What Rate Is Social Security Income Taxed Social Security benefits are 100 tax free when your income is low As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your

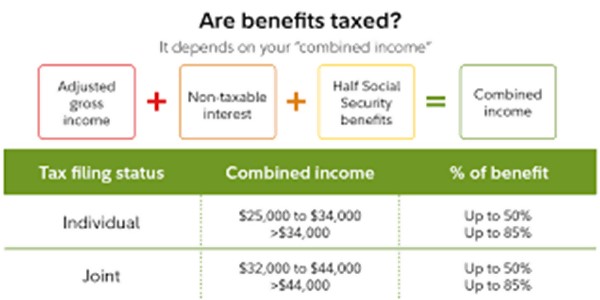

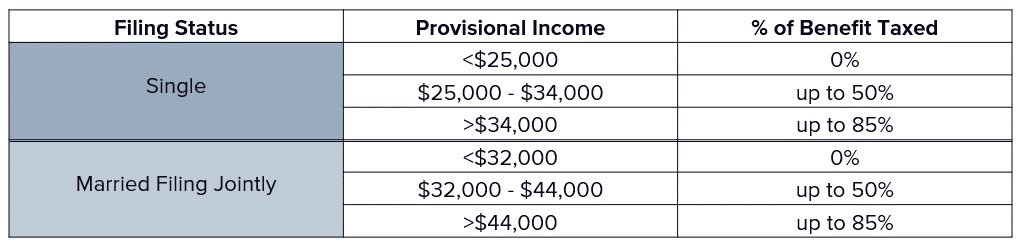

Up to 85 of a taxpayer s benefits may be taxable if they are Filing single head of household or qualifying widow or widower with more than 34 000 income Married filing jointly Up to 50 of your Social Security benefits are taxable if You file a federal tax return as an individual and your combined income is between 25 000 and 34 000

What Rate Is Social Security Income Taxed

What Rate Is Social Security Income Taxed

https://media.zenfs.com/en/smartasset_475/23673842494ef0e9d25ad87fac73fa93

Understanding How Social Security Benefits Are Taxed

https://www.wealthenhancement.com/cms/delivery/media/MCFMWPXDOK6JBF7BTOD5IE2GD5JY

How To Calculate Find Social Security Tax Withholding Social

https://i.ytimg.com/vi/q342U65tAgA/maxresdefault.jpg

The portion of your benefits subject to taxation varies with income level You ll be taxed on up to 50 percent of your benefits if your income is 25 000 to 34 000 for an individual or 32 000 to 44 000 for a married Depending on your income up to 85 of your Social Security benefits can be subject to tax That includes retirement and benefits from Social Security trust funds like survivor and

How your Social Security benefits are taxed depends on your combined income and filing status Income thresholds determine whether your benefits will be taxed at 0 50 or 85 For tax Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a

More picture related to What Rate Is Social Security Income Taxed

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

Social Security Benefit Worksheets 2021

http://socialsecurityintelligence.com/wp-content/uploads/2015/07/percent-of-Social-Security-income-that-is-taxable.png

A Closer Look At Social Security Taxation Jim Saulnier CFP Jim

https://www.jimhelps.com/wp-content/uploads/2019/08/combined-income-calculation.jpg

Up to 85 of your Social Security benefits may be subject to taxes at your ordinary income tax rate but 44 of people won t owe any income taxes on their Social Security benefits Income from Social Security benefits figures into the tax calculation and that income has gotten a big bump in recent years due to inflation The 2023 cost of living

For example if your annual Social Security benefit is 20 000 and 50 is taxable you won t lose half to taxes it means you ll only pay taxes on 10 000 of your Social Security The taxable amount depends on your combined income which is your adjusted gross income AGI plus earnings from nontaxable interest and half of your Social Security benefits and

Calculate Social Security Taxable Amount TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

States That Tax Social Security Benefits Tax Foundation

https://files.taxfoundation.org/20210205100507/States-that-tax-social-security-benefits.-does-my-state-tax-social-security-benefits-01-01.png

https://thefinancebuff.com › social-security-taxable-calculator.html

Social Security benefits are 100 tax free when your income is low As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your

https://www.irs.gov › newsroom › irs-reminds-taxpayers...

Up to 85 of a taxpayer s benefits may be taxable if they are Filing single head of household or qualifying widow or widower with more than 34 000 income Married filing jointly

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

Social Security Tax Limit 2024 Increase Netta Adelheid

Calculate Social Security Taxable Amount TaxableSocialSecurity

Tax Calculator For Social Security Benefits Internal Revenue Code

What Tax Form Do I Use If My Only Income Is Social Security Retire Gen Z

Retire Ready Are Social Security Benefits Taxed

How Do I Get Proof Of Income From Social Security Retire Gen Z

How Do I Get Proof Of Income From Social Security Retire Gen Z

Are My Social Security Benefits Taxable Calculator

What Is The Social Security Benefit Increase For 2024 Noami Belicia

When Can You Do Taxes 2024 Reyna Charmian

What Rate Is Social Security Income Taxed - Between 32 000 and 44 000 you may have to pay income tax on up to 50 of your benefits More than 44 000 up to 85 of your benefits may be taxable Are married and file a