Income Requirement For Spouse Visa Uk 2024 File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was How to determine your income When applying for the Guaranteed Income Supplement and the Allowance you or in the case of a couple you and your spouse or common law partner must

Income Requirement For Spouse Visa Uk 2024

Income Requirement For Spouse Visa Uk 2024

https://i.ytimg.com/vi/SaKmMoS1w1c/maxresdefault.jpg

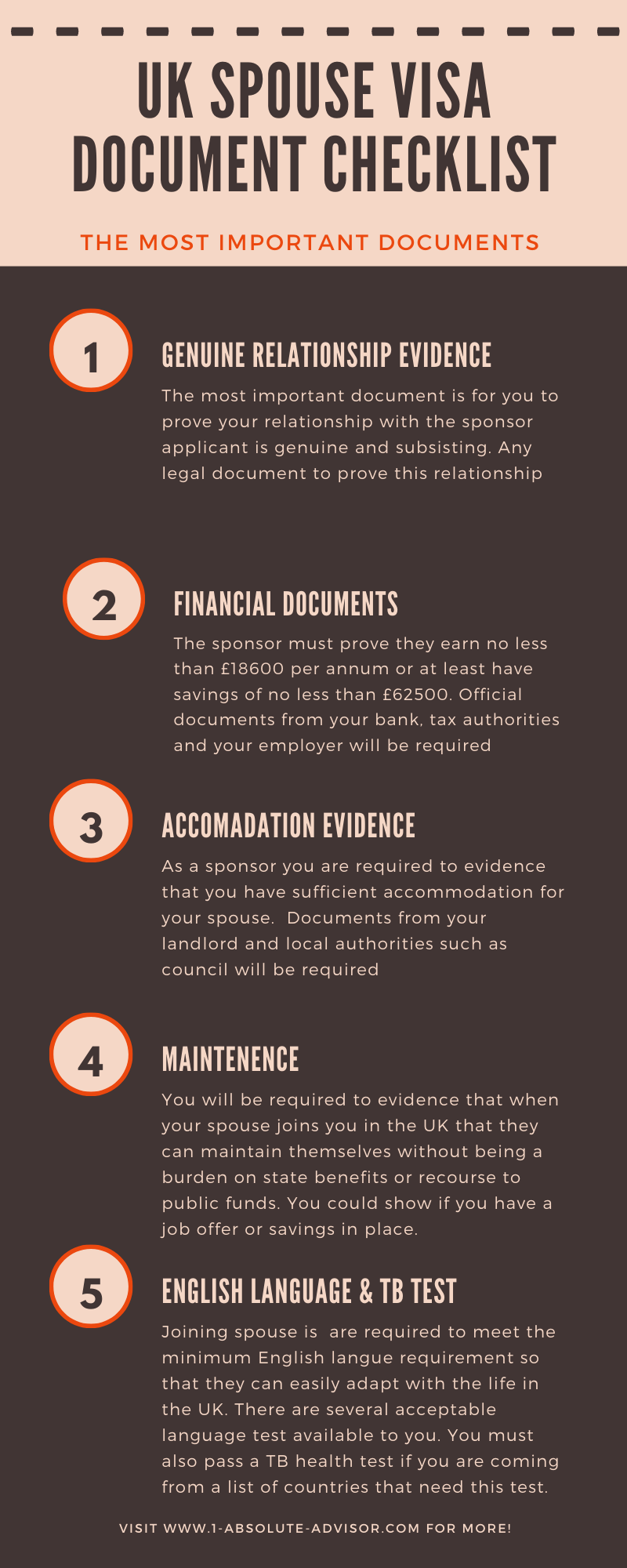

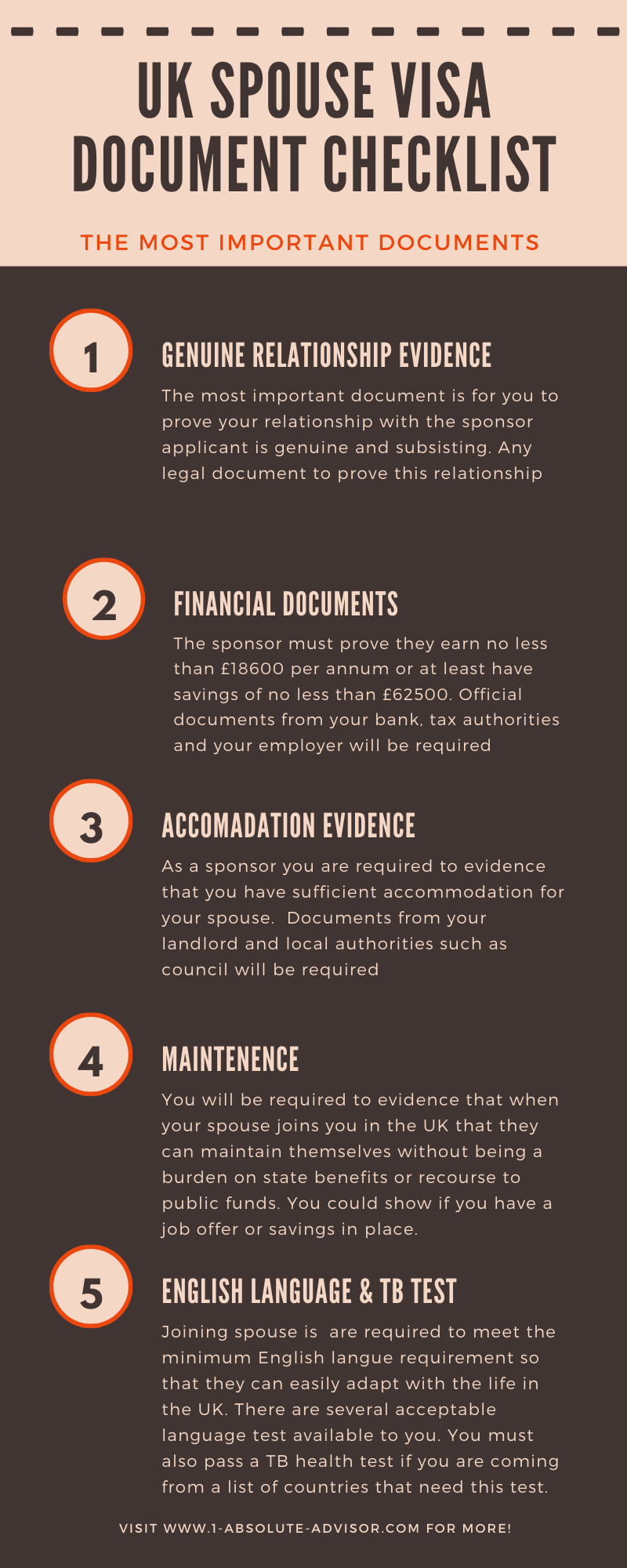

UK SPOUSE VISA DOCUMENT CHECKLIST

https://1-absolute-advisor.com/blog/wp-content/uploads/2020/10/uk-Spouse-Visa-Requirements-2020.png

How Get UK Spouse Visa Employment Letter KQ Solicitors

http://kqsolicitors.com/wp-content/uploads/2023/11/Pi7_Image_kq334.jpg

Enter net income or loss after income tax and extraordinary items at amount A page 1 of Schedule 1 Add the taxable items and the non allowable expenses listed on lines 101 to 199 The income level cut offs do not include the OAS pension the first 5 000 of employment or self employment income and 50 of employment or self employment income

If you are reporting only Canadian source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from Do not report tax exempt employment income you paid to your employee who is registered or entitled to be registered under the Indian Act using box 14 use code 71 or for a

More picture related to Income Requirement For Spouse Visa Uk 2024

Spouse Visa Income Requirement To Increase In Spring 2024

https://visaandimmigrations.com/wp-content/uploads/2023/12/Minimum-income-requirement-for-spouse-visa-will-initially-rise-to-29000-in-Spring-2024.webp

UK Partner Visa Employment Income Requirement

https://www.whytecroftford.com/wp-content/uploads/2022/12/UK-Spouse-Visa-Financial-Requirement-scaled.jpg

Spouse Visa UK Non Employment Income Requirement

https://www.whytecroftford.com/wp-content/uploads/2022/12/UK-Spouse-Non-Employment-Income--scaled.jpg

If your net world income exceeds the threshold amount 86 912 for 2023 you have to repay part or your entire OAS pension Part or your entire OAS pension is reduced as a monthly recovery 2 49 In broad terms the enhanced dividend gross up and dividend tax credit apply to dividends distributed to an individual from corporate income taxed at the general corporate income tax

[desc-10] [desc-11]

Property Inspection Report Norwich Norfolk Spouse Visa UK 2023

https://i.ytimg.com/vi/khQJreypRng/maxresdefault.jpg

UK Visa Photo Requirements 2024 Size Specifications More Reviewed

https://blog.wego.com/wp-content/uploads/uk-photo-requirement-featured.webp

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

https://www.canada.ca › en › revenue-agency › services › forms...

The personal income levels used to calculate your Ontario tax have changed The amount of most provincial non refundable tax credits have changed The alternative minimum tax rate was

How Do I Meet The Financial Requirement For A Spouse Visa Gherson LLP

Property Inspection Report Norwich Norfolk Spouse Visa UK 2023

Eligibility Criteria For UK Spouse Visa 2023 To Join Your Partner

Financial Requirements For State Benefit Seeker UK Spouse Visa UK

How To Apply For A Spouse Visa From Overseas

How To Meet The UK Spouse Visa Or Partner Visa Financial Requirement

How To Meet The UK Spouse Visa Or Partner Visa Financial Requirement

UK New Rules For Spouse VISA UK Dependent Visa Update 2023 Jobs For

How To Apply For Spouse Visa Distancetraffic19

How To Meet The UK Spouse Partner Fiance Visa Financial Requirement

Income Requirement For Spouse Visa Uk 2024 - Do not report tax exempt employment income you paid to your employee who is registered or entitled to be registered under the Indian Act using box 14 use code 71 or for a