Formula For Calculating Tax On Social Security Benefits 85 of your Social Security income can be taxed Learn what is taxable how benefit taxes are calculated amp create a strategy to lower your taxable income

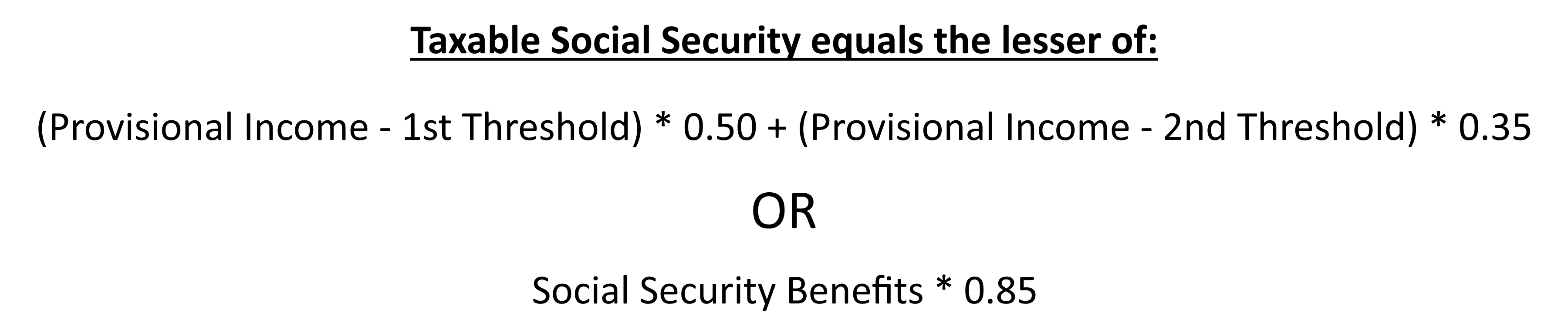

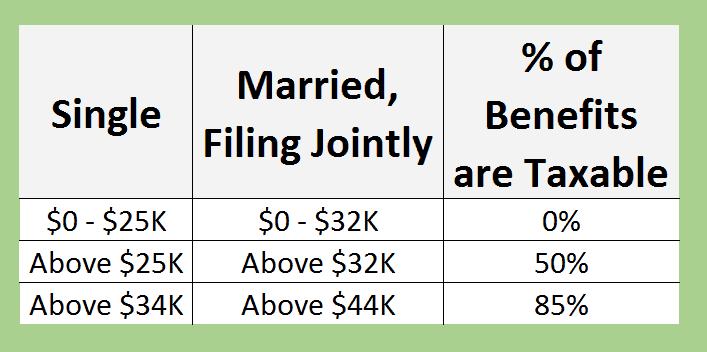

The Social Security Administration uses a specific formula to determine benefit amounts This calculation considers your 35 highest earning years Benefits are influenced by There are two calculations to determine the taxable Social Security Compute them both and use the smaller of the two This one is easy social security benefit times 85 is the maximum amount of taxable benefits

Formula For Calculating Tax On Social Security Benefits

Formula For Calculating Tax On Social Security Benefits

http://socialsecurityintelligence.com/wp-content/uploads/2015/07/provisionalincomethreshholds.png

Taxes Social Security Calculating Minimizing What You Owe

https://www.retireguide.com/wp-content/uploads/combined-income-formula.jpg

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

https://www.marottaonmoney.com/wp-content/uploads/2022/04/UPDATED-Taxable-Social-Security-Formula.png

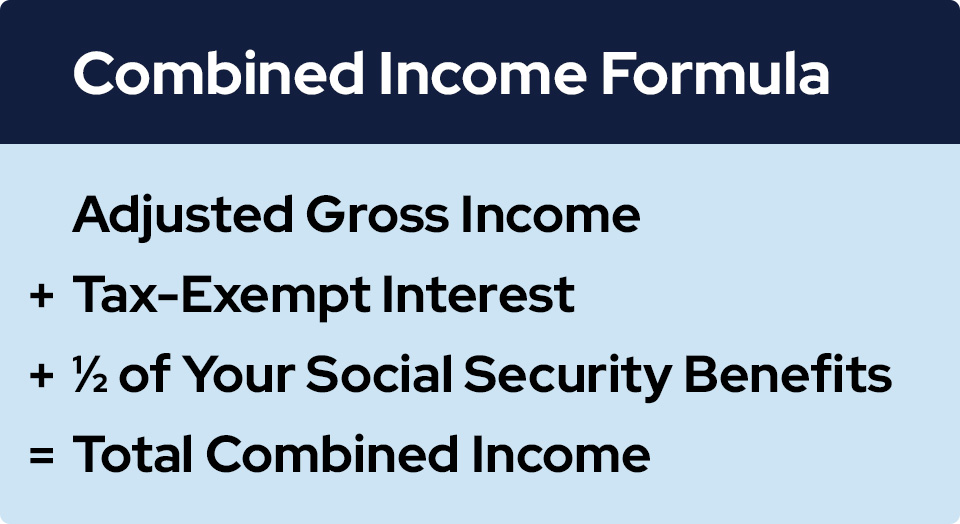

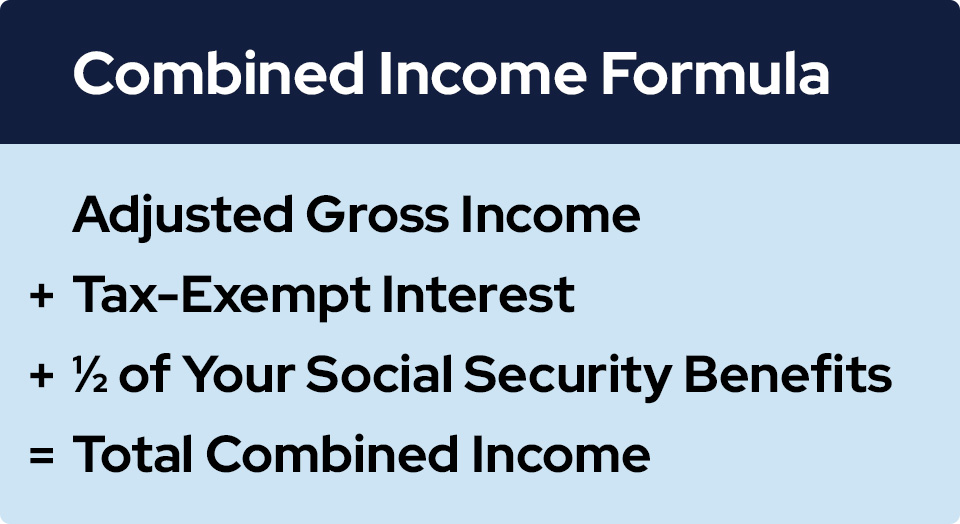

When determining how much you may be taxed the first step is to calculate your combined income The IRS says your combined income is your adjusted gross income AGI plus nontaxable interest To walk you through the process here s a guide to the formula used by the Internal Revenue Service to determine just how much you ll owe on your benefits Are Social Security benefits

You can use the worksheet in IRS Publication 915 fill out a 1040 or use this formula to calculate the taxable portion of Social Security benefits To determine this amount the IRS provides tax filers with the 18 step Social Security Benefits Worksheet found in the 1040 instructions for lines 6a and 6b on the current 2022 tax forms

More picture related to Formula For Calculating Tax On Social Security Benefits

Taxable Social Security Calculator

https://www.covisum.com/hs-fs/hubfs/Imported_Blog_Media/WEB_Covisum_tax-chart-SST.png?width=613&name=WEB_Covisum_tax-chart-SST.png

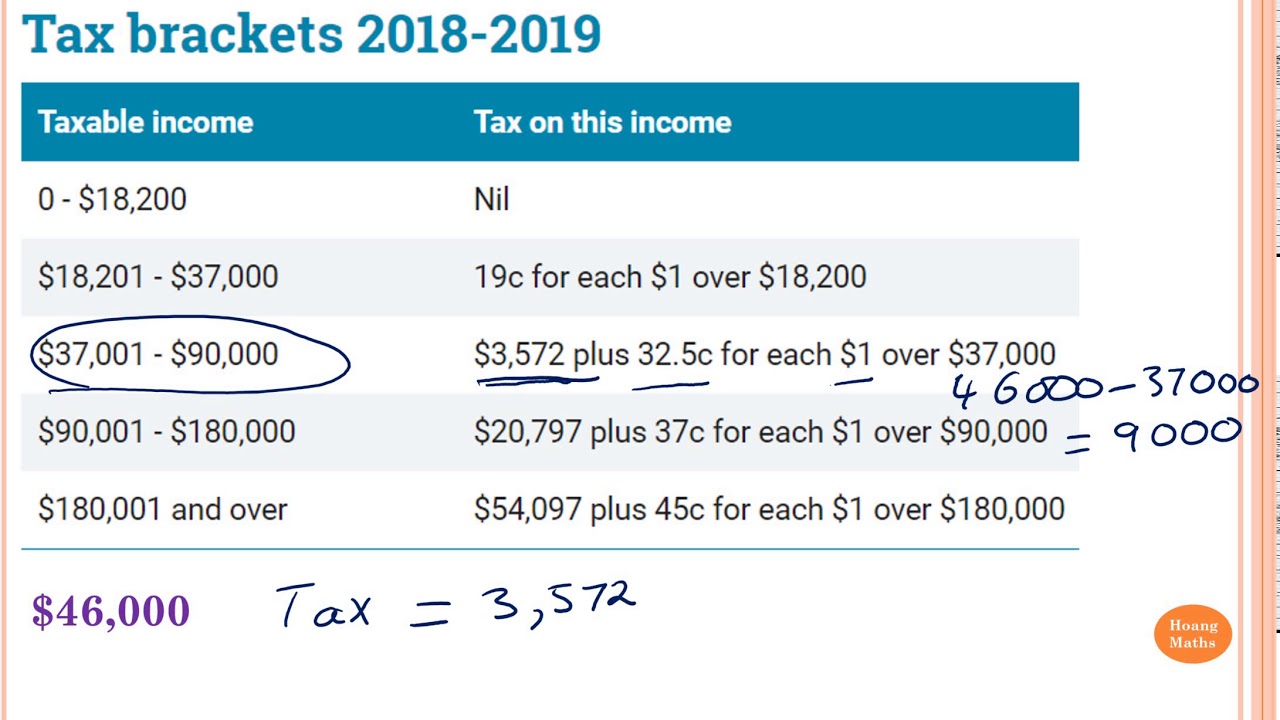

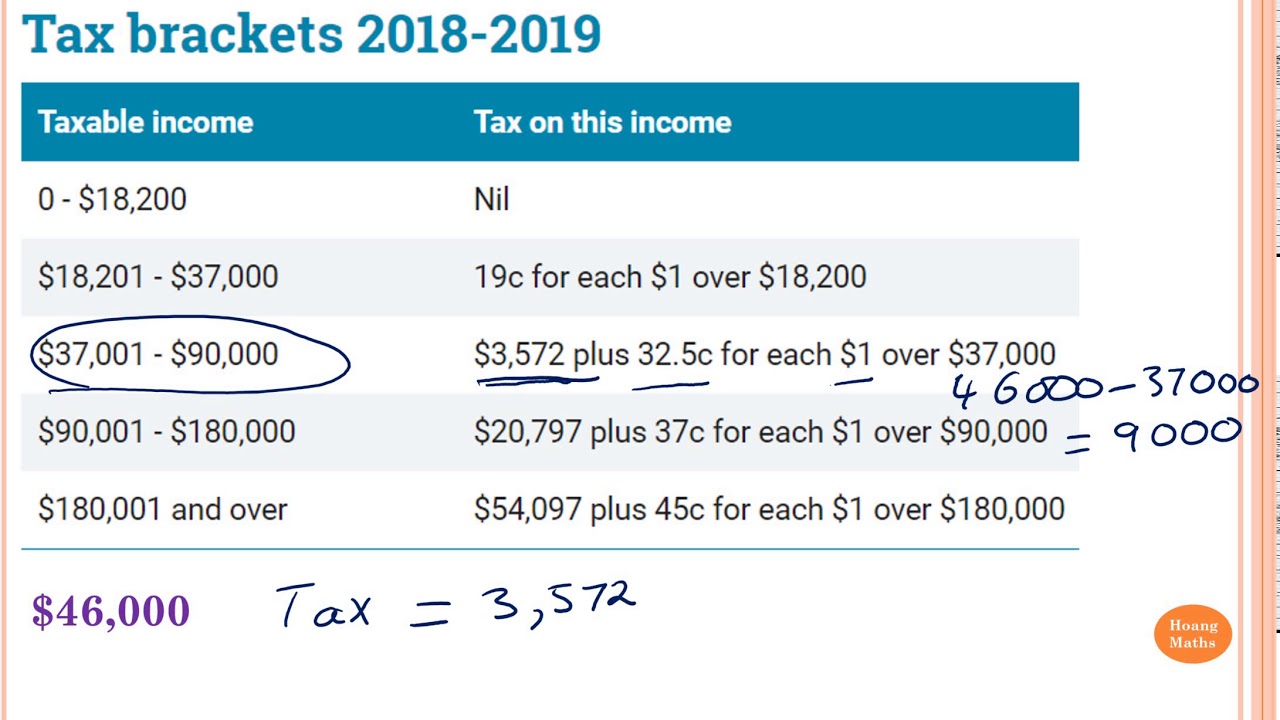

How To Calculate Tax In Australia One Click Life

https://oneclicklife.com.au/wp-content/uploads/2023/04/Budget-Tax-Rates-Threshold-01-scaled-e1681366579595.jpg

Are My Social Security Benefits Taxable Calculator

http://socialsecurityintelligence.com/wp-content/uploads/2015/07/percent-of-Social-Security-income-that-is-taxable.png

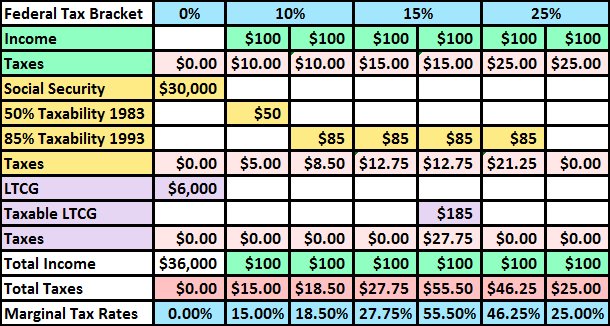

What Is the Social Security Tax Definition Exemptions and Example The Old Age Survivors and Disability Insurance OASDI tax more commonly referred to as the Social Security tax is This formula can help you figure out how much of your benefits the government will tax but what you will owe in taxes on your benefits depends on your income tax bracket for the year

How to Calculate My Social Security Benefits You can use the Money Help Center calculator to determine how much Social Security you will get and how income tax may impact your benefits and income You need to plan for Step by Step Guide to Calculate Your Social Security Benefits How Is Social Security Calculated 1 Calculate Your Monthly Earnings 2 Calculate Your PIA 3 Adjust

Social Security Taxable Income Calculator Top FAQs Of Tax Oct 2022

https://www.irstaxapp.com/wp-content/uploads/2020/03/social-security-benefits-calculator.png

Federal Income Tax Calculating Average And Marginal Tax Rates YouTube

https://i.ytimg.com/vi/X8PrzosOlSo/maxresdefault.jpg

https://www.ml.com › articles › taxes-and-your-social-security

85 of your Social Security income can be taxed Learn what is taxable how benefit taxes are calculated amp create a strategy to lower your taxable income

https://nationaltaxreports.com › how-is-social-security-tax-calculated

The Social Security Administration uses a specific formula to determine benefit amounts This calculation considers your 35 highest earning years Benefits are influenced by

How To Calculate Federal Income Taxes Social Security Medicare

Social Security Taxable Income Calculator Top FAQs Of Tax Oct 2022

Taxes On Social Security Benefits Optima Tax Relief

Tax Definition Meaning

Effective Tax Rate Formula Calculator Excel Template

Calculating Tax Payable Part 1 YouTube

Calculating Tax Payable Part 1 YouTube

Social Security Tax Impact Calculator Bogleheads

2023 Worksheet To Calculate Taxable Social Security

How To Calculate Income Tax Fy 2021 22 Excel Examples Calculation You

Formula For Calculating Tax On Social Security Benefits - The Social Security Benefits Formula Social Security calculates your benefits by tallying up the earned income you made in your top earning years and applying some simple