Is Social Security Disability Income Taxable In California The short answer is yes Social Security benefits are taxable in California However the rules surrounding Social Security taxation in California somewhat differ from those in other states Here s what you need to know

Social Security Disability income may be taxable by the IRS in California depending on your total income though some recipients may not owe taxes Some of your Social Security income may be taxable Visit About Publication 915 Social Security and Equivalent Railroad Retirement Benefits for more information Make an adjustment to

Is Social Security Disability Income Taxable In California

Is Social Security Disability Income Taxable In California

https://moneybliss.org/wp-content/uploads/2023/03/is-social-security-disability-taxable-1.jpg

Is Disability From Social Security Taxable Disability Talk

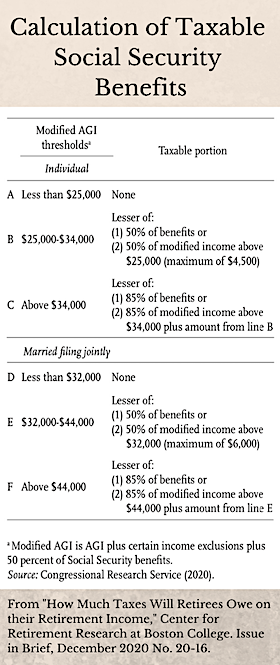

https://www.disabilitytalk.net/wp-content/uploads/is-social-security-taxable-income-2021-social-security.png

Are Social Security Disability Benefits Taxable Direct Express Card Help

https://directexpresshelp.com/wp-content/uploads/2023/04/Is-Social-Security-Disability-Income-Taxable.png

Like the retirement income benefits once you hit that taxability threshold up to 85 of your SSDI benefits may be taxed again depending on your filing status and how much total Social Security Disability Insurance SSDI may be federally taxed if total income exceeds a certain threshold while private disability insurance benefits are typically tax free unless employer paid

Q 2 Are Other Retirement Incomes Taxable in California Ans Yes While Social Security benefits are exempt other retirement incomes like pensions withdrawals from 401 k Social Security payments from the Social Security disability insurance SSDI program may be taxable in your state The majority of states however exempt disability

More picture related to Is Social Security Disability Income Taxable In California

When Will The August Social Security Disability Income Check Arrive For

https://www.tododisca.com/en/wp-content/uploads/2023/07/Social-Security-Disability-Income-benefits-are-about-to-arrive.jpg

Is Social Security Disability Income Taxable Marca

https://phantom-marca.unidadeditorial.es/a2de425e75de669e57e25c94941e7094/resize/1200/f/jpg/assets/multimedia/imagenes/2023/02/19/16768205202466.jpg

Social Security Benefit Worksheets 2021

http://socialsecurityintelligence.com/wp-content/uploads/2015/07/percent-of-Social-Security-income-that-is-taxable.png

In California SSDI benefits can be taxed but the circumstances under which you might pay taxes are specific and require a closer examination Consult with a trusted and knowledgeable Social Security attorney in No per the California State Economic Development Department if you leave work because of a disability and receive disability benefits those benefits are not reportable for tax

Social Security benefits including retirement survivor and disability benefits are not subject to California state income tax However these benefits may be taxed at the federal level based California does not tax social security income from the United States including survivor s benefits and disability benefits Social security income may be partially taxable under federal law

Social Security Disability Missoula Workers Compensation And Social

https://clarkforklaw.com/wp-content/uploads/2017/06/iStock-183295330.jpg

Current Va Disability Pay Chart 2024

https://tuckerdisability.com/wp-content/uploads/2020/10/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1-1.png

https://www.disabilityhelp.org › are-social …

The short answer is yes Social Security benefits are taxable in California However the rules surrounding Social Security taxation in California somewhat differ from those in other states Here s what you need to know

https://sackettlaw.com › blog › social-secur…

Social Security Disability income may be taxable by the IRS in California depending on your total income though some recipients may not owe taxes

Social Security Income Tax Limit 2024 Over 65 Vonny Gabriel

Social Security Disability Missoula Workers Compensation And Social

Social Security Taxability Worksheets

There Are Many Differences Between The Social Security Disability

How Much Of A Raise Is Ssi Getting In 2024 Jody Edeline

Social Security Benefit Tax Limit 2025 Brandon Gill

Social Security Benefit Tax Limit 2025 Brandon Gill

Are My Social Security Benefits Taxable Calculator

Va Disability Percentage Chart

What Is The Average Social Security Check Retirement News Daily

Is Social Security Disability Income Taxable In California - Like the retirement income benefits once you hit that taxability threshold up to 85 of your SSDI benefits may be taxed again depending on your filing status and how much total