Does Self Employed Pay Into Social Security Social Security When You Are Self Employed Most people who pay into Social Security work for an employer Their employer deducts Social Security taxes from their paycheck matches that contribution sends taxes to the Internal Revenue Service IRS and reports wages to Social Security

Paying Social Security and Medicare taxes If you work for an employer you and your employer each pay a 6 2 Social Security tax on up to 168 600 of your earnings Each must also pay a 1 45 Medicare tax on all earnings If you re self employed you pay the combined employee and employer amount The self employment tax rate is 15 3 The rate consists of two parts 12 4 for social security old age survivors and disability insurance and 2 9 for Medicare hospital insurance

Does Self Employed Pay Into Social Security

Does Self Employed Pay Into Social Security

https://www.inshura.com/wp-content/uploads/2022/10/self-employed.jpg

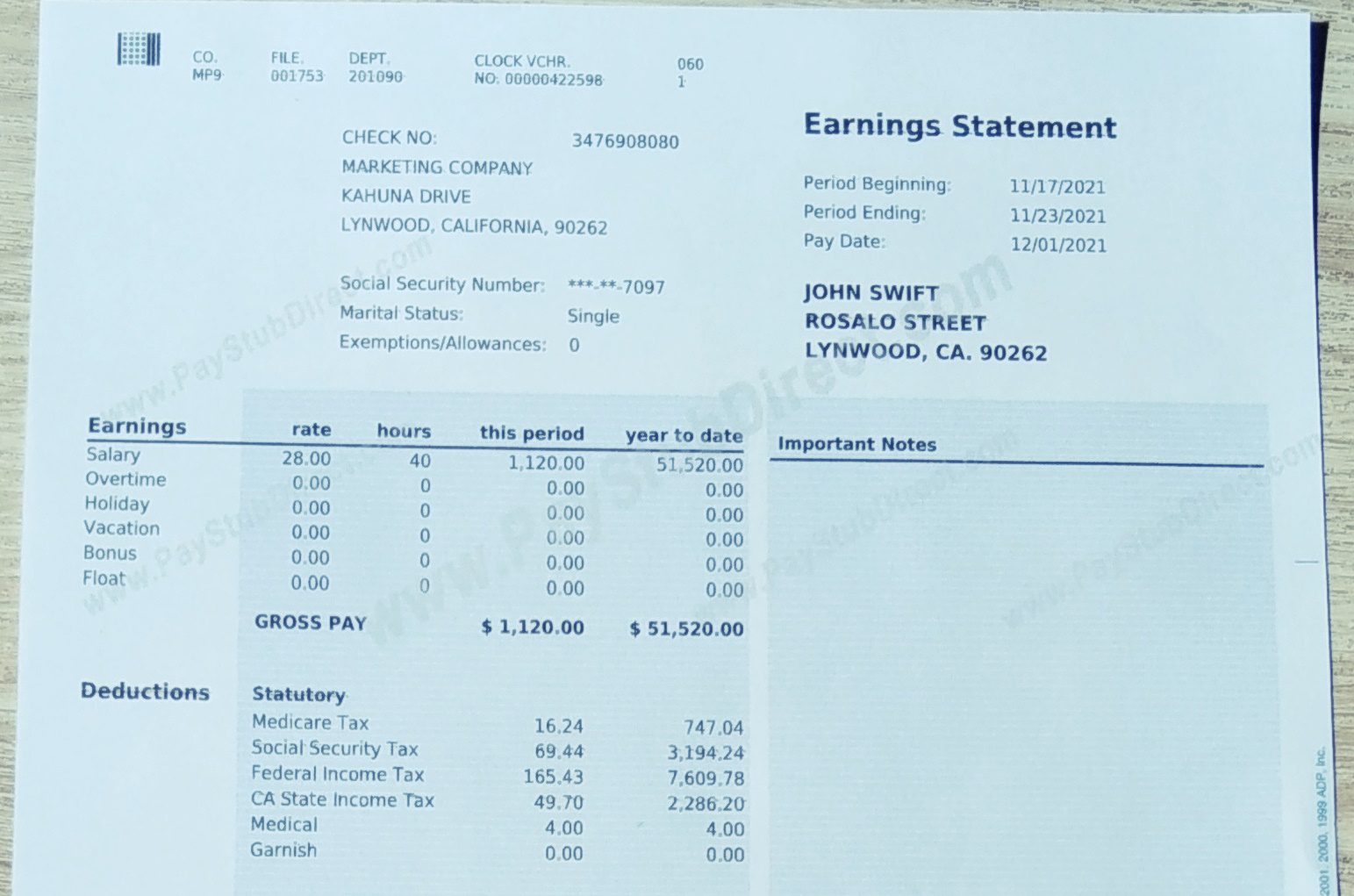

How To Make A Pay Stub For Self Employed PayStub Direct

https://static.paystubdirect.com/uploads/2022/01/pay-stub.jpg

Got A Job At Age 70 Do I Pay Into Social Security Again

https://i2.cdn.turner.com/money/dam/assets/131219135502-social-security-pay-1024x576.png

If you re self employed you still have to pay Social Security taxes Find out how much you ll need to pay how to file and how to claim benefits too Self employed Social Security works a bit differently than for an employee An employee pays on his or her portion of Social Security taxes On your paycheck you see that your employer has withheld a portion of your pay and sent it to the IRS They have also paid their portion of these taxes

Self employed people pay 12 4 Social Security tax on up to 160 200 in net earnings in 2023 as well as a 2 9 Medicare tax for a 15 3 combined tax rate Self employed people must do all these actions and pay their taxes directly to the IRS You re self employed if you operate a trade business or profession either by yourself or as a partner You report your earnings for Social Security when you file your federal income tax return

More picture related to Does Self Employed Pay Into Social Security

How Do I Pay Into Social Security If I Am Self employed

https://glassnercarltonfinancial.com/wp-content/uploads/2020/08/TAXES-FOR-THE-SELF-EMPLOYED-_-HOW-BUSINESS-OWNERS-FILE-SOCIAL-SECURITY-ON-YOUR-TAX-RETURN-THUMBNAIL-1024x576.jpg

How To Pay Social Security Self Employed Retire Gen Z

https://retiregenz.com/wp-content/uploads/2023/05/how-to-pay-social-security-self-employed-NAEL.jpg

Self Employed Workers Access To State Paid Leave Programs In 2023

https://www.americanprogress.org/wp-content/uploads/sites/2/2023/08/SelfEmployedBrief.jpg

Unlike traditionally employed individuals self employed workers must pay both the employer portion 6 2 and employee portion 6 2 of Social Security taxes This amounts to a total of 12 4 of your net earnings While this may seem like a hefty sum it s crucial for securing your Social Security benefits in the future If you are self employed you will need to report your net earnings to Social Security and the Internal Revenue Service IRS Net earnings for Social Security are your gross earnings from your trade or business minus all of your allowable business deductions and depreciation

[desc-10] [desc-11]

How To Qualify For Social Security Disability Benefits

https://static.wixstatic.com/media/nsplsh_343073424a793563434d59~mv2_d_6016_4016_s_4_2.jpg/v1/fill/w_1000,h_668,al_c,q_85,usm_0.66_1.00_0.01/nsplsh_343073424a793563434d59~mv2_d_6016_4016_s_4_2.jpg

Does Congress Pay Into Social Security

https://cdn.aarp.net/content/dam/aarp/retirement/social-security/2021/12/1140-ssa-about-card.imgcache.revcfeea7705cf5f930b79c9b9e17aabbbb.jpg

https://blog.ssa.gov/social-security-when-you-are-self-employed

Social Security When You Are Self Employed Most people who pay into Social Security work for an employer Their employer deducts Social Security taxes from their paycheck matches that contribution sends taxes to the Internal Revenue Service IRS and reports wages to Social Security

https://www.ssa.gov/pubs/EN-05-10022.pdf

Paying Social Security and Medicare taxes If you work for an employer you and your employer each pay a 6 2 Social Security tax on up to 168 600 of your earnings Each must also pay a 1 45 Medicare tax on all earnings If you re self employed you pay the combined employee and employer amount

Self Employed Disability Benefits Explained Marva Match Social

How To Qualify For Social Security Disability Benefits

:max_bytes(150000):strip_icc()/self-employed.asp-Final-371c8b583e994ae5965276ef2d992fe6.jpg)

Self Employment Definition Types And Benefits

Six Tips For Handling Taxes And Financial Planning As A Newly Self

Significant Increase In Social Security Contributions For The Self

Free Self Employed Financial Cheat Sheet Cheating Tax Write Offs

Free Self Employed Financial Cheat Sheet Cheating Tax Write Offs

How Do Self Employed Pay Social Security Retire Gen Z

What Does Self employed Mean Are You Self employed Finansdirekt24 se

How Many Workers Pay The Benefits Of Each Social Security Retiree

Does Self Employed Pay Into Social Security - Self employed Social Security works a bit differently than for an employee An employee pays on his or her portion of Social Security taxes On your paycheck you see that your employer has withheld a portion of your pay and sent it to the IRS They have also paid their portion of these taxes