does-california-tax-social-security-benefits_photo.jpeg

Social Security Income Pre Effectuation Review Conference Or PERC The

https://i.ytimg.com/vi/4ugzxh1QCRA/maxresdefault.jpg

States That May Cut Taxes On Social Security Income SSI Texas

https://texasbreaking.com/wp-content/uploads/2023/02/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg

The lowest California income tax rate of 1 applies on income up to 10 099 for single filers up to 20 198 for joint filers California taxes in retirement California does not tax In California social security benefits are not subject to state taxation Essentially the portion of social security benefits included in adjusted gross income on one s federal return remains untaxed by California

[desc-10] [desc-11]

Does Your State Tax Social Security Benefits Upstate Tax Professionals

https://upstatetaxp.com/wp-content/uploads/2020/04/Social-Security-Benefits-FV-011-1.png

8 Critical Questions To Ask Before Collecting Social Security Income

https://seniordenial.com/wp-content/uploads/2023/07/IMG_1440-scaled.jpg

https://www.kiplinger.com/retirement/602202/taxes...

However Social Security isn t taxed and taxpayers age 65 and older won t pay tax on income from federal local or state retirement plans including military retirement benefits

https://smartasset.com/retirement/california-retirement-taxes

Social Security retirement benefits are not taxed at the state level in California Keep in mind however that if you have income from sources besides Social Security you may need to pay federal taxes on your Social Security income

Meet The 38 States That Do Not Tax Social Security Do You Live In One

Does Your State Tax Social Security Benefits Upstate Tax Professionals

Social Security How Much Does Donald Trump Qualify For

Does California Tax Social Security Robert Hall Associates

Social Security

How Social Security Income Gets Taxed And How You Can Avoid It

How Social Security Income Gets Taxed And How You Can Avoid It

What States Don t Tax Social Security Mistersocialsecurity

California Social Security Tax Rate 2024 2025

The Union Role In Our Growing Taxocracy California Policy Center

Does California Tax Social Security Income - Some of your Social Security income may be taxable Visit About Publication 915 Social Security and Equivalent Railroad Retirement Benefits for more information California return Make an adjustment to exclude any of this income if it was included in your federal AGI