Is Disability Insurance Tax Deductible For personal disability insurance policies premiums are generally not tax deductible as the IRS classifies them as personal expenses similar to life insurance However the tax treatment changes for business related disability insurance

So is disability insurance tax deductible For most individuals the answer is no If you purchase a disability insurance policy to protect your personal income the premiums you pay are considered a personal expense and are not tax deductible Potential buyers and policy owners alike often ask if disability insurance it s tax deductible In most cases the answer is no However there is good news If you need to collect benefits from a personal disability insurance policy you can expect to receive them tax free in most scenarios

Is Disability Insurance Tax Deductible

Is Disability Insurance Tax Deductible

https://flyfin.tax/_next/image?url=https:%2F%2Fblog.flyfin.org%2Fcontent%2Fimages%2F2023%2F03%2FDisability-Insurance-Premiums-Deduction.jpg&w=640&q=40

Is Disability Insurance Tax deductible In 2023

https://flyfin.tax/_next/image?url=https:%2F%2Fblog.flyfin.org%2Fcontent%2Fimages%2F2023%2F03%2FDisability-Insurance-Premiums-Deduction.jpg&w=828&q=40

Is Disability Insurance Tax deductible In 2023

https://flyfin.tax/_next/image?url=https:%2F%2Fblog.flyfin.org%2Fcontent%2Fimages%2F2023%2F03%2FDisability-Insurance-Premiums-Deduction.jpg&w=1200&q=40

Disability insurance offers a tax break but only under specific conditions Contributions to a Health Savings Account HSA are tax deductible up to a certain limit Life insurance and No unlike regular health insurance disability insurance premiums aren t tax deductible But if you own a small business and pay for disability insurance for your employees you may be able to deduct that as a business expense

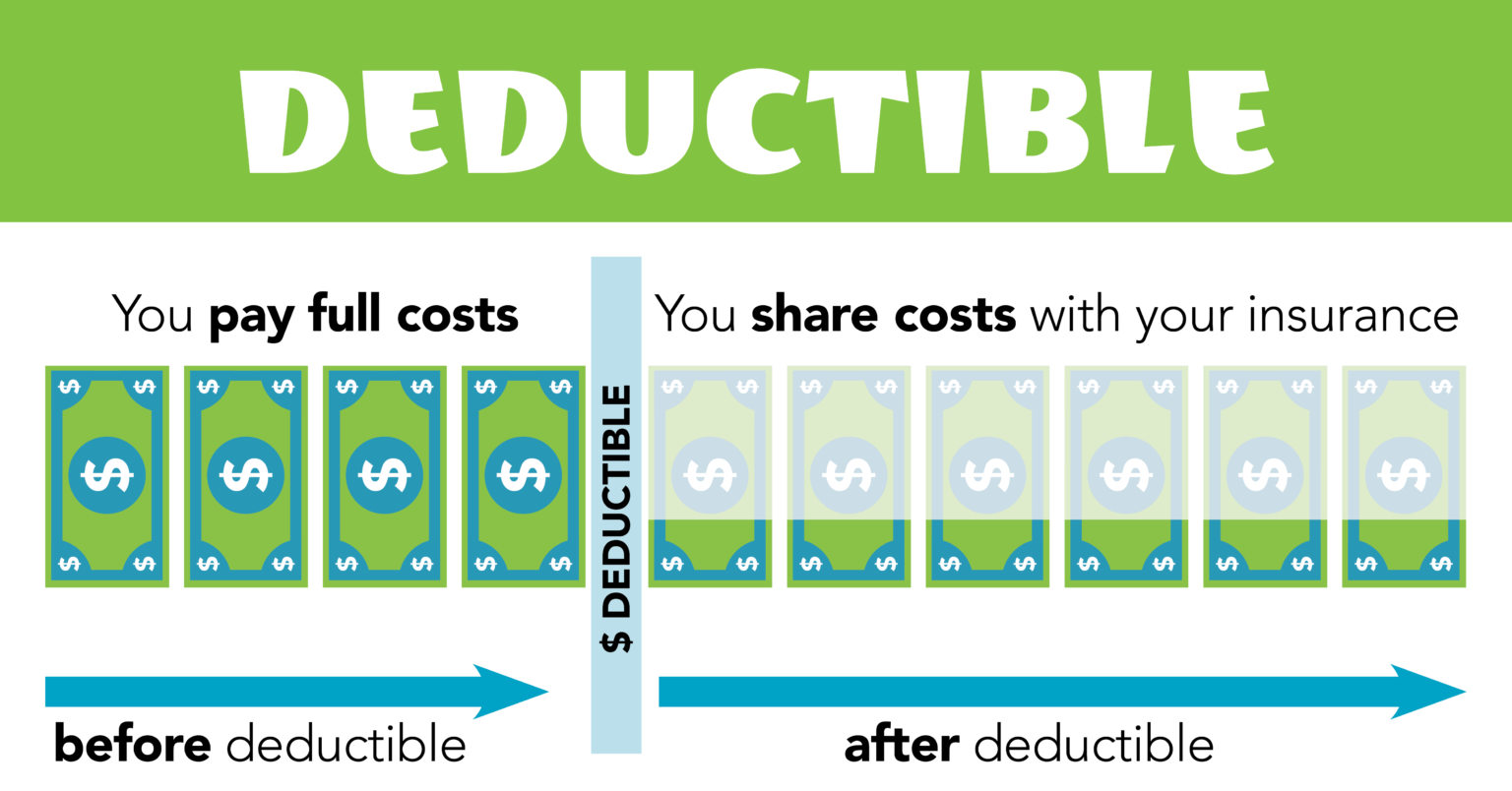

Is disability insurance tax deductible No you can t deduct money you spend on private disability insurance premiums except in certain business cases You also can t deduct the value of SSDI SSI or state disability benefits No disability insurance premiums aren t tax deductible Unlike medical expenses the IRS considers disability insurance a form of income So any money you use to pay disability premiums is taxed as ordinary income

More picture related to Is Disability Insurance Tax Deductible

Deductible Maryland Health Connection

https://www.marylandhealthconnection.gov/wp-content/uploads/2016/06/MHC_Deductible_Chart.png

Demystifying Disability Insurance UF At Work

https://news.hr.ufl.edu/wp-content/uploads/sites/11/2022/10/UFHR_BenefitsStories_Disability_Infographic.jpg

![]()

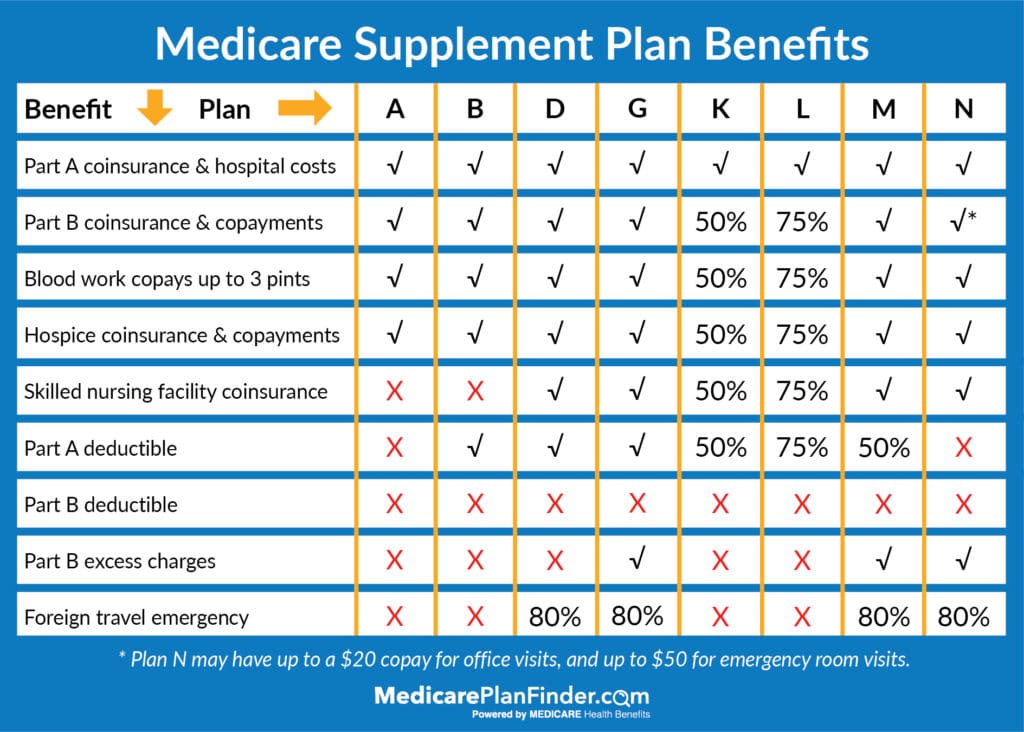

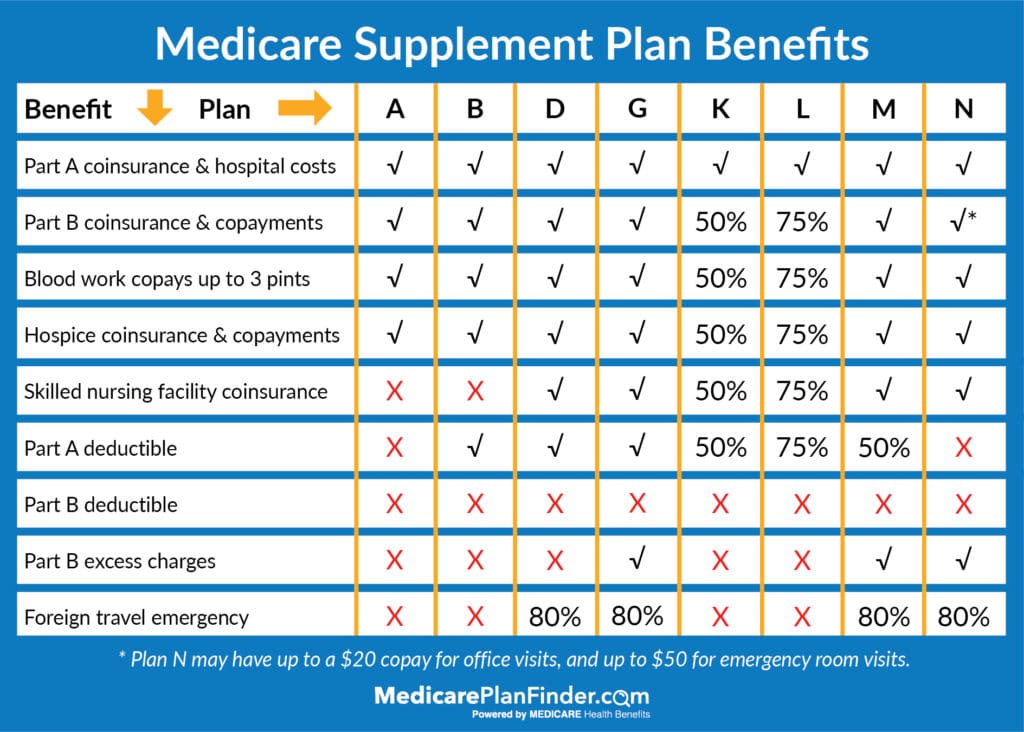

Part A Medicare Deductible 2025 Noushin Paige

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_1680,h_1202/https://www.medicareplanfinder.com/wp-content/uploads/2019/10/2020-Medicare-Supplement-Plan-Benefits-Medicare-Plan-Finder-01-1.jpg

Unlike other health insurance which disability insurance is technically classified as you typically cannot deduct the premiums on your tax return However because the premiums are paid with after tax dollars the benefits would be received tax free during a claim Who pays for disability insurance premiums employer employee or a combination and how premiums are paid pre tax or after tax dollars determine if disability insurance contributions are tax deductible and if benefit payments are taxable or tax free

[desc-10] [desc-11]

Is Health Insurance Tax Deductible Get The Answers Here

https://help.taxreliefcenter.org/wp-content/uploads/2018/10/TRC-PIN-Is-Health-Insurance-Tax-Deductible_.png

Is Health Insurance Tax Deductible Get The Answers Here

https://help.taxreliefcenter.org/wp-content/uploads/2018/10/health-insurance-application-forms-banknote-stethoscope-is-health-insurance-tax-deductible-ss-Feature.jpg

https://accountinginsights.org › is-disability...

For personal disability insurance policies premiums are generally not tax deductible as the IRS classifies them as personal expenses similar to life insurance However the tax treatment changes for business related disability insurance

https://paradigmlife.net › is-disability-insurance-tax-deductible

So is disability insurance tax deductible For most individuals the answer is no If you purchase a disability insurance policy to protect your personal income the premiums you pay are considered a personal expense and are not tax deductible

Disability Insurance Definition Types Long Short Term Example

Is Health Insurance Tax Deductible Get The Answers Here

Medicare Schedule Fee 2025 Natalie Rose

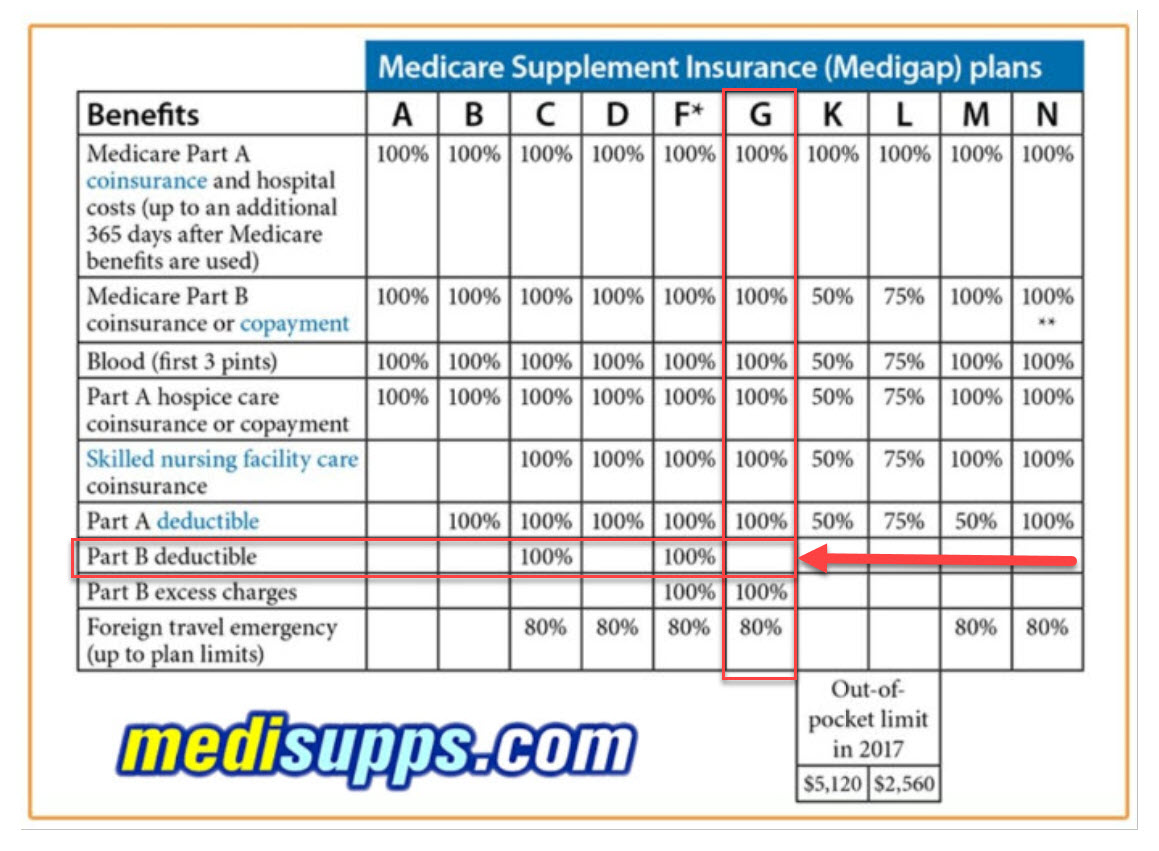

Medigap Plan G Cost 2024 Alene Aurelie

Pet Care Tax Deduction 2025 Schedule Janey Beatriz

2025 Medicare Deductible Rates By State Ghasem Dakota

2025 Medicare Deductible Rates By State Ghasem Dakota

Disability Insurance Benefits What Is Deductible Key Murray Law

Are Health Insurance Premiums Tax Deductible

Is Medicare Deductible Calendar Year Jemmie Dorolice

Is Disability Insurance Tax Deductible - No unlike regular health insurance disability insurance premiums aren t tax deductible But if you own a small business and pay for disability insurance for your employees you may be able to deduct that as a business expense