What Is Demand Payment As Regular Assessment Tax 400 When the taxpayers are making the payment in response to outstanding demand they need to select 400 Tax on Regular Assessment while paying Read more at Income Tax

Tax on regular assessment is the tax that a taxpayer is required to pay against a notice of demand from the Income tax department So when notice of demand is received and it is Demand payment as Regular Assessment Tax 400 Select from the available list of Demand Reference Number DRNs available You can search by DRN or filter by the Assessment Year

What Is Demand Payment As Regular Assessment Tax 400

What Is Demand Payment As Regular Assessment Tax 400

https://d1xuqjt1wg0fxw.cloudfront.net/c266dc60-3256-11ec-94dc-816b2a77ad91.jpg

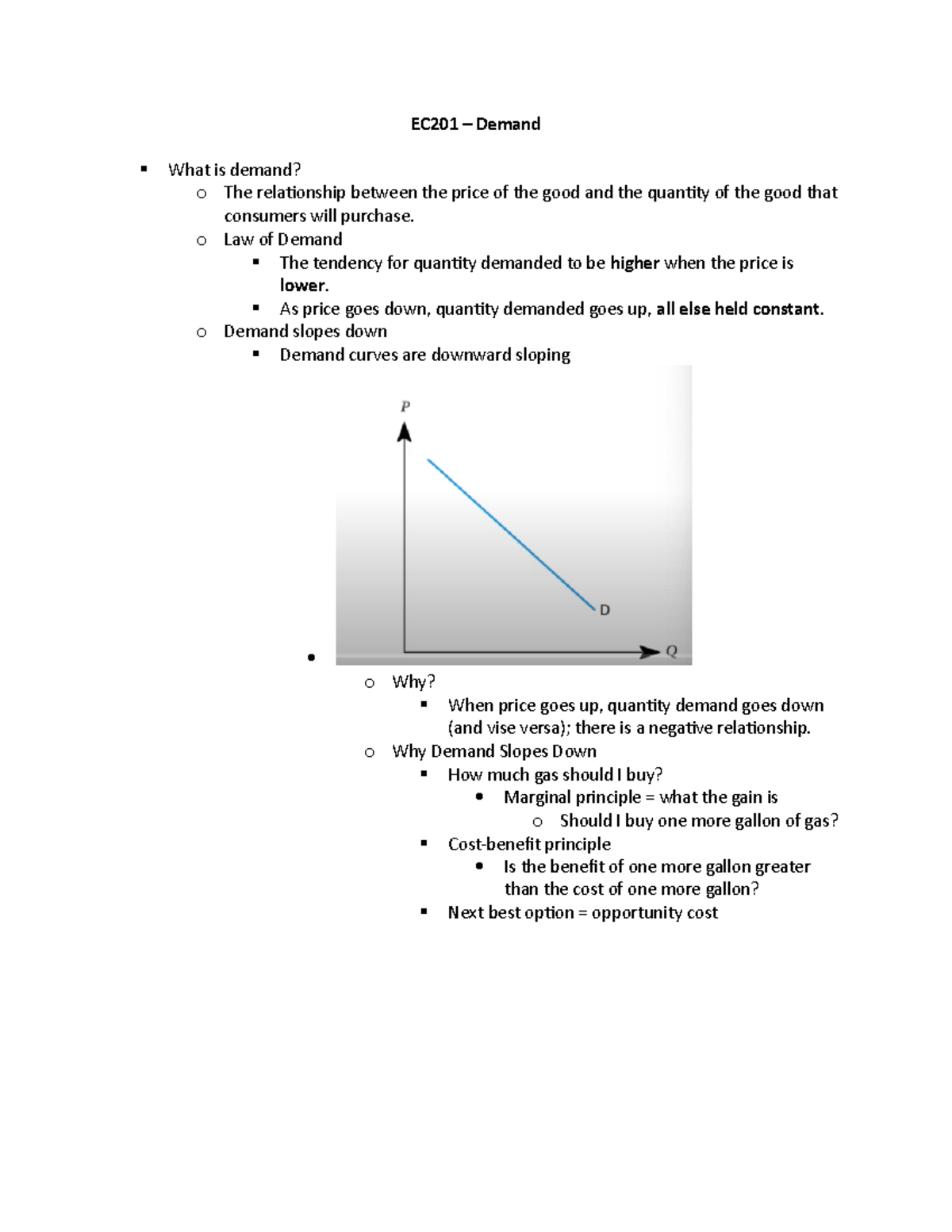

Demand Analysis In Economics Class 12 What Is Demand Types Of

https://i.ytimg.com/vi/H9IQJ1NkW8c/maxresdefault.jpg

What Is Demand Its Features Class 11th Mirco Economics Explained

https://i.ytimg.com/vi/8FeONmtB79o/maxresdefault.jpg

This demand raised on the person is called as Tax on regular assessment The tax on regular assessment 400 has to be paid within 30 days of receipt of the notice of demand As you have paid the tax under the correct minor head i e 300 only as self assessment tax there seems to be nothing wrong in your payment of tax The demand raised by the ITD may

Income tax for NRI Capital gain income Section 80 savings House property File TDS Guide on income tax Guide for professionals How to e file ITR Income tax refund status The tax on regular assessment has to be paid within 30 days of receipt of the notice of demand through income tax challan on Income Tax Portal by selecting the head Tax on regular

More picture related to What Is Demand Payment As Regular Assessment Tax 400

Regular Assessment Tax Challan

https://help.myitreturn.com/hc/article_attachments/16032803999641

Payment Demand Letter Template Payment Demand Letter Payment Demand

https://i.etsystatic.com/17017872/r/il/f66ad5/4360126387/il_1080xN.4360126387_eyf7.jpg

Self Assessment Tax Online Payment And Challan

https://static.wixstatic.com/media/fa2e10_ecee2d6bde434aef8b21e598616ed95c~mv2.png/v1/fill/w_1000,h_563,al_c,q_90,usm_0.66_1.00_0.01/fa2e10_ecee2d6bde434aef8b21e598616ed95c~mv2.png

Following are the steps to pay outstanding demand from ITD Step 1 Login on https www incometax gov in iec foportal with your credentials Step 2 Click on Pending Actions then Response to Outstanding Demand to see the list of Challan Correction Request can be submitted only for Minor Heads 100 Advance Tax 300 Self Assessment Tax and 400 Demand Payment as Regular Assessment Tax and their

Where the Department finds that there has been understatement of income and resultant tax due it takes measures to compute the actual tax amount that ought to have been paid This Challan No ITNS 281 is used by the Deductors to deposit Tax Deducted at source Tax Collected Source TDS TCS and Demand Payment User should have Internet

Study Material Of Economics What Is Demand And Law Of Demand YouTube

https://i.ytimg.com/vi/0r5tlWOOLJw/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGH8gEygVMA8=&rs=AOn4CLDSgTrrWpmUfIB7aUxcWE6jJOcsIw

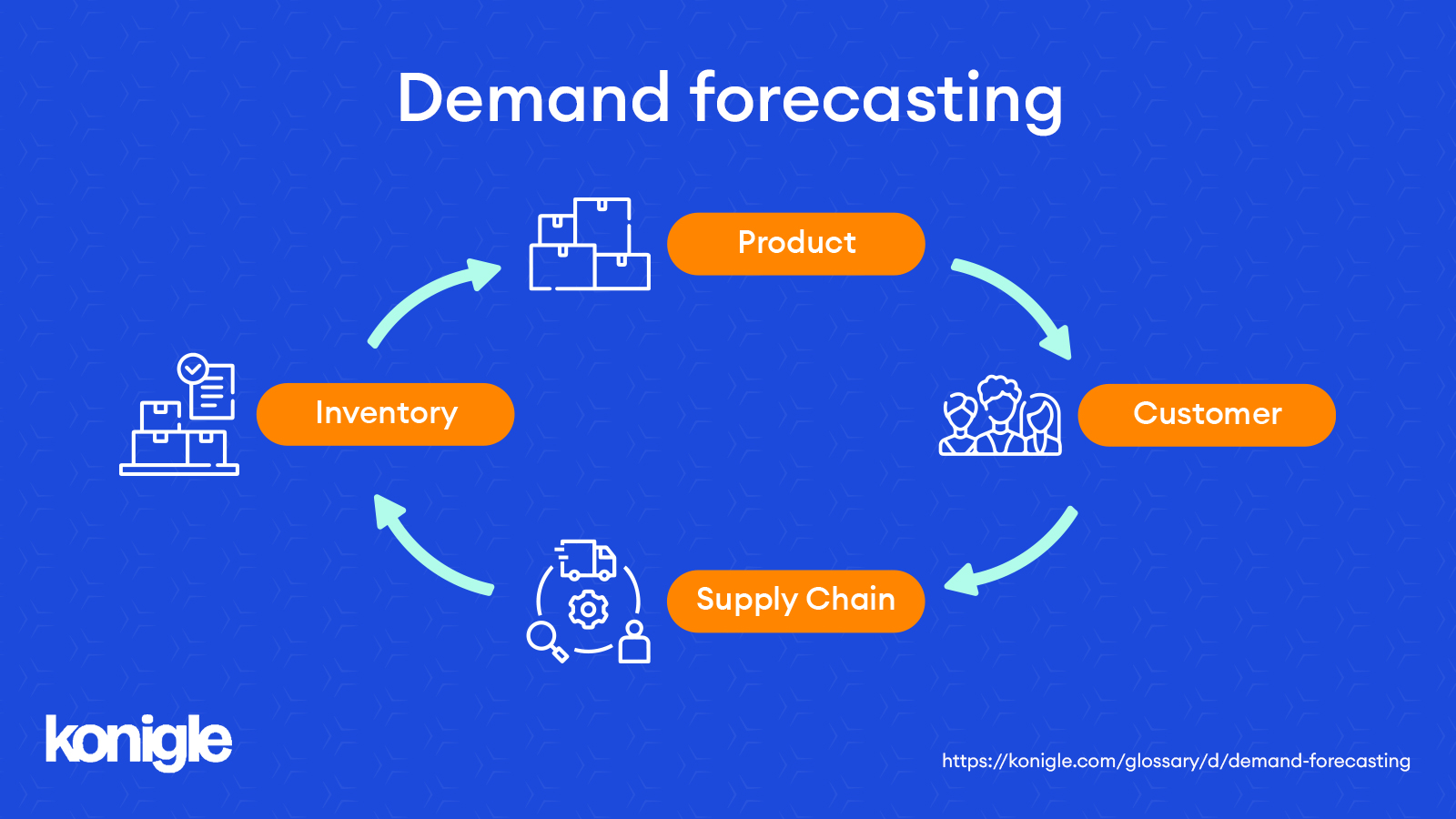

What Is Demand Forecasting And Its Importance

https://cdn.konigle.com/images/2022/Demand_forecasting--v1669607703.jpg

https://taxconcept.net/income-tax/responding-to...

When the taxpayers are making the payment in response to outstanding demand they need to select 400 Tax on Regular Assessment while paying Read more at Income Tax

https://help.myitreturn.com/hc/en-us/articles/...

Tax on regular assessment is the tax that a taxpayer is required to pay against a notice of demand from the Income tax department So when notice of demand is received and it is

What Is Demand Economics 101 Episode 3 YouTube

Study Material Of Economics What Is Demand And Law Of Demand YouTube

6 Types Of Demand Forecasting And Projection Benefits 2023

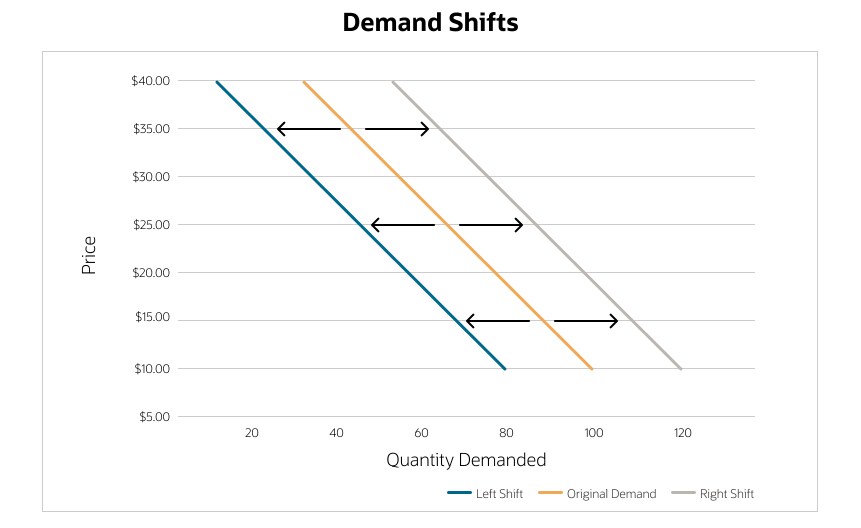

EC201 Demand 2 EC201 Demand What Is Demand O The Relationship

What Is Demand Generation AI Digital Marketing Agency

What Is Demand Generation Top Experts Explain

What Is Demand Generation Top Experts Explain

What Is Demand Destruction And How Does Inflation Cool The Economy

What Is Demand Forecasting Blogs

GCSE Economics How Prices Are Determined Edumentors

What Is Demand Payment As Regular Assessment Tax 400 - You have to select 400 Tax on Regular Assessment for making the Regular Assessment Tax payment There would be two modes of payment available i e Net Banking