Is Social Security Disability Taxable In Ohio Yes if your taxable Social Security benefits are for SSDI Social Security Disability Income you can add that amount to your taxable disability pension amount You can deduct

Social Security payments from the Social Security disability insurance SSDI program might be taxable in your state The vast majority of states however exempt disability A In accordance with division A of section 5747 01 of the Revised Code a taxpayer may generally deduct to the extent included in federal adjusted gross income the amount of 1

Is Social Security Disability Taxable In Ohio

Is Social Security Disability Taxable In Ohio

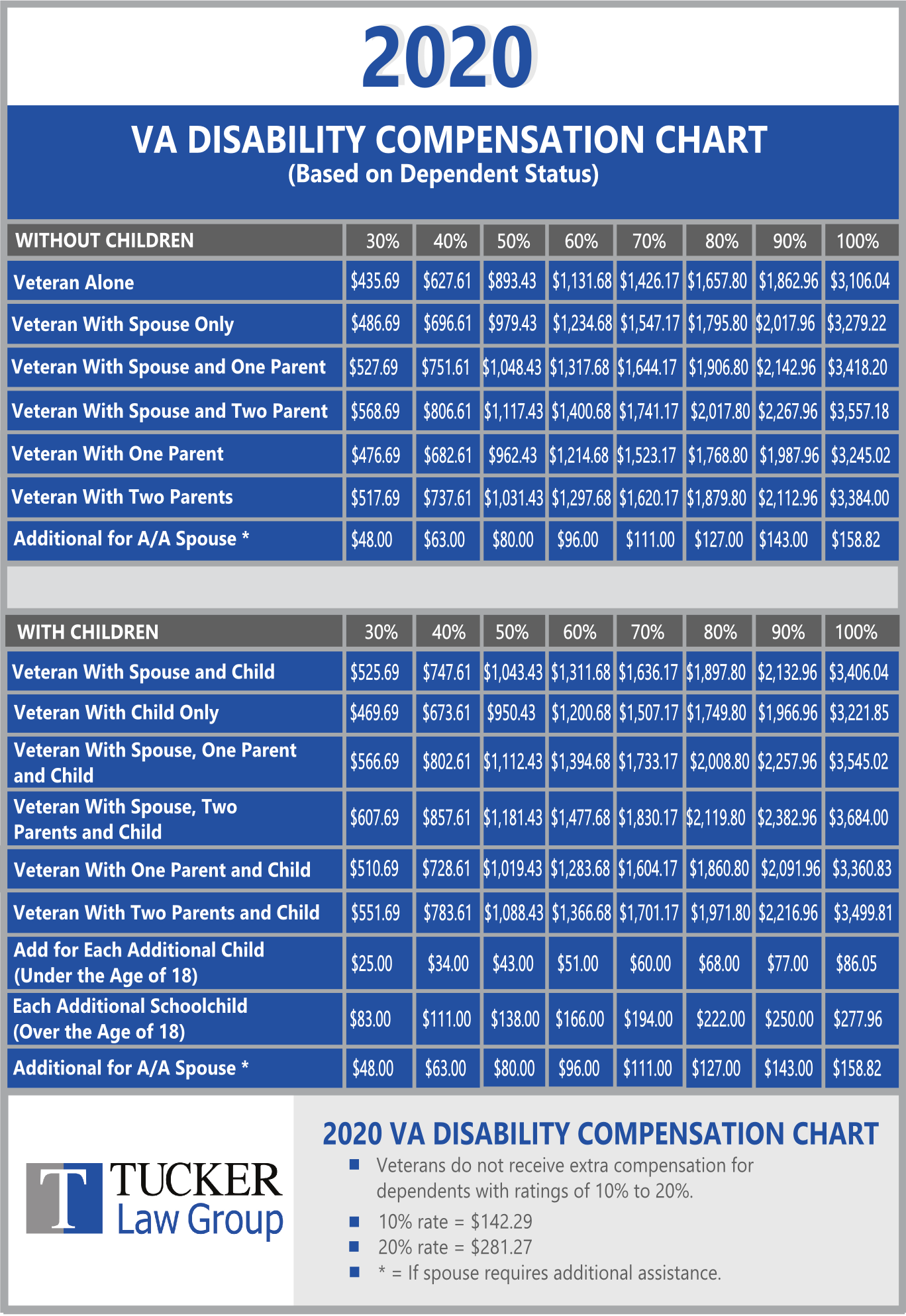

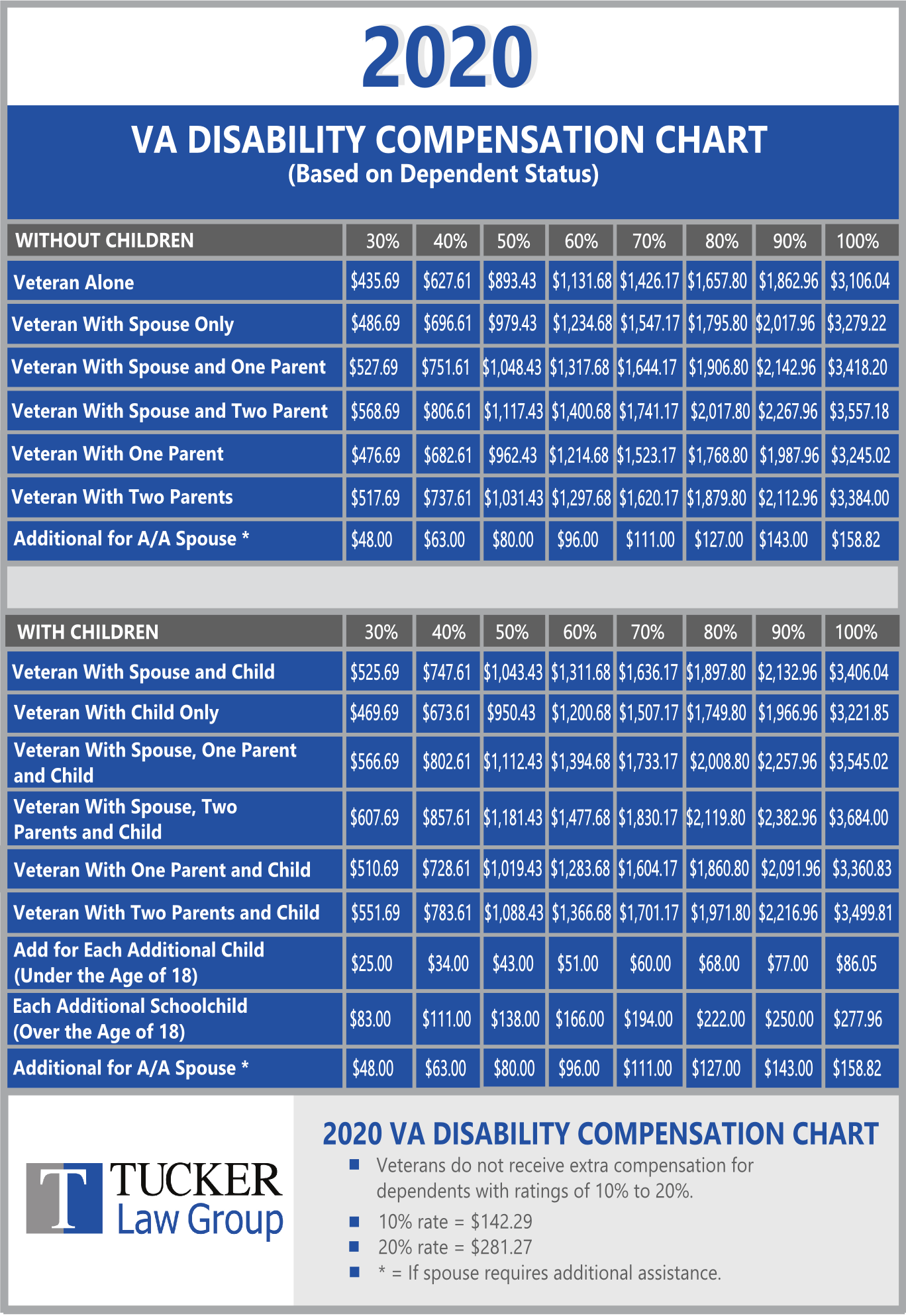

https://tuckerdisability.com/wp-content/uploads/2020/10/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1-1.png

Va Benefits Rating Chart 2024

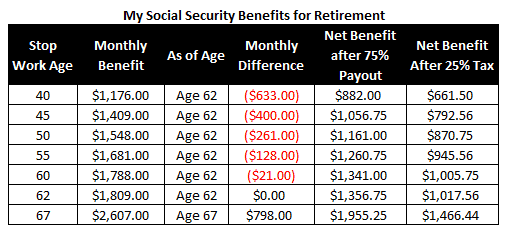

https://i.pinimg.com/originals/6a/b7/51/6ab751f3fda67136e4521bd069913c7b.jpg

Taxable Social Security Worksheet 2023

https://www.moneytree.com/wp-content/uploads/2020/10/taxableSocialSecurity-1.png

Retirees and disabled persons receiving Social Security benefits may wonder if there s income tax in Ohio on those earnings Social Security is not taxable in Ohio although it Social Security retirement benefits are fully exempt from state income taxes in Ohio Any income from retirement accounts like a 401 k or an IRA or pensions is taxed as regular

The good news for Ohio residents is that Ohio exempts Social Security benefits from your taxable income That means when it comes to your SSDI benefits you need only Does Ohio Tax Social Security Disability Benefits SSDI benefits are exempt from state taxes in Ohio which means you do not have to pay taxes on them However SSDI benefits are sometimes taxed on the federal level

More picture related to Is Social Security Disability Taxable In Ohio

Va Disability Payment Table 2024

https://tuckerdisability.com/wp-content/uploads/2020/02/Tucker-Law-Group-Inforgraphic-for-VA-Disability-Compensation-Benefits-Rate-in-2020-1.png

Social Security Benefits The Kid Picked Last For Dodgeball

http://www.mymoneydesign.com/wp-content/uploads/2012/09/Social-Security-Benefits-Example-01.png

Social Security Limit 2024 Taxable Minne Christabella

https://www.socialsecurityintelligence.com/wp-content/uploads/2016/11/2021-Income-Limit-1536x961.png

If your Social Security disability benefits are subject to federal taxation do not fret about the possibility of a huge tax bill You will be taxed at the marginal income tax rate Basically this Many disabled individuals are surprised to learn that their Social Security Disability SSD benefits may be taxable depending on their situation In fact while Ohio doesn t tax

Ohio allows for a subtraction of Disability and Survivor benefits as well as a subtraction for Uniformed Services Retirement Income You can deduct the Disability and Survivor Benefits to Q I have received long term disability benefits reported on a W2 This income is from a LTD policy which was paid for by my employer Am i able to deduct this on my Ohio

Social Security Benefit Tax Limit 2025 Brandon Gill

http://seniorsleague.org/assets/TSCL_SocialSecurity_Chart.jpg

[img_title-8]

[img-8]

https://ttlc.intuit.com › community › tax-credits...

Yes if your taxable Social Security benefits are for SSDI Social Security Disability Income you can add that amount to your taxable disability pension amount You can deduct

https://www.disabilitysecrets.com › resources › social...

Social Security payments from the Social Security disability insurance SSDI program might be taxable in your state The vast majority of states however exempt disability

[img_title-9]

Social Security Benefit Tax Limit 2025 Brandon Gill

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Is Social Security Disability Taxable In Ohio - Ohio does not tax Social Security benefits offering a financial advantage to retirees who depend on these payments This exemption is part of the state s efforts to reduce the financial strain