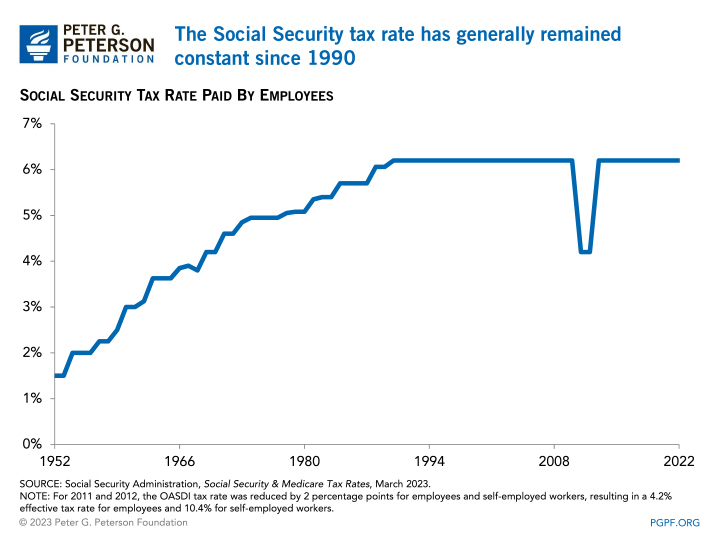

Social Security Tax Rate 2024 The current tax rate for Social Security is 6 2 for the employer and 6 2 for the employee or 12 4 total The current rate for Medicare is 1 45 for the employer and 1 45 for the employee or 2 9 total

In Nigeria social security deductions such as contributions to the National Pension Scheme National Health Insurance Scheme NHIS and the National Housing Fund NHF are generally deductible when calculating taxable income Social security and Medicare tax for 2024 The social security tax rate is 6 2 each for the employee and em ployer The social security wage base limit is 168 600 The Medicare tax rate is 1 45 each for the employee and employer unchanged from 2023 There is no wage base limit for Medicare tax

Social Security Tax Rate 2024

Social Security Tax Rate 2024

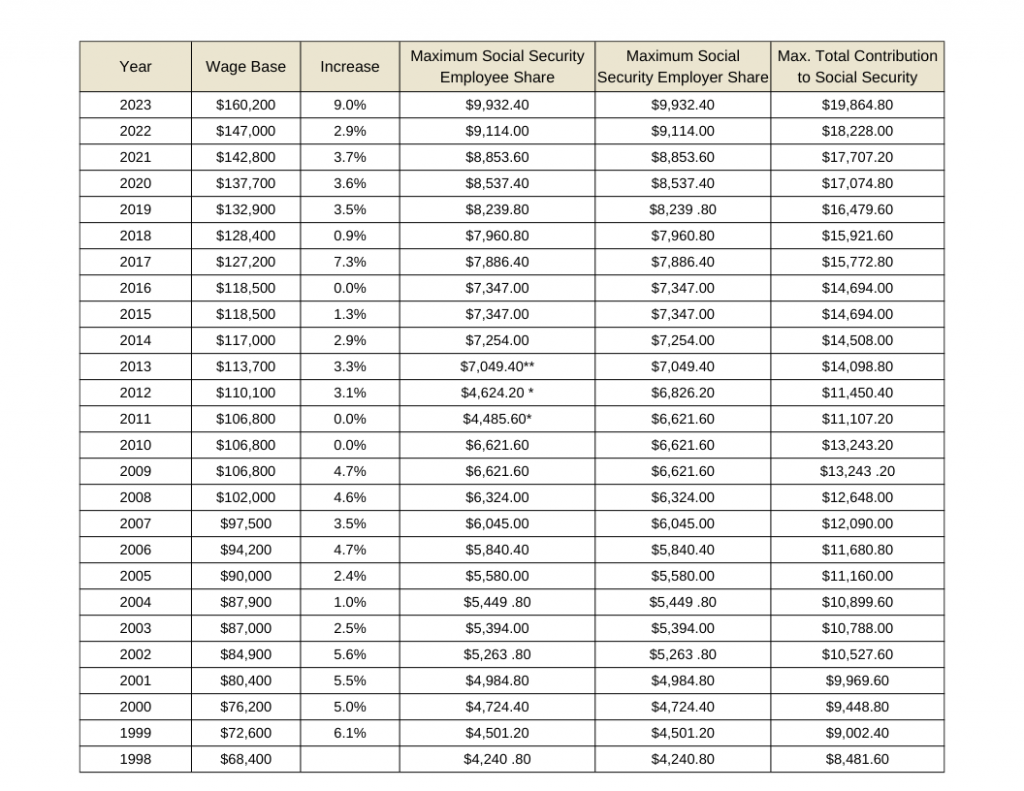

https://www.financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png

Social Security Tax Limit 2024 Withholding Table Dena Morena

https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png

Tax Rates For The 2024 Year Of Assessment Just One Lap

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?resize=849%2C569&ssl=1

Social Security benefits are 100 tax free when your income is low As your total income goes up you ll pay federal income tax on a portion of the benefits while the rest of your Social Security income remains tax free This taxable portion goes up as your income rises but it will never exceed 85 An individual who earns under 168 600 in 2024 pays a 6 2 Social Security tax rate on their entire income Someone who earns 200 000 per year pays that same percentage on just the first

If your Social Security income is taxable depends on your income from other sources Here are the 2025 IRS limits For employees The Social Security tax rate is 6 2 of your gross income up to a wage base limit For self employed individuals You are responsible for both the employee and employer share totaling 12 4 of net self employment income

More picture related to Social Security Tax Rate 2024

Tax Rates For The 2024 Year Of Assessment Just One Lap

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?w=1526&ssl=1

Social Security 2024 Max Withholding Calculator Linn Kizzie

https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2019/12/historical-maximum-social-security-income-limits.png?fit=1456

The Social Security Administration SSA announced that the maximum earnings subject to Social Security OASDI tax will increase from 160 200 to 168 600 in 2024 an increase of 8 400 The maximum Social Security employer contribution will increase by In 2024 earnings up to 168 600 are subject to the Social Security tax The earnings used to calculate benefits in retirement are capped at the same level In 1977 Congress raised the taxable maximum to a level that covered 90 of total national earnings

[desc-10] [desc-11]

States That Tax Social Security Benefits Tax Foundation

https://files.taxfoundation.org/20210205100507/States-that-tax-social-security-benefits.-does-my-state-tax-social-security-benefits-01-01.png

Social Security Tax Limit 2024 Know Taxable Earnings Income Increase

https://cwccareers.in/wp-content/uploads/2024/01/Social-Security-Tax-Limit-2024.png

https://www.irs.gov › taxtopics

The current tax rate for Social Security is 6 2 for the employer and 6 2 for the employee or 12 4 total The current rate for Medicare is 1 45 for the employer and 1 45 for the employee or 2 9 total

https://ng.icalculator.com › income-tax-rates

In Nigeria social security deductions such as contributions to the National Pension Scheme National Health Insurance Scheme NHIS and the National Housing Fund NHF are generally deductible when calculating taxable income

Social Security Tax Withholding Limit 2024 Flore Jillana

States That Tax Social Security Benefits Tax Foundation

13 States That Tax Social Security Benefits Tax Foundation

Social Security Tax Increase In 2023 City Of Loogootee

Social Security Tax Limit 2024 Know Rate Earnings Benefits

Social Security Tax Limit 2024 All You Need To Know About Tax Limit

Social Security Tax Limit 2024 All You Need To Know About Tax Limit

Payroll Taxes What Are They And What Do They Fund 2023

Social Security Tax Rate 2024 Limit Liuka Prissie

Social Security Checks To Get Big Increase In 2019 Social Security

Social Security Tax Rate 2024 - [desc-13]