Does Virginia Tax Pensions For Seniors Overview of Virginia Retirement Tax Friendliness Social Security retirement benefits are not taxed in Virginia Other types of retirement income such as pension income and retirement account withdrawals are deductible up to

In Virginia Social Security benefits are not taxed while other types of retirement income such as pensions and retirement account withdrawals may be deductible up to Generally yes Virginia taxes retirement pensions The state considers pension income as part of an individual s taxable income subject to state income tax However there

Does Virginia Tax Pensions For Seniors

Does Virginia Tax Pensions For Seniors

https://i.ytimg.com/vi/qOgJg6KZ9pI/maxresdefault.jpg

Does Virginia Tax Disability Income YouTube

https://i.ytimg.com/vi/7K5MrMBv0J8/maxresdefault.jpg

Sons Of The Forest Clone Kelvin And Virginia Archyde

https://images.cgames.de/images/gamestar/4/sons-of-the-forest-kelvin-klone-gs_6220432.jpg

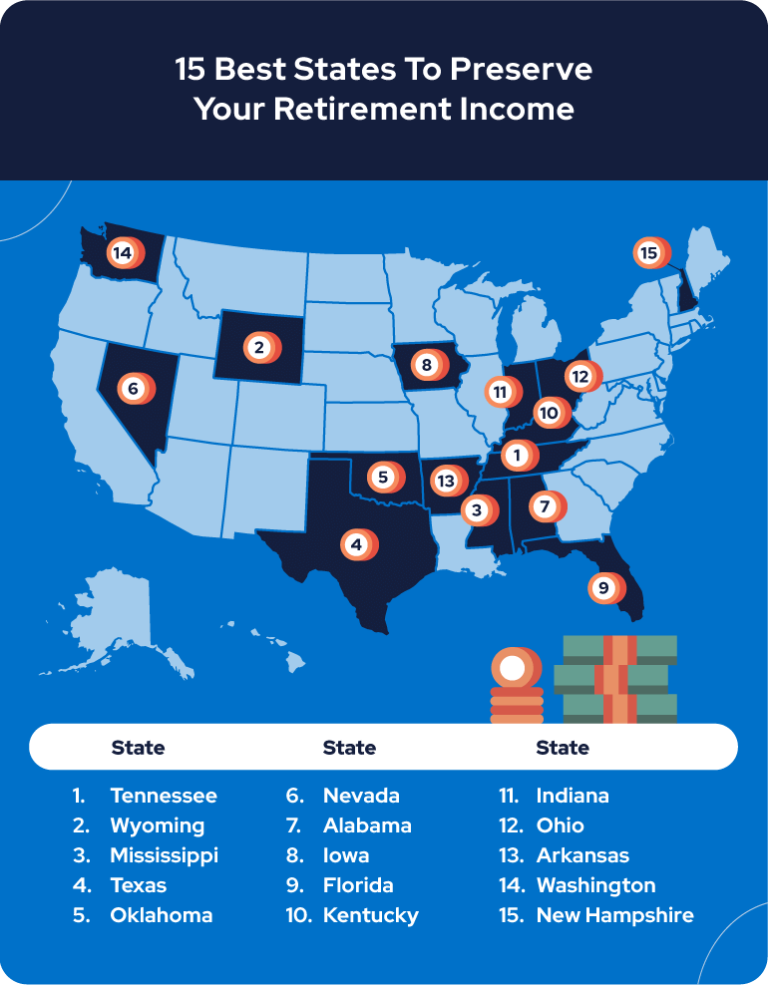

52 rowsRetirement income and Social Security not taxable Tax info 601 923 7700 or dor ms gov Deduct public pension up to 37 720 or maximum social security benefit if Over a dozen states don t tax pension income regardless of your age or how much money you have

In Virginia income tax relief programs are designed to ease the tax burden on seniors by offering exemptions and deductions Social Security Income Exclusion Virginia does not tax Social Security benefits providing a substantial reduction Virginia does impose a tax on retirement income However you can take an Age Deduction of up to 12 000 if you qualify The age deduction depends on your age filing status and income

More picture related to Does Virginia Tax Pensions For Seniors

Retiring These States Won t Tax Your Distributions

https://www.taxdefensenetwork.com/wp-content/uploads/2022/01/military-benefits-map-2500x1875.jpg

States That Don t Tax Pensions 2023 Wisevoter

https://wisevoter.com/wp-content/uploads/2023/03/States-That-Dont-Tax-Pensions.png

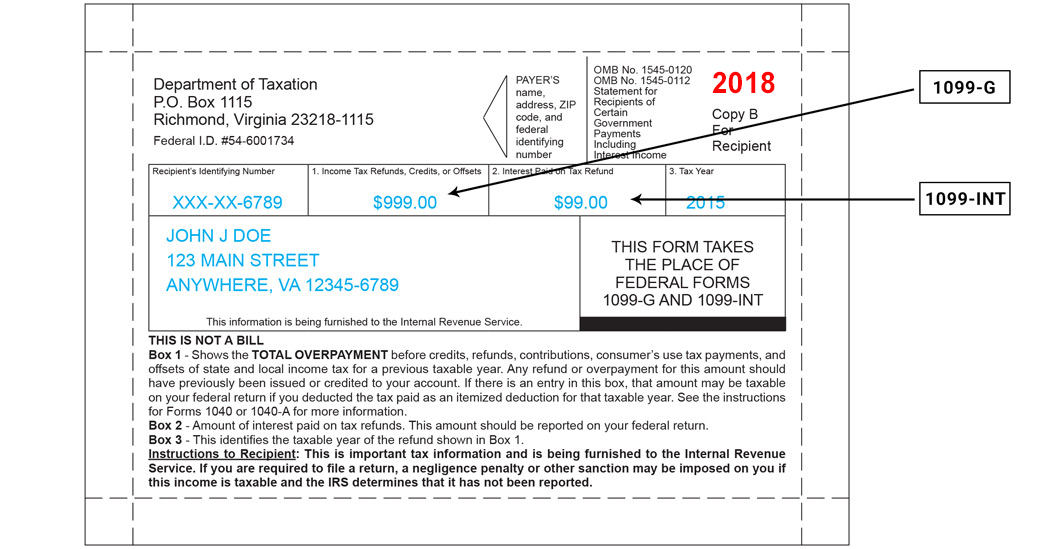

Virginia Refund Withheld Guide To VA Tax Offset Program

https://images.taxcure.com/uploads/tmp/1716924273-148879519517380-0090-7224/virginia-offset.webp

Social Security income is not taxed in Virginia and the state offers an extra tax exemption for seniors aged 65 and over that can be as high as 12 000 annually Pension income received while you are a Virginia resident is taxable by Virginia even though it may have been received from another state Virginia law exempts Social

Virginia Does Tax Pensions While Virginia offers significant tax advantages by not taxing Social Security benefits it does tax most retirement income sources such as pensions Many Virginia counties cities and towns provide tax relief programs for seniors and people with disabilities These programs allow for an exemption deferral or both The tax

States That Won t Tax Social Security Or My Pension In Retirement

https://i.ytimg.com/vi/BAGupbKZdxY/maxresdefault.jpg

States That Don t Tax Social Security Retiree Friendly States

https://www.retireguide.com/wp-content/uploads/best-states-to-preserve-your-retirement-income-768x0-c-default.png

https://smartasset.com › ... › virginia-retire…

Overview of Virginia Retirement Tax Friendliness Social Security retirement benefits are not taxed in Virginia Other types of retirement income such as pension income and retirement account withdrawals are deductible up to

https://mypersonaltaxcpa.com › virginia-retirement...

In Virginia Social Security benefits are not taxed while other types of retirement income such as pensions and retirement account withdrawals may be deductible up to

How To Get 1099 g Ohio

States That Won t Tax Social Security Or My Pension In Retirement

Does Virginia Tax Retirement Income

Does Virginia Tax Lottery Winners

State Pension MbarakDaeney

Virginia 2023 Tax Form Printable Forms Free Online

Virginia 2023 Tax Form Printable Forms Free Online

How To Determine The Most Tax Friendly States For Retirees

Margin Calculation Example AydinEvylyn

Virginia Income Tax Rate Fill Out Sign Online DocHub

Does Virginia Tax Pensions For Seniors - Virginia does impose a tax on retirement income However you can take an Age Deduction of up to 12 000 if you qualify The age deduction depends on your age filing status and income