How To Amend A Self Assessment Tax Return If you filed your 2021 2022 tax return by 31st January 2023 you have until 31st January 2024 to make an amendment online If your year is up then you have to request the

HMRC will normally accept an amendment to a return or self assessment under Section 9ZA TMA whether notified by the taxpayer or trustee or by an agent authorised to act on the trust or Refunds appeals and penalties Check how to claim a tax refund Disagree with a tax decision or penalty Estimate your penalty for late Self Assessment tax returns and payments

How To Amend A Self Assessment Tax Return

How To Amend A Self Assessment Tax Return

https://i.ytimg.com/vi/hjcuCUBZxxs/maxresdefault.jpg

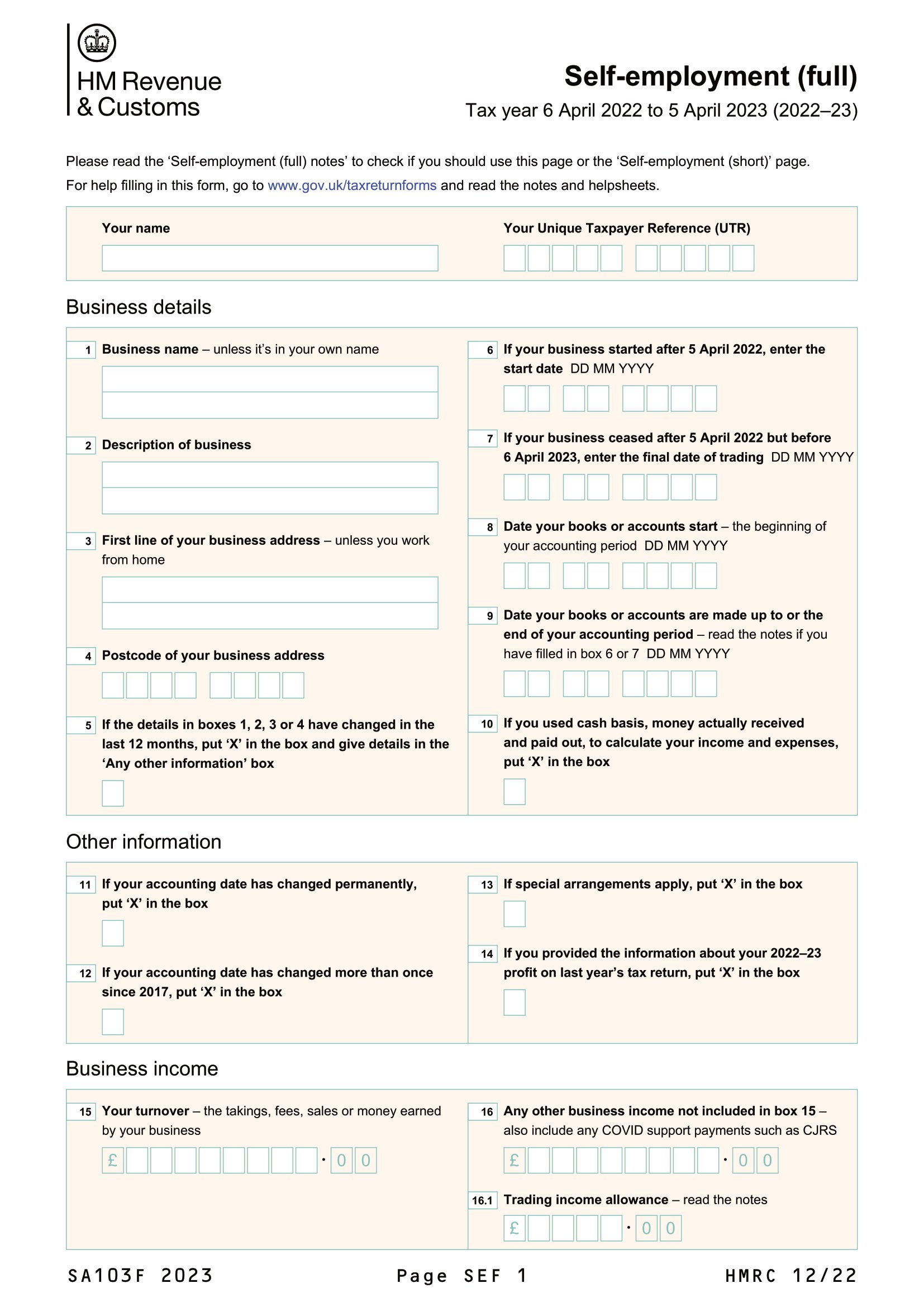

Filing A Self Assessment Tax Return A Complete Guide

https://cloudcogroup.com/wp-content/uploads/2020/01/guide-to-filling-in-self-assessment-tax-returns.jpg

How To File Your Self Assessment Tax Return On Time The Cheap Accountants

https://thecheapaccountants.com/wp-content/uploads/2017/01/File-Your-Self-Assessment-Tax-Return.jpg

If after making a successful submission you need to make changes and file an amended return Please see the video tutorial for a walk through of the process Make your You file your Self Assessment tax return to HMRC before the deadline and then realise that you made a mistake on one of the forms Luckily HMRC has devised a simple process to help you

You can make an amend to your Self Assessment within 12 months of the submission deadline January 31 st Amends made within these 12 months are fairly easy to HMRC has the right to amend the tax return within nine months of the date of receipt ie the date the return was filed rather than the due date for filing without opening an enquiry Usually

More picture related to How To Amend A Self Assessment Tax Return

Can I Amend My Self Assessment Tax Return Jon Davies Accountants

https://www.jondaviesaccountants.co.uk/wp-content/uploads/2019/06/self_assessment_tax_return.jpg

Self Assessment Tax Return Form Employment Pages Employment Form

https://www.employementform.com/wp-content/uploads/2022/08/self-assessment-tax-return-form-employment-pages.jpg

A Step by Step Guide To Filing Your Self Assessment Tax Return

https://adamaccountancy.co.uk/wp-content/uploads/2024/01/Self-assessment-tax-return.png

Self Assessment tax returns deadlines who must send a tax return penalties corrections and returns for someone who has died HMRC will let you adjust your Self Assessment submission for 12 months after the statutory deadline So for the 2020 2021 tax year due 31 January 2022 you may make any

You can use the Self Assessment forms and helpsheets to download a new tax return Send the corrected pages to HMRC Self Assessment general enquiries address You should write the You are able to make changes to your self assessment tax return after you ve already filed it with HMRC How you do this depends on HMRC s time limits and how you

How To Complete A Self Assessment Tax Return Workingmums co uk

https://www.workingmums.co.uk/wp-content/uploads/2017/01/AdobeStock_82858474.jpg

How To Fill In A Self assessment Tax Return Which

https://media.product.which.co.uk/prod/images/ar_2to1_1500x750/06dfdd599313-self-assessment.jpg

https://taxscouts.com/self-assessment-basics/can-i...

If you filed your 2021 2022 tax return by 31st January 2023 you have until 31st January 2024 to make an amendment online If your year is up then you have to request the

https://www.gov.uk/hmrc-internal-manuals/self...

HMRC will normally accept an amendment to a return or self assessment under Section 9ZA TMA whether notified by the taxpayer or trustee or by an agent authorised to act on the trust or

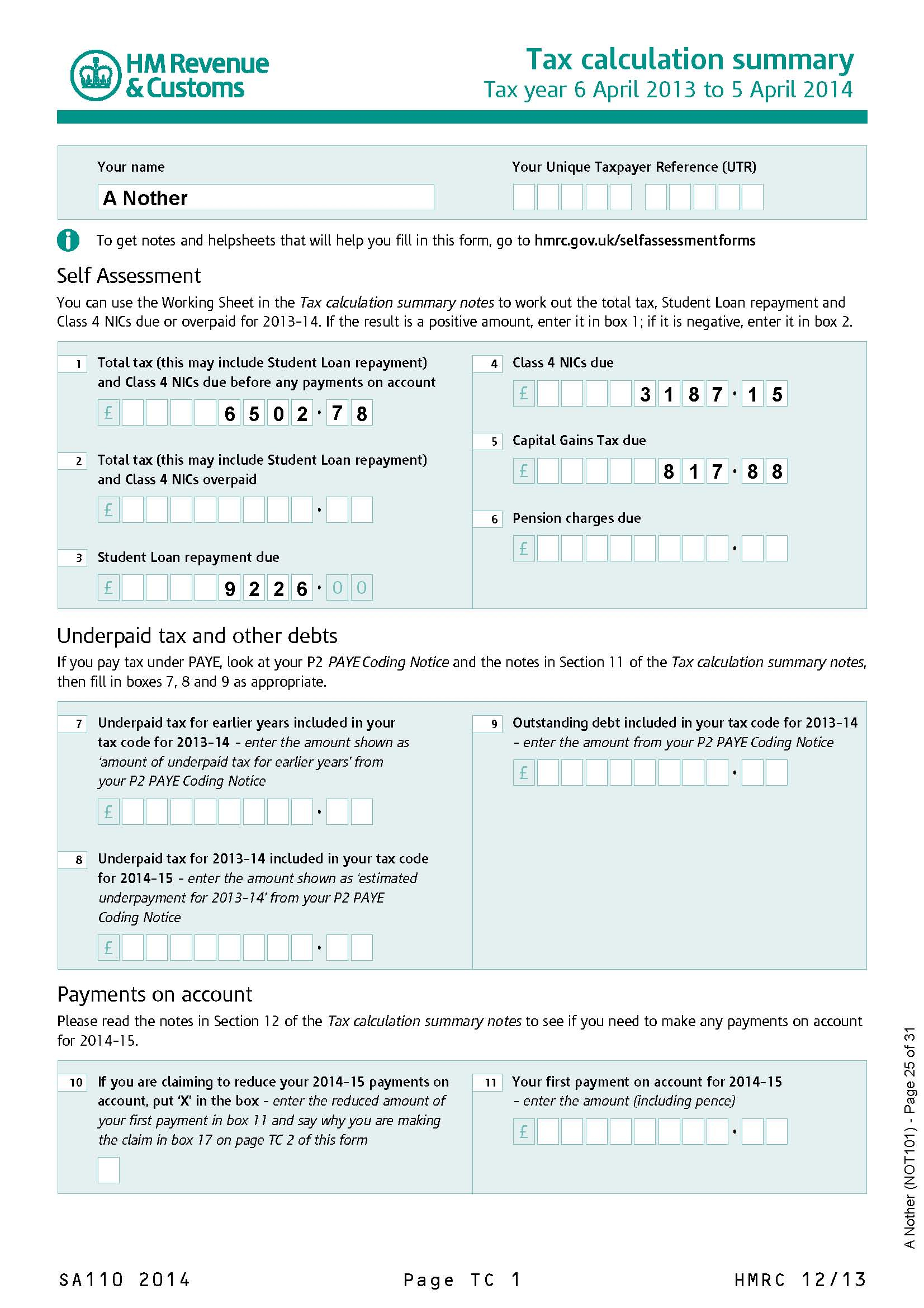

The Ultimate Guide To Self Assessment Tax Returns APARI

How To Complete A Self Assessment Tax Return Workingmums co uk

Self Employed Tax Return In The UK A Step by Step Guide Health

Email Contract Template

How To File Your Self Assessment Tax Return Online Bowes Brooks

Why Is HMRC Asking Me To File A Tax Return Who Needs To File Self

Why Is HMRC Asking Me To File A Tax Return Who Needs To File Self

Everything You Need To Know About Filling Out Your Self Assessment Tax

.jpg)

Self Assessment Tax Return

How Does Hmrc Calculate Income Tax TAX

How To Amend A Self Assessment Tax Return - You file your Self Assessment tax return to HMRC before the deadline and then realise that you made a mistake on one of the forms Luckily HMRC has devised a simple process to help you