What Is Additional Assessment In Taxation If however SARS is of the view that your supporting documents do not match your tax return they may issue you an Additional Assessment This usually happens when SARS

Additional assessments In terms of section 92 of the Tax Administration Act SARS is obliged to issue an additional assessment if it is satisfied that an assessment does not If we revise your tax assessment you need to pay the additional taxes You will receive the Notice of Additional Assessment and the additional tax you need to pay is shown as Additional Tax

What Is Additional Assessment In Taxation

What Is Additional Assessment In Taxation

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/9ef63b072e18a5253e6b47043fe6d8f0/thumb_1200_1835.png

Slide Redesign Checklist In PowerPoint On Due Diligence Example

https://www.effective-slides.com/wp-content/uploads/2022/10/legal-due-diligence-checklist-ppt-comparison-slide-infodiagram.png

J M In Taxation LL M Degrees

https://www.law.ua.edu/llmdegrees/files/2023/02/Landing-pages-2023-1-1.png

In the event that your carefully considered response to SARS questions falls on deaf ears or if they simply disagree with your submissions the inevitable result is a notice of The report is structured around nine chapters that examine the performance of tax administration systems using an extensive data set and a variety of examples to highlight recent innovations

If you do not send back your tax return we will impose an assessment on you We will base this on an estimation of your income If this estimation turns out to be too low in retrospect we may The publication is structured around nine chapters that examine and comment on tax administration performance and trends up to the end of the 2019 fiscal year and it includes a

More picture related to What Is Additional Assessment In Taxation

Taxation In Intraday Trading

https://boomingbulls.com/wp-content/uploads/2023/03/Taxation-Blog-Banner--scaled.jpg

Business Risk Assessment And Management Excel Template Etsy Australia

https://i.etsystatic.com/36343571/r/il/0a9b18/4059704003/il_fullxfull.4059704003_kvgb.jpg

Virginia Department Of Taxation Review Letter Sample 1

http://www.taxaudit.com/getattachment/98081946-fe3f-4e1b-a43e-e04648bf2b56/Virginia-Department-of-Taxation-Review-Letter;

HLSEA2024036 ISBN 9798400294044 ISSN 2959 4103 The implementation of capacity development CD advice and reforms since a 2018 TADAT assessment shows The government is ensuring that tax that is owed is paid by introducing the most ambitious ever package to close the tax gap raising 6 5 billion in additional tax revenue per

Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate Your property tax assessment is A special assessment tax is a local tax in addition to property taxes that is levied on homeowners to fund a specific project The assessment is levied for a pre set number

Possible Questions For Title Defense 1 Why Did You Choose This Topic

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a7f056fac38255f86f5852ce4171e7ee/thumb_1200_1698.png

:max_bytes(150000):strip_icc()/additionalpaidincapital-final-6c076433118e4b9bb699fa576696fb0e.png)

Additional Paid in Capital What It Is Formula And Examples

https://www.investopedia.com/thmb/J3kTnV5W8ffTIpMrovU2nq1tafs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/additionalpaidincapital-final-6c076433118e4b9bb699fa576696fb0e.png

https://www.taxtim.com/za/blog/i-have-received-an...

If however SARS is of the view that your supporting documents do not match your tax return they may issue you an Additional Assessment This usually happens when SARS

https://www.thesait.org.za/news/news.asp?id=459945

Additional assessments In terms of section 92 of the Tax Administration Act SARS is obliged to issue an additional assessment if it is satisfied that an assessment does not

What Is US Taxation

Possible Questions For Title Defense 1 Why Did You Choose This Topic

323787915 Taxation Multiple Choice Questions And Answers TAXATION

Chapter 15 A Regular Income Taxation Special Corporations

Assessment Types Office Of The Provost

Comprehensive Examination 1 Taxation COMPREHENSIVE EXAMINATION 1

Comprehensive Examination 1 Taxation COMPREHENSIVE EXAMINATION 1

Taxation Basic Int Capital Allowances TAXATION BASIC INTERMEDIATE

Assessment Taxation YouTube

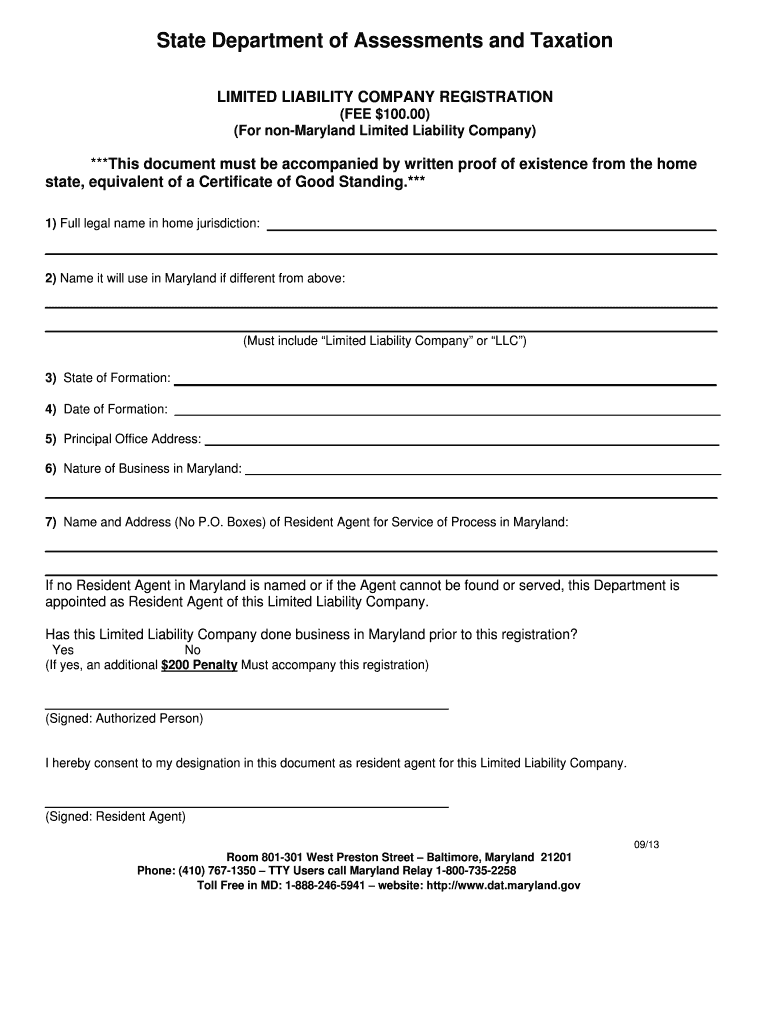

Forms Maryland Department Of Assessments And Taxation Fill Out And

What Is Additional Assessment In Taxation - In the event that your carefully considered response to SARS questions falls on deaf ears or if they simply disagree with your submissions the inevitable result is a notice of