Does Short Term Disability Count As Income Generally short term disability payments as well as long term disability payments received before retirement age are earned income while long term disability payments

Employer plans often provide short term or long term disability coverage each with distinct implications Short term plans typically cover a portion of salary for three to six months Taxpayers often ask are short term disability payments taxable The answer is It depends If the employer paid premiums that counts as income for the employee The

Does Short Term Disability Count As Income

/short-term-disability-basics-1177839_V2-5bbd0f8146e0fb0051d0c4cf.png)

Does Short Term Disability Count As Income

https://www.thebalancemoney.com/thmb/RUfh9WNxtVlixfvirwBLFepDMHE=/1500x1000/filters:fill(auto,1)/short-term-disability-basics-1177839_V2-5bbd0f8146e0fb0051d0c4cf.png

Understanding Your Short Term Disability Benefits The New York City

https://nyccbf.org/wp-content/uploads/2021/10/Understanding-Your-Short-Term-Disability-1583x2048.jpg

Does VA Disability Count As Income For Food Stamps All You Need To

https://esquilo.io/wp-content/uploads/2023/05/food-stamps-38.jpg

Short term disability payments can indeed be considered taxable income but this largely depends on how the disability premium was paid making the determination of Short term disability is an income replacement benefit that provides a percentage of pre disability earnings on a weekly basis when employees are out of work on a disability claim It typically covers off the job accidents and illnesses that

If your employer paid 100 of your premiums all of your short term disability income is taxable If you and your employer split the premiums exactly 50 50 and if you paid your portion of the premiums with after tax dollars not Short term disability benefits are not taxed in all situations Here are the rules for when you can expect to owe taxes If your employer paid for an accident or health insurance

More picture related to Does Short Term Disability Count As Income

10 Working Memory Examples 2024

https://helpfulprofessor.com/wp-content/uploads/2023/01/working-memory-examples-and-definition-768x543.jpg

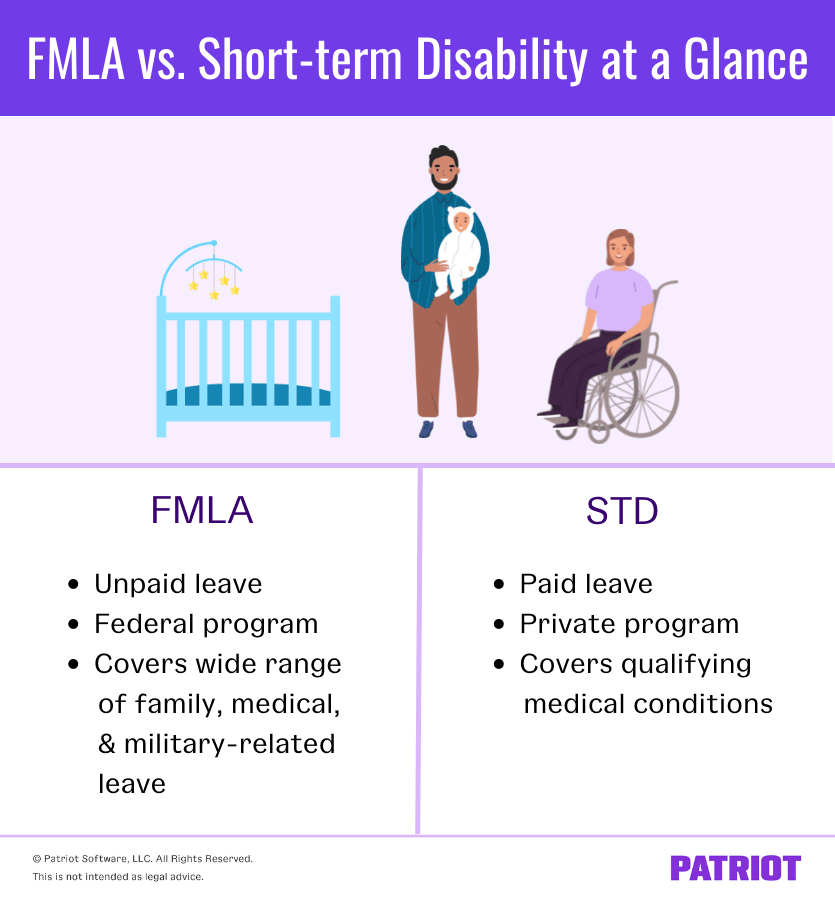

FMLA Vs Short Term Disability 2022

https://www.patriotsoftware.com/wp-content/uploads/2022/07/FMLA-vs-Short-term-Disability-835-×-900-px-3-2.png

Does VA Disability Count As Income For SNAP Chad Barr Law

https://chadbarrlaw.com/wp-content/uploads/Does-VA-Disability-Count-as-Income-for-SNAP-Chad-Barr-Law.jpg

Disability benefits may or may not be taxable You will not pay income tax on benefits from a disability policy where you paid the premiums with after tax dollars This includes A employer sponsored policy you contributed to with Whether or not your short term disability payments are considered taxable income depends on a few different factors First the answer depends on who makes your

According to HUD regulations the full amount of disability payments must be counted as income HUD Handbook 4350 3 Exhibit 5 1 There may be no deduction for any Short term disability benefits can be taxable or non taxable depending on how the insurance plan was paid for In general if your employer paid for the plan the benefits you

Does VA Disability Count As Income VetLaw

https://vet.law/wp-content/uploads/2024/11/VetLaw-x-WHG-Logo-Nov-2024-1024x364.png

Does VA Disability Count As Income For SSI VADC

https://vadisabilitycoach.com/wp-content/uploads/2023/06/Does-VA-Disability-Count-as-Income-for-SSI.jpg

/short-term-disability-basics-1177839_V2-5bbd0f8146e0fb0051d0c4cf.png?w=186)

https://budgeting.thenest.com › disability-benefits...

Generally short term disability payments as well as long term disability payments received before retirement age are earned income while long term disability payments

https://accountinginsights.org › do-disability...

Employer plans often provide short term or long term disability coverage each with distinct implications Short term plans typically cover a portion of salary for three to six months

Does VA Disability Count As Income VetLaw

Does VA Disability Count As Income VetLaw

Does VA Disability Count As Income A Comprehensive Guide

Va Disability Chart 2023 Eligibility

Does VA Disability Count As Income A Comprehensive Guide

Does VA Disability Count As Income VetLaw

Does VA Disability Count As Income VetLaw

Property And Evidence Technician Melbourne FL IAPE International

Where Do I Find My Medicaid Number MedicAidTalk

Long Term Disability Insurance Term Insurance Insurance Agent

Does Short Term Disability Count As Income - Short term disability payments can indeed be considered taxable income but this largely depends on how the disability premium was paid making the determination of