Social Security Benefits Tax Rate In Massachusetts Partially Taxed Massachusetts only taxes a portion of your social security benefits not the full amount Specifically the state does not tax social security benefits up to 32 000

Massachusetts gross income doesn t include Social Security benefits Under I R C 86 these benefits may be included in federal gross income depending on income Does Massachusetts tax Social Security benefits No But you may pay federal taxes on a portion of your Social Security benefits depending on your income Up to 50 percent of your benefits will be taxed if you file an

Social Security Benefits Tax Rate In Massachusetts

Social Security Benefits Tax Rate In Massachusetts

https://www.disabilitybenefitscenter.org/sites/default/files/images/blog/DBC-Sept-2023-payment-dates-article-image-2.png

60k Salary Effective Tax Rate V s Marginal Tax Rate AW Tax 2023

https://aw.icalculator.com/img/og/AW/51.png

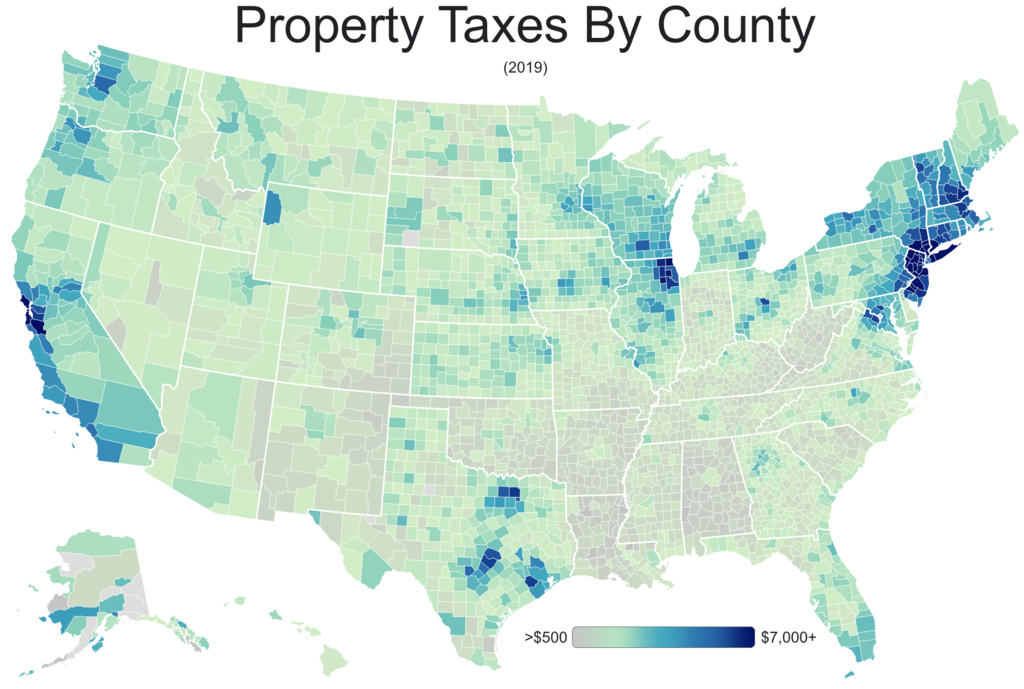

How Much Are Your Massachusetts Property Taxes MassLandlords

https://masslandlords.net/wp-content/uploads/mass-property-taxes-image-1-cc-by-sa-wikimedia.png

Social Security benefits are not included in Massachusetts income For federal purposes these benefits may be included in federal gross income depending on income Massachusetts is moderately tax friendly for retirees It fully exempts Social Security retirement benefits and income from most public pension funds from taxation On the other hand other types of retirement income receive no

Social Security Unlike some other states Massachusetts does not tax Social Security benefits which is welcome news for retirees depending on this income stream Pensions Massachusetts generally taxes pension The Income tax rates and personal allowances in Massachusetts are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances

More picture related to Social Security Benefits Tax Rate In Massachusetts

Boost Your Monthly Social Security Benefits By 2233 Social Security

https://i.ytimg.com/vi/MrLcifMcEVU/maxresdefault.jpg

Individual Tax Rate Tax Rates Income Tax Rates For Resident

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a696ac3a274f79c15646086b98a09d5a/thumb_1200_1698.png

Second Job Tax Rate In Australia TaxLeopard

https://taxleopard.com.au/wp-content/uploads/Discover-the-Second-Job-Tax-Rate-1.jpeg

Military retirement and Social Security benefits are exempt You can deduct medical or dental expenses greater than 7 5 of your federal adjusted gross income Massachusetts provides a 700 exemption for those A Based on Social Security annual maximum taxable earnings of 147 000 in 2022 b Includes both employee and employer contributions Data are not adjusted for tax refunds to persons

While the IRS may tax you on up to 85 of on Social Security benefits all Social Security income is tax free on your Massachusetts state income tax return regardless of income or the size Social Security payments are not considered taxable income in Massachusetts so you can deduct them from your state tax return There is an exemption for retirement income but it is only

Social Security Benefits Increase Maine Credit Unions

https://mainecreditunions.org/wp-content/uploads/2022/10/Untitled-design-1.png

Tax Rate In Europe Vs US How Do They Differ

https://qubit-labs.com/wp-content/uploads/2023/10/Tax-Rate-in-Europe-vs-US-–-How-Do-They-Differ_-1-scaled.jpg

https://gbtimes.com › does-massachusetts-tax...

Partially Taxed Massachusetts only taxes a portion of your social security benefits not the full amount Specifically the state does not tax social security benefits up to 32 000

https://www.mass.gov › info-details › massachusetts...

Massachusetts gross income doesn t include Social Security benefits Under I R C 86 these benefits may be included in federal gross income depending on income

Taxable Social Security Worksheets

Social Security Benefits Increase Maine Credit Unions

Tax Rate In Pdf

Take up Of Social Security Benefits Past Present And Future In

A Shock For Many Retirees Social Security Benefits Can Be Taxed The

Social Security Taxable Explaining Income Limits SSI Rules 9news

Social Security Taxable Explaining Income Limits SSI Rules 9news

Social Security Income Benefits Verification

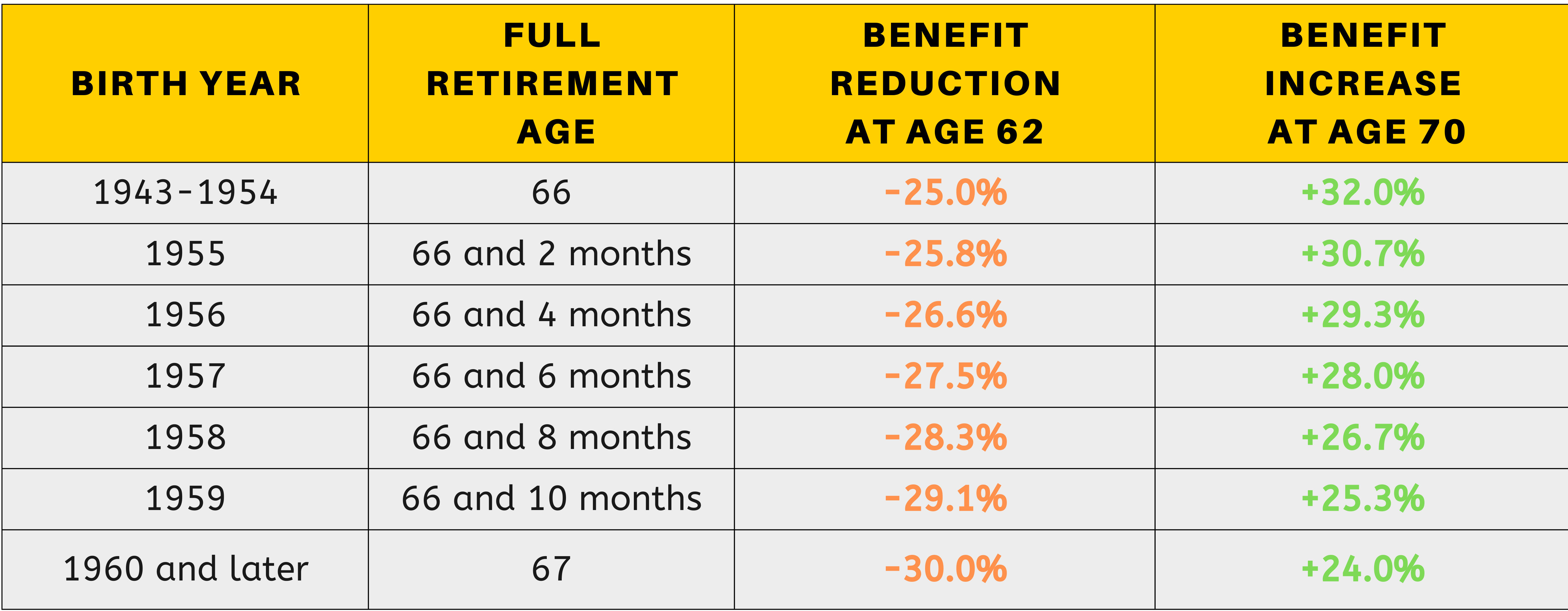

When To Claim Your Social Security Benefits Policy Engineer

How Much Of My Social Security Benefit Can My Ex Spouse Receive

Social Security Benefits Tax Rate In Massachusetts - Massachusetts is moderately tax friendly for retirees It fully exempts Social Security retirement benefits and income from most public pension funds from taxation On the other hand other types of retirement income receive no