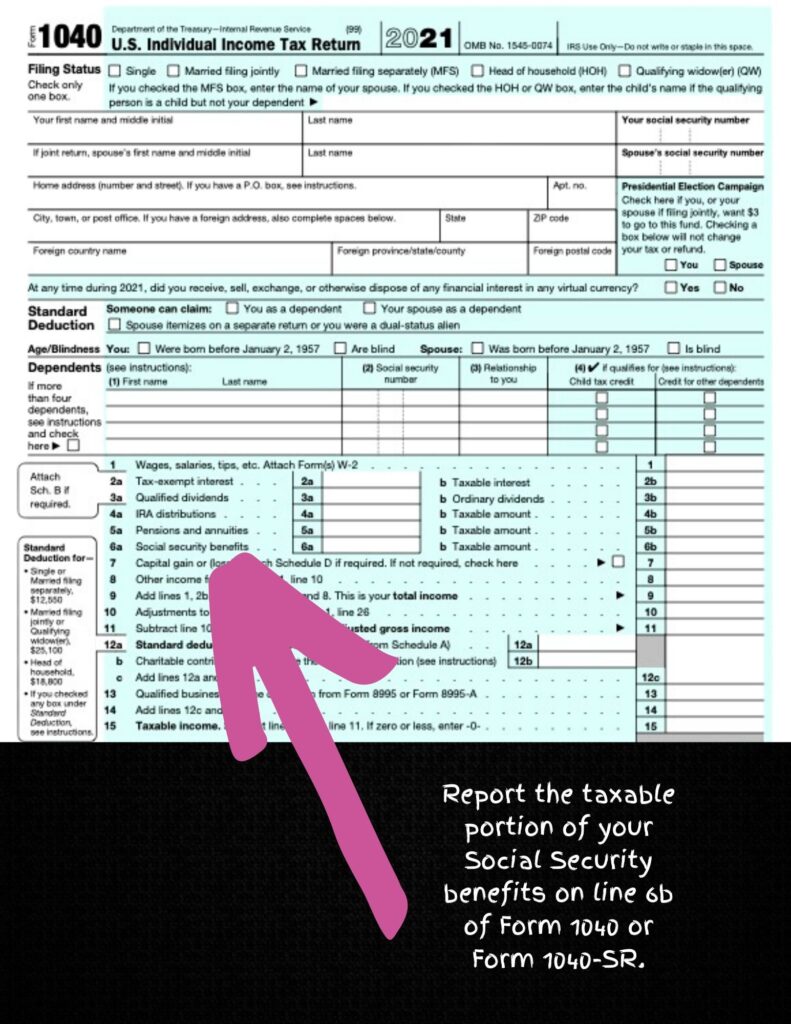

Is Social Security Disability Insurance Considered Income Social Security Disability Insurance SSDI benefits may be taxable if you receive income from other sources such as dividends or tax exempt interest or if your spouse earns income If you are married and file jointly you can report up to 32 000 of income made up of half of your SSDI benefits plus all of your other income before needing

The Social Security administration has outlined what does and doesn t count as earned income for tax purposes While the answer is NO disability benefits are not considered earned income it s important to know the difference between earned and unearned income and know where your benefits fit in during tax season Let s start with the basics do Social Security Disability Insurance SSDI benefits count as income For the most part SSDI payments do not count as income However these payments could still be taxed if they exceed a certain amount

Is Social Security Disability Insurance Considered Income

Is Social Security Disability Insurance Considered Income

https://www.cbpp.org/sites/default/files/atoms/files/8-1-17ss-chartbook_p1f3.png

Qualifying For SSDI Benefits Key Eligibility Criteria EDDCaller Blog

https://momsinmotion.net/wp-content/uploads/2020/06/SSI-v-SSDI-768x576.png

What Is The Difference Between Social Security Disability Insurance

https://i.pinimg.com/originals/8d/91/ef/8d91ef6c08d151325cbf3153bc80d16c.png

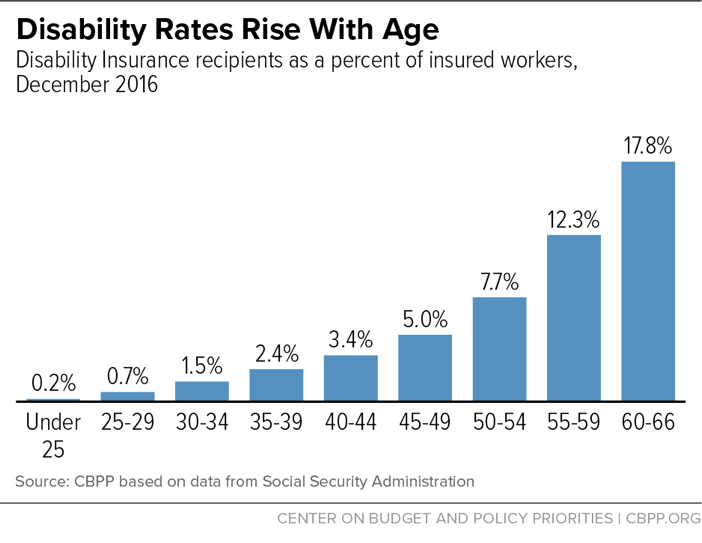

The SSDI program doesn t put a limit on the amount of assets or unearned income you have unlike the low income disability program Supplemental Security Income SSI But the Social Security Administration SSA does put a limit on the amount of money that you can earn through work when you receive Social Security disability benefits because Social Security disability benefits aren t earned income and neither are military disability benefits They are unearned income In addition most people receiving Social Security and military disability won t have to pay taxes on their benefits unless they have a lot of income from other sources

The SSA offers two main types of disability benefits Social Security Disability Insurance SSDI and Supplemental Security Income SSI SSDI provides monthly payments based on your prior earnings history SSI pays out a flat rate amount each month regardless of past income levels When you receive Social Security Disability Insurance SSDI benefits it is crucial to understand the types of income you must report to the Social Security Administration SSA Reporting income accurately ensures compliance with SSA regulations and helps maintain your benefits Let s dive deeper Types of Income to Report

More picture related to Is Social Security Disability Insurance Considered Income

Ssdi Max Income 2025 Benny Cecelia

https://quikaidpublicweb.blob.core.windows.net/brand/SOCIAL SECURITY DISABILITY INSURANCE VS. SUPPLEMENTAL SECURITY INCOME.png

ADA Disability Discrimination And SSDI Benefits Claim

http://sacemploymentlawyer.com/wp-content/uploads/2015/02/ssdi-benefits-application.jpg

Ssi Disability Increase 2025 Teresa R Moors

https://www.clausonlaw.com/blog/wp-content/uploads/2021/12/2300-disability-benefit-calculator-PROMO-2048x1365.jpg

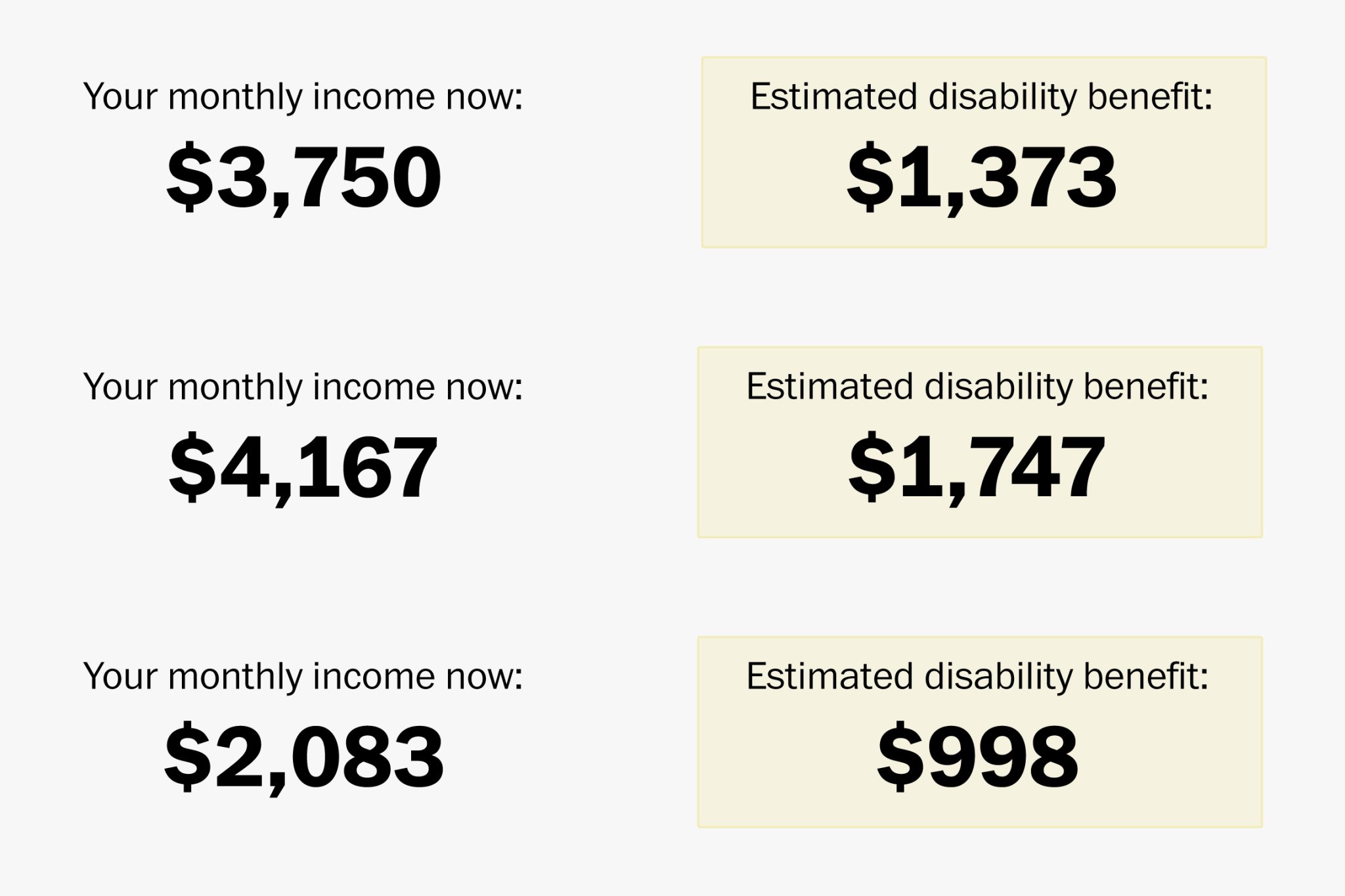

If you re eligible for Social Security Disability Insurance SSDI benefits the amount you receive each month will be based on your average lifetime earnings before your disability began Unlike veterans compensation workers comp or Supplemental Security Income payments SSDI isn t based on how severe your disability is or how much income Income is a key factor in determining eligibility for Supplemental Security Income SSI a monthly benefit for people in financial straits who are 65 and older blind or have a disability The Social Security Administration SSA which operates the program strictly regulates the type and amount of income someone can receive and still qualify

[desc-10] [desc-11]

Social Security Payment Schedule May 2025 Eli Rami

https://directexpress.info/wp-content/uploads/2021/09/SSA-payments-Schedule.png

Ssi Disability Increase 2025 Donia Teddie

https://clarkforklaw.com/wp-content/uploads/2017/06/iStock-183295330.jpg

https://turbotax.intuit.com › tax-tips › disability › is...

Social Security Disability Insurance SSDI benefits may be taxable if you receive income from other sources such as dividends or tax exempt interest or if your spouse earns income If you are married and file jointly you can report up to 32 000 of income made up of half of your SSDI benefits plus all of your other income before needing

https://www.disabilitybenefitscenter.org › faq › is...

The Social Security administration has outlined what does and doesn t count as earned income for tax purposes While the answer is NO disability benefits are not considered earned income it s important to know the difference between earned and unearned income and know where your benefits fit in during tax season

Ssi Increase 2024 Disability Amount Deena Othelia

Social Security Payment Schedule May 2025 Eli Rami

Social Security 2025 Fact Sheet In Hindi Minnie G Larue

2025 Ssdi Payment Schedule Pdf Selena Noor

Social Security Income Limit 2025 Increase Asha Claire

Social Security Disability Income Limit 2024 Dion Mozelle

Social Security Disability Income Limit 2024 Dion Mozelle

How Much Does Ssdi Pay In 2024 Bebe Marijo

Ssdi Taxable Income Calculator RanaldBraiden

Social Security Disability Benefits Cola 2024 Margi Saraann

Is Social Security Disability Insurance Considered Income - [desc-12]