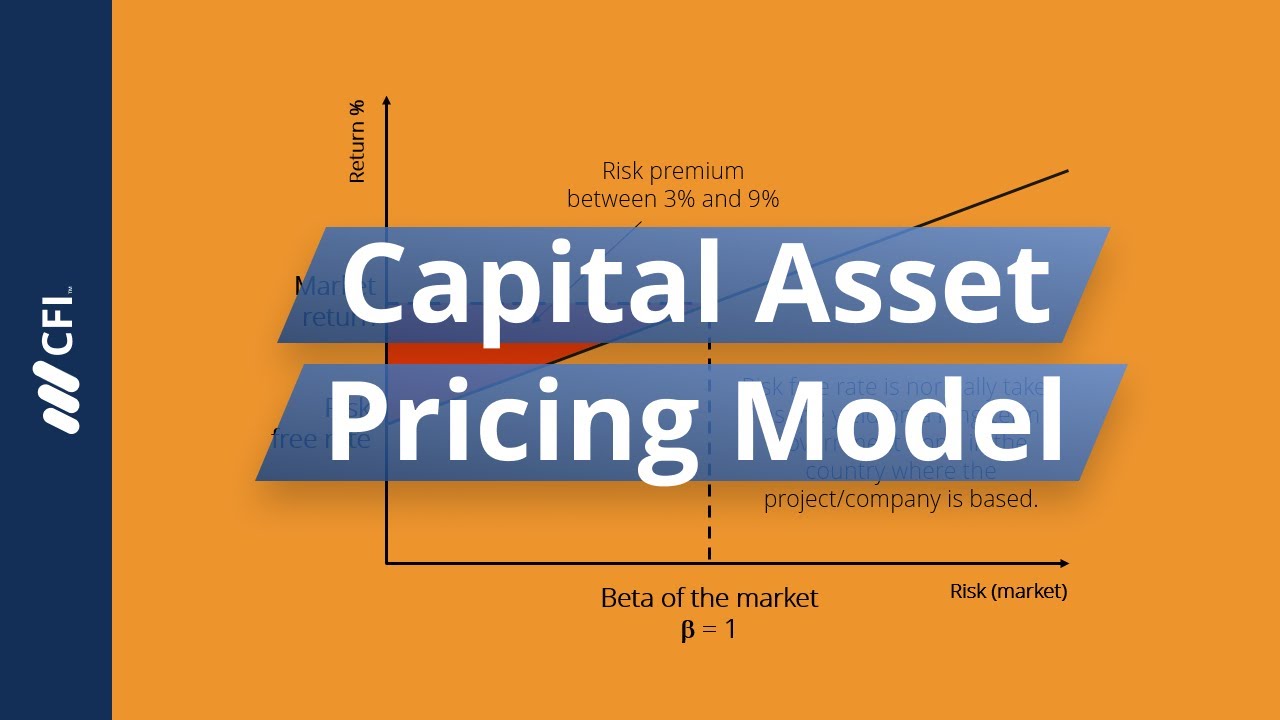

What Is Capital Asset Pricing Model The Capital Asset Pricing Model CAPM is a model that describes the relationship between the expected return and risk of investing in a security It shows that the expected return on a security is equal to the risk free return plus a risk premium which is based on the beta of that security

The capital asset pricing model CAPM helps investors understand the returns they can expect given the level of risk they assume A bedrock principle of all investing The capital asset pricing model CAPM is a theory that explains the relationship between the risk of an asset and its expected return It suggests that investors should be compensated for taking on additional risk through higher expected returns

What Is Capital Asset Pricing Model

What Is Capital Asset Pricing Model

https://www.wisbees.com/content/images/size/w1200/2023/03/capm-2.jpg

What Is Capital Asset Pricing Model Archives Your Guest Post

https://www.yourgpost.com/wp-content/uploads/2021/06/Capital-Asset-Pricing-Model-820x480.jpg

What Is The Capital Asset Pricing Model CAPM Valuation Master Class

https://valuationmasterclass.com/wp-content/uploads/2020/08/Corporate-Finance-Blogpost-1024x683.jpg

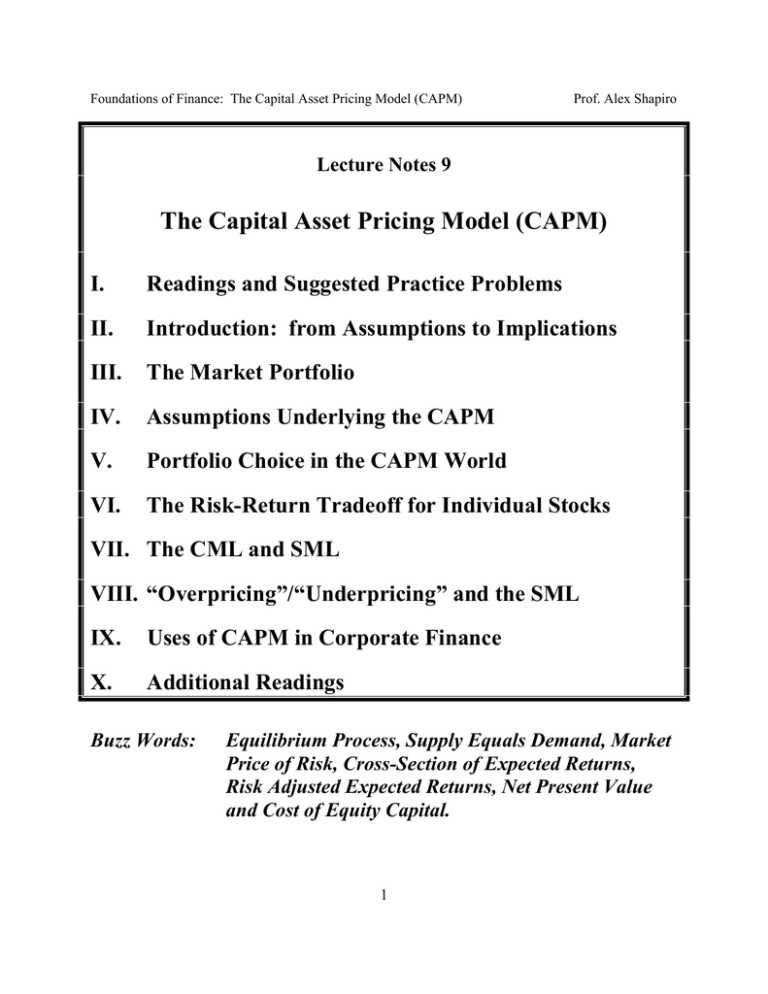

Section E of the Study Guide for Financial Management contains several references to the Capital Asset Pricing Model CAPM This article introduces the CAPM and its components shows how it can be used to estimate the cost of equity and introduces the asset beta formula Section E of the Financial Management study guide contains several references to the Capital Asset Pricing Model CAPM This article is the final one in a series of three and looks at the theory advantages and disadvantages of the CAPM

What is the Capital Asset Pricing Model CAPM The capital asset pricing model CAPM is used to calculate the required rate of return for any risky asset Your required rate of return is the increase in value you should expect to see The capital asset pricing model CAPM calculates predicted returns based on capital costs and asset risk The CAPM calculation requires the overall market rate of return the stock s beta value and the risk free rate

More picture related to What Is Capital Asset Pricing Model

Understanding The Capital Asset Pricing Model Shiksha Online

https://images.shiksha.com/mediadata/images/articles/1706535033phpNHs3Qu.jpeg

Importance Of Capital Asset Pricing Model Dunbaby

https://i.ytimg.com/vi/IJeYwx-cXyc/maxresdefault.jpg

What Is Capital Asset Pricing Model Definition And Meaning Business

https://businessjargons.com/wp-content/uploads/2015/11/CAPM-1.jpg

Developed by William Sharpe CAPM provides a framework that links an asset s risk with its potential return guiding investors in building balanced portfolios At its core CAPM simplifies investment decision making by offering insights CAPM stand for Capital Asset Pricing Model and is a common valuation method for stocks What is CAPM The Capital Asset Pricing Model or CAPM calculates the value of a security based on the expected return relative to the risk investors incur by

[desc-10] [desc-11]

The Capital Asset Pricing Model

https://bookboon.com/thumbnail/720/35d7ee13-0f5e-e011-bd88-22a08ed629e5/5fd64c5d-40d7-421a-ae21-a5d900d9d963/the-capital-asset-pricing-model.jpg

The Capital Asset Pricing Model

https://s2.studylib.net/store/data/010069202_1-15a124bde3a79781fa3e1f33767bef8e-768x994.png

https://corporatefinanceinstitute.com › resources › ...

The Capital Asset Pricing Model CAPM is a model that describes the relationship between the expected return and risk of investing in a security It shows that the expected return on a security is equal to the risk free return plus a risk premium which is based on the beta of that security

https://www.forbes.com › advisor › investing › capm...

The capital asset pricing model CAPM helps investors understand the returns they can expect given the level of risk they assume A bedrock principle of all investing

What Is Capital Asset Pricing Model CAPM Tavaga Tavagapedia

The Capital Asset Pricing Model

CAPM Capital Asset Pricing Model In 4 Easy Steps What Is Capital

Capital Asset Pricing Model CAPM And Its Role In Discounted Cash Flow

The Capital Asset Pricing Model CAPM

Capital Asset Pricing Model Risks Applications Returns Explained

Capital Asset Pricing Model Risks Applications Returns Explained

Capital Asset Pricing Model Make Smart Investment Decisions To Build A

Capital Asset Pricing Model Importance Examples TradeSmart

The Capital Asset Pricing Model CAPM Formula And Examples

What Is Capital Asset Pricing Model - [desc-12]