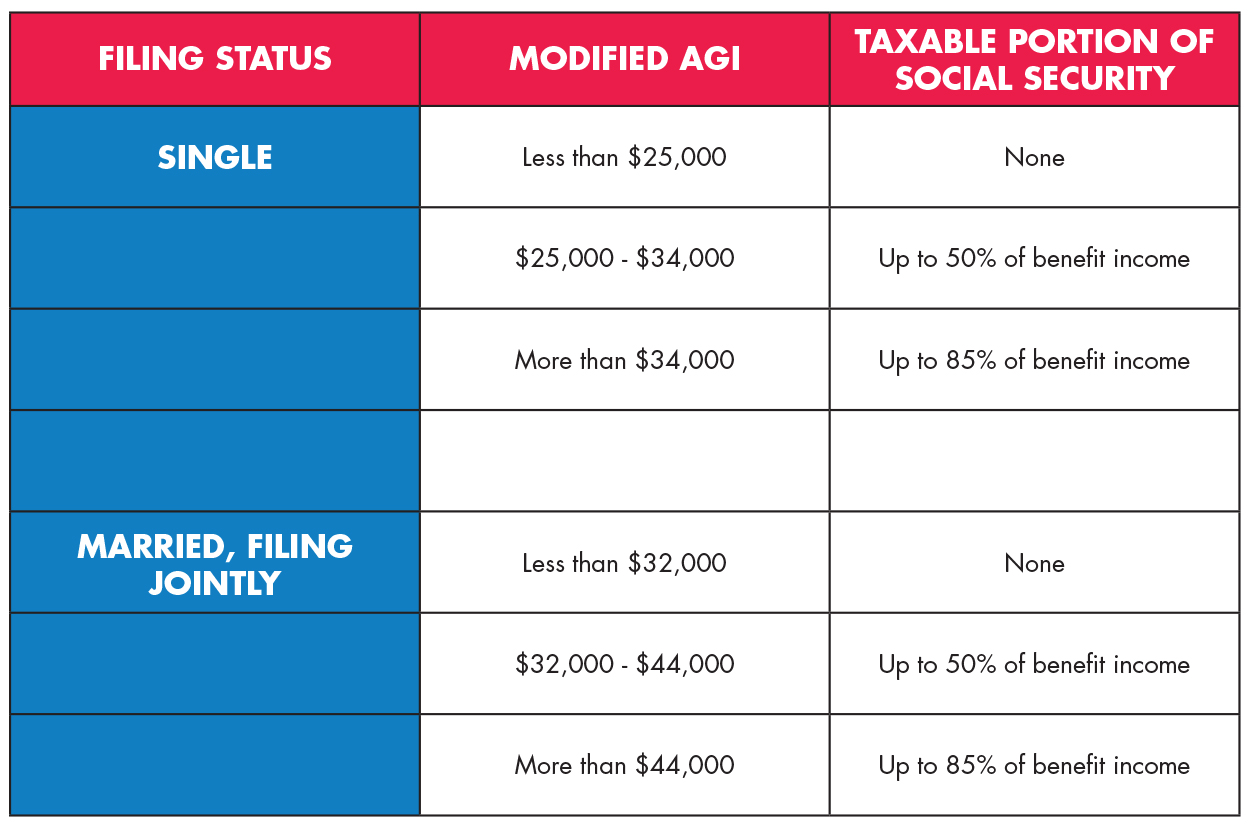

Max Social Security Income Tax 2024 Up to 85 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is more than 34 000 You file a joint return and you and

If your Social Security income is taxable depends on your income from other sources Here are the 2025 IRS limits In 2024 the maximum possible Social Security income for someone of full retirement age will be 3 822 up 195 from 2023 Maximum Social Security Payout The

Max Social Security Income Tax 2024

Max Social Security Income Tax 2024

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png

Social Security Benefit Tax Limit 2025 Brandon Gill

http://seniorsleague.org/assets/TSCL_SocialSecurity_Chart.jpg

Social Security Checks To Get Big Increase In 2019 Social Security

https://i.pinimg.com/originals/33/55/6b/33556ba693ff68b3c911e28dfacf40c0.png

2024 max Social Security tax Unlike the tax rate which has been at 6 2 for employees since 1990 the tax limit also known as the taxable maximum changes every year 58 rowsListed below are the maximum taxable earnings for Social Security by year from 1937 to the present

42 rowsBenefit Examples For Workers With Maximum Taxable Earnings The initial benefit amounts shown in the table below assume retirement in January of the stated year with The maximum amount of earnings subject to Social Security tax taxable maximum will increase to 168 600 from 160 200 The standard deduction used instead of itemized

More picture related to Max Social Security Income Tax 2024

app

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png?fit=1456

Social Security Limit 2024 Taxable Minne Christabella

https://www.socialsecurityintelligence.com/wp-content/uploads/2016/11/2021-Income-Limit-1536x961.png

[img_title-6]

[img-6]

The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits Social Security benefits include monthly For this year the maximum earnings subject to the Social Security tax is 168 600 This wage base limit means that only the first 168 600 of an individual s earnings are taxed at

The wage base or earnings limit for the 6 2 Social Security tax rises every year The 2025 limit is 176 100 up from 168 600 in 2024 In 2024 employees are required to pay a 6 2 Social Security tax with their employer matching that payment on income up to 168 600 up from 160 200 in 2023 up

[img_title-7]

[img-7]

[img_title-8]

[img-8]

https://www.usatoday.com › story › mone…

Up to 85 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is more than 34 000 You file a joint return and you and

https://smartasset.com › retirement › is-soci…

If your Social Security income is taxable depends on your income from other sources Here are the 2025 IRS limits

[img_title-9]

[img_title-7]

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

Max Social Security Income Tax 2024 - To even have a shot at receiving the maximum Social Security benefit when you retire you ll need to earn 168 600 this year So is this the magic number to make Yes and