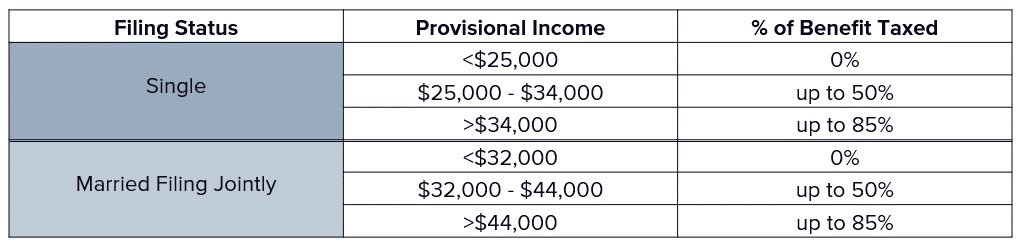

Is Social Security Automatically Taxed If your Social Security income is taxable depends on your income from other sources Here are the 2025 IRS limits

Social Security benefits are not taxed as ordinary income Ordinary income encompasses wages salaries and other income streams that fall into typical tax brackets Depending on your income up to 85 of your Social Security benefits can be subject to tax That includes retirement and benefits from Social Security trust funds like survivor and disability

Is Social Security Automatically Taxed

Is Social Security Automatically Taxed

https://www.wealthenhancement.com/cms/delivery/media/MCFMWPXDOK6JBF7BTOD5IE2GD5JY

Will I Have To Pay Taxes On My Social Security Income

https://media.zenfs.com/en/smartasset_475/23673842494ef0e9d25ad87fac73fa93

Social Security 2023 How Are Social Security Benefits Taxed When You

https://i.ytimg.com/vi/0FFLvqQiDOI/maxresdefault.jpg

Are Social Security benefits taxable Yes The rules of the Internal Revenue Service dictate that many who receive Social Security benefits will have to pay an income tax on that money Social Security benefits are 100 tax free when your income is low As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your

In summary Social Security benefits are taxed based on your combined income regardless of whether Medicare deductions are taken from your benefit payments While While you may have paid into Social Security throughout your working life a significant aspect of retirement planning involves understanding how these benefits are

More picture related to Is Social Security Automatically Taxed

How To Calculate Find Social Security Tax Withholding Social

https://i.ytimg.com/vi/q342U65tAgA/maxresdefault.jpg

How Is Social Security Income Taxed

https://taxprocpa.com/images/social-security-income-tax.jpg

Here s Exactly How Social Security Gets Taxed Root Financial

https://www.rootfinancialpartners.com/wp-content/uploads/2023/06/pexels-tima-miroshnichenko-5708719-scaled.jpg

Eliminating federal income tax on Social Security retirement benefits could benefit many retirees especially those who receive other types of taxable income such as from wages or Eliminating Social Security taxes would also require finding new funding sources for the program as these taxes contributed 50 7 billion to the Social Security trust fund in

The question Is Social Security taxed as ordinary income is a common one The answer though is not as simple as it appears In this guide we will explore the details of The answer is not that simple Social Security benefits are taxed for some people but not others Social Security taxation is complicated but not as complicated as Social

At What Age Is Social Security No Longer Taxed Hayah Magazine

https://hayahmagazine.com/wp-content/uploads/2023/04/Social-Security-Benefits.jpg

Are Social Security Benefits Taxed Part 2

https://media-exp1.licdn.com/dms/image/D4E12AQHcPKCO8rrvNQ/article-cover_image-shrink_720_1280/0/1669225527758?e=2147483647&v=beta&t=MQgh-Um5P7pi7aCCZkakxvIlvHv8TTSvkwdO0vBjTz0

https://smartasset.com › retirement › is-soc…

If your Social Security income is taxable depends on your income from other sources Here are the 2025 IRS limits

https://nationaltaxreports.com › how-social-security-benefits-are-taxed

Social Security benefits are not taxed as ordinary income Ordinary income encompasses wages salaries and other income streams that fall into typical tax brackets

At What Age Is Social Security Not Taxable YouTube

At What Age Is Social Security No Longer Taxed Hayah Magazine

How Is Social Security Taxed YouTube

IRS Announces Taxes Retirees Will Have To File In 2024

Taxes On Social Security Benefits YouTube

Is Social Security Taxable socialsecuritybenefits

Is Social Security Taxable socialsecuritybenefits

Social Security Savvy Overview How To The Henry Carter Hull Library

Are Social Security Disability Benefits Taxable Direct Express Card Help

What Is Social Security Tax YouTube

Is Social Security Automatically Taxed - While you may have paid into Social Security throughout your working life a significant aspect of retirement planning involves understanding how these benefits are