What Is Tax Write Off For Donating A Car Giving up an old car to charity may qualify you for a tax deduction And charities benefit because even junk cars are more valuable amid high prices for new and used vehicles

Recordkeeping and filing requirements depend on the amount you claim for the deduction 1 If the deduction you claim for the car is at least 250 but not more than 500 If you are eligible to deduct charitable contributions for federal income tax purposes see Qualifying for a Tax Deduction below and you want to claim a deduction for donating your

What Is Tax Write Off For Donating A Car

What Is Tax Write Off For Donating A Car

https://i.etsystatic.com/5859452/r/il/323444/4694076996/il_fullxfull.4694076996_6x45.jpg

TheRealSullyG The Tax Write Off Song Lyrics Genius Lyrics

https://images.genius.com/6f99225620435bad0aa4abc6f784e4db.1000x563x1.jpg

Tax Benefits Of Donating A Car Guide

https://tagvault.org/wp-content/uploads/2023/11/tax-benefits-of-donating-a-car-768x614.jpg

You ll need to report your deduction on Schedule A of your federal income tax return If your car donation is more than 500 you must also fill out IRS Form 8283 If your deduction for the car is between 501 and 5 000 fill How much of a tax deduction do you get for donating your car According to the IRS if a charity sells your car for less than 500 you can claim the fair market value for up to a maximum of 500 If the car sells for more

Learn how to maximize your car donation tax deduction Understand the process IRS rules and how to ensure you get the best possible tax benefit Car Donations Donating your car to a qualified charity allows you to claim a tax deduction which reduces your taxable income Understanding the rules and limitations of this

More picture related to What Is Tax Write Off For Donating A Car

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

https://i.pinimg.com/originals/6c/16/af/6c16af3ad58c7b51e20fad31e7bb90ad.jpg

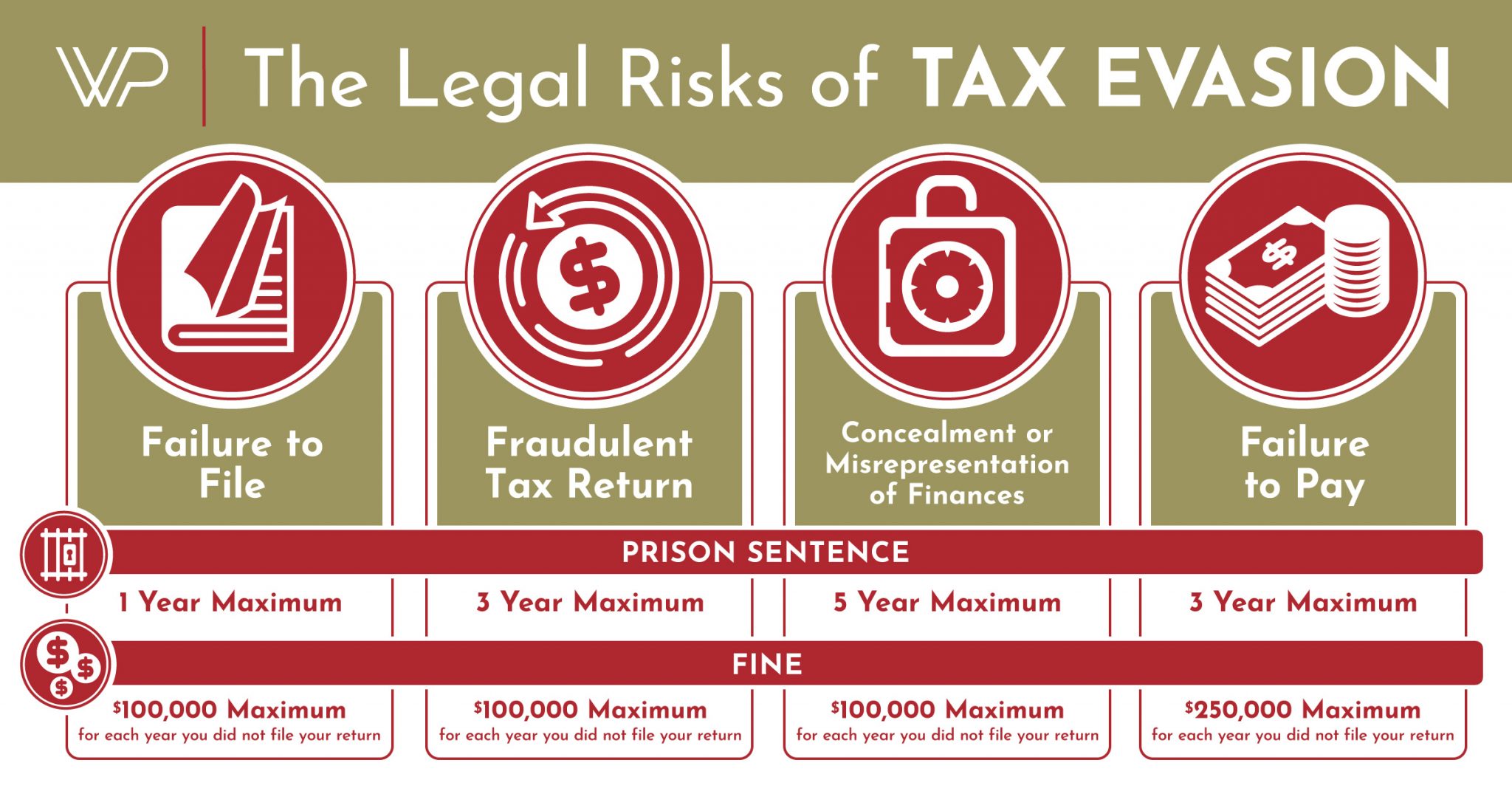

Tax Evasion Vs Tax Avoidance What Are The Legal Risks Entrapped

https://www.entrapped.com/wp-content/uploads/2022/08/TaxEvasion-InfoGraphic-1-2048x1075.jpg

The Tax Write Off Song YouTube

https://i.ytimg.com/vi/AMw3EjASaK8/maxresdefault.jpg

To be eligible for a tax deduction the car must be donated to a tax exempt nonprofit organization most commonly known as a 501 c 3 organization To verify if an organization is tax exempt use the IRS search tool or ask to see A tax write off for a car donation is a way that you can a benefit from the non cash charitable donation of a motor vehicle In most cases donated vehicles that sell for less than 500 are able to be claimed at the fair market value up to 500

If you do have enough tax deductible expenses to exceed the standard deduction and you choose to itemize then donating your car may be tax deductible However it s not as simple as giving away the car and writing off To ensure you qualify for a tax deduction follow these IRS guidelines The charity s name and EIN The date of the donation A description of the car make model VIN

17 Big Tax Deductions Write Offs For Businesses

https://assets-global.website-files.com/645d153299ce00e5b32eb70b/64a72ea086c87c63f632eccb_2022_Small_Business_Tax_Deductions.png

How Do Tax Deductions Work When Donating A Car Dollars Bag

https://dollarsbag.com/wp-content/uploads/2023/10/donate-car.jpg

https://www.forbes.com › advisor › taxes › …

Giving up an old car to charity may qualify you for a tax deduction And charities benefit because even junk cars are more valuable amid high prices for new and used vehicles

https://www.irs.gov › faqs › itemized-deductions...

Recordkeeping and filing requirements depend on the amount you claim for the deduction 1 If the deduction you claim for the car is at least 250 but not more than 500

Donate Car For Tax Credit REETHINC

17 Big Tax Deductions Write Offs For Businesses

What Can You Write Off On Your Taxes SoundOracle Sound Kits

How To Donate A Car To Heritage For The Blind

Receive A Tax Deduction For Donating A Car

Tax Write Offs For Vehicles Over 6000 Lbs Thustt Accounting

Tax Write Offs For Vehicles Over 6000 Lbs Thustt Accounting

Are Donations To Charities 100 Tax Deductible Leia Aqui How Much Of

Car Donation Tax Writeoff Understanding The Benefits Of Donating A Car

Brilliant Tax Write Off Template Stores Inventory Excel Format

What Is Tax Write Off For Donating A Car - You ll need to report your deduction on Schedule A of your federal income tax return If your car donation is more than 500 you must also fill out IRS Form 8283 If your deduction for the car is between 501 and 5 000 fill