Does North Carolina Tax Social Security Does North Carolina tax Social Security benefits No but you may pay federal taxes on a portion of your Social Security benefits depending on your income

In North Carolina Social Security benefits are exempt from state income tax consistent with federal rules This policy helps retirees retain more income particularly those In North Carolina all Social Security and Railroad Retirement benefits are exempt from state income taxes which is a great advantage for retirees relying on these sources of income

Does North Carolina Tax Social Security

Does North Carolina Tax Social Security

https://youngandtheinvested.com/wp-content/uploads/states-that-tax-social-security-benefits.jpg

All The States That Don t Tax Social Security

https://s.yimg.com/ny/api/res/1.2/dgwqwQhvH515JfC5eoMr_A--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en/gobankingrates_644/4afa518b9fffb011352f000d64b66f59

Does Social Security Count Toward Your AGI Leia Aqui Is Social

https://cdn.mos.cms.futurecdn.net/uiZ7oNVwGfuaD9UhiJodCF.jpg

Thirty seven states and D C either have no income tax AK FL NV SD TN TX WA WY or do not include Social Security benefits in their calculation for taxable income AL North Carolina exempts all Social Security retirement benefits from income taxes Other forms of retirement income are taxed at the North Carolina flat income tax rate of 4 50 The state s

If your social security or railroad retirement benefits were taxed on your federal return you may take a deduction for those benefits on your North Carolina individual income tax return While Social Security income is not taxed the state does charge income tax on most other retirement sources including 401 k s pensions and IRAs Currently North

More picture related to Does North Carolina Tax Social Security

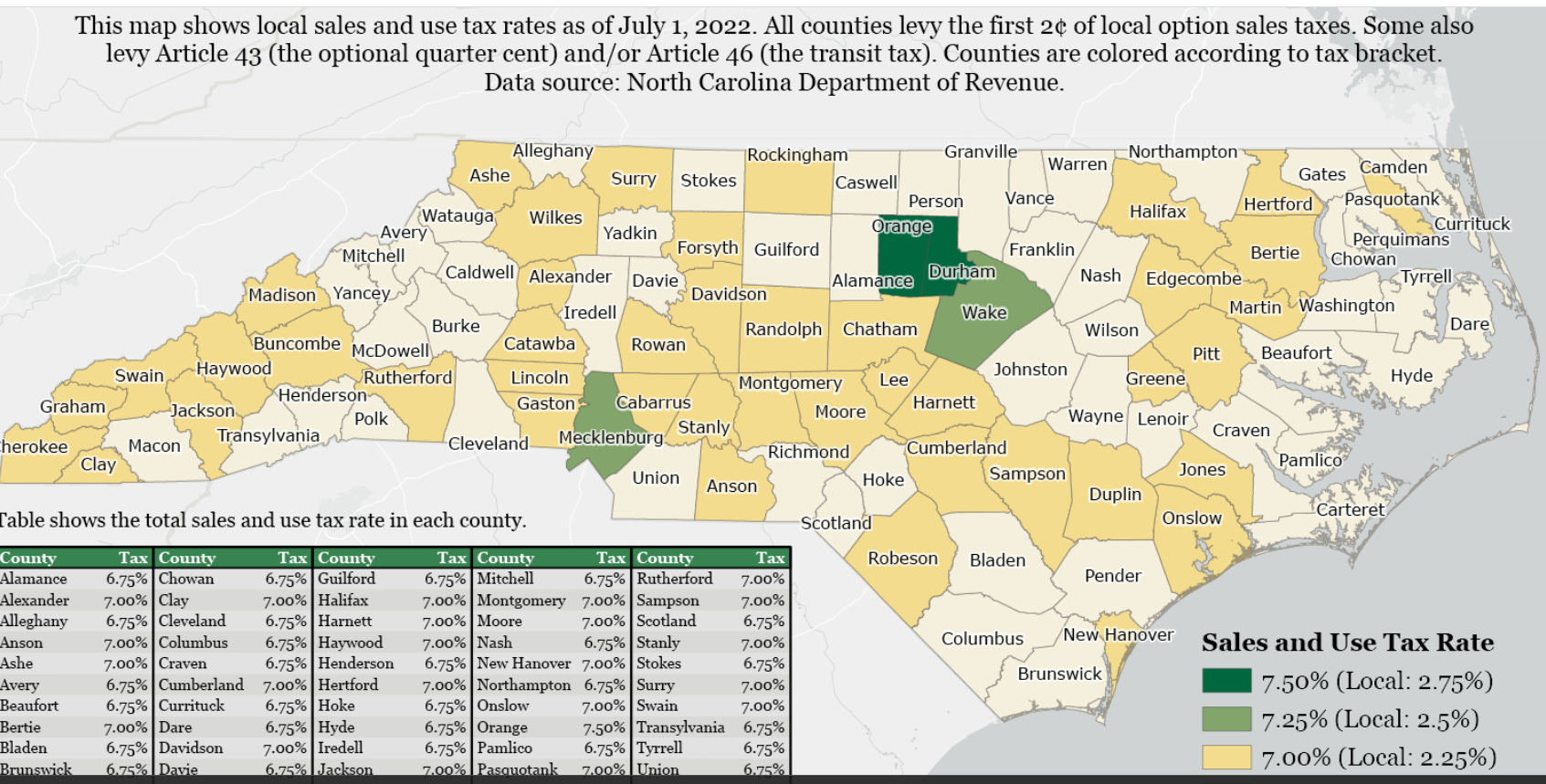

Would Regressive Sales Tax Create Less New Burden On County Taxpayers

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fdaf8bfff-682f-486d-b2cb-348665f826b0_1693x859.png

Meet The 38 States That Do Not Tax Social Security Do You Live In One

https://www.tododisca.com/en/wp-content/uploads/2022/10/In-some-States-you-do-not-have-to-pay-taxes-from-your-Social-Security-benefit-1024x631.jpg

What States Don t Tax Social Security Mistersocialsecurity

https://i4.ytimg.com/vi/a3ok3woyMgw/sddefault.jpg

North Carolina is one of 38 states without a tax on Social Security income as of 2020 However there could still be a tax bill to cover if you drew income from other sources For the 2024 tax year 35 of Social Security benefits were exempt from the tax This year 65 of benefits are exempt and beginning in 2026 all Social Security benefits will

[desc-10] [desc-11]

Biz North Carolina Tax Rates Change Interest Rate Hikes Hit Home

https://media.bizj.us/view/img/12420427/5258955143794efa6592fk*1200xx2048-1152-0-107.jpg

Is Yours One Of The States That Do Not Tax Social Security YouTube

https://i.ytimg.com/vi/vp5DRmgCwfY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBPKEEwDw==&rs=AOn4CLCJZ00HGqYB3ZAe66KQ5IWM97Cfrg

https://states.aarp.org › north-carolina › state-taxes-guide

Does North Carolina tax Social Security benefits No but you may pay federal taxes on a portion of your Social Security benefits depending on your income

https://accountinginsights.org › is-social-security...

In North Carolina Social Security benefits are exempt from state income tax consistent with federal rules This policy helps retirees retain more income particularly those

States That May Cut Taxes On Social Security Income SSI Texas

Biz North Carolina Tax Rates Change Interest Rate Hikes Hit Home

Retirees In These States May Need To Prepare For Lower Social Security

Money On LinkedIn Which States Tax Social Security Benefits Missouri

A National Security Disaster Intel Officials Sound The Alarm Of The

Zuhause November 2020

Zuhause November 2020

NC Bill Would Require Parents To Opt in For Sex Ed In Schools Wcnc

July PAY STUB 03 PDF Federal Insurance Contributions Act Tax

Are North Carolina Retirement Taxes Affordable For Retirees

Does North Carolina Tax Social Security - If your social security or railroad retirement benefits were taxed on your federal return you may take a deduction for those benefits on your North Carolina individual income tax return