Is Disability Insurance Considered Income If you get benefits from a disability insurance policy the IRS classifies your payments based on who paid the insurance premiums If you paid the whole cost of the

While the answer is NO disability benefits are not considered earned income it s important to know the difference between earned and unearned income and know where your benefits fit in Social Security Disability Insurance SSDI does not have strict income and asset requirements like Supplemental Security Income SSI does But one may still wonder what

Is Disability Insurance Considered Income

Is Disability Insurance Considered Income

https://news.hr.ufl.edu/wp-content/uploads/sites/11/2022/10/UFHR_BenefitsStories_Disability_Infographic-602x1024.jpg

Disability Insurance A Benefit For All

http://blog.disabilitycanhappen.org/wp-content/uploads/sites/5/2017/03/Screen-Shot-2017-03-28-at-9.31.00-PM.png

Disability Insurance Personal Insurance Solutions

https://brsipersonal.com/wp-content/uploads/sites/4/2015/06/bigstock-Ability-Not-Disability-79289611.jpg

Many insurance companies offer disability policies and if you buy one it is usually out of your own pocket which means after tax In that case the payments you later receive on How disability payments are taxed depends on the source of the disability income The answer will change depending on whether the payments are from a disability insurance policy

If you re receiving disability income you may wonder if it s taxable The answer It depends Disability income can vary widely from private insurance benefits to Social Security Social Security Disability Insurance SSDI benefits may be taxable based on the recipient s total income If an individual s combined income exceeds 25 000 for single filers or

More picture related to Is Disability Insurance Considered Income

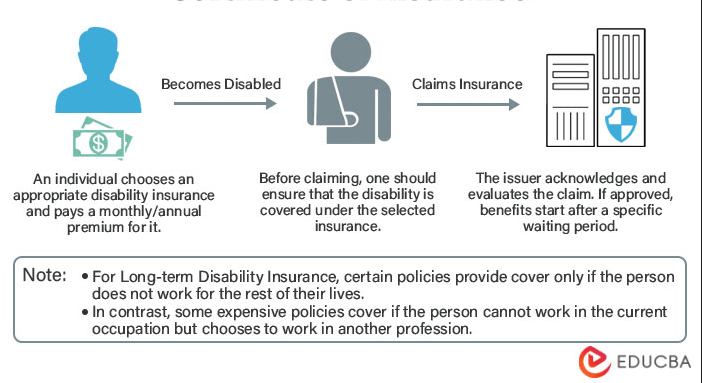

Disability Insurance Meaning Types Benefits Examples

https://cdn.educba.com/academy/wp-content/uploads/2022/11/How-Does-Disability-Insurance-Work.png

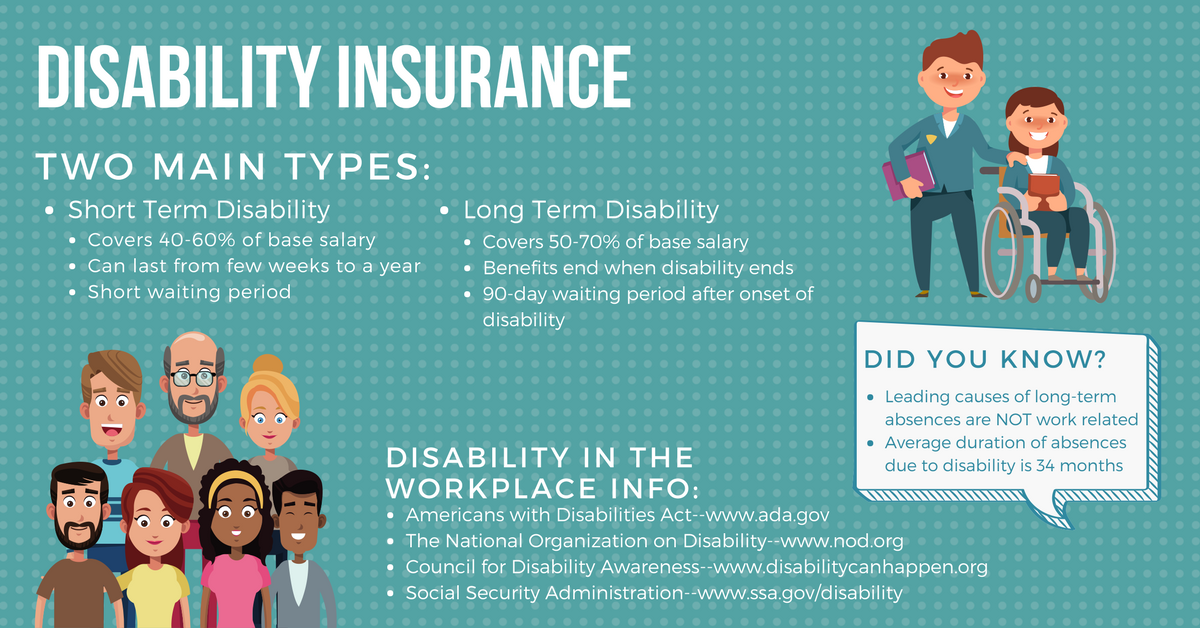

What Is Disability Insurance

https://static.secure.website/wscfus/10525758/10368066/disability-insurance-image-w960-o.jpg

Florida Temporary Disability Insurance Polreproductions

https://images.squarespace-cdn.com/content/v1/5759d27e1d07c0ba50a9bd7e/1522866847656-QICH7I3H8Q70QCGWJ58M/Disability+Insurance+infographic.png

The IRS generally considers any disability benefits you receive to be taxable income though some of these funds may qualify for exemption if your medical expenses How Pre Tax vs Post Tax Premium Payments Cause Different Disability Insurance Taxation Your employer pays 100 of the group disability insurance premium and deducts the premium

[desc-10] [desc-11]

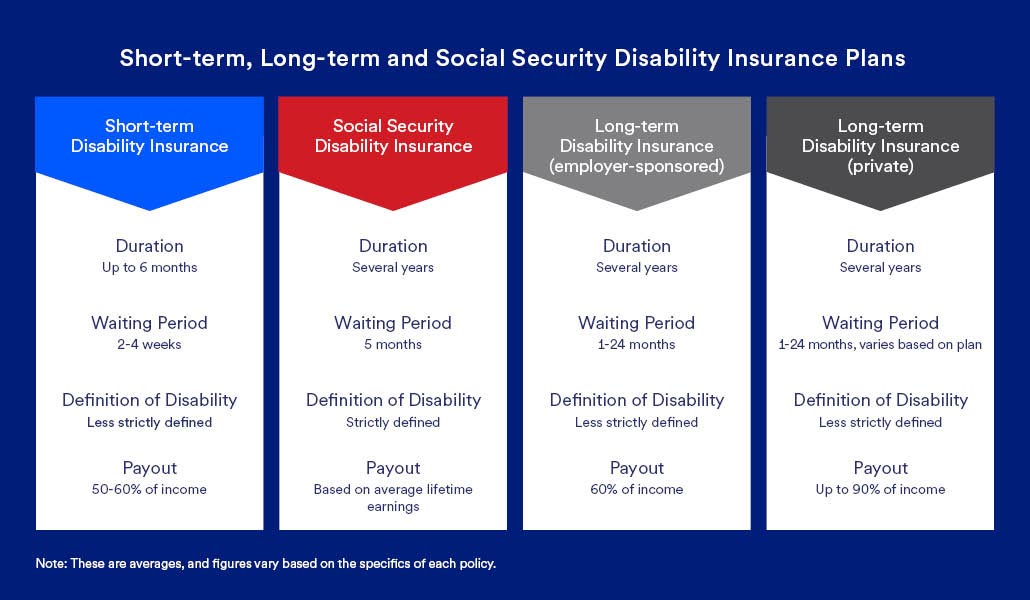

What Is The Difference Between Social Security Disability Insurance

https://i.pinimg.com/originals/8d/91/ef/8d91ef6c08d151325cbf3153bc80d16c.png

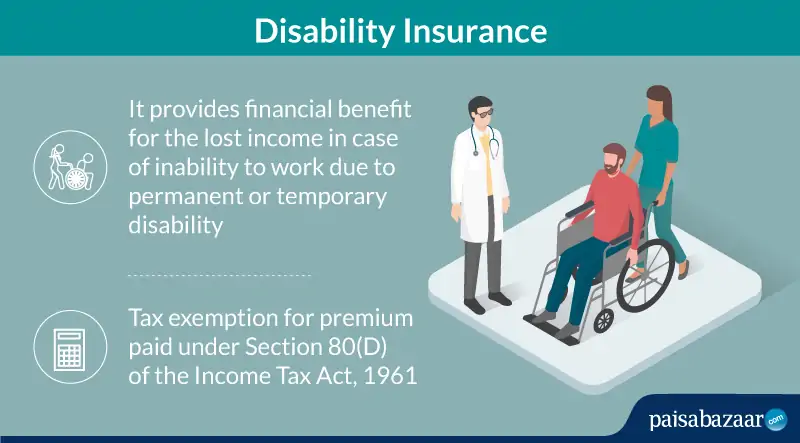

Disability Insurance Definition Why You Need It And How To Get It

https://www.thestreet.com/.image/t_share/MTY3NTM5NTUyODkzMTUxMTE4/disability-insurance-definition-why-you-need-it-and-how-to-get-it.jpg

https://budgeting.thenest.com › disability-benefits...

If you get benefits from a disability insurance policy the IRS classifies your payments based on who paid the insurance premiums If you paid the whole cost of the

https://www.disabilitybenefitscenter.org › faq › is...

While the answer is NO disability benefits are not considered earned income it s important to know the difference between earned and unearned income and know where your benefits fit in

:max_bytes(150000):strip_icc()/diinsurance_v3-bf77d05568264d77a7f79ec956ef3d82.png)

Disability Insurance Images

What Is The Difference Between Social Security Disability Insurance

Disability Insurance Images

Disability Insurance Graphs

Social Security Benefits 2025 Amandy Velvet

Disability Income Limits 2025 Scott M Fridley

Disability Income Limits 2025 Scott M Fridley

Disability Insurance Explained Thams Agency

Ssi Disability Increase 2025 Donia Teddie

Disability Insurance Coverage Claim Renewal

Is Disability Insurance Considered Income - Social Security Disability Insurance SSDI benefits may be taxable based on the recipient s total income If an individual s combined income exceeds 25 000 for single filers or