What Is Taxable Income In Malaysia An individual whether tax resident or non resident in Malaysia is taxed on any income accruing in or derived from Malaysia Resident individuals are also subject to tax on

Resident individuals are taxed according to the tax rate and eligible for tax reliefs in accordance with section 45A section 49 of the ITA 1967 While non resident individuals are taxed at a flat Malaysia practices a progressive rate income tax This means that your income is not taxed as a whole but rather different amounts are taxed at different rates This ranges from 0 to 30 at the highest income band

What Is Taxable Income In Malaysia

What Is Taxable Income In Malaysia

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2.jpg

Explained Current State Of Malaysian Income

https://theikhwanhafiz.com/wp-content/uploads/2022/08/BNM-2021-Annual-Report-Malaysias-households-debt.png

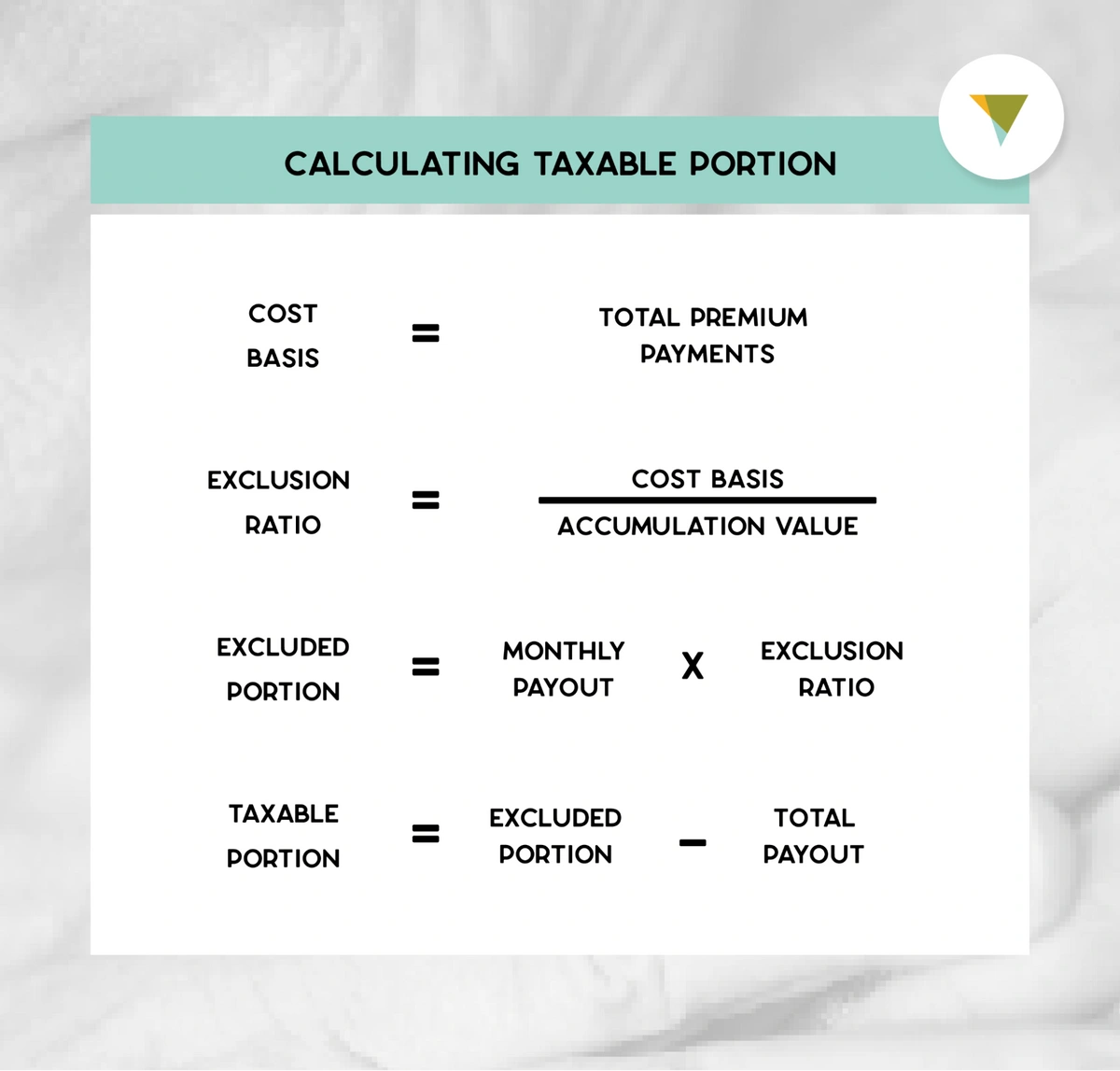

How To Calculate The Taxable Income Of An Annuity

https://cdn.buttercms.com/XcS30FnbSIuKWap6KZ6w

An individual employed in Malaysia is subject to tax on income arising from Malaysia regardless of where the employment contract is signed or the remuneration is paid With the announcement of the Malaysia Budget 2024 an individual with a taxable income of between RM50 001 and RM70 000 can enjoy a reduction in tax from 13 to 11 The tax rate for those falling within the RM70 001 to RM100 000

With this simple and easy to understand Malaysia income tax guide 2024 for Year of Assessment 2023 you will be filing your tax like a whiz in no time Want to get an estimate In this income tax Malaysia guide we have tried to explain relevant topics such as taxable income deductions tax rates and exemptions available Apart from this you can also go through our FAQs sections to get expert answers to your

More picture related to What Is Taxable Income In Malaysia

Definition Financial Literacy Taxable Income Media4Math

https://www.media4math.com/sites/default/files/library_asset/images/Definition--FinancialLiteracy--TaxableIncome.png

Personal Finance 101 Salary From KL Property From Selangor

https://img.iproperty.com.my/angel/750x1000-fit/wp-content/uploads/sites/2/2021/07/What-is-the-average-income-in-Malaysia.jpg

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

Income Tax

https://www.investopedia.com/thmb/vmecxtzh3YtlhkIY783GtuYo7Ds=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg

Apparently we are taxed because it is included in these types of taxable income Read this article to find out more Taxable Income Gross income tax exemptions Take the total amount of income you are earning and minus off the types of income that isn t taxable Let s say Ahmad has a

An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made Employment income includes salary allowances perquisites Personal Income Tax Rates Malaysia uses a progressive tax system which means that a taxpayer s tax rate increases as the income increases You must pay taxes if you

9 Types Of Taxable Income In M sia That You Never Knew

https://cdn.loanstreet.com.my/learning_articles/images/000/001/275/original/loanstreet-types-of-taxable-income-malaysia.jpg?1647329141

How To Determine Your Taxable Income In Pakistan

https://media.licdn.com/dms/image/D4D12AQF_mmcLkAOSpw/article-cover_image-shrink_720_1280/0/1690079931222?e=2147483647&v=beta&t=2oP-RpiaPZJginsu6L4bqFUiEXszDhxDyoQS7kOG5Wo

https://taxsummaries.pwc.com › malaysia › individual › ...

An individual whether tax resident or non resident in Malaysia is taxed on any income accruing in or derived from Malaysia Resident individuals are also subject to tax on

https://www.hasil.gov.my › ... › who-is-taxable

Resident individuals are taxed according to the tax rate and eligible for tax reliefs in accordance with section 45A section 49 of the ITA 1967 While non resident individuals are taxed at a flat

Budget 2023 Those Earning Up To 7 Lakh A Year Need Not Pay Income

9 Types Of Taxable Income In M sia That You Never Knew

Excel Income Tax Calculator How To Make Income Tax SexiezPix Web Porn

Income Tax Rates 2025 Australia Peters Pringer

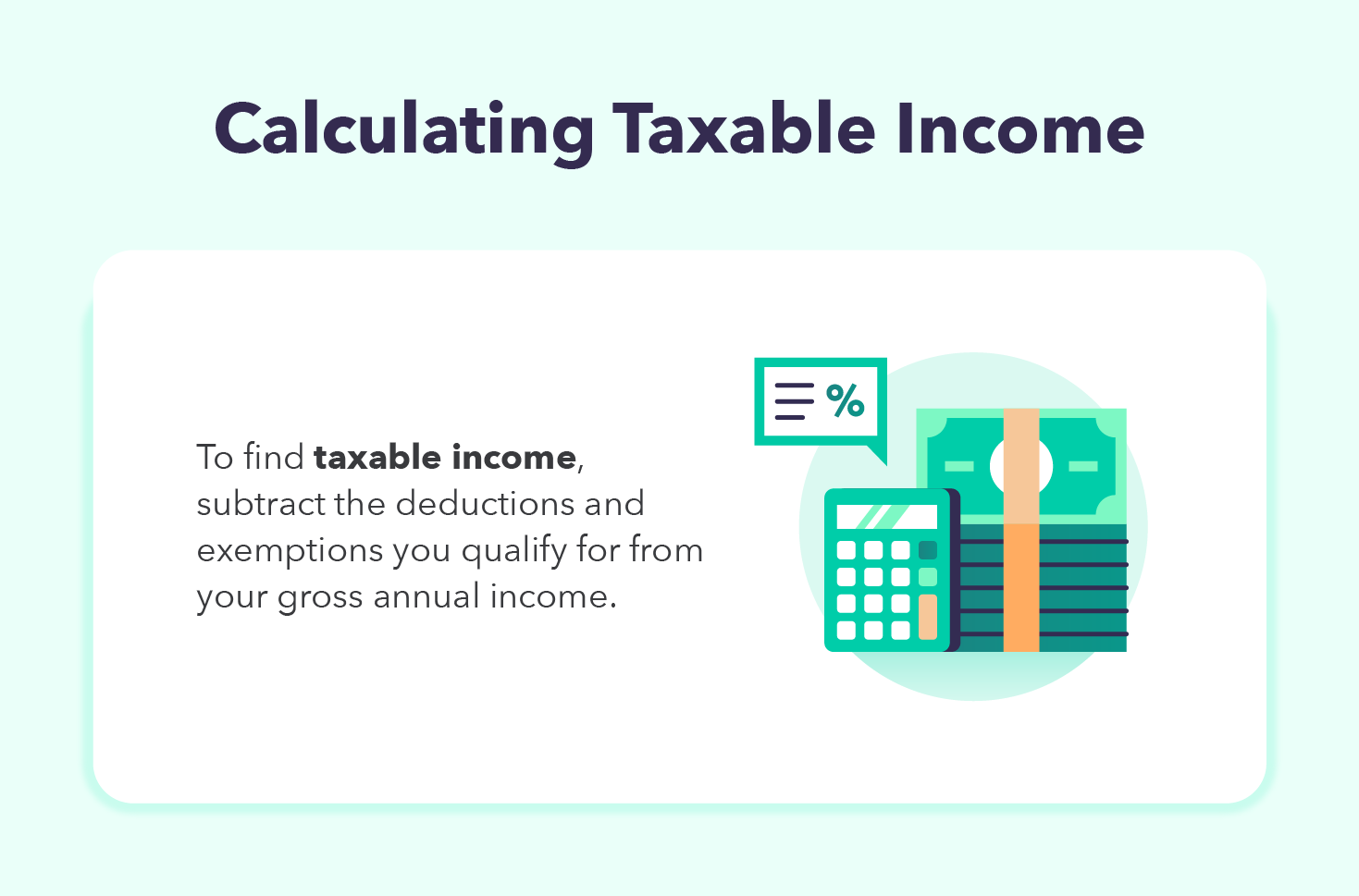

What is taxable income Financial Wellness Starts Here

What Is Income Tax And How Is It Calculated Personal Finance Library

What Is Income Tax And How Is It Calculated Personal Finance Library

Income Tax Rate Malaysia 2023 Calculator Printable Forms Free Online

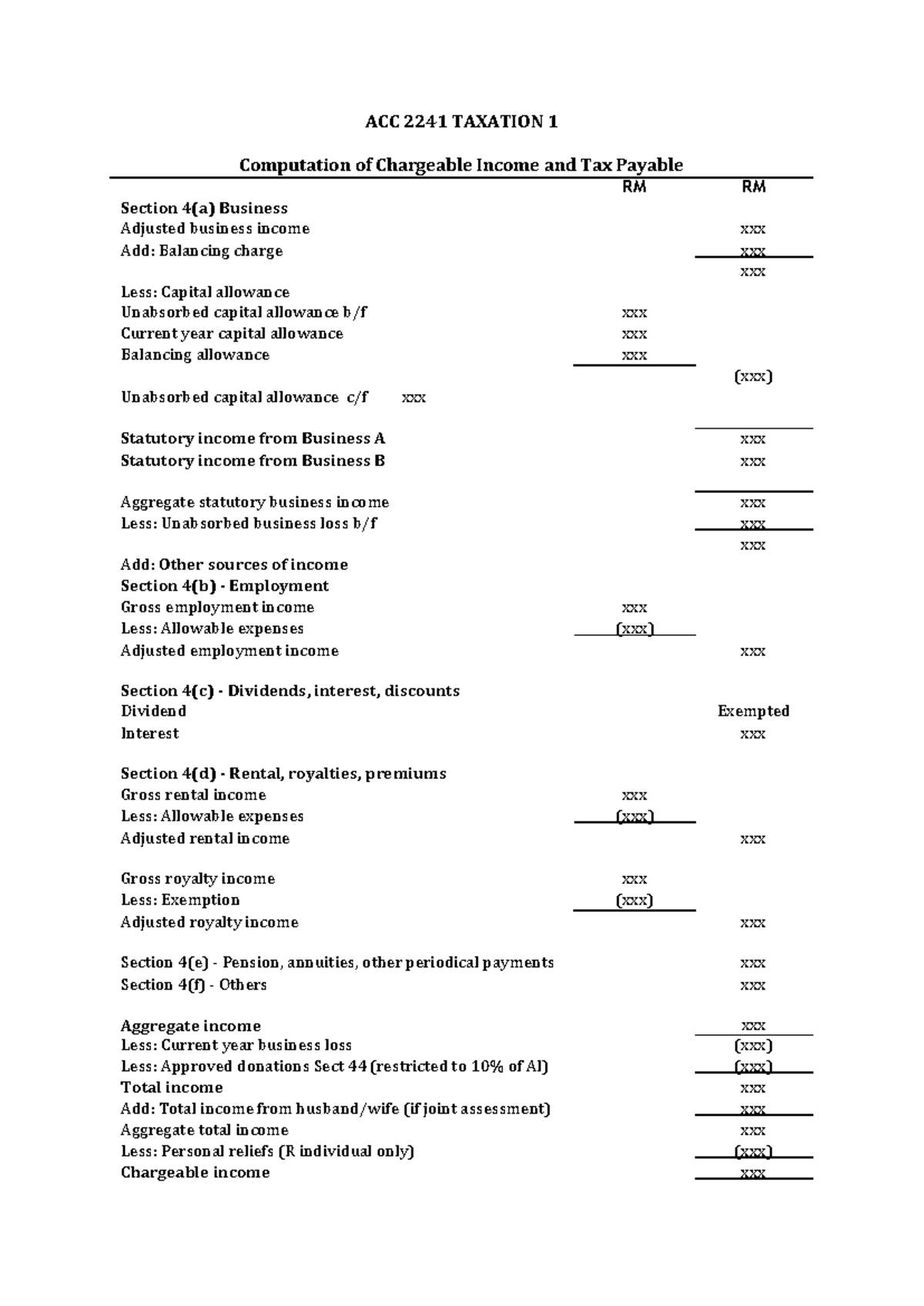

ACC 2241 Format For Chargeable Income ACC 2241 TAXATION 1 Computation

Foreign Source Income Taxable In Malaysia Nov 10 2021 Johor Bahru

What Is Taxable Income In Malaysia - Generally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business or employment income Therefore income received from