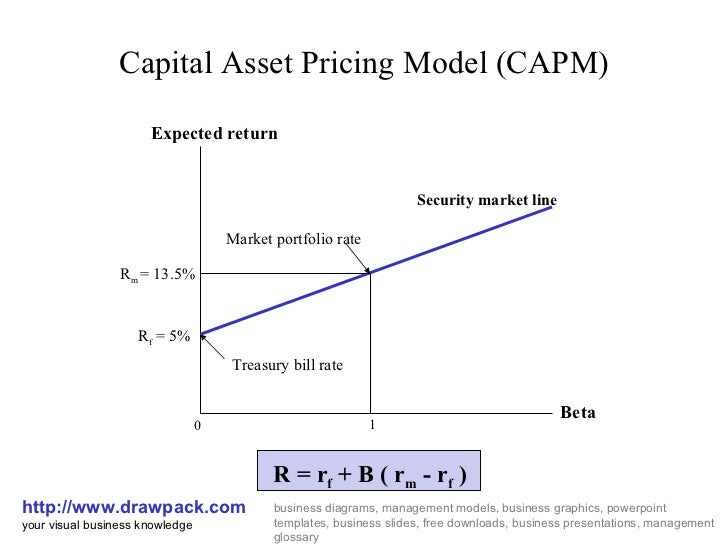

Explain The Capital Asset Pricing Model Capm The Capital Asset Pricing Model CAPM is a model that describes the relationship between the expected return and risk of investing in a security It shows that the expected return on a security is equal to the risk free return plus a risk premium which is based on the beta of that security

The capital asset pricing model CAPM is used to assess the risk of an investment Let s break down how it s calculated and whether you should use it The capital asset pricing model CAPM helps investors understand the returns they can expect given the level of risk they assume A bedrock principle of all investing

Explain The Capital Asset Pricing Model Capm

Explain The Capital Asset Pricing Model Capm

https://cdn.slidemodel.com/wp-content/uploads/6216-01-camp-curve-blue-1.jpg

CAPM Capital Asset Pricing Model Hivelr

https://www.hivelr.com/wp-content/uploads/2023/05/CAPM-Graph.jpeg

What Is The Capital Asset Pricing Model CAPM Valuation Master Class

https://valuationmasterclass.com/wp-content/uploads/2020/08/Corporate-Finance-Blogpost-1024x683.jpg

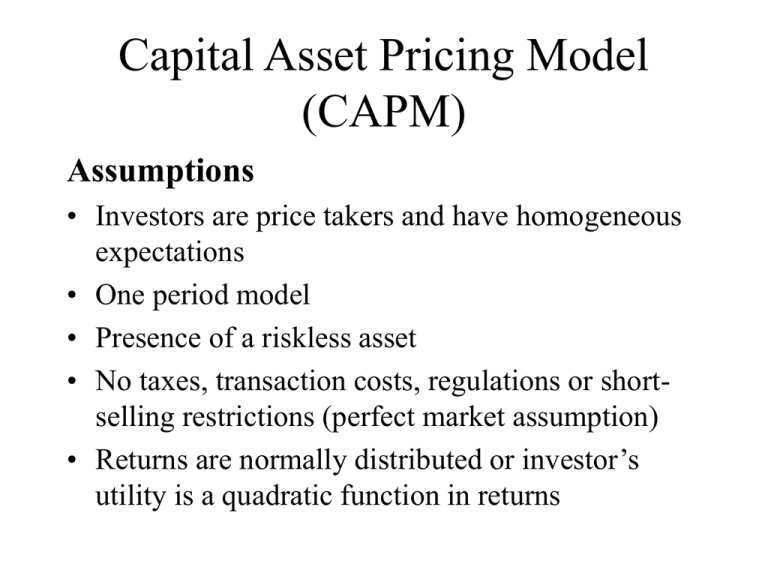

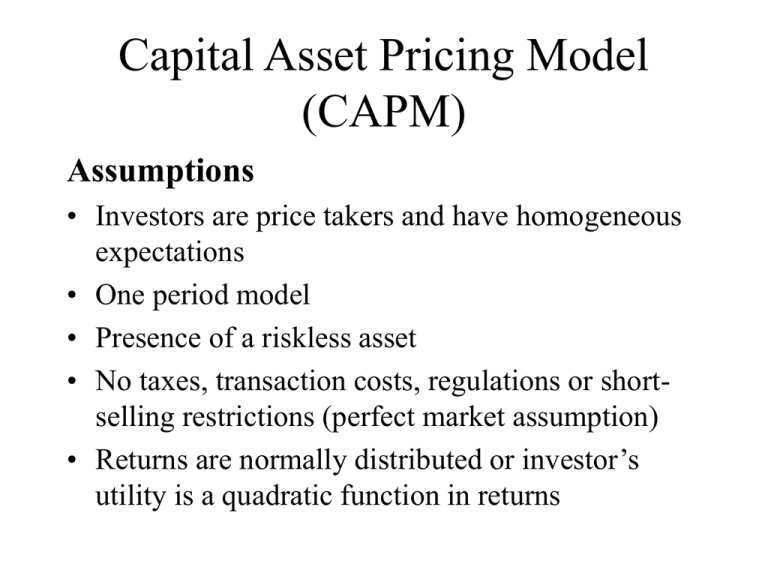

The capital asset pricing model CAPM is a theory that explains the relationship between the risk of an asset and its expected return It suggests that investors should be compensated for taking on additional risk through higher expected returns The Capital Asset Pricing Model or CAPM calculates the value of a security based on the expected return relative to the risk investors incur by investing in that security How is CAPM calculated

The Capital Asset Pricing Model known as CAPM serves to elucidate the interplay between risk and anticipated return for investors It facilitates the computation of security prices by considering the expected rate of return and the cost of capital The Capital Asset Pricing Model CAPM shows how systematic risk or the risks of trading in general affects the expected return on assets mostly stocks The company s equity capital cost is a significant issue that the financial manager has to figure out

More picture related to Explain The Capital Asset Pricing Model Capm

Capital Asset Pricing Model CAPM Definition Formula Example

https://learn.financestrategists.com/wp-content/uploads/FS-Illustrations-new-format-2.png

CAPM Model Template SlideBazaar

https://slidebazaar.com/wp-content/uploads/2022/09/capm-graph.jpg

The Capital Asset Pricing Model CAPM

https://s2.studylib.net/store/data/010276146_1-2bafd071cf57287ef7855da0f8e283d5-768x994.png

What is the Capital Asset Pricing Model CAPM The capital asset pricing model CAPM is used to calculate the required rate of return for any risky asset Your required rate of return is the increase in value you should expect to see The Capital Asset Pricing Model determines the value of a security or CAPM based on the expected return concerning the risk investors accept when purchasing that instrument This financial model establishes a linear link between the needed return on

[desc-10] [desc-11]

Capital Asset Pricing Model CAPM

https://s2.studylib.net/store/data/015361764_1-2bdb8960d6caf2141cd4643cc72b51c4-768x994.png

CAPM Capital Asset Pricing Model In 4 Easy Steps What Is Capital

http://i.ytimg.com/vi/LWsEJYPSw0k/maxresdefault.jpg

https://corporatefinanceinstitute.com › resources › ...

The Capital Asset Pricing Model CAPM is a model that describes the relationship between the expected return and risk of investing in a security It shows that the expected return on a security is equal to the risk free return plus a risk premium which is based on the beta of that security

https://smartasset.com › investing › capital-asset-pricing-model

The capital asset pricing model CAPM is used to assess the risk of an investment Let s break down how it s calculated and whether you should use it

Where Are The Billionaire Financial Academics The Mathematical Investor

Capital Asset Pricing Model CAPM

Capital Asset Pricing Model Importance Examples TradeSmart

Capital Asset Pricing Model CAPM And Its Role In Discounted Cash Flow

Capital Asset Pricing Model CAPM Capital Assets Financial Asset

Figure A1 Representation Of CAPM Capital Asset Pricing Model And The

Figure A1 Representation Of CAPM Capital Asset Pricing Model And The

Capital Asset Pricing Model CAPM Pengertian Rumus Dan Contohnya

Beta What Is The Relation Between Capital Market Line And Capital

Capital Asset Pricing Model CAPM Overview Formula Example

Explain The Capital Asset Pricing Model Capm - The Capital Asset Pricing Model or CAPM calculates the value of a security based on the expected return relative to the risk investors incur by investing in that security How is CAPM calculated