How Are Social Security Benefits Taxed The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits

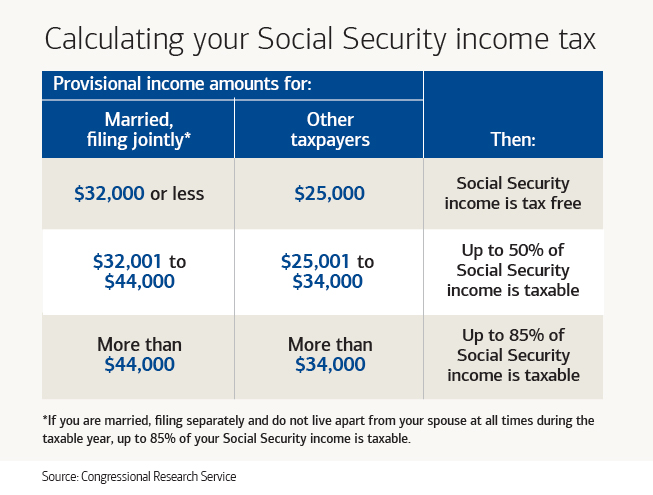

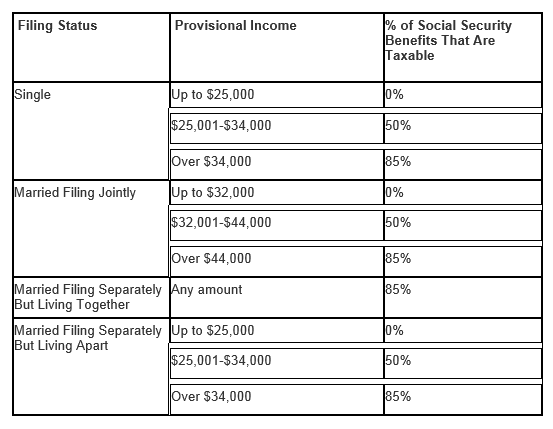

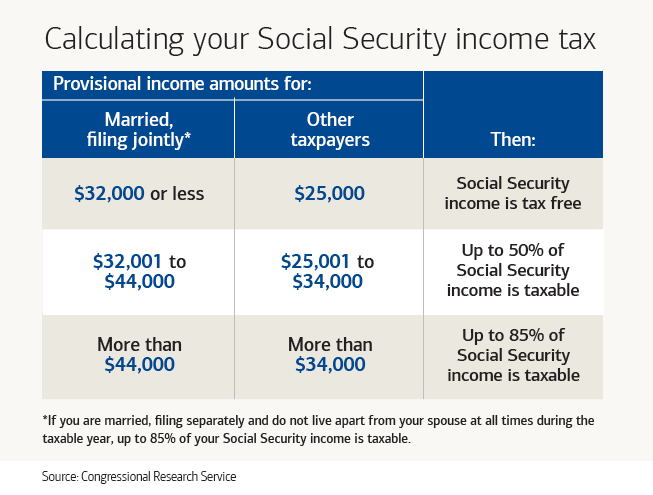

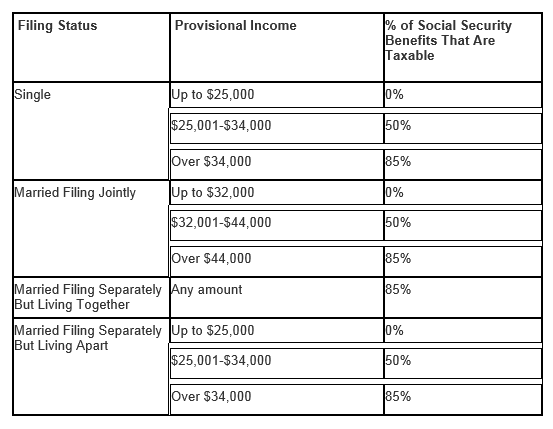

If your total income is more than 25 000 for an individual or 32 000 for a married couple filing jointly you must pay federal income taxes on your Social Security benefits Below those thresholds your benefits are not taxed If your Social Security income is taxable depends on your income from other sources Here are the 2025 IRS limits

How Are Social Security Benefits Taxed

How Are Social Security Benefits Taxed

https://realdaily.com/wp-content/uploads/2018/07/ml_calc-social.jpg

Do I Get Taxed On Social Security Income Tax Walls

http://www.cap-strat.com/wp-content/uploads/2014/02/table.png

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

How Working After Full Retirement Age Affects Social Security Benefits

https://www.investopedia.com/thmb/gN1XR_3vHWcy2AQMat6vc2RsIXg=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg

The taxation rules apply to all forms of benefits paid out of Social Security s trust funds retirement benefits survivor benefits and Social Security Disability Insurance SSDI Whichever type of Social Security benefit you re getting you could owe taxes on it depending on your overall income You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay income tax on up to 50 of your benefits

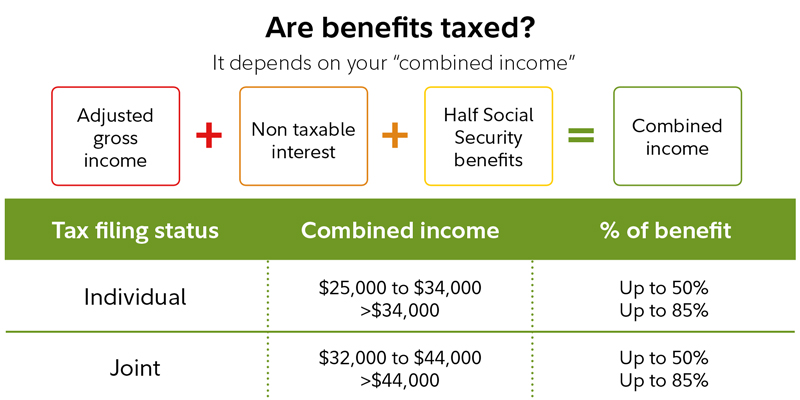

Learn how to calculate the taxable portion of your Social Security benefits Understand income thresholds provisional income and strategies to minimize tax liability Social Security benefit taxes are based on what the Social Security Administration SSA refers to as your combined income That consists of your adjusted gross income plus any nontaxable interest you earned and certain other items and half of your Social Security income

More picture related to How Are Social Security Benefits Taxed

Do I Have To Pay Social Security Tax After Retiring Tax Walls

https://www.fidelity.com/bin-public/060_www_fidelity_com/images/Viewpoints/RET/social_security_working_2019_info_2.jpg

Taxable Social Security Calculator

https://www.covisum.com/hs-fs/hubfs/Imported_Blog_Media/WEB_Covisum_tax-chart-SST.png?width=613&name=WEB_Covisum_tax-chart-SST.png

The Senior Citizens League National Survey Says 56 Of Social

http://ww1.prweb.com/prfiles/2016/01/26/13184899/TSCL_SocialSecurity_Chart.jpg

Your Social Security benefits are taxable if you meet specific income levels Here are three strategies that can reduce the taxes if you re required to pay Up to 50 or even 85 of your Social Security benefits are taxable if your provisional or total income as defined by tax law is above a certain base amount Your Social Security income may not be taxable at all if your total income is below the base amount Ah retirement Time to kick back and enjoy your golden years

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

https://www.investopedia.com/thmb/RBr58FzwHr4Erp9b4DeWCfKHb0s=/6256x3918/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg

Taxes On Social Security Benefits YouTube

https://i.ytimg.com/vi/juj4YsXOdkc/maxresdefault.jpg

https://www.irs.gov › newsroom › irs-reminds-taxpayers...

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly retirement survivor and disability benefits

https://www.aarp.org › retirement › social-security › ...

If your total income is more than 25 000 for an individual or 32 000 for a married couple filing jointly you must pay federal income taxes on your Social Security benefits Below those thresholds your benefits are not taxed

Do I Get Taxed On Social Security Income Tax Walls

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

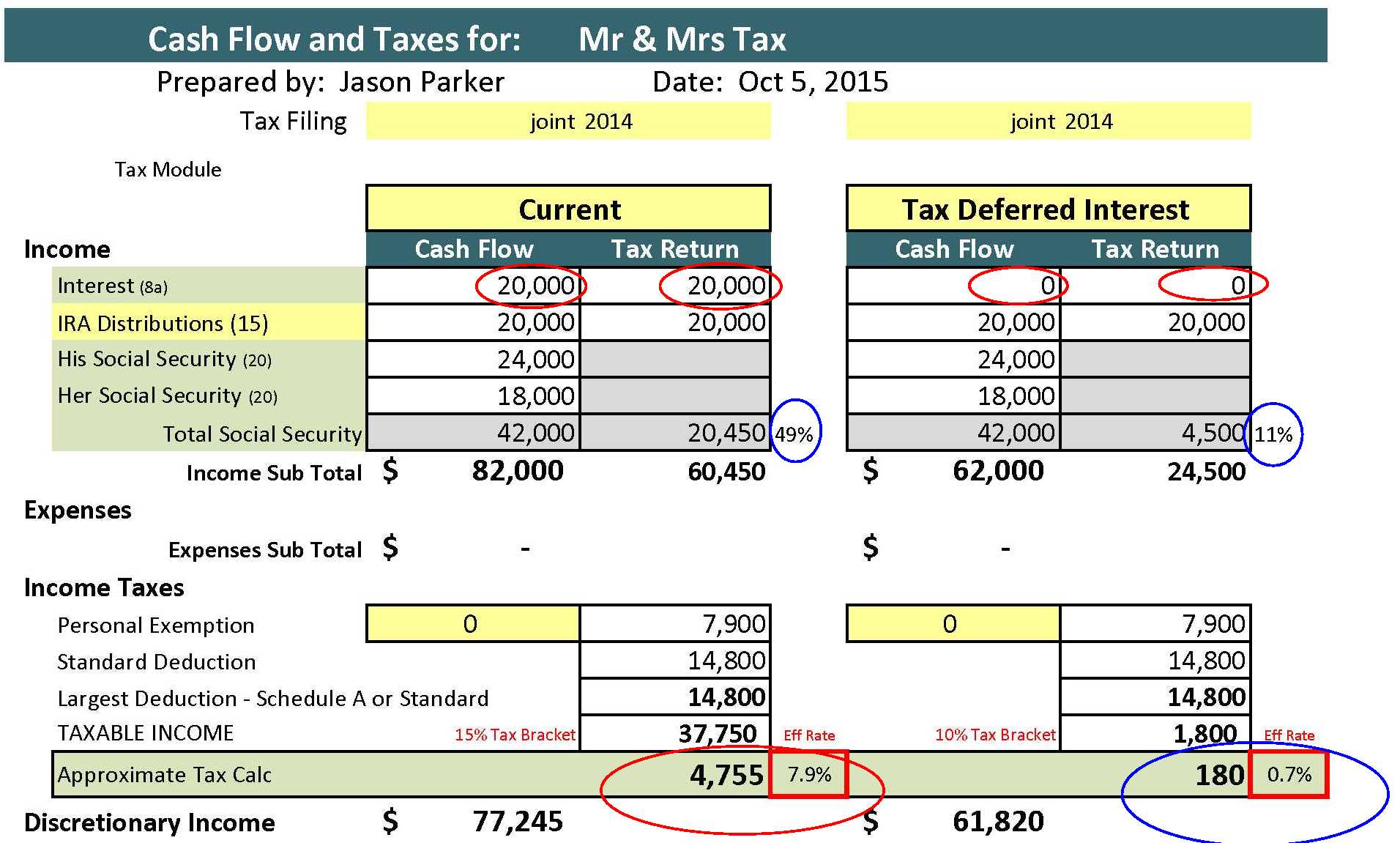

One Way To Reduce Taxes On Social Security Income Sound Retirement

Retire Ready Are Social Security Benefits Taxed

How Are Social Security Benefits Taxed In 2015 Retire Gen Z

How To Calculate Taxable Social Security Income 2023

How To Calculate Taxable Social Security Income 2023

How Are Social Security Benefits Taxed In 2015 Retire Gen Z

How To Calculate Find Social Security Tax Withholding Social

Ssa Taxable Income Worksheet

How Are Social Security Benefits Taxed - Social Security benefit taxes are based on what the Social Security Administration SSA refers to as your combined income That consists of your adjusted gross income plus any nontaxable interest you earned and certain other items and half of your Social Security income