Does North Carolina Tax Social Security Retirement Benefits Thirteen states tax Social Security benefits a matter of significant interest to retirees Each of these states has its own approach to determining what share of benefits is

North Carolina taxes on retirees North Carolina taxes most types of retirement income But the state has a low flat income tax rate and that rate will drop even lower over the In North Carolina your Social Security benefits are not taxable however the state taxes most other retirement income at the flat rate of 4 5 Additionally North Carolina has

Does North Carolina Tax Social Security Retirement Benefits

Does North Carolina Tax Social Security Retirement Benefits

https://imageio.forbes.com/specials-images/imageserve/5f57afb43ae66c5013d10081/0x0.jpg?format=jpg&height=900&width=1600&fit=bounds

.png?width=1000&name=MicrosoftTeams-image (13).png)

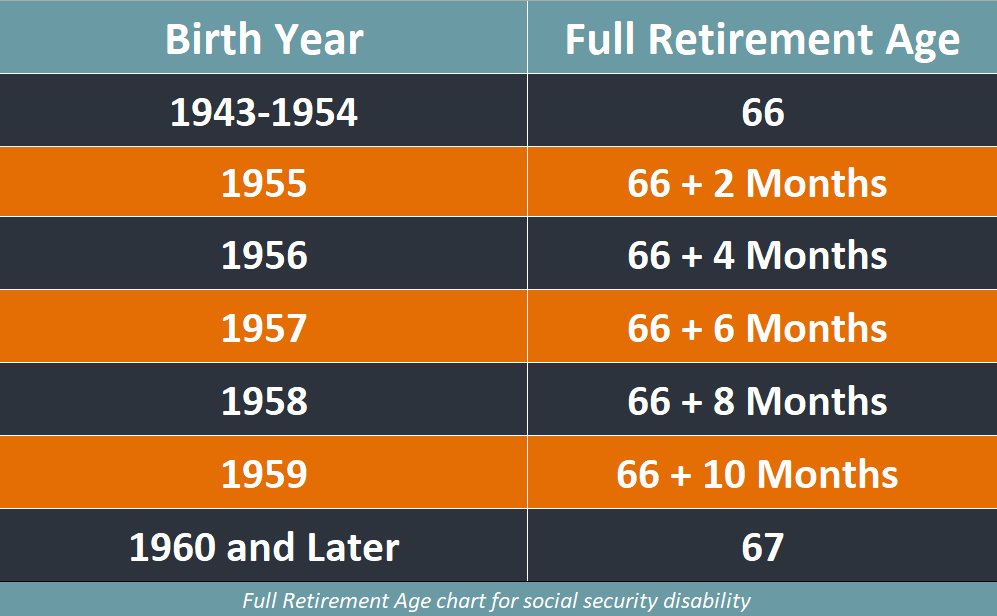

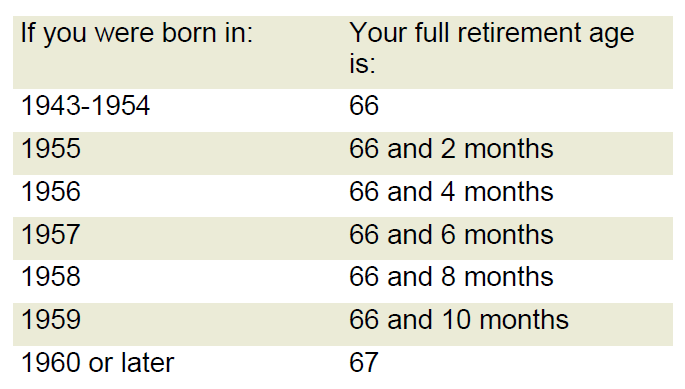

How Much Social Security Will I Get At Age 65

https://www.disabilityexpertsfl.com/hs-fs/hubfs/MicrosoftTeams-image (13).png?width=1000&name=MicrosoftTeams-image (13).png

Social Security Retirement Benefits Eligibility Amount Calculator

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhe0BohAkx4I9CGDVYi9OqXtSIQS8VpgEx5kqdShpC4zogrygl0H22T5pay-X29kAJHk8VM8KNGqPrxNzQFn08Oz3gSTDvxAyArRnHocMwMWfy8NcWePzQFe2o6SJOrLkONRt5yA4FQoRANU-Bwg-aB0GUceTwKezvaBCCkuECn_SdIisX4JzPaPOQd/s756/rb1.jpg

State of North Carolina North Carolina may not tax certain retirement benefits received by retirees or by beneficiaries of retirees of the state of North Carolina and its local governments If you do not have 5 years of maintained retirement service credit as of August 12 1989 the taxable portion of your retirement benefit is subject to North Carolina income tax If you are not a resident of North Carolina you may not owe North

North Carolina cannot tax certain retirement benefits received by retirees or by beneficiaries of retirees of the U S government and the state of North Carolina and its local governments as Social Security is exempt All other forms of retirement income are taxed at the North Carolina flat income tax rate of 5 25 Although the state taxes retirement benefits the

More picture related to Does North Carolina Tax Social Security Retirement Benefits

Optimizing Your Social Security Retirement Benefits Canavan Wealth

https://static.fmgsuite.com/media/ContentFMG/variantSize/cfb5b76a-0290-483f-840e-b550162bd521.png?v=1

What You Need To Know About Social Security Retirement Benefits

https://static.wixstatic.com/media/b2f968_3ff9bc1b6d2546ab8ee4684e2c2cf71d~mv2.jpg/v1/fill/w_1000,h_562,al_c,q_85,usm_0.66_1.00_0.01/b2f968_3ff9bc1b6d2546ab8ee4684e2c2cf71d~mv2.jpg

Can You Work Full Time While Receiving Social Security At 66

https://www.clausonlaw.com/blog/wp-content/uploads/2022/08/data-1.png

North Carolina cannot tax certain retirement benefits such as the North Carolina Teachers and State Employees Retirement System and the North Carolina Consolidated North Carolina is one of the many states that does not impose a tax on social security benefits Taxable Social Security and Railroad Retirement on your federal tax return are exempt from

In North Carolina Social Security benefits are not taxable However the state does tax most other retirement income including withdrawals from retirement accounts and pension No Social security and railroad retirement benefits are not subject to NC State income tax No Your federal retirement will not be taxed as long as the retiree had five or

What Happens If I Work And Get Social Security Retirement Benefits

https://i.ytimg.com/vi/uIVSAm64b4Q/maxresdefault.jpg

These 12 States At Risk Losing Some Social Security Retirement Benefits

https://i.ytimg.com/vi/GMFjoxHQsAU/maxresdefault.jpg

https://taxfoundation.org/data/all/state/states...

Thirteen states tax Social Security benefits a matter of significant interest to retirees Each of these states has its own approach to determining what share of benefits is

.png?width=1000&name=MicrosoftTeams-image (13).png?w=186)

https://www.kiplinger.com/retirement/602202/taxes...

North Carolina taxes on retirees North Carolina taxes most types of retirement income But the state has a low flat income tax rate and that rate will drop even lower over the

Working And Receiving Social Security Retirement Benefits Don t Forget

What Happens If I Work And Get Social Security Retirement Benefits

Maximizing Social Security Benefits EBook Mary Beth Franklin

Social Security Retirement Benefit Basics Articles Consumers Credit

How To Maximize Your Social Security Retirement Benefits National

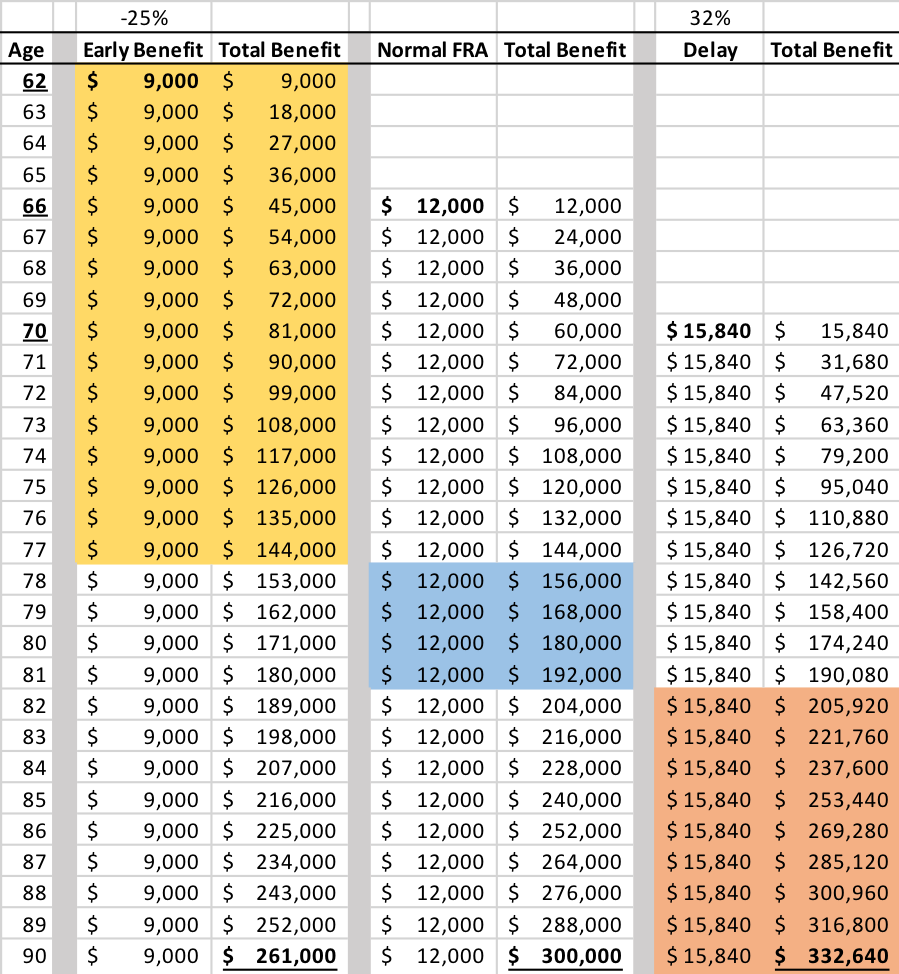

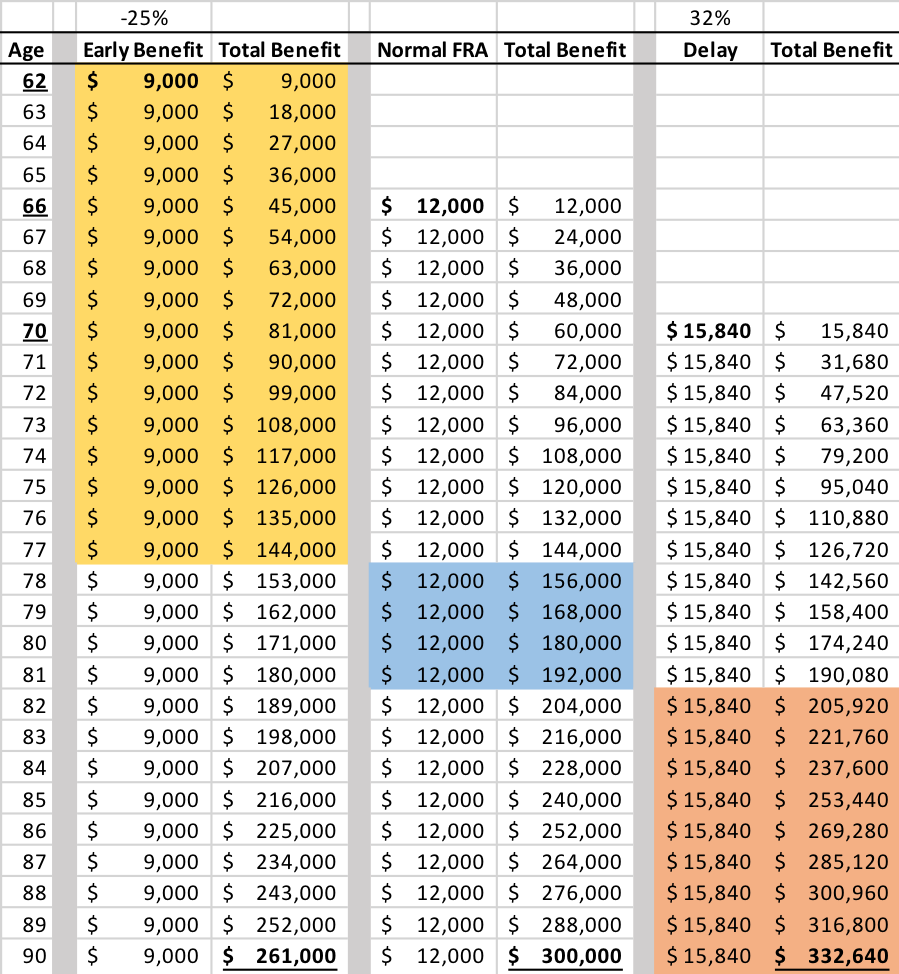

The Best Age To Begin Collecting Social Security Retirement Benefits

The Best Age To Begin Collecting Social Security Retirement Benefits

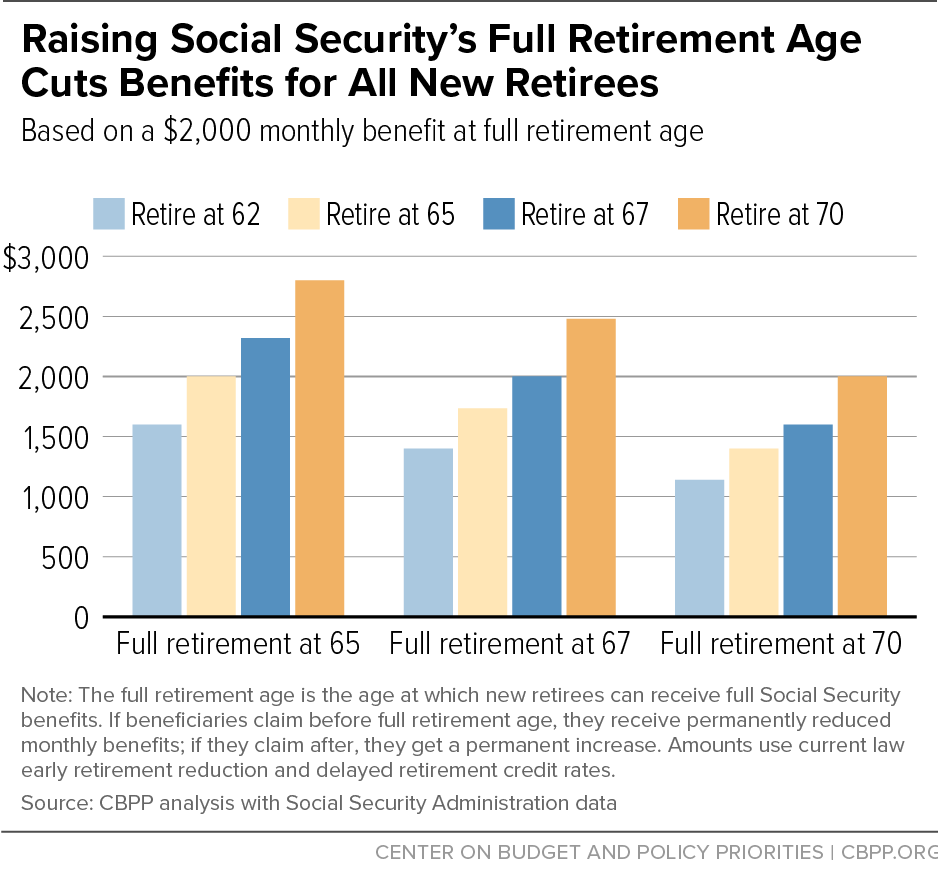

Raising Social Security s Retirement Age Would Cut Benefits For All New

These Retirees Will Not Receive More Social Security Payments In 2023

NC Gives Veterans Tax Credits On Income And Property Taxes Wfmynews2

Does North Carolina Tax Social Security Retirement Benefits - North Carolina is considered moderately tax friendly for retirees While the state does impose income tax on most retirement sources Social Security benefits are exempted