Is Military Disability Pension Payments Considered Earned Income Your military retirement pay is excluded from income tax up to the amount of the V A disability benefits you would have obtained In addition you can claim a refund on taxes

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes However military disability retirement pay and Veterans benefits VA disability benefits also aren t considered earned income to qualify for the federal Earned Income Tax Credit EIC However a veteran who receives disability benefits and also has earned income may qualify for EIC Some

Is Military Disability Pension Payments Considered Earned Income

Is Military Disability Pension Payments Considered Earned Income

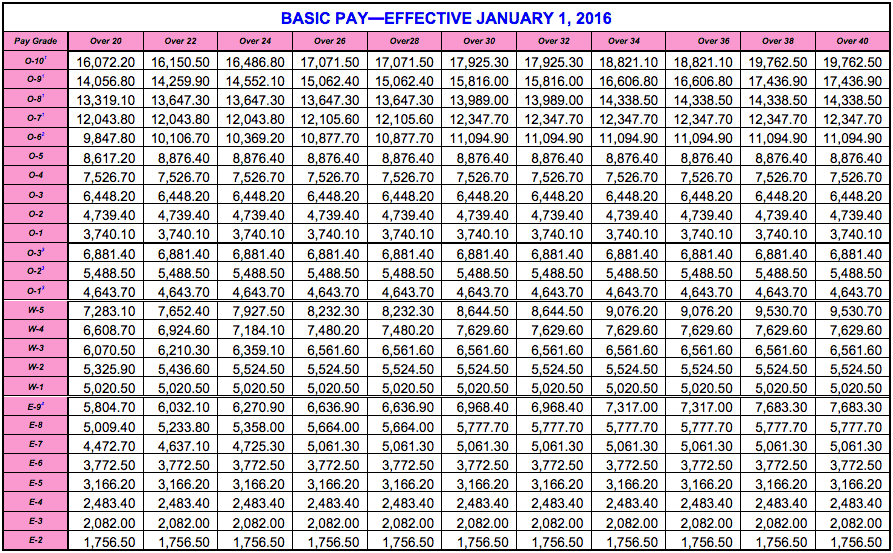

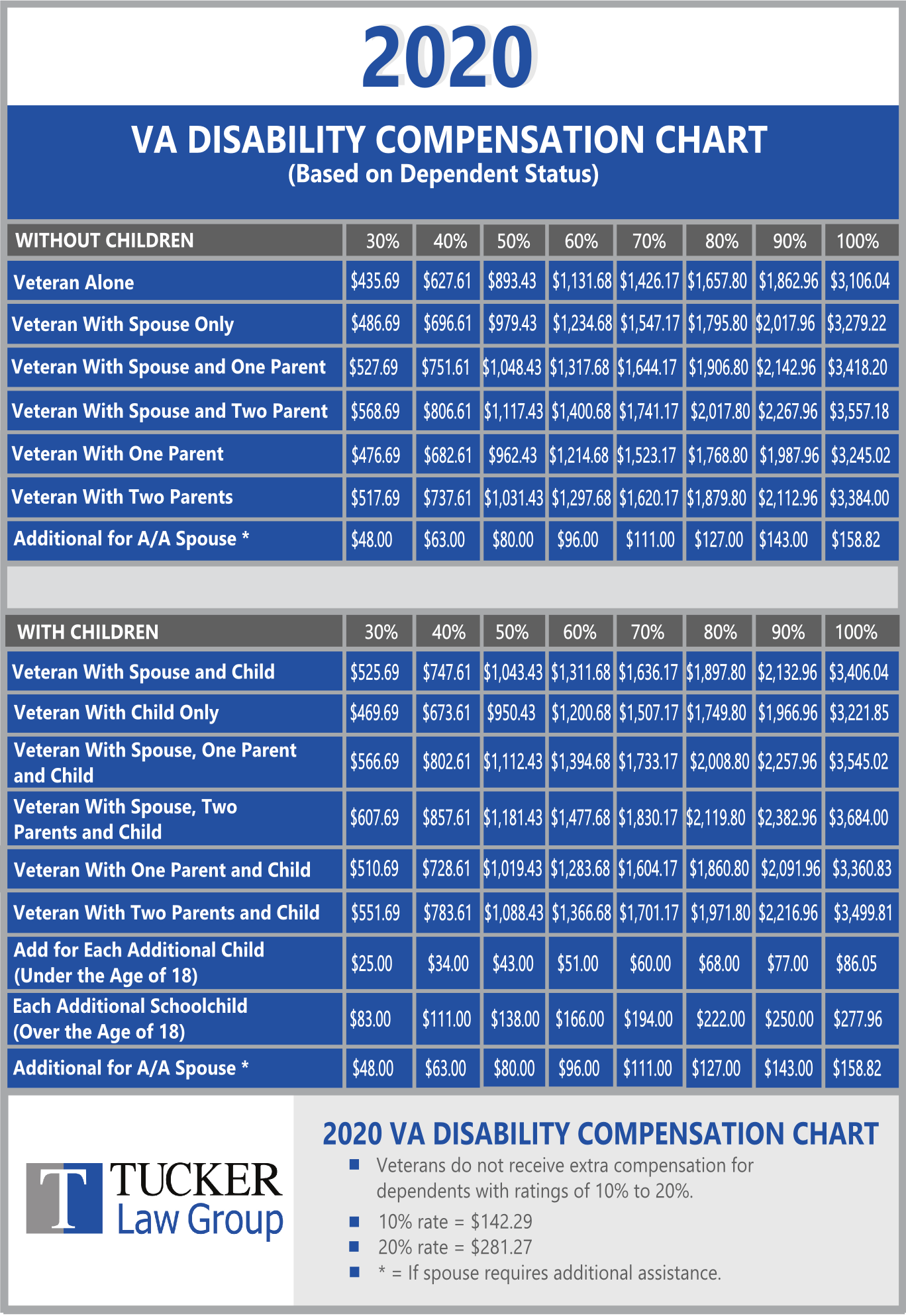

https://tuckerdisability.com/wp-content/uploads/2020/10/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1-1.png

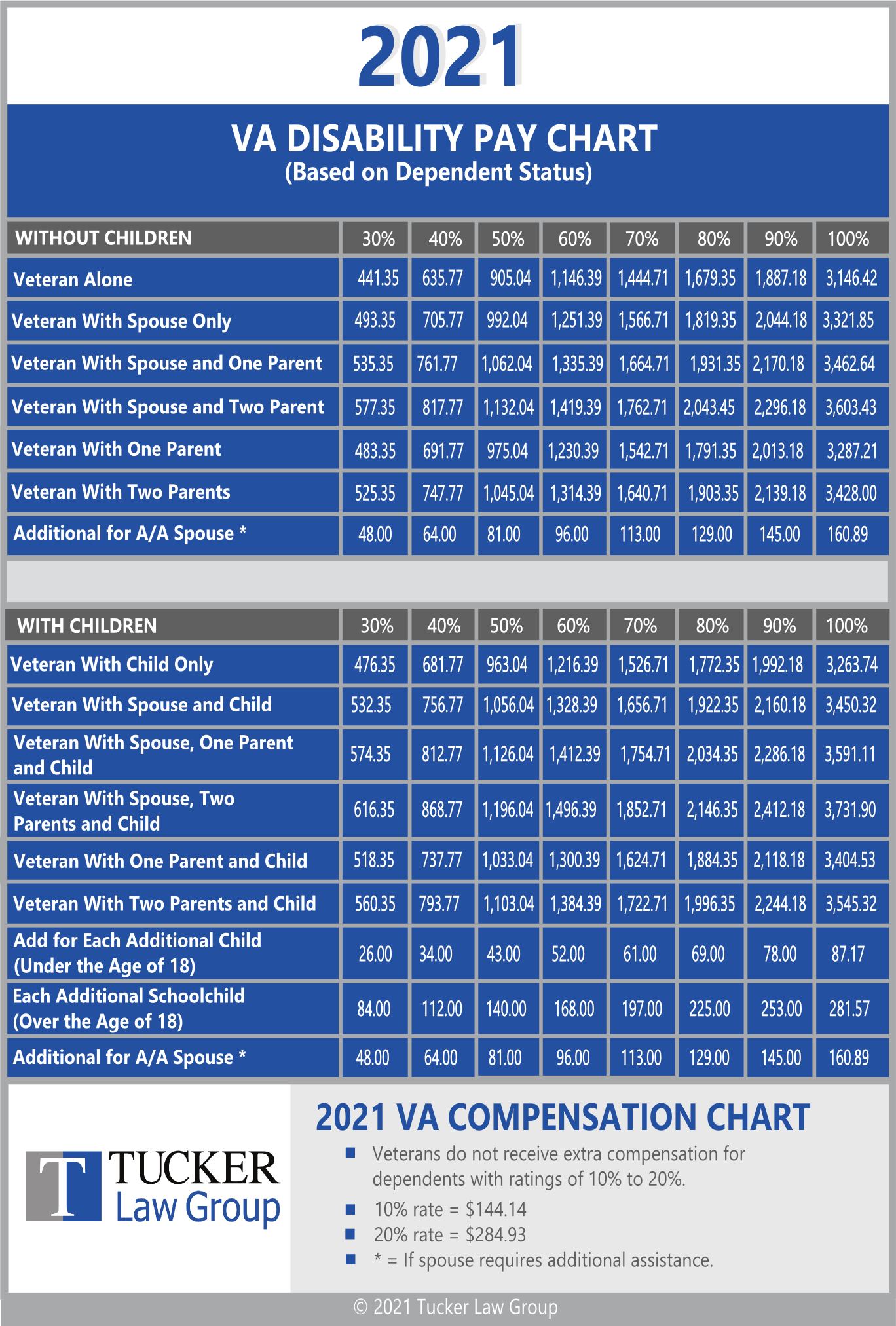

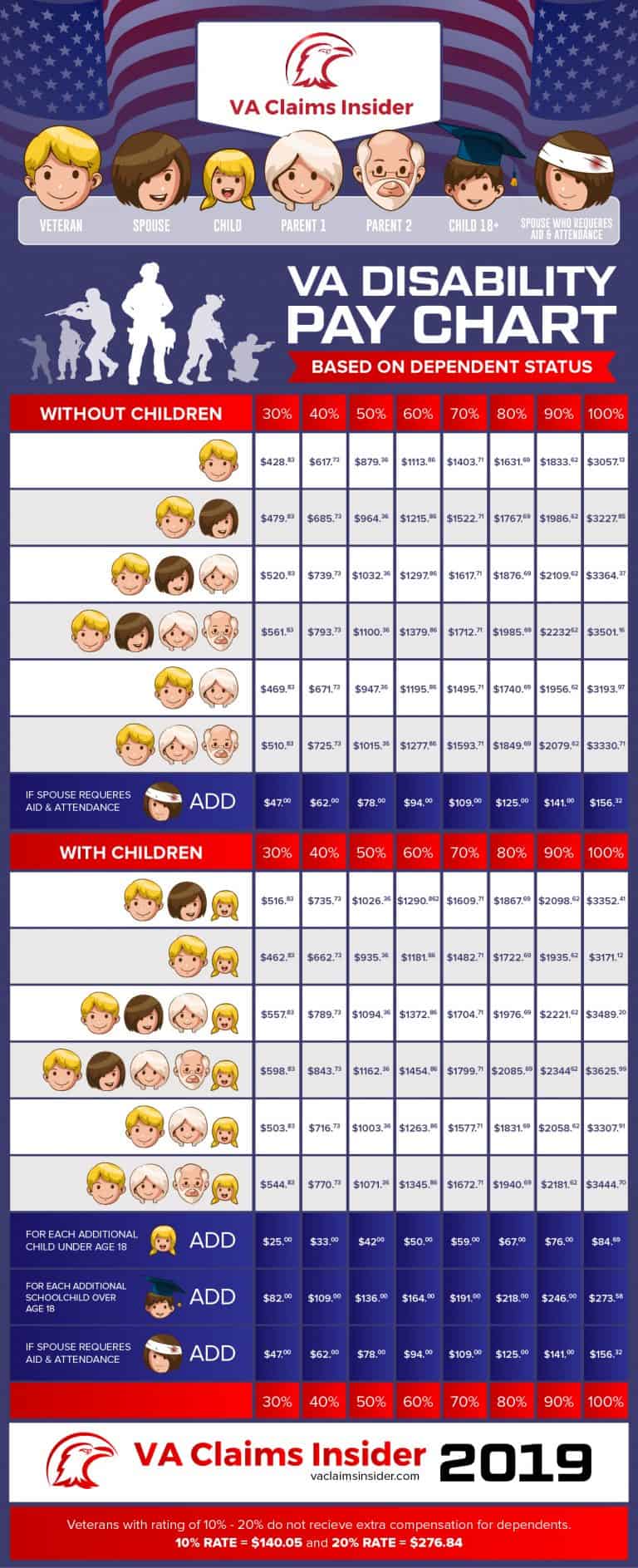

VA Disability Retirement Pay Calculator VA Disability Rates 2021

https://va-disability-rates.com/wp-content/uploads/2021/08/va-disability-pension-pay-chart-fumut.jpg

Monthly Va Benefit Rates 2023 Increase

https://va-disability-rates.com/wp-content/uploads/2021/08/2019-va-disability-pay-chart-based-on-dependent-status-1-scaled.jpg

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes and most state income taxes However military disability retirement According to the Internal Revenue Service IRS VA disability is not considered income Therefore veterans should not include disability benefits paid by VA in their gross income when filing taxes

No military retirement pay is not subject to Social Security FICA or Medicare taxes because it is not considered earned income However if your total income including military retirement pay exceeds certain thresholds Military retirement pay based on age or length of service is considered taxable income for Federal income taxes However military disability retirement pay and Veterans benefits

More picture related to Is Military Disability Pension Payments Considered Earned Income

Army Federal Taxes On Veterans Disability Or Military Retirement

https://myarmybenefits.us.army.mil/images/Federal and Misc/Federal Taxes on Veterans Disability.jpg

Military Pay Chart 2021 With Dependents Military Pay Chart 2021

https://tuckerdisability.com/wp-content/uploads/2021/02/JVT-REVIEWED-NO-EDITS-Tucker-Law-Group-Inforgraphic-for-VA-Disability-Pay-Chart-2021.png

Cost Of Living Payment For Pensioners 2022

https://cck-law.com/wp-content/uploads/2022/08/Projected-2023-VA-Disability-Pay-Rates-1-1-1024x683.jpg

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes However military disability retirement pay and Veterans benefits including Your military retirement pay is not considered earned income from a tax standpoint I didn t say you didn t earn it you earned every penny This means your military

One crucial fact to grasp is that VA disability benefits aren t considered earned income It is reliable monthly income that can improve a veteran applicant s financial standing Military disability retirement pay if used to mitigate personal injury from active duty is non taxable if it follows any of the below criteria Your qualified for disability payments

Is Short Term Disability Taxable Taxation Portal

https://lh5.googleusercontent.com/K55xicJOgjnT4f_84U0SJ3OcMIlDVQ4nmH_FSM4pJ5eg32sZJl_MXWbkwBfJPn7EKN9hfFf2oEGAf3YWJVMVMr1Swzo0sPgOERi4w_D9iltuwfUsfojFgOwP-Er7HndU8KqDRZvY

Social Security Announces December 2022 Disability Pension Payments

https://www.tododisca.com/en/wp-content/uploads/2022/12/Disability-Social-Security-Payments-are-on-the-way-and-you-could-get-it-in-one-of-these-dates.jpg

https://www.militaryverification.com › is-military-retirement-taxable

Your military retirement pay is excluded from income tax up to the amount of the V A disability benefits you would have obtained In addition you can claim a refund on taxes

https://myarmybenefits.us.army.mil › Ben…

Military retirement pay based on age or length of service is considered taxable income for Federal income taxes However military disability retirement pay and Veterans benefits

What Is The Treatment Of Disability Pension Income Retire Gen Z

Is Short Term Disability Taxable Taxation Portal

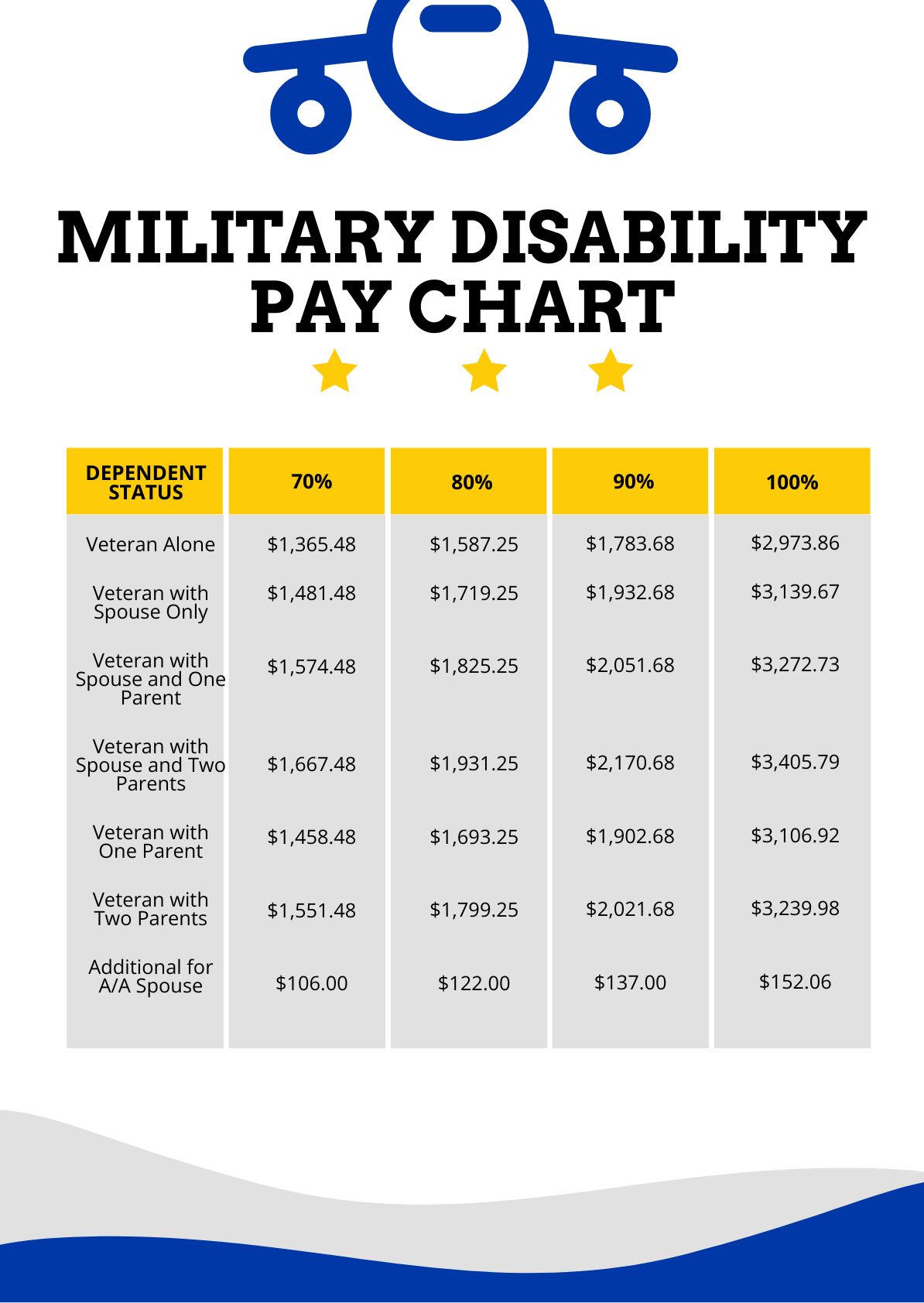

Military Disability Pay Chart In PDF Download Template

Solved Required Information The Following Information Chegg

2024 VA Disability Pay Chart And Compensation Rates YouTube

VA Compensation Tables VA Disability Rates 2021

VA Compensation Tables VA Disability Rates 2021

Solved Question 15 Of 100 Which Of The Following Is NOT Chegg

Smart Short Term Disability 2021 2024 Form Fill Out And Sign

2024 Va Disability Pay Chart With Spouse Benefits Wynn Amelina

Is Military Disability Pension Payments Considered Earned Income - VA disability benefits are not considered taxable income by federal or state governments Veterans need to prove eligibility for VA disability benefits which compensate for service