What Will My Federal Tax Rate Be In Retirement When you re contributing to a retirement account you probably want to look at your marginal tax rate That s the tax rate you pay on an additional dollar of income The reason is because

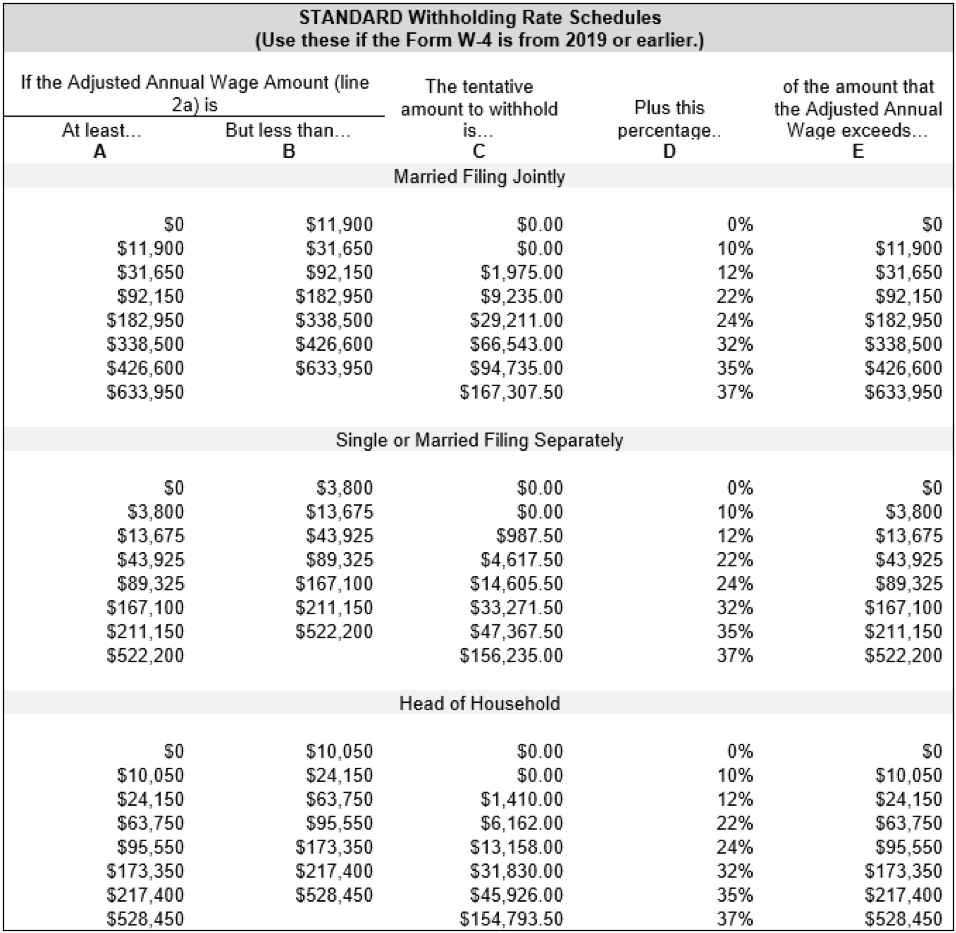

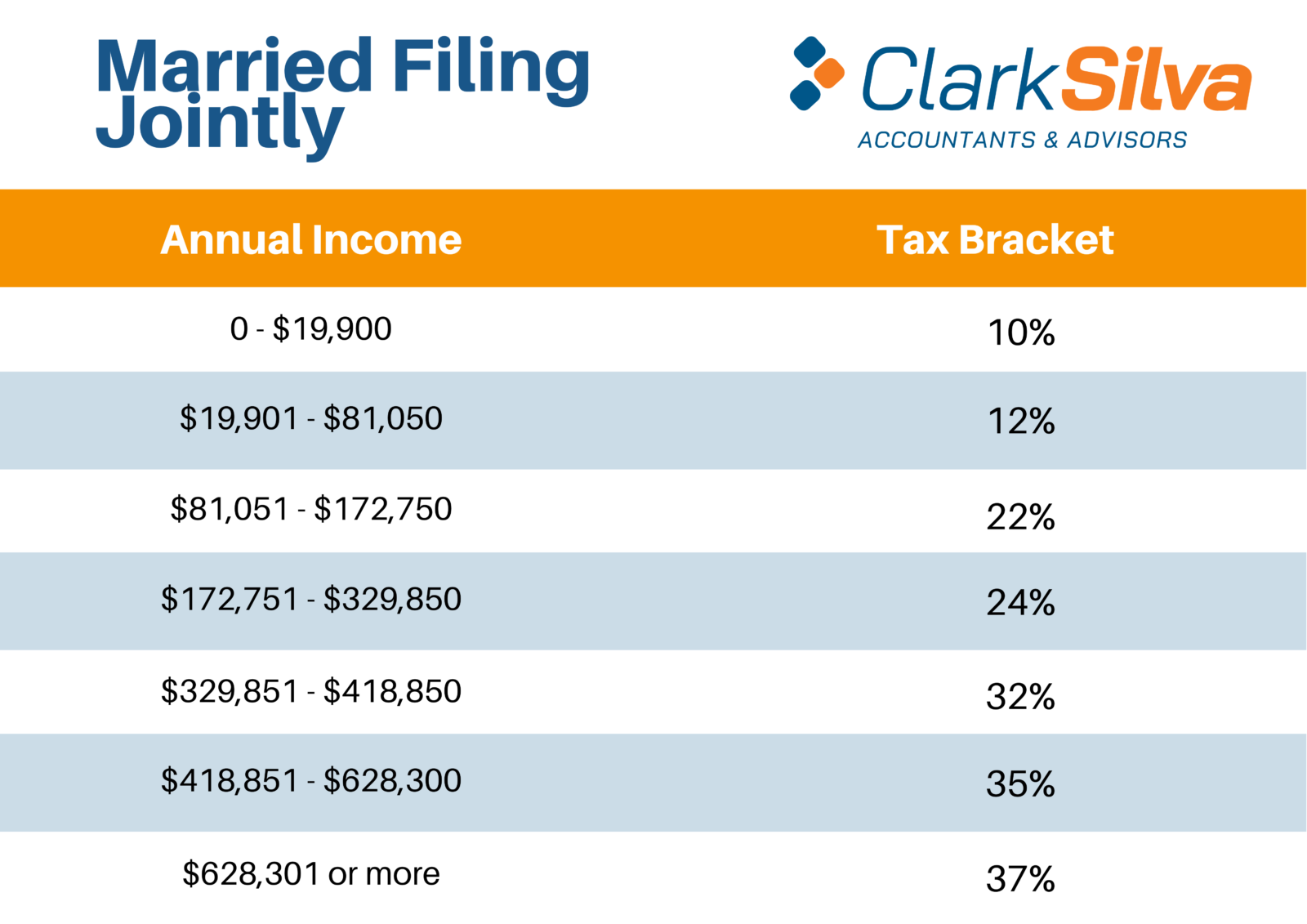

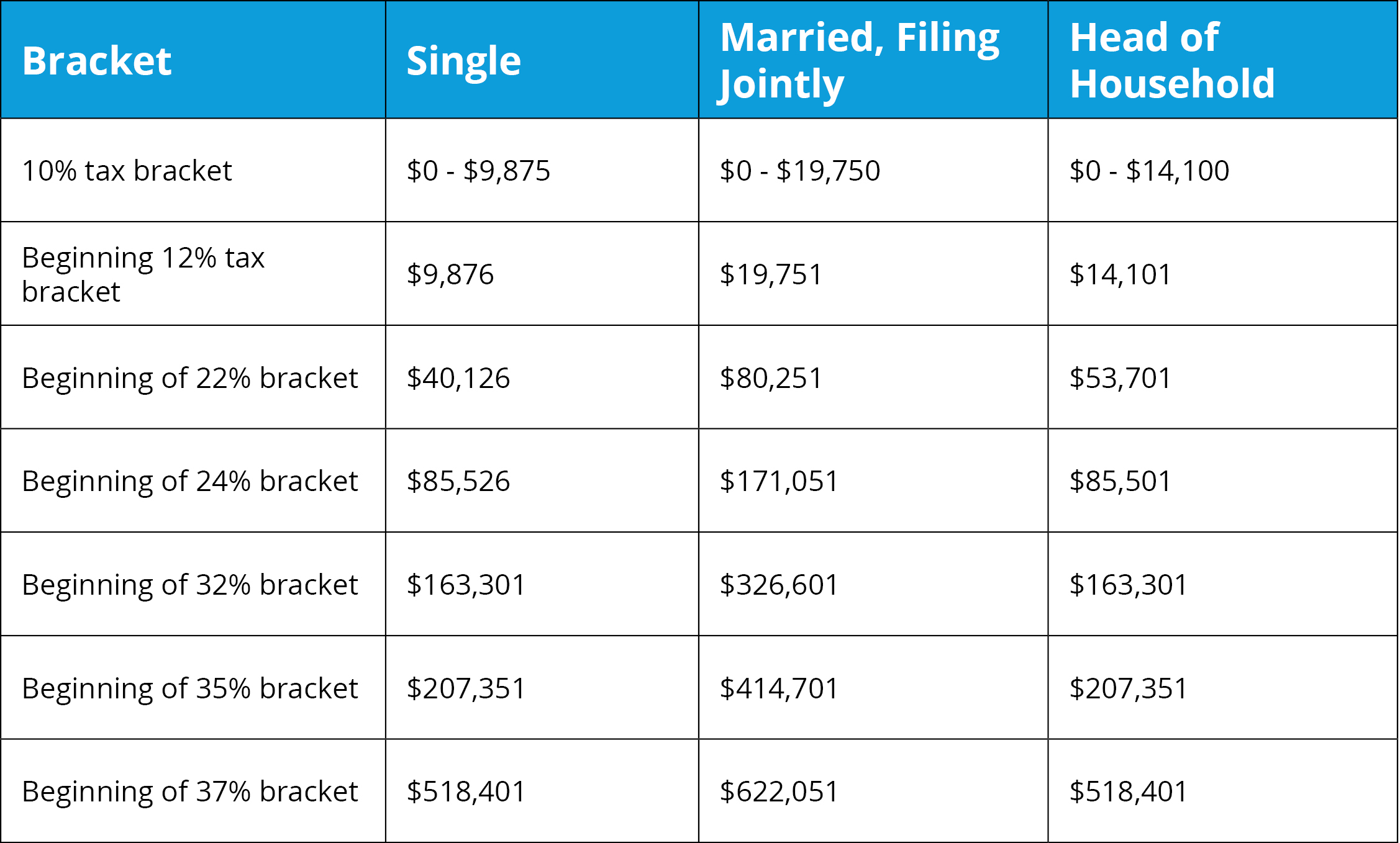

Understanding how federal income tax rates work is critical to estimating your tax burden today and planning for retirement tomorrow This The total federal income tax is 3 230 on 85 000 of retirement withdrawals from a tax diversified portfolio an effective federal income tax rate of 3 8 In our high tax state an additional 2 525 state income tax is owed

What Will My Federal Tax Rate Be In Retirement

What Will My Federal Tax Rate Be In Retirement

https://federal-withholding-tables.net/wp-content/uploads/2021/07/monthly-withholding-tax-table-2019-elcho-table-1.png

Income Tax Brackets 2024 25 2024 25 Calculator Hilary Linnell

https://federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours-1.png

Income Tax Brackets 2024 Nj Elita Heloise

https://thecollegeinvestor.com/wp-content/uploads/2022/10/TCI_-_2023_Federal_Tax_Brackets_1600x974.png

The federal tax rate on pensions is your ordinary income tax rate however you ll only be taxed to the extent that you did not contribute any post tax dollars to the pension fund The same is true for taxes on IRA and 401 k distributions made The short and general answer is yes individuals and couples generally must pay taxes in retirement Some of the taxes assessed while working will no longer be paid in retirement but other taxes will still be due

Find the 2025 tax rates for money you earn in 2025 See current federal tax brackets and rates based on your income and filing status Up to 85 of your Social Security benefits may be taxable depending on your total income and your filing status Distributions from 401 k and traditional IRA accounts are generally taxable

More picture related to What Will My Federal Tax Rate Be In Retirement

Federal Tax Guide For 2023 Image To U

https://www.wiztax.com/wp-content/uploads/2022/10/2.png

Listed Here Are The Federal Tax Brackets For 2023 Vs 2022 Finapress

https://s.yimg.com/ny/api/res/1.2/9OoVAtst.kBuEKSi3_7vLA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MA--/https://s.yimg.com/os/creatr-uploaded-images/2023-01/256761a0-9a65-11ed-b57b-4f397ac4ee71

Every State With A Progressive Tax Also Taxes Retirement Income

https://files.illinoispolicy.org/wp-content/uploads/2020/07/BT_2020.07.01_retirement-taxes.png

Your tax bracket in retirement will depend on a variety of factors including your retirement income any deductions or exemptions you may have and the tax laws in effect at the time you retire How can I plan for my tax In this article we will look at a series of sample calculations so you can see how to calculate your tax withholding in retirement We look at scenarios using the 2024 tax rates and rules The goal is to withhold enough taxes that

The paradox is this If you re in a lower tax bracket now the only way for you to be in a higher tax bracket in retirement is by spending a ton of money after you retire but you Even if your annual income is 1 million at least 15 of your Social Security benefits will stay tax free The IRS has a somewhat complex formula to determine how much

Tax Brackets 2024 Irs Single Tasia Fredrika

https://topdollarinvestor.com/wp-content/uploads/2022/11/2022-Federal-Income-Tax-Brackets-1.png

Irse A Madrid Ayuda A Crecer Profesionalmente IT Forocoches

https://files.taxfoundation.org/20230217151820/2023-state-individual-income-tax-rates-2023-state-income-taxes-by-state.png

https://www.forbes.com › sites › financialfi…

When you re contributing to a retirement account you probably want to look at your marginal tax rate That s the tax rate you pay on an additional dollar of income The reason is because

https://www.thebalancemoney.com

Understanding how federal income tax rates work is critical to estimating your tax burden today and planning for retirement tomorrow This

Here Are The Federal Income Tax Brackets For 2023

Tax Brackets 2024 Irs Single Tasia Fredrika

2024 Irs Tax Rates And Brackets Lotta Rhiamon

Tax Brackets 2021 2020 Year End Tax Planning Highlights For

What Items Are Subject To Use Tax At Sue Walker Blog

Tax Calculator Canada Free At Donald Hernandez Blog

Tax Calculator Canada Free At Donald Hernandez Blog

[img_title-14]

[img_title-15]

[img_title-16]

What Will My Federal Tax Rate Be In Retirement - Find the 2025 tax rates for money you earn in 2025 See current federal tax brackets and rates based on your income and filing status