How To Calculate Taxable Social Security Benefits 2023 Your benefits may be taxable see IRS Pub 915 and Social Security Benefits in your 2023 federal income tax return instructions If none of your benefits are taxable but you must otherwise file a tax return do the following Enter the total amount from line A above on Form 1040 or 1040 SR line 6a and enter 0 on Form 1040 or 1040 SR

To determine if their benefits are taxable taxpayers should take half of the Social Security money they collected during the year and add it to their other income Other income includes pensions wages interest dividends and capital gains How Social Security tax is calculated Each January after you begin receiving Social Security benefits you will receive a statement Form SSA 1099 showing the total benefits you received

How To Calculate Taxable Social Security Benefits 2023

How To Calculate Taxable Social Security Benefits 2023

https://www.irs.gov/pub/xml_bc/24811vwa.gif

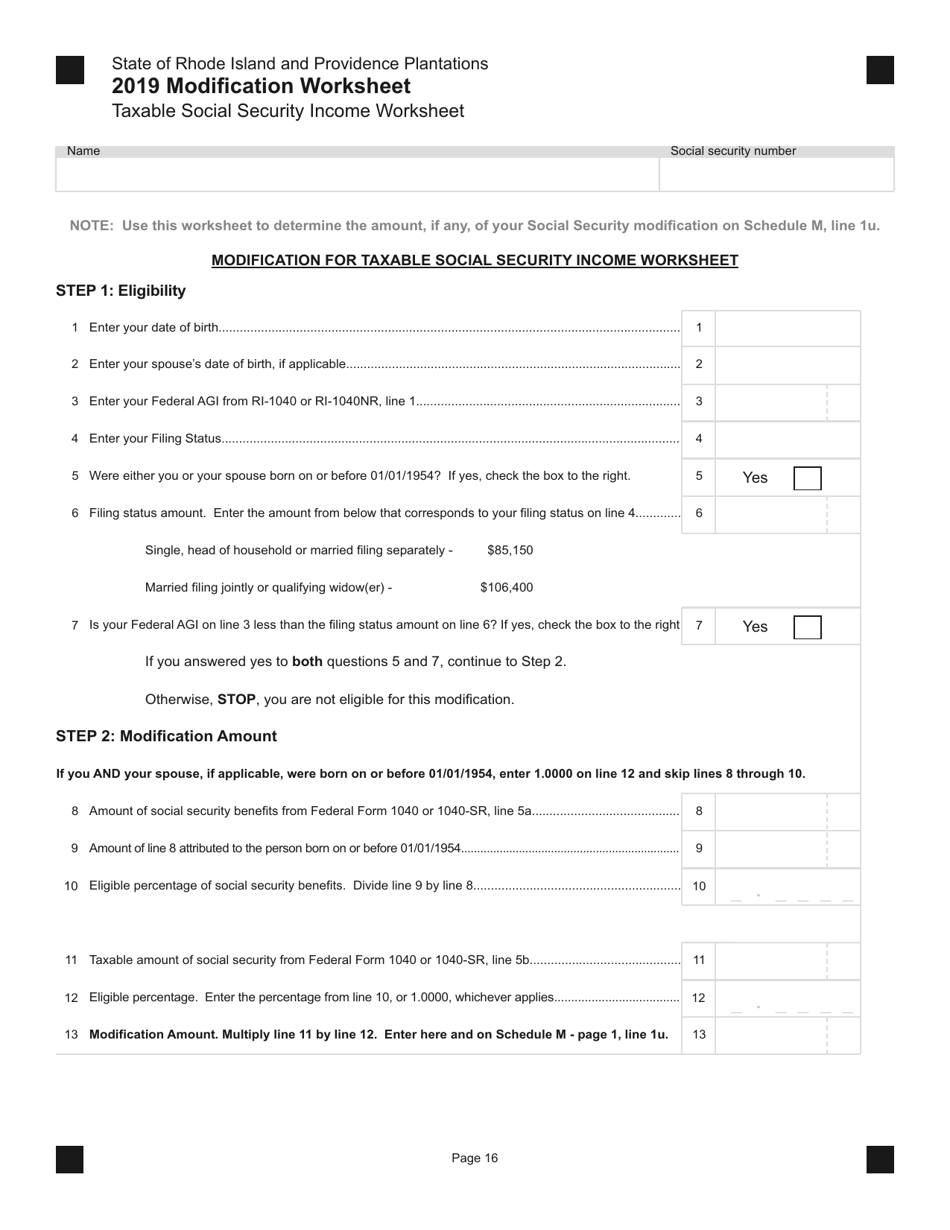

Taxable Social Security Worksheet 2019

https://data.templateroller.com/pdf_docs_html/2018/20180/2018025/taxable-social-security-income-worksheet-rhode-island_print_big.png

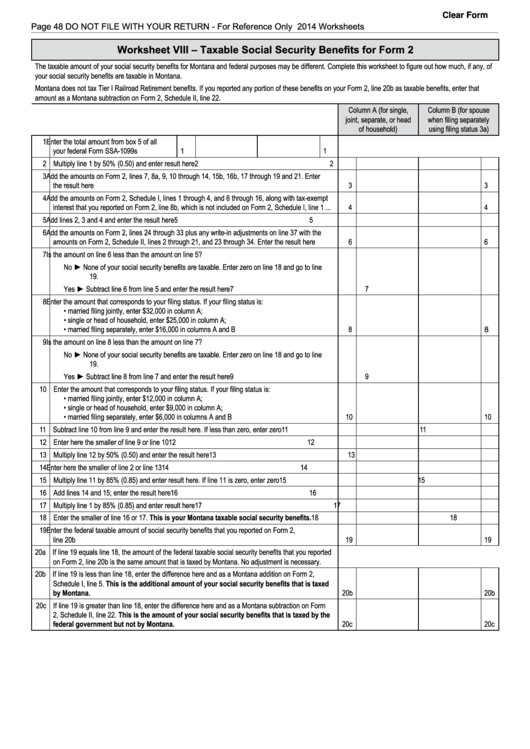

Taxable Social Security Benefits Worksheet

https://data.formsbank.com/pdf_docs_html/333/3331/333120/page_1_thumb_big.png

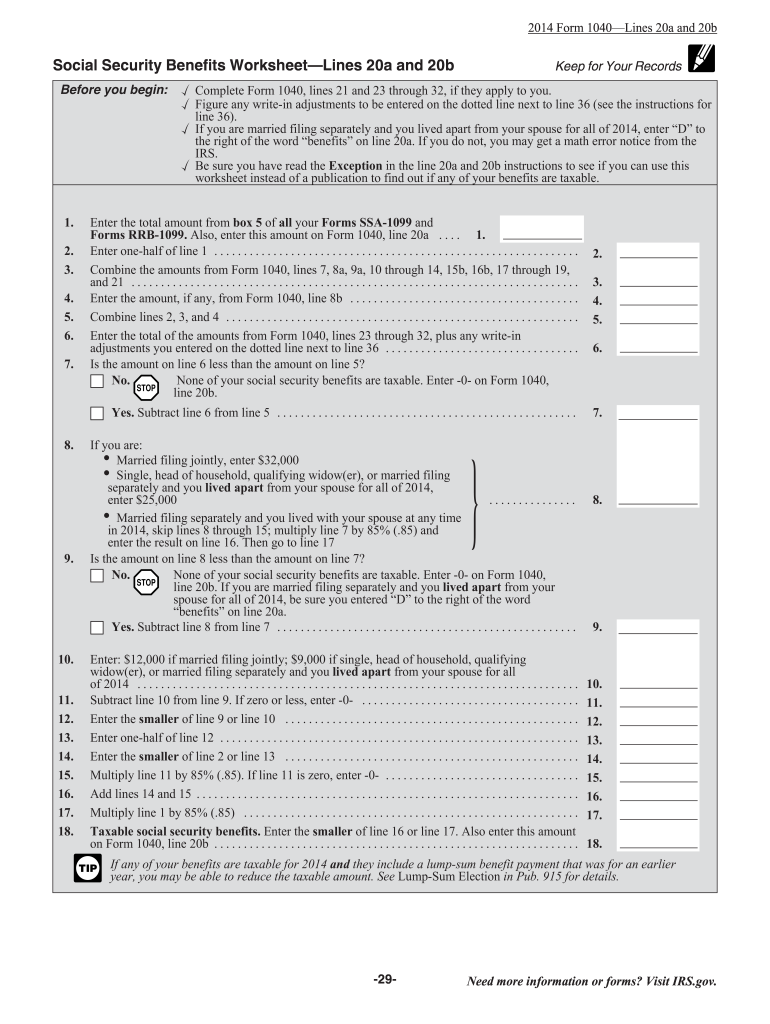

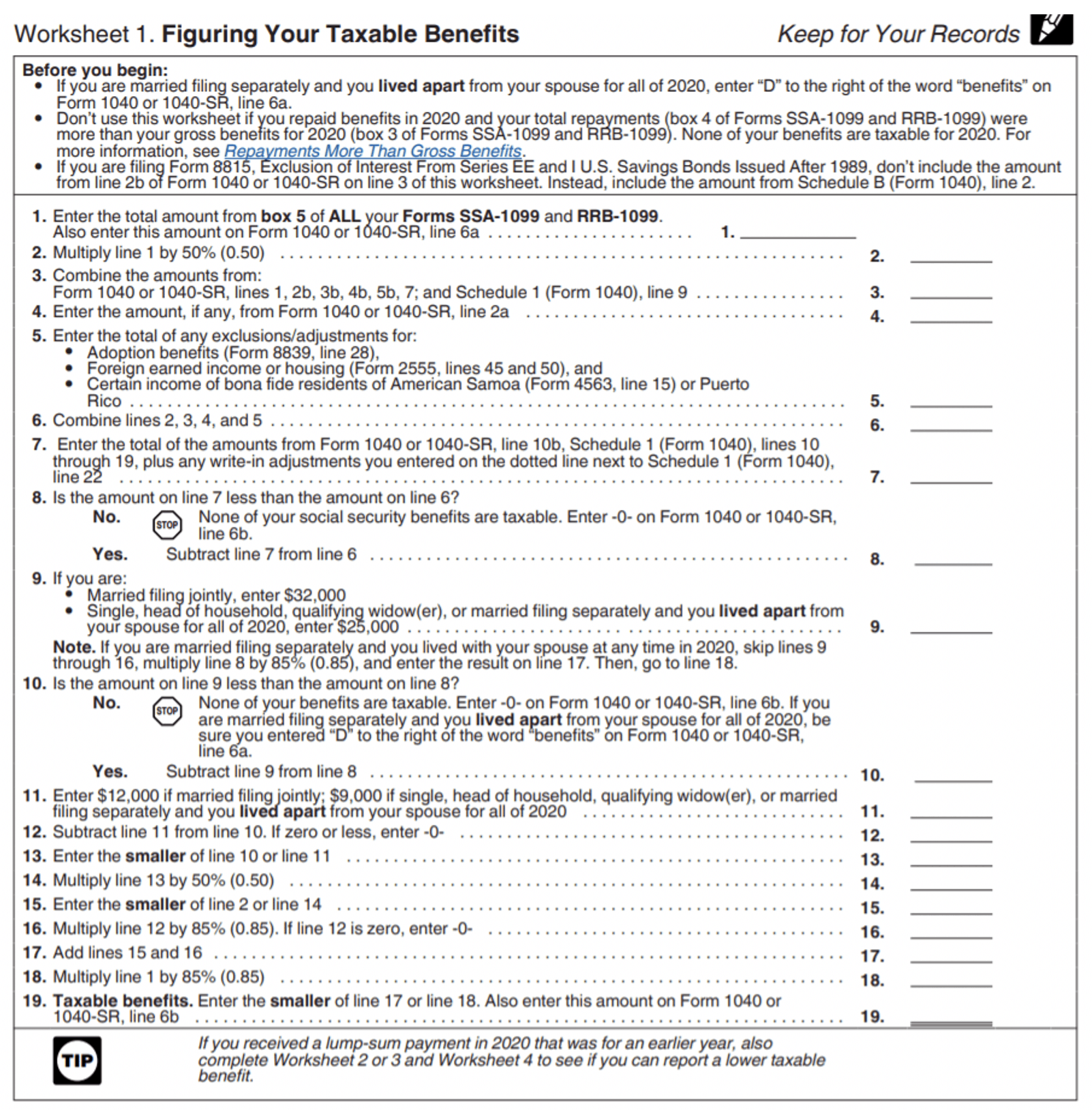

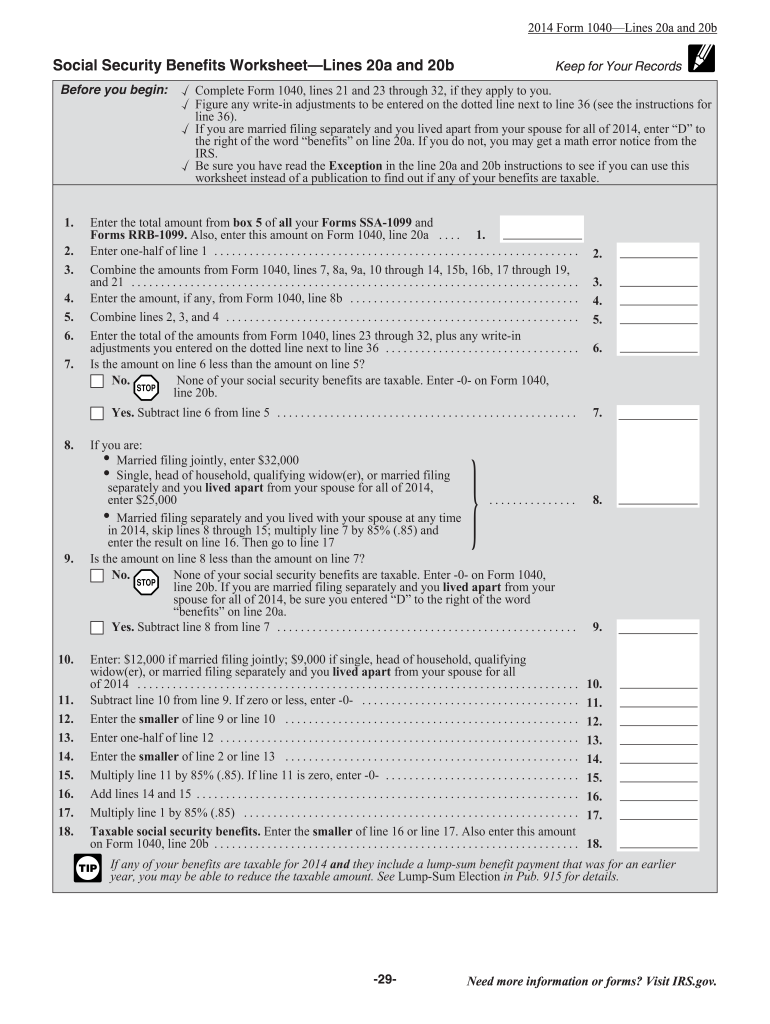

The government determines whether you owe taxes on your Social Security benefits by looking at your provisional income This is your adjusted gross income AGI plus any nontaxable interest Generally you can figure the taxable amount of the benefits in Are my Social Security or railroad retirement tier I benefits taxable on a worksheet in the Instructions for Form 1040 and Form 1040 SR or in Publication 915 Social Security and Equivalent Railroad Retirement Benefits

To calculate the taxable portion of your Social Security benefits you can use the IRS Form 1040 or Form 1040 SR depending on your age and filing status These forms include a worksheet for determining the taxable amount of your benefits Up to 50 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is between 25 000 and 34 000 You file a joint

More picture related to How To Calculate Taxable Social Security Benefits 2023

2022 Social Security Taxable Benefits Worksheet

https://www.signnow.com/preview/6/963/6963800/large.png

Taxable Social Security Worksheets

https://www.irs.gov/pub/xml_bc/24811v37.gif

Calculate Taxable Portion Of Social Security TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable Note that not everyone pays taxes on benefits but clients who have other income in retirement beyond Social Security will likely pay taxes on their benefit The 2 5 percent cost of living adjustment COLA will begin with benefits payable to nearly 68 million Social Security beneficiaries in January 2025 Increased payments to nearly 7 5 million SSI recipients will begin on December 31 2024 Note some people receive both Social Security and SSI benefits

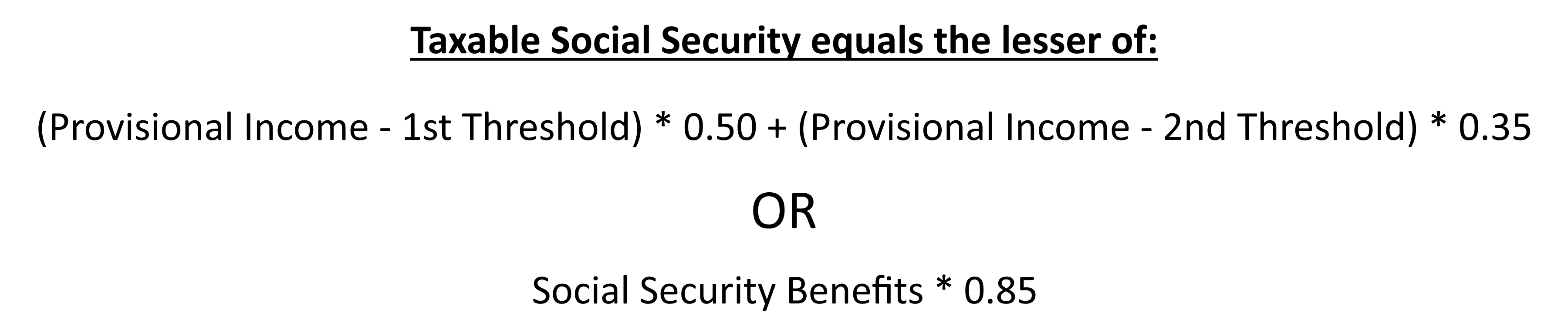

Did you know that up to 85 of your Social Security Benefits may be subject to income tax If this is the case you may want to consider repositioning some of your other income to minimize how much of your Social Security Benefit may be taxed and thereby maximize your retirement income sources There are two calculations to determine the taxable Social Security Compute them both and use the smaller of the two Method 1 85 of the SS benefit maximum taxation This one is easy social security benefit times 85 is the maximum amount of taxable benefits Method 2 Provisional Income

2024 Social Security Tax Limit Calculator Roch Violet

https://www.irstaxapp.com/wp-content/uploads/2020/03/social-security-benefits-calculator.png

Social Security Benefits Worksheet 2023

https://i.pinimg.com/originals/91/34/e2/9134e282b72a5606b41ad37573bc4069.png

https://www.irs.gov › pub › irs-pdf

Your benefits may be taxable see IRS Pub 915 and Social Security Benefits in your 2023 federal income tax return instructions If none of your benefits are taxable but you must otherwise file a tax return do the following Enter the total amount from line A above on Form 1040 or 1040 SR line 6a and enter 0 on Form 1040 or 1040 SR

https://www.irs.gov › newsroom › irs-reminds-taxpayers...

To determine if their benefits are taxable taxpayers should take half of the Social Security money they collected during the year and add it to their other income Other income includes pensions wages interest dividends and capital gains

Income Tax Worksheet 2023

2024 Social Security Tax Limit Calculator Roch Violet

1040 Social Security Worksheet 2021

Taxable Social Security Worksheet 2024

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

Taxes On Social Security Social Security Intelligence

Taxes On Social Security Social Security Intelligence

Calculate Taxable Social Security Worksheets

Social Security Taxable Income Worksheet 2021

Taxable Social Security Worksheet 2023 Pdf

How To Calculate Taxable Social Security Benefits 2023 - The government determines whether you owe taxes on your Social Security benefits by looking at your provisional income This is your adjusted gross income AGI plus any nontaxable interest