Tax Rate For Ss Benefits Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a

Up to 85 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is more than 34 000 You file a joint return and you You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint

Tax Rate For Ss Benefits

Tax Rate For Ss Benefits

https://media.brainly.com/image/rs:fill/w:1080/q:75/plain/https://us-static.z-dn.net/files/d88/7628a8c932bb486472a917f0b563f619.png

Trust Tax Rates KTS Chartered Accountants

https://kts.co.nz/wp-content/uploads/2023/11/Shutterstock_2244701263.jpg

How To Apply Tax Rates To Appointments StyleSeat

https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/69075556788/original/Vow3tBR-okSb25kj9oI92Gfqh0tI6ba6qg.png?1684255443

Depending on your income up to 85 of your Social Security benefits can be subject to tax That includes retirement and benefits from Social Security trust funds like survivor and Ten states will tax Social Security benefits this year down from 12 states last year Social Security benefits collected in 2024 may be taxed at the federal and state levels Most retirees

You owed taxes taxes on 85 percent of your 18 000 in annual benefits or 15 300 at the regular rate for your tax bracket Nobody pays taxes on more than 85 percent of their Social Security benefits no matter their income The Social Security tax rate for employees and employers is 6 2 of employee compensation each for a total of 12 4 The Social Security tax rate for those who are self employed is 12 4

More picture related to Tax Rate For Ss Benefits

Tax Rates Allen County IN

https://www.allencounty.in.gov/ImageRepository/Document?documentID=65

Concessional Income Tax Rate In Traders List Of Demands For Modi Govt

https://image.isu.pub/190528095558-3d2543d7671f5a95691911f9bf5e1c5c/jpg/page_1.jpg

Income Tax Rate In Nepal For The Fiscal Year 2078 79

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4UqaDAobenIfdGj_TW3r7O6Yri5q9cAE2IFqK8MrobrEDEWLdwVdSMOSQrrV_j90rpiD5_gUFKySYHXqZ48wBdlf_9IqtBYyDw1Tng_ikZGyzl33OVWJrQnvRDlzn9nfxOzsTNmKligxFkGEGClpH0iFEUgxMu2cao8jPI_oYUl11LsbP4FwkcJ4Rjw/w1600/TAX rate 2079.080-1.jpg

Income taxes on benefits paid out in 2022 added 48 6 billion to Social Security s coffers accounting for about 4 percent of the program s revenue the vast majority of which comes from payroll taxes levied separately Most high income retirees will have 85 of Social Security benefits taxable For lower income retirees less than 85 will be taxable but many retirees in a 12 tax bracket will face a marginal tax rate much higher

As much as 85 of your Social Security income can be taxed Learn what is taxable how taxes are calculated and how to minimize taxes owed The Social Security Administration estimates that 40 of recipients pay income tax on their benefits The taxable benefits include retirement and spousal survivor and disability

Cene Nekretnina Strana 955 Beobuild Forum

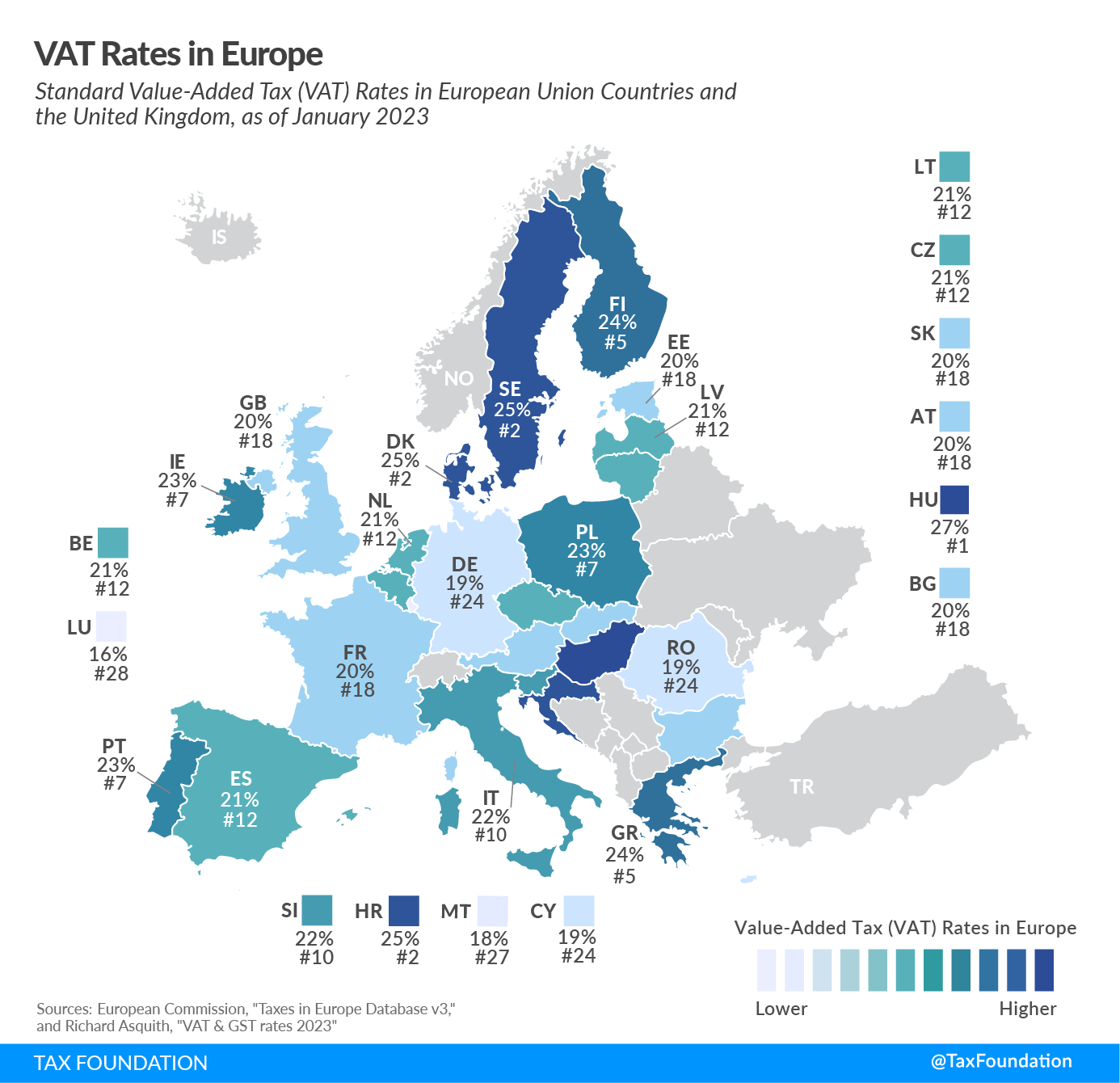

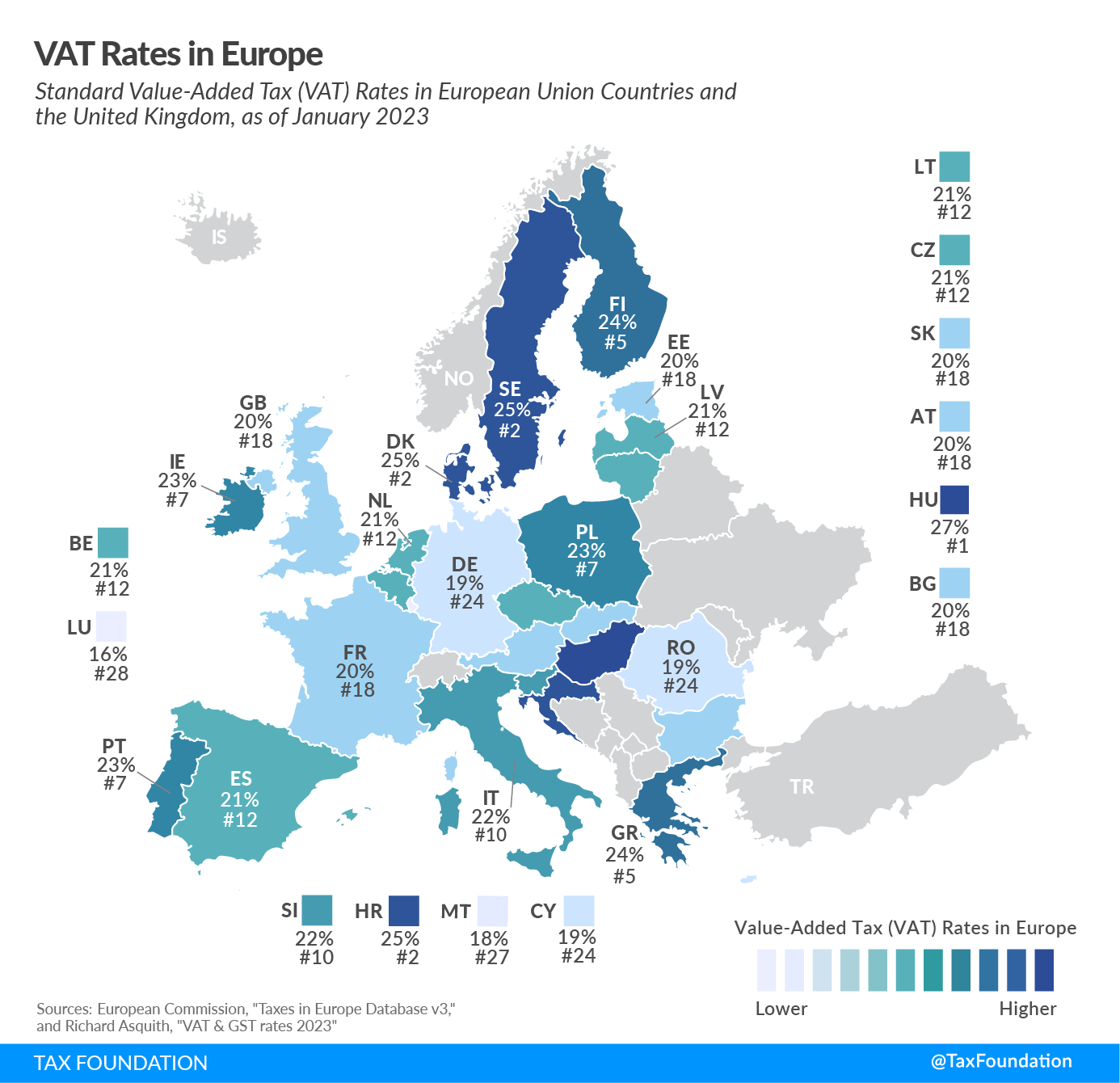

https://files.taxfoundation.org/20230130150714/VAT_Rates_2023.png

56 Of Social Security Households Pay Tax On Their Benefits Will You

http://seniorsleague.org/assets/TSCL_SocialSecurity_Chart.jpg

https://www-origin.ssa.gov › benefits › retirement › planner › taxes.html

Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a

https://www.usatoday.com › story › mone…

Up to 85 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is more than 34 000 You file a joint return and you

Tax Rates Kladana

Cene Nekretnina Strana 955 Beobuild Forum

Social Security Checks To Get Big Increase In 2019 Social Security

Ass 2 Answer Assignment 2 For Financial Accounting Answer 1 a

UK Patent Box Scheme Set To Become An Even More Valuable Tax Benefit

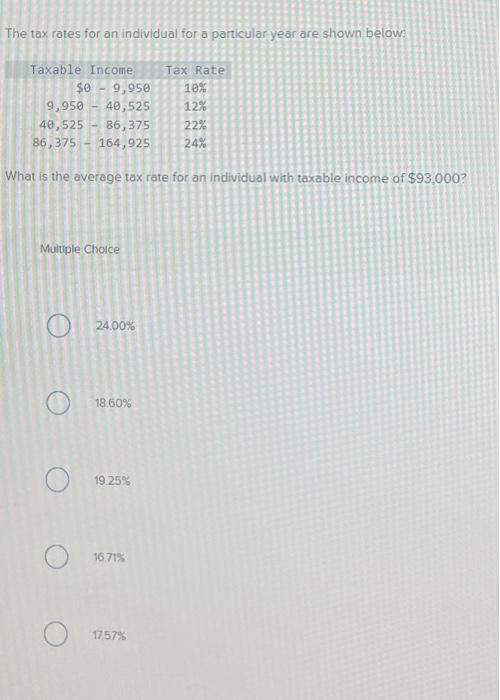

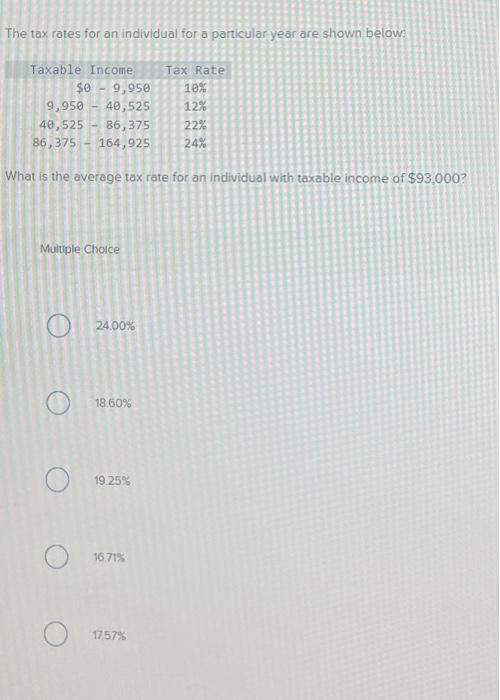

Solved The Tax Rates For An Individual For A Particular Year Chegg

Solved The Tax Rates For An Individual For A Particular Year Chegg

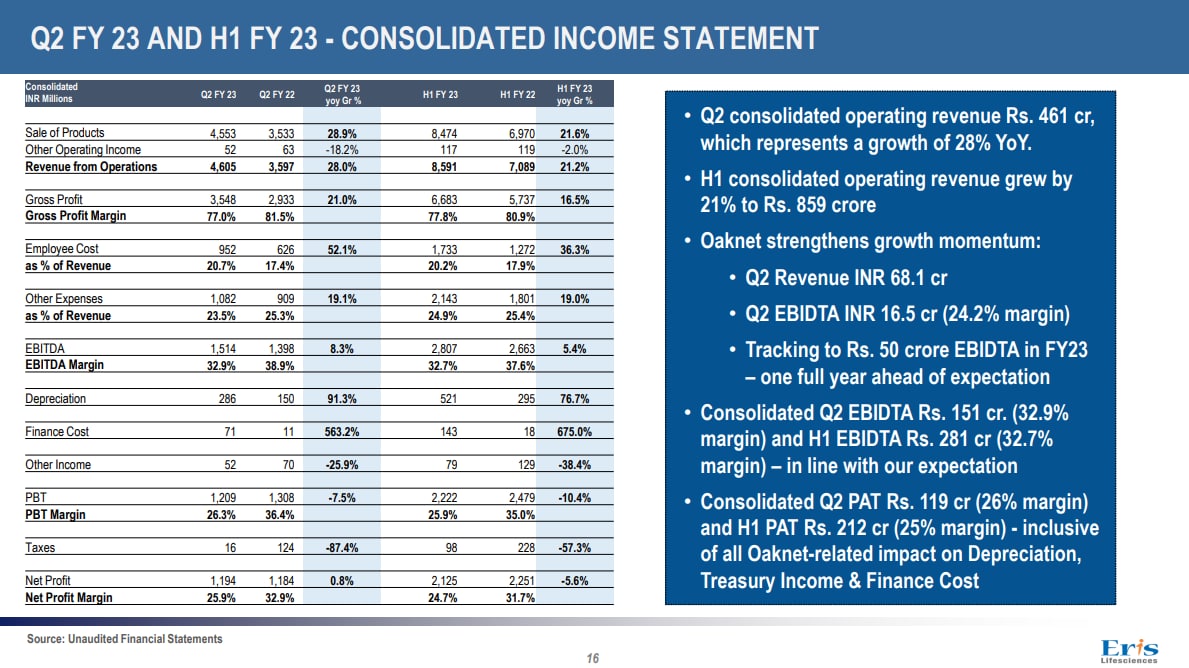

Eris Lifesciences Conducted Q2 FY23 Con Call On 20 October 2022 Here

Current Tax Rate District Comal Independent School District

VATRE Voter Approval Tax Rate Election VATRE

Tax Rate For Ss Benefits - The Social Security tax rate for employees and employers is 6 2 of employee compensation each for a total of 12 4 The Social Security tax rate for those who are self employed is 12 4