How Much Social Security Tax Is Withheld The current tax rate for Social Security is 6 2 for the employer and 6 2 for the employee or 12 4 total The current rate for Medicare is 1 45 for the employer and 1 45

Social Security Contributions paid by employed persons are called Class 1 Contributions and are paid by direct deductions from the same employees wages salary In a normal case scenario What percent of Social Security tax is withheld The employee tax rate for Social Security is 6 2 and the employer tax rate for Social Security is also 6 2

How Much Social Security Tax Is Withheld

How Much Social Security Tax Is Withheld

https://www.groupmgmt.com/media/articulate-import//2019/04/PercentageMethodChartExample-clean.png

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

W 2 Doctored Money

https://images.squarespace-cdn.com/content/v1/57a4d128e6f2e1220f6a1d97/1493148041563-F9T3U93CORCE9Q3YMKE4/image-asset.png

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply You can have 7 10 12 or 22 percent of your monthly benefit withheld for You choose whether or not taxes will be withheld from your Social Security check The amount of taxes that you will pay depends on your total income including your Social

To avoid surprises you can request that federal income taxes be withheld from your monthly payments To do this you must fill out Form W 4V and submit it to your local Social Security tax withholding calculator Calculate the estimated payroll taxes due on wages for both employees and employers

More picture related to How Much Social Security Tax Is Withheld

Social Security 2024 Max Withholding Calculator Linn Kizzie

https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png

Income Tax Brackets 2024 25 2024 25 Calculator Hilary Linnell

https://federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours-1.png

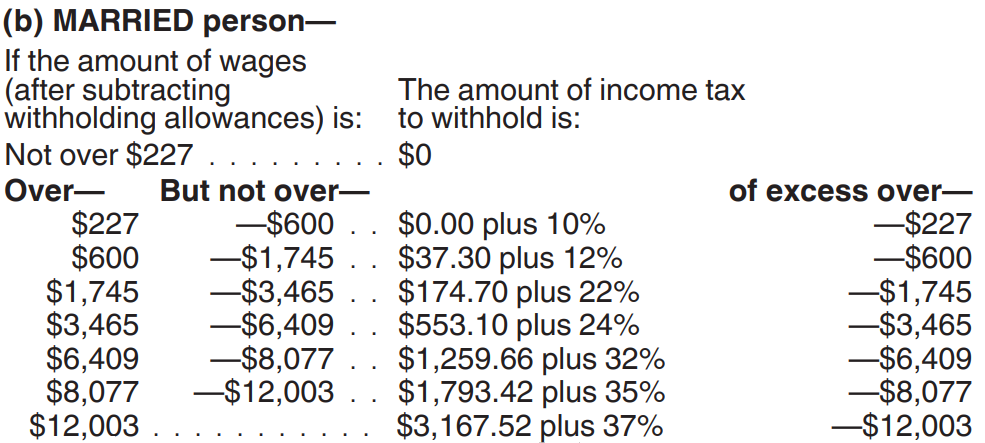

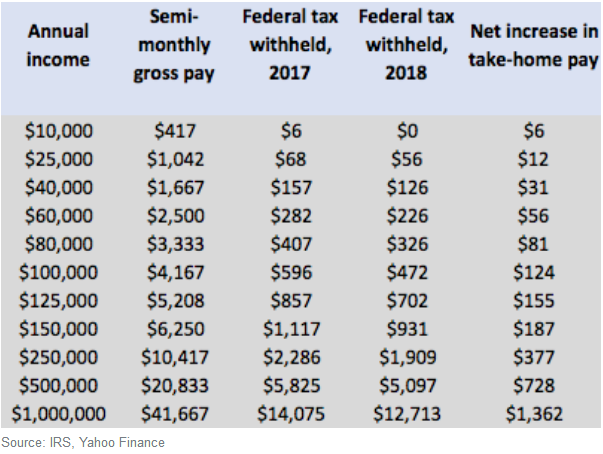

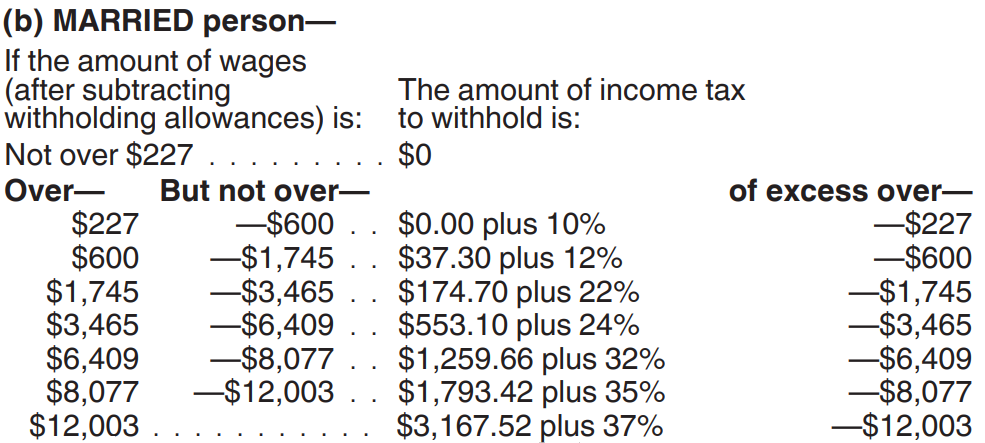

New IRS Tax Withholding Tables Mean Your Paycheck Might Be Getting A

https://clark.com/wp-content/uploads/2018/01/irs-withholding.png

Both employees and their employers pay into Social Security with 6 2 percent of an employee s taxable income withheld from each paycheck and another 6 2 percent paid by the employer in a As mentioned one way to avoid tax surprises is to have federal income taxes withheld from your Social Security payments To do this complete IRS Form W 4V Voluntary

[desc-10] [desc-11]

2024 Tax Tables Pdf Uk Tatum Renelle

https://www.taxuni.com/wp-content/uploads/2020/04/Federal-Withholding-Tables.jpg

About Employee Social Security Withholding Deferral

https://www.halfpricesoft.com/payroll-software/images/defer_paystub.jpg

https://www.irs.gov › taxtopics

The current tax rate for Social Security is 6 2 for the employer and 6 2 for the employee or 12 4 total The current rate for Medicare is 1 45 for the employer and 1 45

https://socialsecurity.gov.mt › en › information-and...

Social Security Contributions paid by employed persons are called Class 1 Contributions and are paid by direct deductions from the same employees wages salary In a normal case scenario

For 2024 What Percentage Of Ssi Is Taxable Zarah Kathleen

2024 Tax Tables Pdf Uk Tatum Renelle

Virginia Tax Calculator Calculate Your Virginia State Taxes

Social Security Tax Equation Tessshebaylo

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

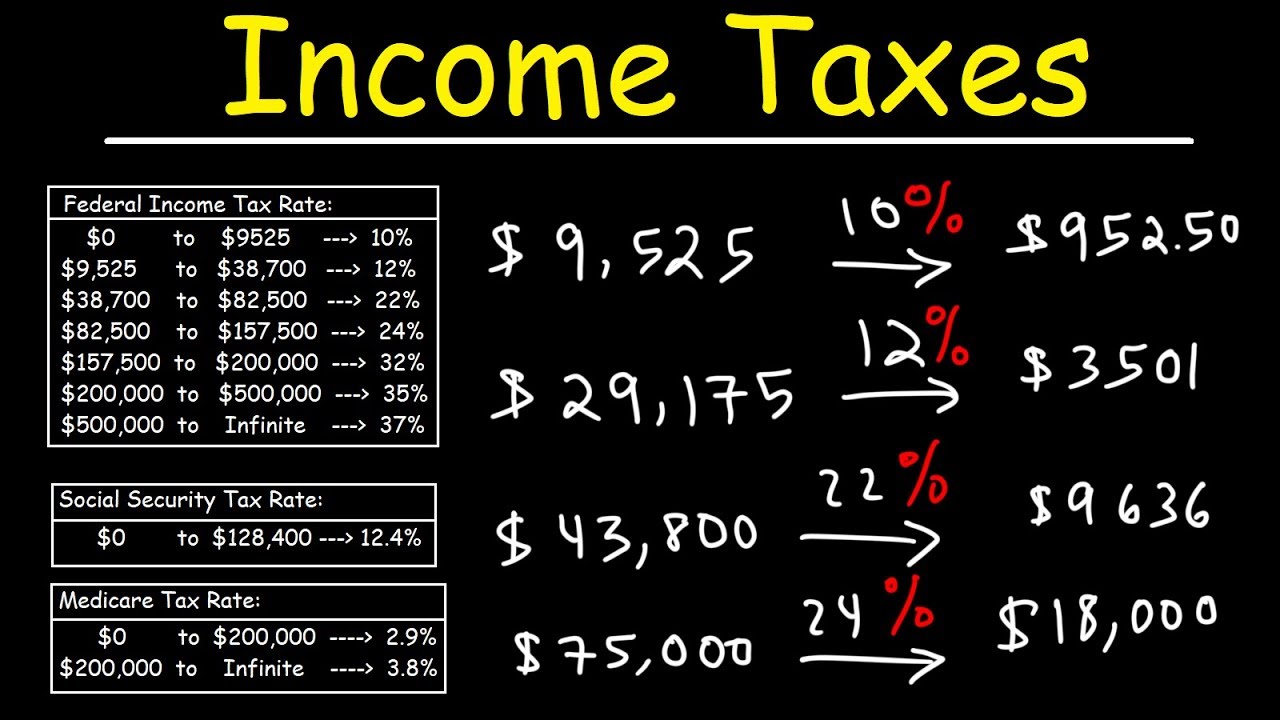

How Much Social Security Tax Is Withheld - Social Security tax withholding calculator Calculate the estimated payroll taxes due on wages for both employees and employers