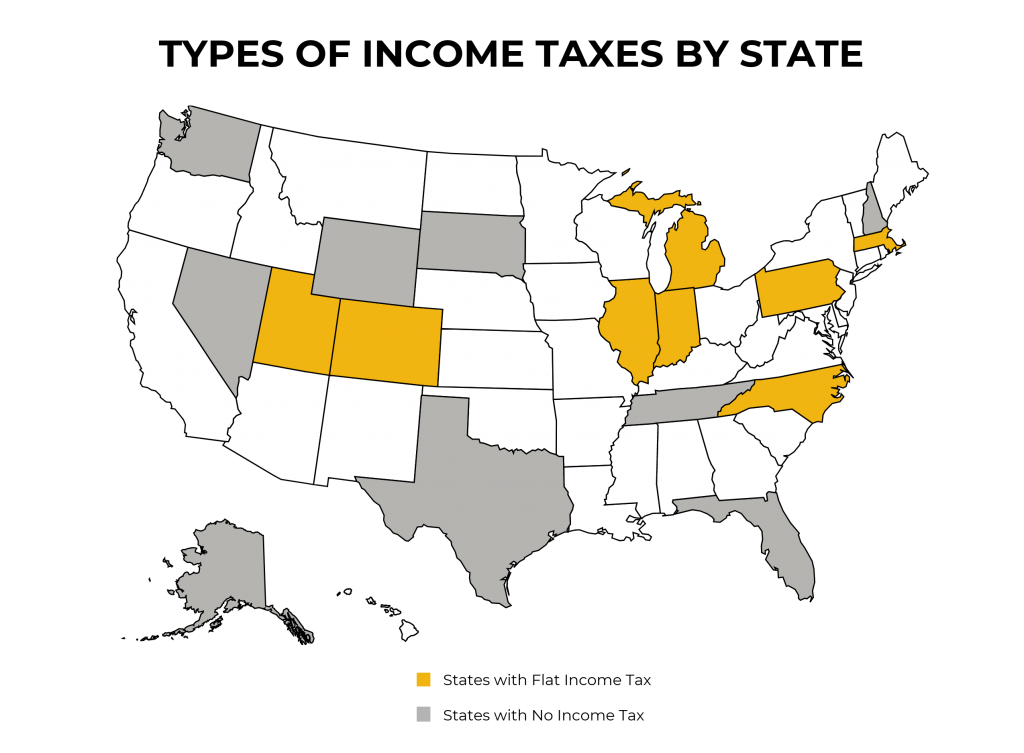

Does Colorado Tax Social Security Disability Benefits Does Colorado tax Social Security benefits Colorado is one of 9 states that tax Social Security benefits However Coloradans 65 and older

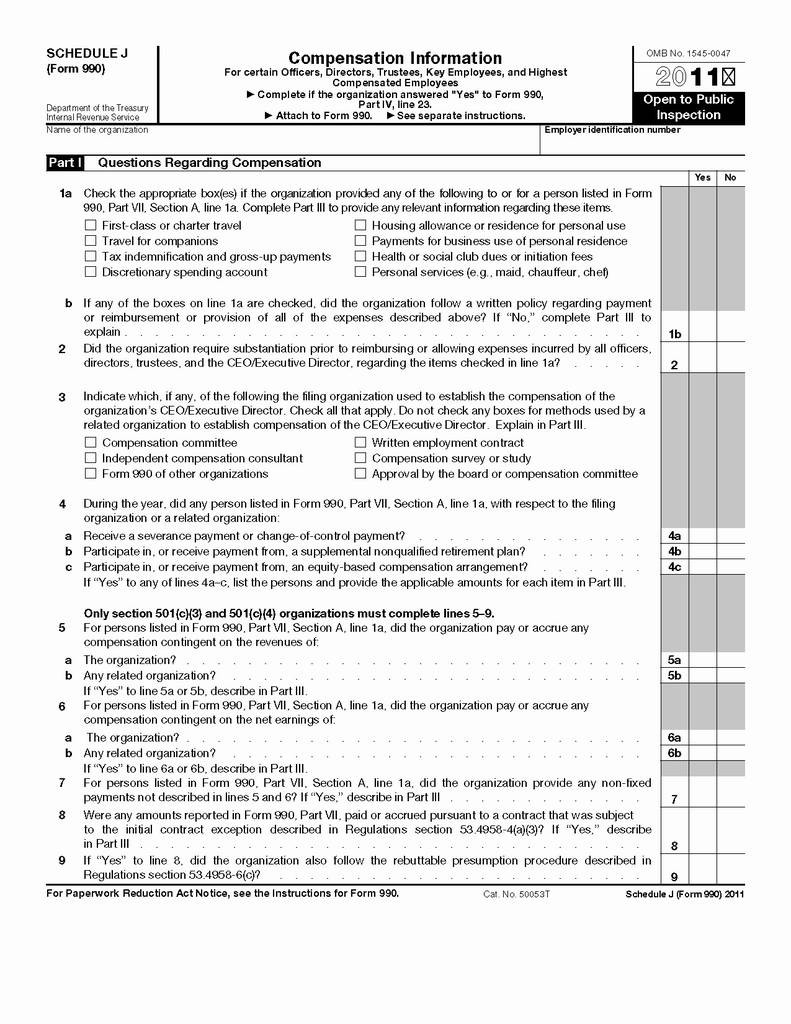

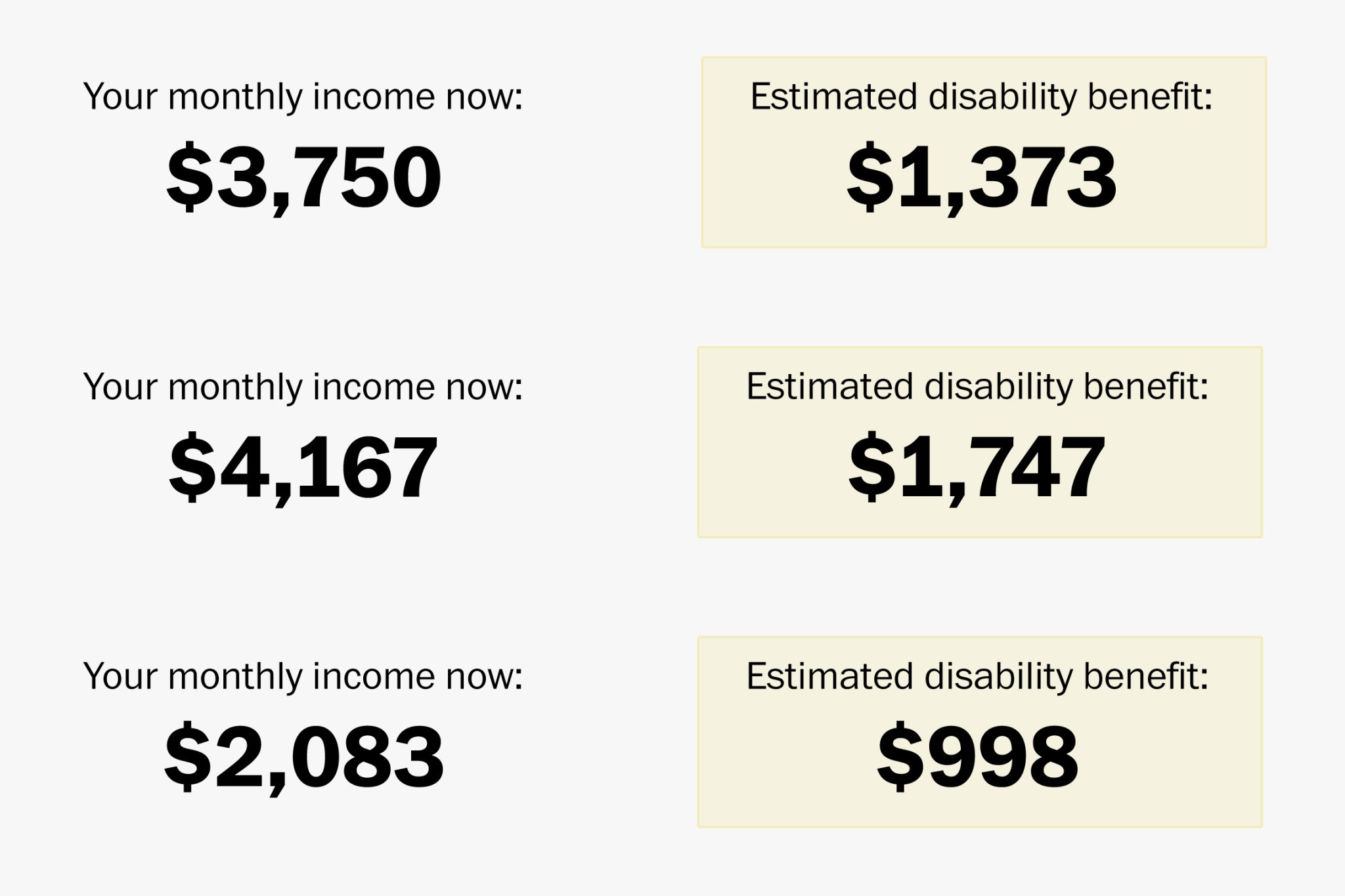

Qualifying taxpayers may claim the subtraction for social security benefits pensions or annuities on lines 3 6 of the 2022 Subtractions from Income Schedule DR 0104AD For more Colorado People younger than age 65 who receive Social Security disability benefits can exclude up to 20 000 of benefits from their income that is subject to state taxation Disability

Does Colorado Tax Social Security Disability Benefits

Does Colorado Tax Social Security Disability Benefits

https://i.pinimg.com/originals/bb/a8/a4/bba8a4334fd1998f21ff388b189c44a8.png

Ssi Disability Increase 2025 Teresa R Moors

https://www.clausonlaw.com/blog/wp-content/uploads/2021/12/2300-disability-benefit-calculator-PROMO-2048x1365.jpg

Va Disability Pay Rates 2025 Chart Jaxon Idris

https://va-disability-rates.com/wp-content/uploads/2021/08/2019-va-disability-pay-chart-based-on-dependent-status-1-scaled.jpg

Taxable permanent disability benefits received by an individual age 55 or older at the close of the tax year qualify for the subtraction even if the compensation is characterized as wages rather Colorado is one of thirteen states that taxes SSDI benefits The state s pension subtraction exemption is based on the age of the taxpayer income and considers all taxable

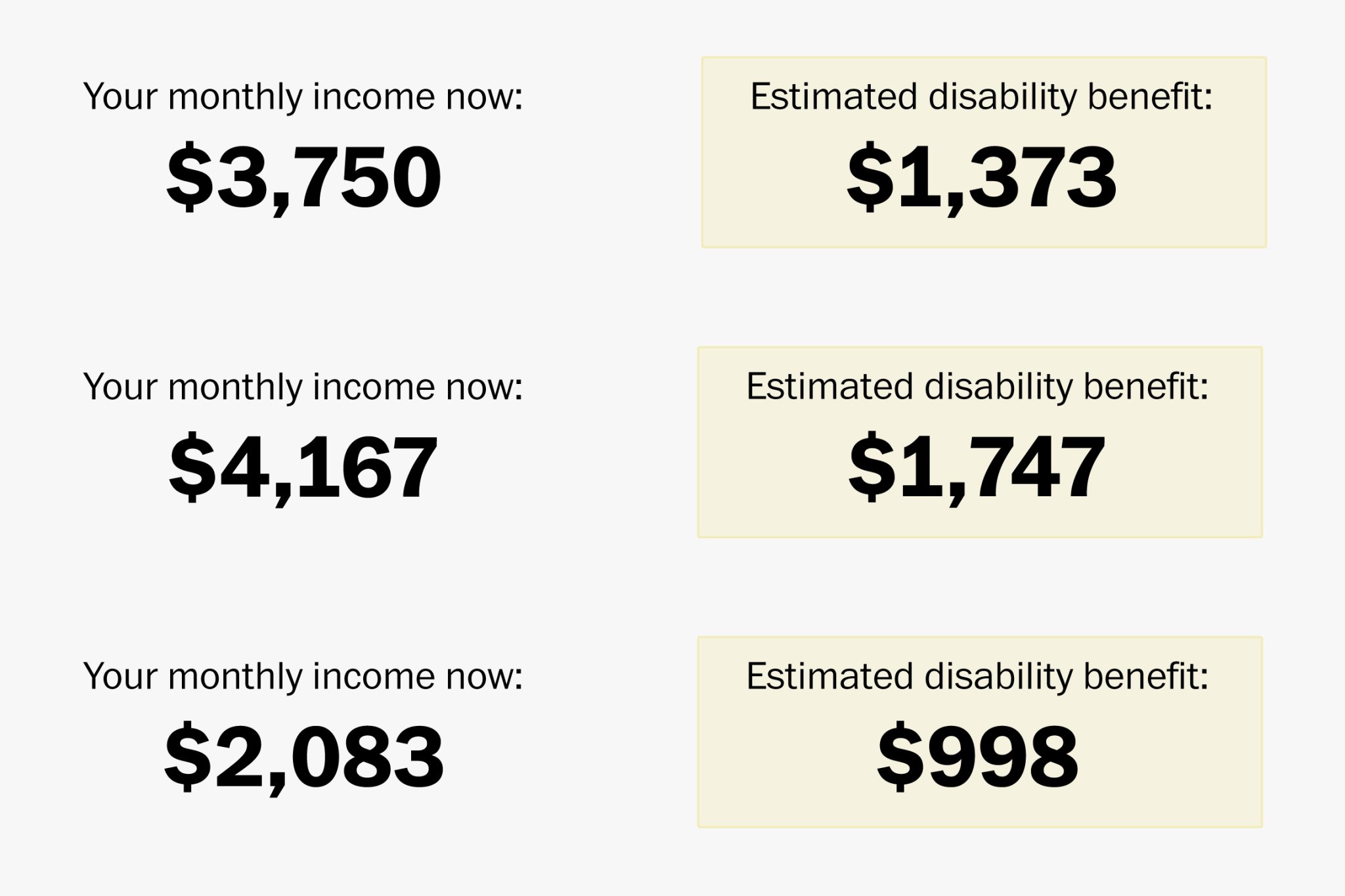

Pension Annuity IRA Disability Social Security Subtraction An income tax subtraction is allowed to individuals age 55 or older for pension and annuity income included in their federal To qualify for Social Security Disability Colorado residents must have paid a sufficient amount of Social Security taxes also known as FICA taxes over the course of their working life The Social Security Administration

More picture related to Does Colorado Tax Social Security Disability Benefits

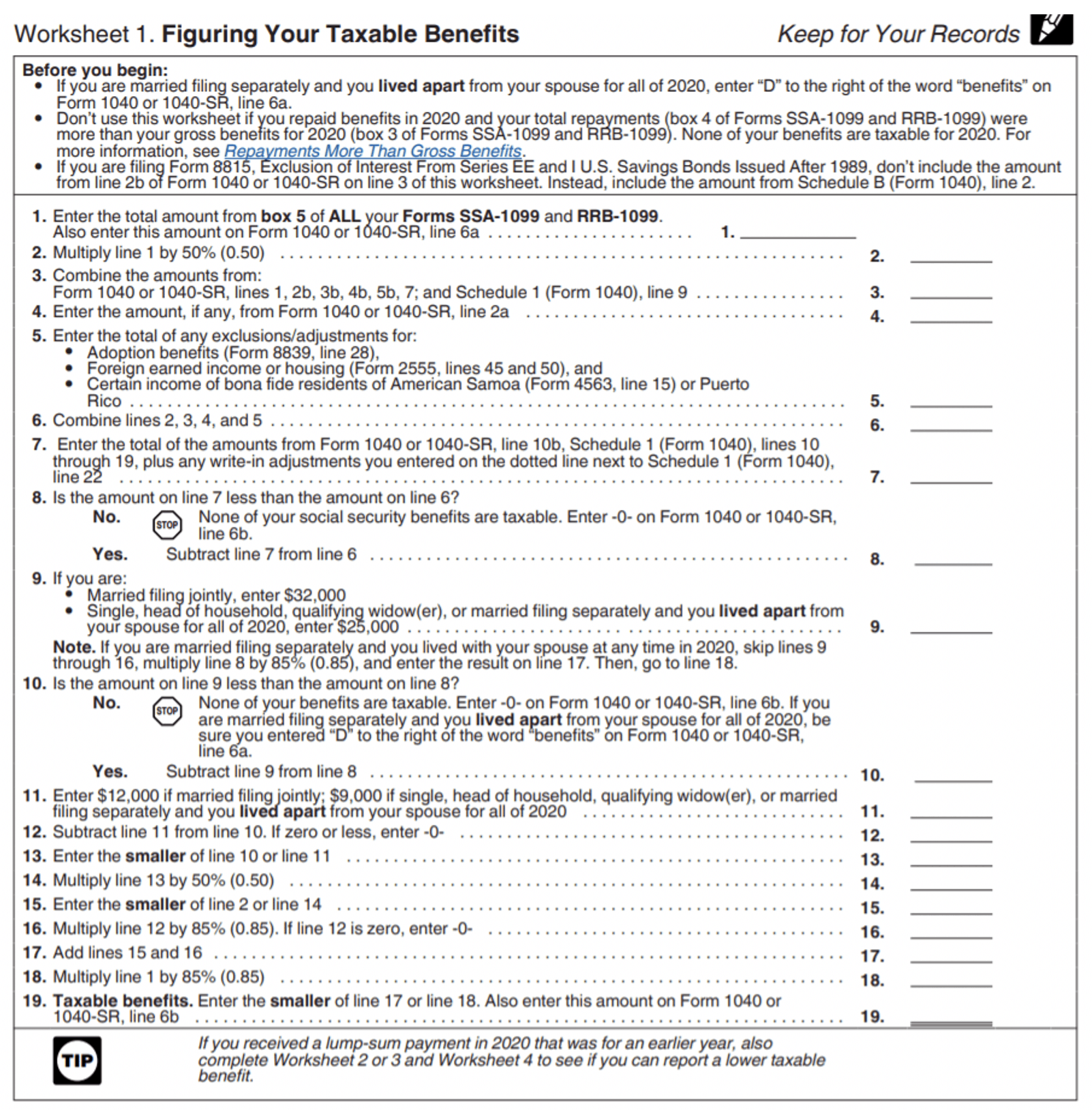

Publication 523 Worksheets

https://db-excel.com/wp-content/uploads/2019/09/2016-schedule-c-tax-form-brilliant-social-security.jpg

Va Benefits Amounts 2023

https://www.ebilaw.com/wp-content/uploads/2022/06/chart1-min.png

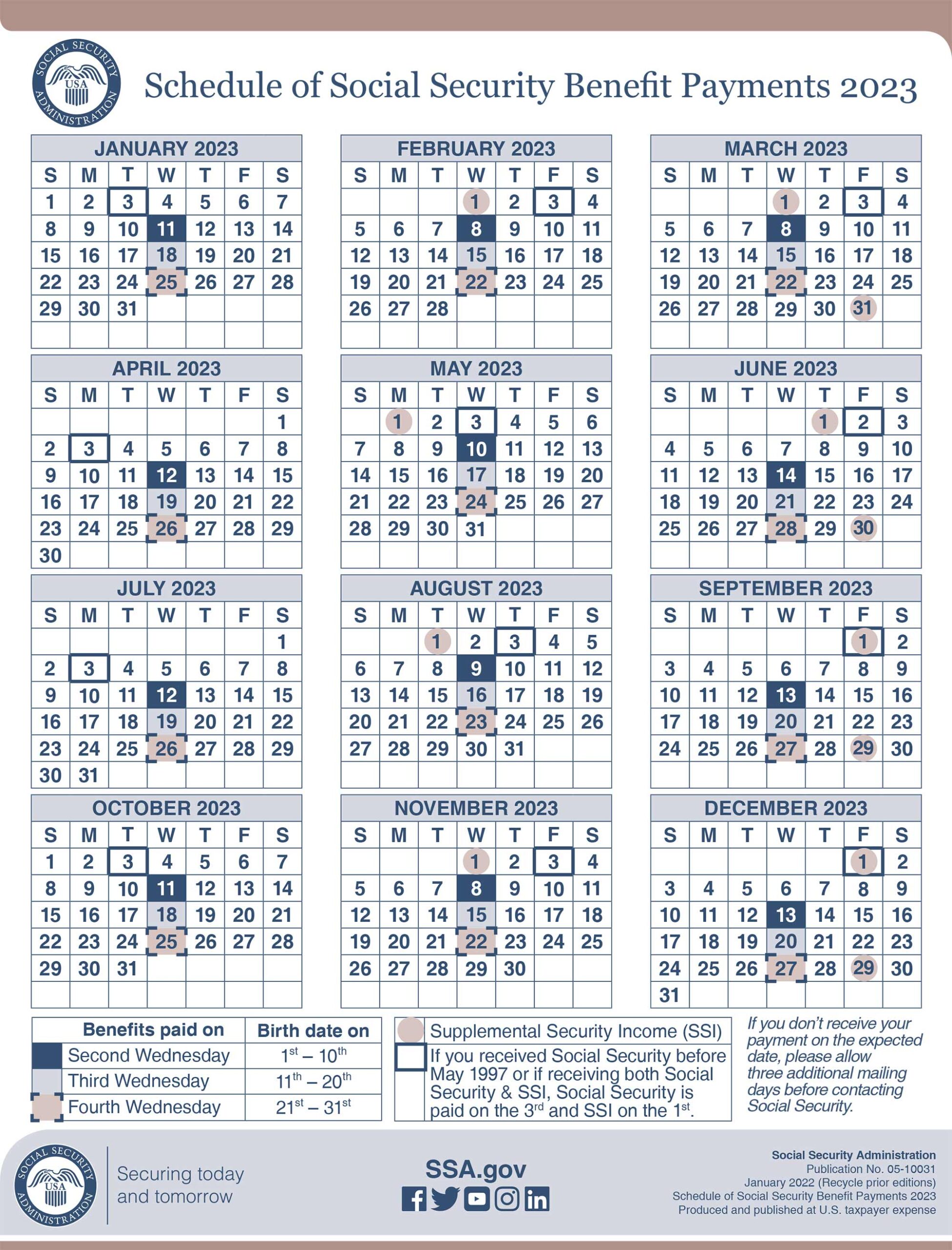

Schedule Social Security Benefit Payment 2024 Meara Sibylla

https://www.sgsdisability.com/wp-content/uploads/EN-05-10031-2023-scaled.jpg

As of 2024 the following states tax or previously taxed SSDI benefits to some extent Colorado Colorado taxes SSDI benefits for taxpayers at a flat rate of 4 4 for those under 65 Individuals 65 and older can deduct Understanding the financial and tax implications of Social Security Disability benefits can be overwhelming If you re seeking help with your claim appeals or any aspect of the SSDI

The AARP backed measure allows more Coloradans to fully deduct their Social Security benefits from their state taxable income starting with the 2025 tax year In Colorado retirees aged 55 to 64 can deduct up to 20 000 of their Social Security benefits from their taxable income The state taxes all taxable income at a flat rate of

Cola 2025 Va Disability Compensation Rates Camila Yasmeen

https://vaclaimsinsider.com/wp-content/uploads/2022/10/2023-VA-Disability-Pay-Chart-2048x1229.jpg

Social Security Income Limit 2025 Increase Asha Claire

https://www.socialsecurityintelligence.com/wp-content/uploads/2016/11/2021-Income-Limit-1536x961.png

https://states.aarp.org › colorado › state-ta…

Does Colorado tax Social Security benefits Colorado is one of 9 states that tax Social Security benefits However Coloradans 65 and older

https://tax.colorado.gov › retirees

Qualifying taxpayers may claim the subtraction for social security benefits pensions or annuities on lines 3 6 of the 2022 Subtractions from Income Schedule DR 0104AD For more

Ssdi Direct Deposit Dates 2025 Maryam Patrick

Cola 2025 Va Disability Compensation Rates Camila Yasmeen

Calculate 2023 Taxable Income

Va Disability Benefit Amounts 2023

Social Security Withholding 2025 Max Lekaren Eli Rami

Social Security Limit 2025 Earnings Per Naomi Pink

Social Security Limit 2025 Earnings Per Naomi Pink

Learn More Quick Facts On A Fair Tax For Colorado

Social Security Taxable Worksheet 2022

1040 Sr Social Security Worksheets

Does Colorado Tax Social Security Disability Benefits - Taxable permanent disability benefits received by an individual age 55 or older at the close of the tax year qualify for the subtraction even if the compensation is characterized as wages rather