How Are Spousal Disability Benefits Calculated The spousal benefit calculation is straightforward if you don t have a benefit of your own Remember in that case it s between 32 5 and 50 of the higher earning spouse s full retirement age benefit depending on your filing age

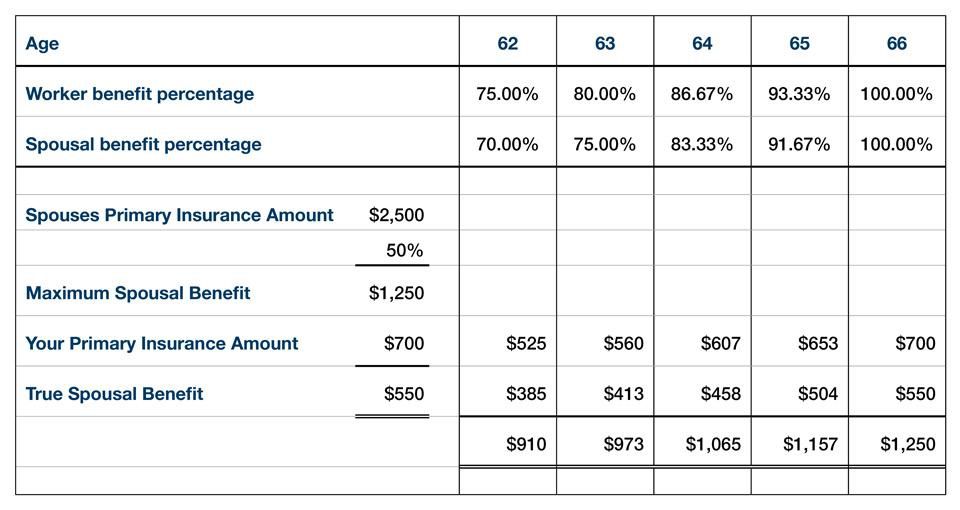

A Social Security spousal benefit is calculated as 50 of the other spouse s PIA Note that the age at which the other spouse files for Social Security benefits doesn t affect this calculation Example Jane files for her retirement benefit at age 63 and is therefore receiving a retirement benefit that is smaller than her PIA Yes If you are collecting Social Security Disability Insurance SSDI your spouse can draw a benefit on that basis if you have been married for at least one continuous year and he or she is either age 62 or older or any age and caring for a

How Are Spousal Disability Benefits Calculated

How Are Spousal Disability Benefits Calculated

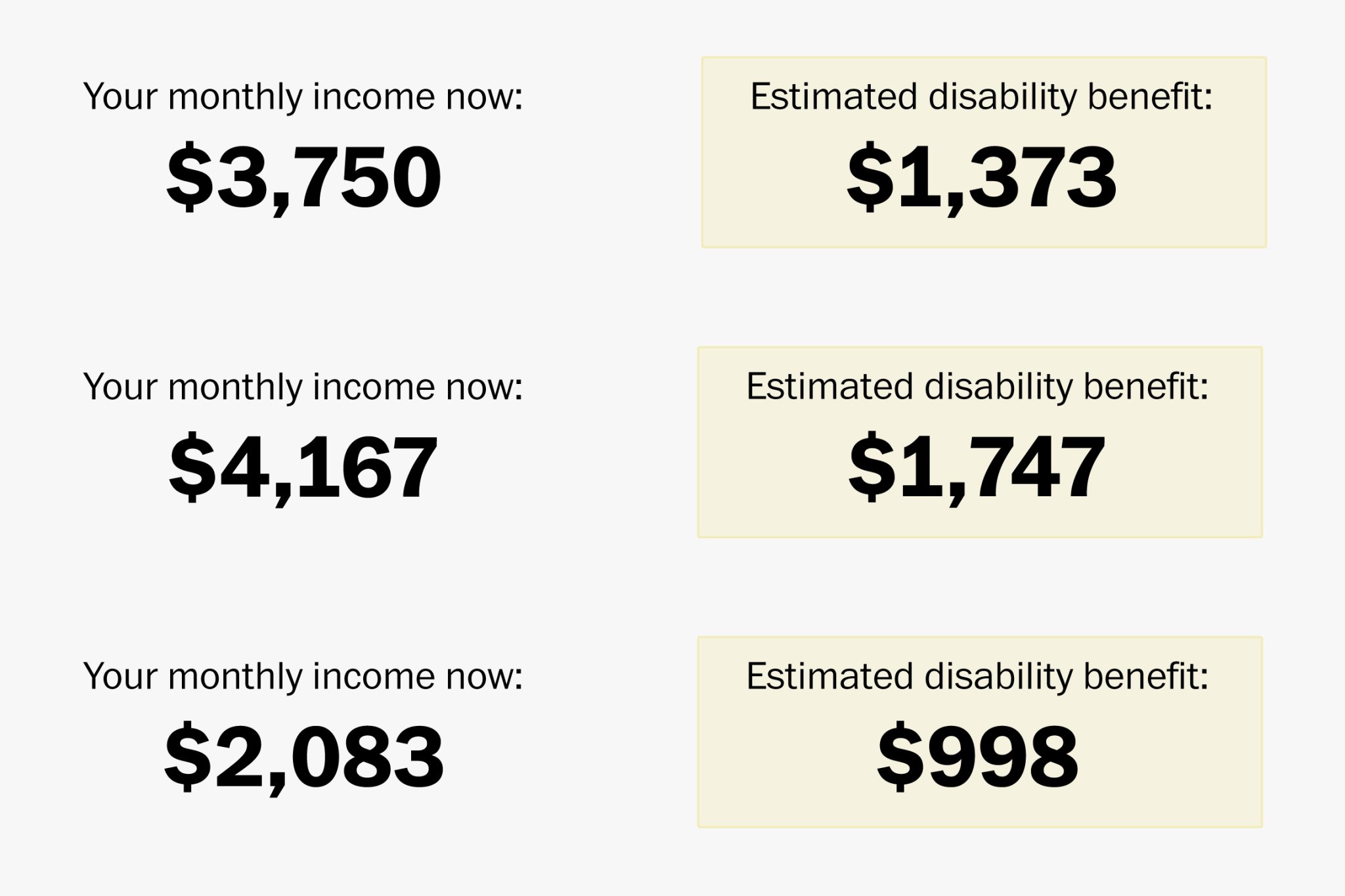

https://news.hr.ufl.edu/wp-content/uploads/sites/11/2022/10/UFHR_BenefitsStories_Disability_Infographic.jpg

Social Security Spousal Benefits Simplified YouTube

https://i.ytimg.com/vi/3yTEY6QXK8g/maxresdefault.jpg

How Are Disability Benefits Calculated Auto Accident Attorney

https://blog.havenlife.com/wp-content/uploads/2023/06/disability-benefits-calculated.jpg

To be eligible for spousal benefits that is SSDI benefits based on the earnings record of your disabled spouse or disabled ex spouse one of the following must be true you ve been married to the disabled worker for at least a year you re a divorced spouse who was married to the disabled worker for at least 10 years or A spouse who is receiving spousal retirement benefits is entitled to up to 50 of your monthly SSDI benefit amount subject to a family maximum amount If you have children who are also collecting benefits your spouse s benefit amount might be

Several factors influence Social Security spousal benefits including eligibility requirements benefit calculations claiming strategies and taxation Spouses can claim spousal benefits as early as age 62 but the benefit amount will be reduced if claimed before their Full Retirement Age FRA Spousal benefits are calculated based on how much the other spouse would receive if that person began collecting Social Security benefits at the full

More picture related to How Are Spousal Disability Benefits Calculated

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How Are Social Security Spousal Benefits Calculated

https://www.investopedia.com/thmb/LhUM_LlUG-urAfGPF_6fzVNJYqk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg

How Are Social Security Spousal Benefits Calculated

https://securemoneyadvisors.com/wp-content/uploads/2018/12/blog-callout-social-security-spousal-benefits.jpg

Workers Compensation Disability Rating Chart

https://tuckerdisability.com/wp-content/uploads/2020/10/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1-1.png

How to calculate spousal Social Security Benefits A spousal benefit is calculated as 50 of the other partner s Primary Insurance Amount PIA There are some scenarios in which your spousal benefits will decrease A Social Security spousal claim is calculated as 50 of the partner s PIA irrespective of the year of filing Such as X is born in 1960 and files for retirement benefits at the age of 62 In this condition X is liable to get an amount that is lesser than the actual PIA

Learn how your spouse s income can affect your Social Security Disability SSD benefits Understand the complex rules and regulations that govern spousal benefits and how they may impact your financial situation How to Calculate Spousal Benefits for Social Security A Social Security spousal benefit is calculated as 50 of the other spouse s Primary Insurance Amount PIA The primary insurance amount is the Social Security benefits paid to a retiree at full retirement age

Social Security Disability Spousal Benefits Loopholes

https://www.collinsprice.com/wp-content/uploads/2023/07/SocialSecurityDisabilityBenefitsSpousalLoophole-702x526.png

Social Security Spousal Benefits What You MUST Know YouTube

https://i.ytimg.com/vi/lb80rfUX77A/maxresdefault.jpg

https://www.socialsecurityintelligence.com › social...

The spousal benefit calculation is straightforward if you don t have a benefit of your own Remember in that case it s between 32 5 and 50 of the higher earning spouse s full retirement age benefit depending on your filing age

https://articles.opensocialsecurity.com › spousal-benefit-calculation

A Social Security spousal benefit is calculated as 50 of the other spouse s PIA Note that the age at which the other spouse files for Social Security benefits doesn t affect this calculation Example Jane files for her retirement benefit at age 63 and is therefore receiving a retirement benefit that is smaller than her PIA

Spousal Social Security Benefits Strategies To Maximize Your Benefits

Social Security Disability Spousal Benefits Loopholes

2023 Veterans Disability Compensation Rates COLA Increases

Calculating Social Security Spousal Benefits With Dual Entitlement

Social Security Benefits Maximum 2024 Jesse Rosita

Can You Collect Your Ex s Social Security When They Die

Can You Collect Your Ex s Social Security When They Die

How To Claim Spousal Benefits

How To Write A Disability Claim Letter Allen Words

Does Surviving Spouse Get Social Security Benefits Covenant Wealth

How Are Spousal Disability Benefits Calculated - Spousal benefits are calculated using both your Primary Insurance Amounts and your spouse s Primary Insurance Amount Spousal benefits are layered on top of any worker